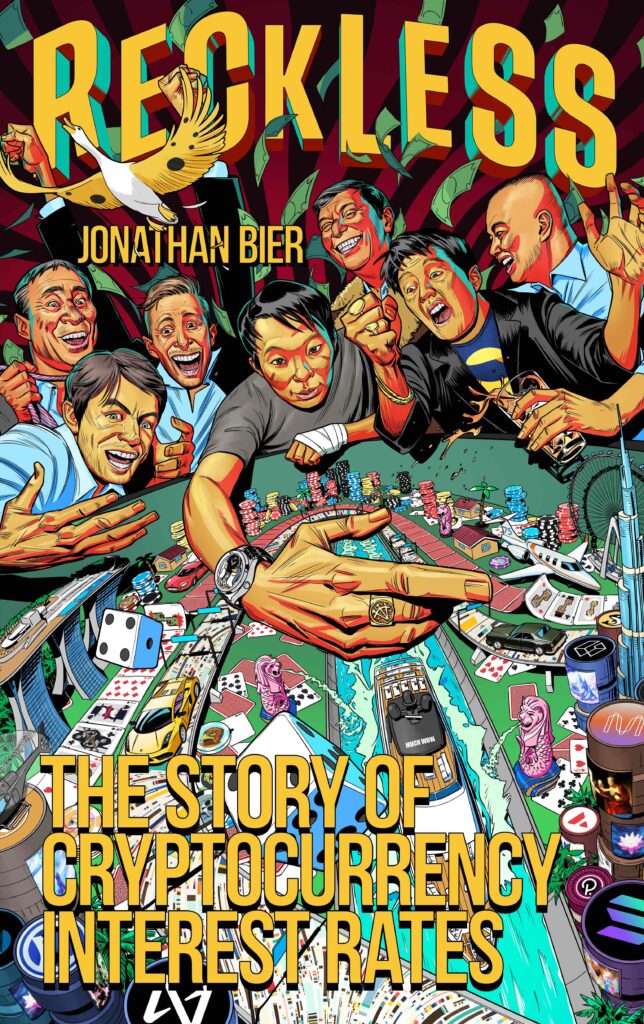

Chapter 21 of the book Reckless: The Story Of Cryptocurrency Interest Rates is published below. The full book is available on Amazon. The book was written before the bankruptcy of FTX and therefore does not include coverage of this event. However, the book does provide useful commentary in the run up to the failure of FTX, which provides context for the eventual calamity.

Once the staking yield establishes itself in the Ethereum economy, the yield could begin to act like a risk free rate in Ethereum or an Ethereum base rate. In theory, nobody should lend Ethereum to anyone at a rate lower than this rate. Why should anyone make a risky loan, if they could earn the same or higher rates earning yield in this counterparty risk free way? Therefore, the staking yield could provide a floor to other Ethereum based interest rates.

If the staking yield is too high, it could prevent or “crowd out” other loans denominated in Ethereum or other Ethereum denominated DeFi yield generating products. It could make loans or other DeFi yield generating activity economically non-viable. This may be a disappointment to many in the Ethereum community and would represent the manifestation of a risk identified in 2015 by Paul Sztorc. At the time this problem was considered as only a theoretical weakness. However, it may one day have practical ramifications. This weakness could be mitigated by modifying the protocol and lowering the yield. Afterall, the algorithms which determine the yield rates were made up, it’s possible the wrong parameters were set and they may need tweaking. Tweaking the parameters could be challenging, as there could be a delicate balancing act between preventing the crowding out of other yield generating use cases and ensuring enough coins are used in staking to secure the network.

The staking yield could also influence and drive other lending rates or other DeFi related rates, just like how the base US Dollar rate drives other rates in the economy. The staking yield could eventually act as a kind of benchmark rate, with some loans contracted at a rate which is a fixed spread over the staking yield rate. This is similar to the traditional banking system, where some people have variable rate mortgages, which follow the central bank base rate plus a fixed spread. DeFi smart contracts could reference the staking yield, factoring it into its calculations or using it as a benchmark to determine other rates. For example, AAVE could offer a new product, quoting a spread over the staking yield rate to those who want to borrow Ethereum. OTC lending companies like Genesis could contract with proprietary trading firms, to lend out Ethereum at the staking yield plus 2%, for example.

Proof of Stake is complicated enough at the technical level. As the last part of this book explains, Proof of Stake and the associated yield is also quite complex when analysed using an economic framework. Determining the economic endgame for Ethereum’s Proof of Stake system is therefore difficult. It’s possible that stETH becomes more dominant, resulting in an increasingly centralised and unstable system. Under the surface there is the pretence of a Proof of Stake system, but in reality, it barely matters, with most investors engaging with stETH.

The centralisation pressures on highly financialised systems like staking do seem quite considerable and therefore Proof of Stake systems may be too exposed to centralisation risks. The system could therefore be exposed to the risk of a regulatory crackdown. This seems like a possible potential outcome and therefore investors should be weary.

Ethereum’s staking system is a financial system and it therefore should be analysed using a financial and economic framework and it may be exposed to financial risks. Financial systems often contain imbalances that can build up over the years behind the scenes. Imbalances that only become apparent in a crisis. Proof of Stake systems could also be susceptible to this type of risk. Afterall, the staking system has no anchor to the real world; it just operates on its own. There is an analogy here to the fiat money standard, after gold convertibility closed in the 1970s, the financial system also lost its anchor to the real world. There was nothing to keep the system in check and extreme imbalances could build up, resulting in a potentially unstable system. Likewise, Ethereum’s consensus system no longer has an anchor to the real world, the Merge can therefore be contrasted to the removal of gold convertibility for the US Dollar in 1971. Ethereum could therefore become more vulnerable to dislocation and extremities. There will never be universal agreement as to whether the removal of this anchor was a good idea or not, just like some economists today still blame many of our economic problems on structural imbalances which have built up over time due to the lack of an anchor in the financial system. These economists do not believe in a world where you can keep lowering interest rates to keep everyone happy, eventually there will be costs. Proudhon’s dream was not realistic and using analogous logic, Proof of Stake can’t survive forever either, it’s too good to be true.

The effectiveness of the staking system could therefore degrade over time, with the weaknesses and financial imbalances not apparent until it’s too late. It therefore seems possible that the system may one day fail or almost fail. However, the pathway to this potential failure or what it may look like is not clear. It could be a change in the economic climate that causes the calamity, resulting in a panic flow of funds out of the staking system. On the other hand, the protocol does have systems in place to deal with this, such as an exit queue and this risk may seem somewhat farfetched. DeFi proved the critics wrong in the way it handled the crashes in May 2021 and June 2022, and the Proof of Stake system could also prove itself to be more resilient than many of the critics think.

It is possible that Ethereum is extremely successful for many years and enjoys considerable price appreciation, with the staking system making a material contribution to this success. If you like excitement, volatility and rapid price appreciation, Ethereum and its staking system are probably for you. Ethereum’s Proof of Stake system could have many years left in it. If you prefer resilience and something that you can have confidence in to withstand the worst forms of economic and financial chaos, Bitcoin and its Proof of Work system is probably your best bet. The Proof of Work system may well survive longer than the Proof of Stake alternative.