Overheard at the recent Polly Pocket Investor Day.

Polly Pocket is the managing partner of Polly Pocket Capital. The fund invests solely in tokens.

Schmuck is an investor in the fund.

Polly – Welcome everyone to our Investor Day. 2018 has been a challenging year for our fund but we are fully confident in our ability, over the long run, to deliver superior returns.

Schmuck – Speaking of performance, can I get some more colour on what your fund actually holds?

Polly – Great question. As you know, we don’t disclose exactly what we own, but I can give you a taste. Our fund is divided into listed and unlisted tokens.

Schmuck – Ok, what do you mean by listed and unlisted? I thought the mandate only allowed the fund to invest in tokens that are already traded on a secondary market.

Polly – Well, that is true. But we saw some great deals, so we created a side pocket. The side pocket contains all the pre-ICO deals that we invested in.

Schmuck – Hmm…So you basically can invest in whatever you like, regardless of the fund mandate?

Polly – In a nutshell, yes.

Schmuck – Greeeeaaat. How do you mark these illiquid, unlisted tokens?

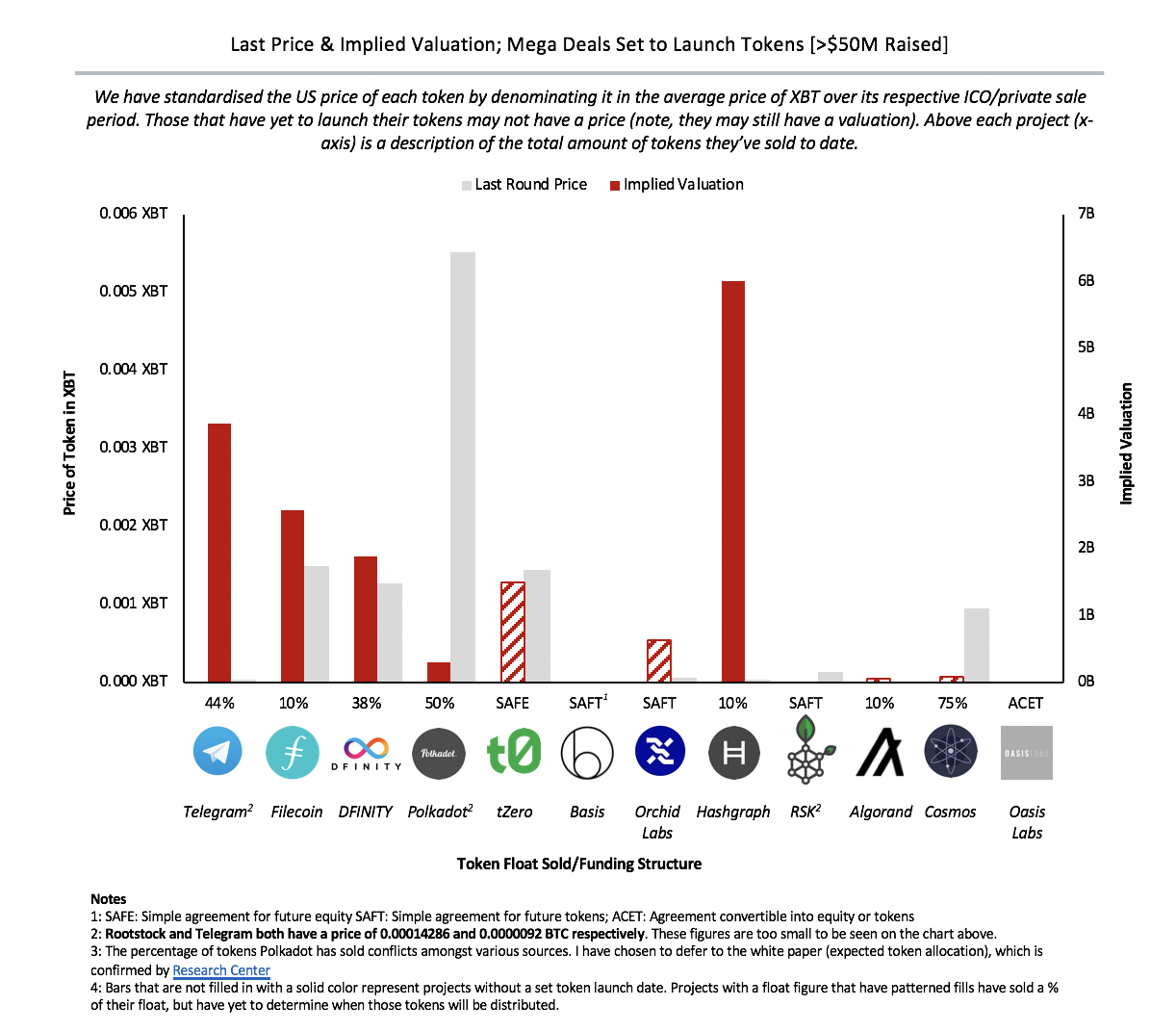

Polly – As you know, due to our amazing connections, we get in on deals well before the unwashed masses. Typically we get a 70% – 90% discount to the last round where most of the plebes purchase these tokens. We then mark the value of the token to the last round price.

Schmuck – So if you invest a price of $1,and the last round which could be a very small amount of the total float, is sold at $10, you record a 10x gain?

Polly – Yes.

Schmuck – Does that also mean that I get charged management fees on the 10x value?

Polly – Yes.

Schmuck – Your liquid token portfolio got molly whopped this year, correct?

Polly – Yes.

Schmuck – So the AUM will get bled at an accelerated rate due to the marking of the side pocket? I’m am paying 2% on a 10x marked up illiquid token with no secondary market, and there is no visibility as to when it will actually list?

Polly – I mean that sounds worse than it is, but you are essentially correct.

Schmuck – Do you apply a haircut to this valuation because there is no liquidity, and an indefinite time to listing?

Polly – No. We believe there is extreme value, and this is reflected in the last round price. Our team of token experts really knows how to value these things.

Schmuck – Maybe, but the management fees paid on these side pocket investments could consume the entire value of the investors’ capital. What happens if I would like to redeem?

Polly – We would sell our liquid tokens first. Once that pool of capital is exhausted, we would be unable to meet your redemption request.

Schmuck – Is there no way to sell your interest in these projects? Have you ever tried?

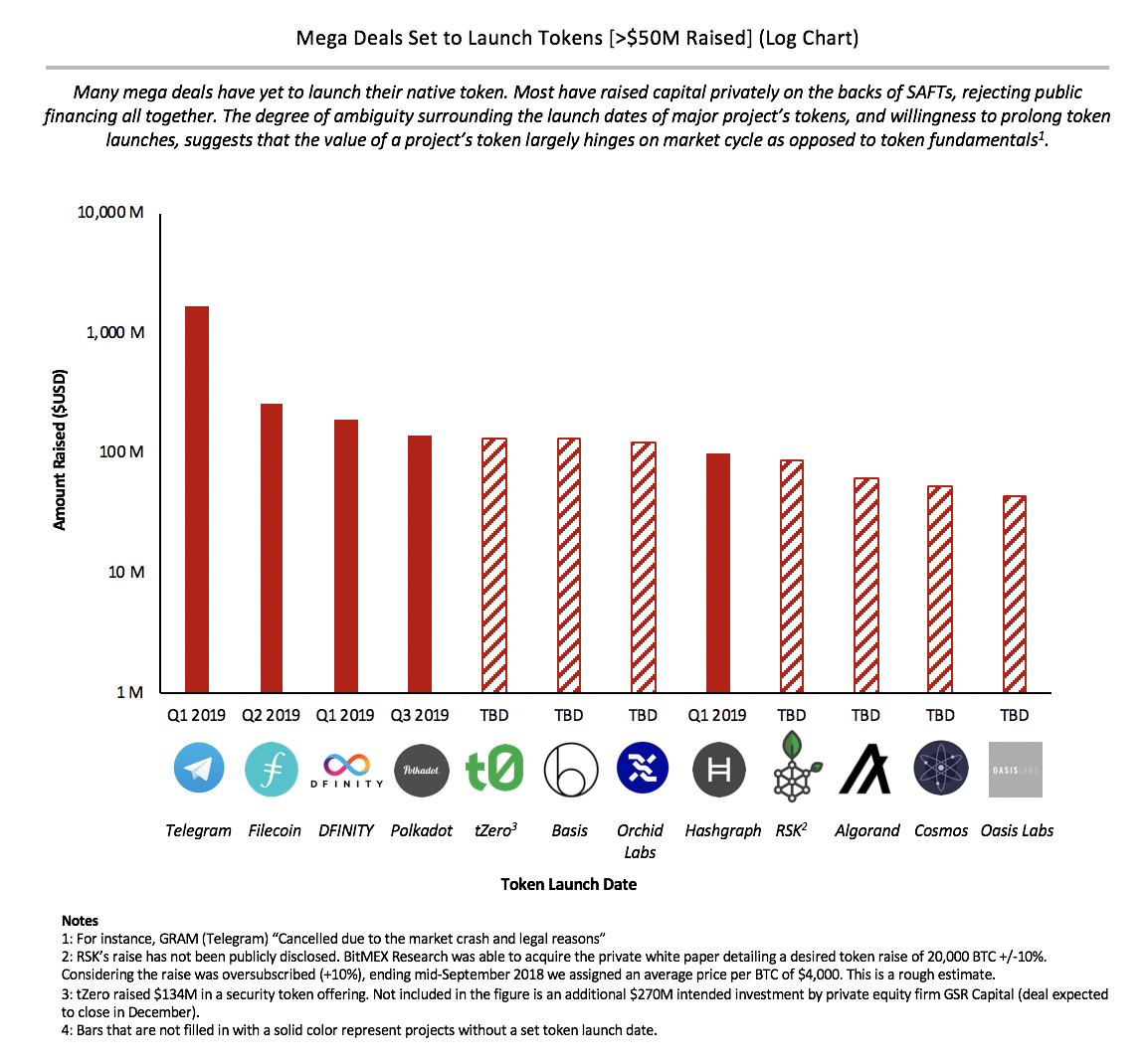

Polly – Legally we can’t. The SAFT term sheet does not allow us to transfer our interest before the token lists.

Schmuck – So basically you are telling me, I’m up shit creek without a paddle?

Polly – I wouldn’t put it that way. Sometimes we suffer liquidity issues.

REAL TALK

The BitMEX Research team has compiled a list of tokens that raised over US$50 million that have yet to list.

These deals have massive valuations, and many of the most venerated token funds took down large chunks. It is unclear when, if ever, these deals will ever list on the secondary market.

Given the large amount of token supply out there, who will buy this shit?

Can you really mark these investments to the last round price?

There are anecdotal reports of funds attempting to sell their SAFT interest, and the prices offered were way below the last round price.

2019 is going to be the year of reckoning for many funds. You can mark something to an absurd level in year 1. But the meter starts again on January 1st. If these things come to market, there will be no accounting tricks to hide the gargantuan losses that these funds will post.