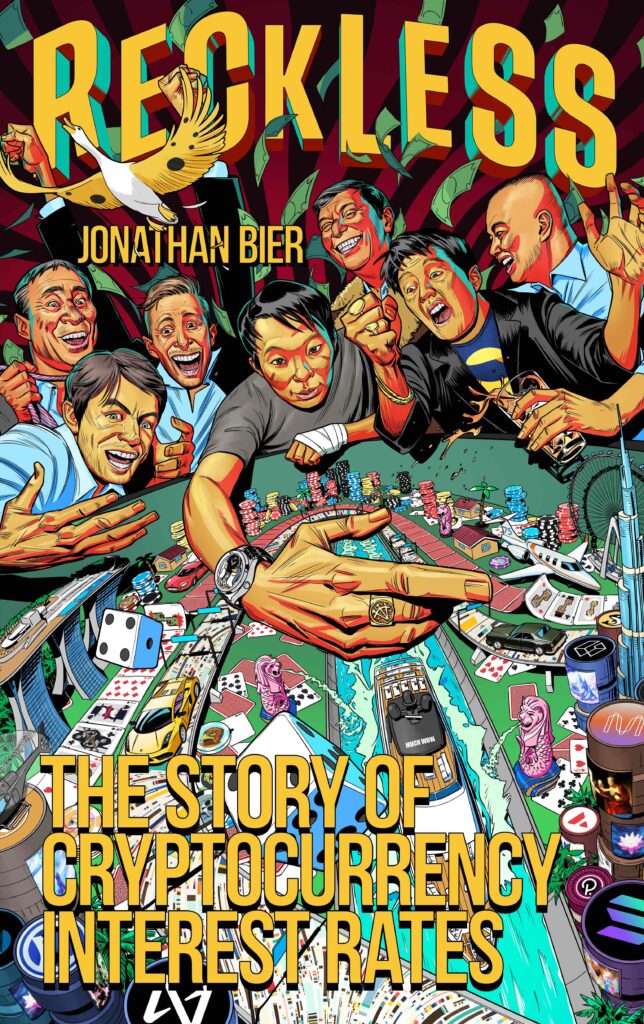

Chapter 2 of the book Reckless: The Story Of Cryptocurrency Interest Rates is published below. The full book is available on Amazon. The book was written before the bankruptcy of FTX and therefore does not include coverage of this event. However, the book does provide useful commentary in the run up to the failure of FTX, which provides context for the eventual calamity.

The legitimacy and ethics of interest has long been a contentious issue. Famously under Islamic finance, interest is typically banned. The term usury, which means interest on loans at an unreasonably high level, is associated with unethical lending, enriching the lender at the expense of the borrower. It is not only in Islam. Perhaps less well known is that Jewish/Christian bible also has texts which look unfavourably on interest.

You shall not charge interest on loans to your brother, interest on money, interest on food, interest on anything that is lent for interest.

While in historical Jewish, Christian or Islamic societies, interest of any kind was considered wrong, in other societies, including today, interest is considered ok as long as the rates are not deemed exploitative. Interest rates above a certain level are often regulated or seen as unethical and unfair.

In 1849, perhaps the first person to declare himself an anarchist, French philosopher Pierre-Joseph Proudhon argued against the legitimacy and efficacy of interest, in a discussion with another French economist, Bastiat.

[Interest constitutes] a reward for idleness, [and is] the basic cause for inequality, but also of poverty. I call interest theft.

Proudhon went on to criticise the exponential growth implicit in compound interest, which could lead to unsustainable debt burdens that could cripple the economy and lead to stagnation. In theory, compound interest can keep enlarging the debt burden, such that the amount of debt exceeds the total amount of money in the world. This theory has grown increasingly popular in the aftermath of the 2008 global financial crisis. For example, this theory is explained in the 2011 movie “Zeitgeist: Moving Forward”, which has over 25 million YouTube views. This film argues that modern money is based on debt and with the impact of compounding interest, repaying all the debt is mathematically impossible and therefore the economy must become more and more indebted until we have stagnation and then the system collapses.

Proudhon also argued that interest fuels antagonism between the lenders and the borrowers. Proudhon advocated lowering interest rates to near zero, plus introducing a wealth tax, such that the effective interest rate would be negative. This, Proudhon argued, would result in an economic boom, with no bankruptcies, higher consumption and guaranteed employment. Such an experiment was never carried out in society, except perhaps until 2009 when interest rates went to near zero and bonds started trading at negative rates. Proudhon would have been delighted.

The liberal economist Bastiat countered Proudhon by arguing that interest was a fair price for a mutually agreed exchange of services. The lender provides use of his/her capital for a period of time and time has value. Instead of depressing output, interest encourages lenders to provide capital, which boosts production, benefiting all. If there were no interest rates, why would anyone lend? You could have a “People’s Bank” that could lend. However, in a lesson similar to the one Richard Cantillon learned over one hundred years earlier during the Mississippi scheme, a centralised system distributing newly issued money is not likely to be able to allocate these funds equally to everyone in a fair manner. It may result in a system where only the wealthy and well connected can borrow. The poor may be unable to borrow, trapped on the wrong side of an interest rate apartheid.

At least one early Bitcoiner appears to have been an admirer of Proudhon. In early 2011 a user on the BitcoinTalk forum, with the username “Proudhon” began enthusiastically talking about his Bitcoin mining operations. This Proudhon never appeared to be a massive fan of speculation and Bitcoin price appreciation, he seemed to mostly want to mine Bitcoin and use Bitcoin as decentralised money. Just hoping for the price to go up was laziness, a “reward for idleness” and this is an aspect of Bitcoin Proudhon appeared to dislike. After the June 2011 Bitcoin price crash, Proudhon became quite negative on Bitcoin and the Bitcoin price. In December 2011, when the Bitcoin price was around US$2.50, Proudhon wrote:

Did anyone sincerely believe any significant amount of new money was entering this pathetic system? It’s just old money changing hands, and as I’ve said before, you can’t get the price to stick in that kind of scenario. It’ll bounce around after large drops and might recover to nearly the “stable” pre-drop price, but, ultimately, the price will continue going down as long as no new money enters the system; and, again, it’s apparent that there isn’t really any new money entering the system and there’s absolutely no reason for anyone to put money into this sinking ship.

Proudhon then continued his negativity and scepticism into the next Bitcoin price bubble in 2013. In a timely post, right before the monumental April 2013 Bitcoin price crash, a parody song was published, “The Proudhon Song”. This parody of Proudhon’s negative views is to the tune of “Girl on Fire” by Alicia Keys:

Bitcoin’s a fad and it’s on fire.

Higher than a fantasy, like a singularity.

Bulls are living in a world full of denial.

I’m feeling a catastrophe, they’re thinking it can fly away.

I keep on riding my bear, though I’m falling a tear.

It’s gonna crash to the ground and I’m not backing down.

Bitcoin is a bubble…

Bitcoin is a bubble…