On 11 April at 04:00 UTC, we enabled our new profit and loss (PnL) realisation feature – allowing cross-margining users to automatically realise their PnL for open positions, with the same margin currency, every 10 minutes.

On 11 April at 04:00 UTC, we enabled our new profit and loss (PnL) realisation feature – allowing cross-margining users to automatically realise their PnL for open positions, with the same margin currency, every 10 minutes.

Put simply, this means cross-margining users can now free up capital from their winning positions, which they can then deploy when trading multiple contracts.

The result? More capital-efficient trading and an overall reduction in liquidation risk.

For the lowdown on our new feature – and examples of how it works – read on.

If you haven’t yet signed up for a BitMEX account, you can do so here.

How the New PnL Realisation Feature Works

Cross-margining users who have positions with the same margin currency (e.g. XBT, USDT, ETH) and opposing PnL can now more easily prevent liquidations – by offsetting their PnL across multiple contracts. It’s a process that happens automatically every 10 minutes*.

In the event that a particular position has incurred unrealised losses – which is checked every time the Mark Price changes – its position margin will be topped up from the available margin when required. In other words, profits are transferred from Unrealised PnL to Realised PnL using the Mark Price.

In contrast, if a winning position contributes realised profit to the user’s wallet and the losing position then takes it away, then this new feature will see liquidation and bankruptcy prices move towards the winning positions and in some cases through the initial entry price of the trade (i.e. the trader may get liquidated on a winning position).

Note: This new feature will be applicable to all users – across all cross margin derivatives positions – perpetual swaps, futures contracts, and settlement currencies.

*In the near future, we will be making incremental increases to the frequency of our PnL realisation feature.

Any change we make to the frequency of PnL realisation on BitMEX will be communicated to users ahead of time, via socials and site announcements.

Okay, Show Me the Examples

To illustrate the benefits of our new PnL realisation feature, we’ve included example scenarios below (needless to say, they’re fictional trading scenarios):

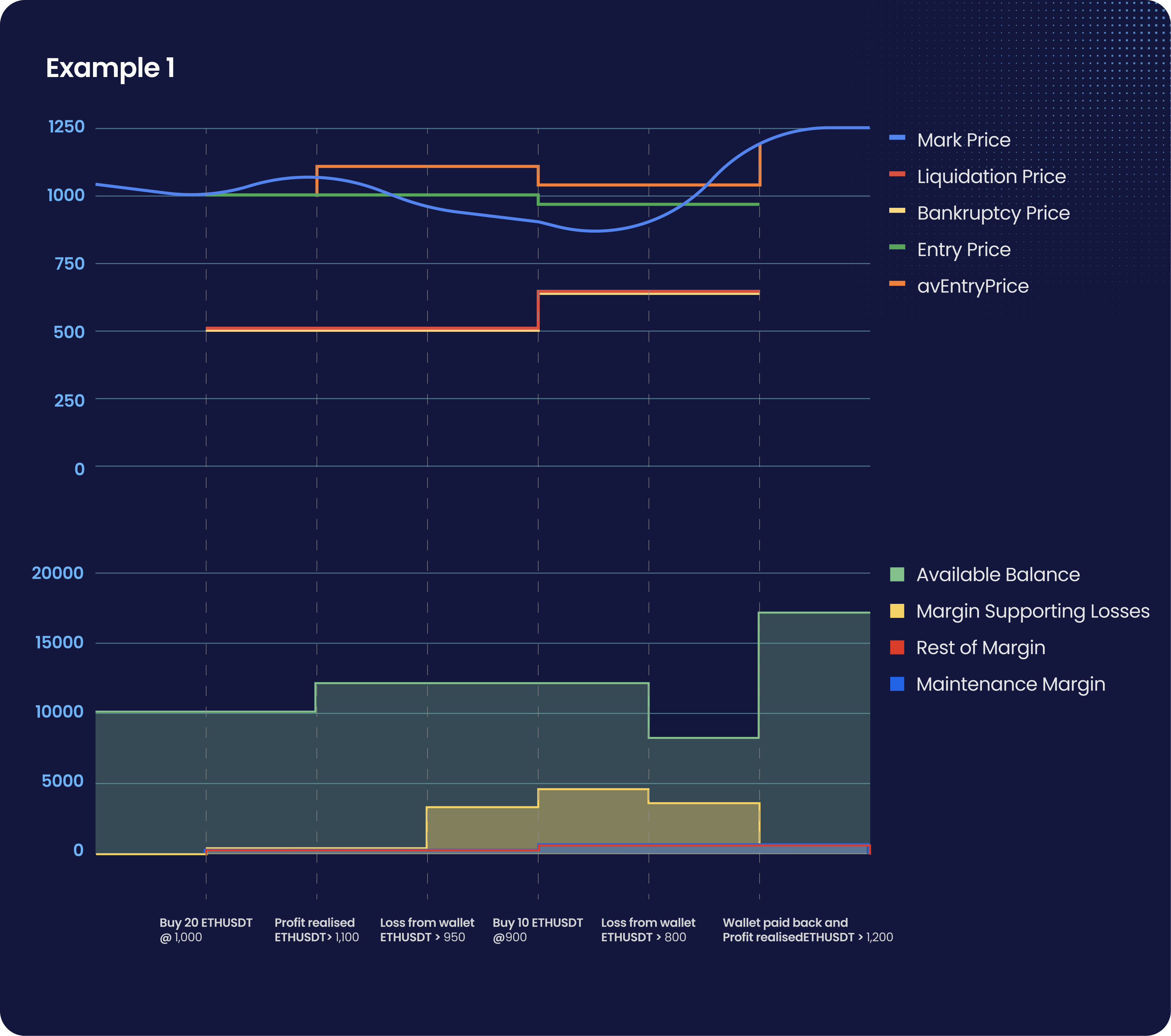

Scenario one: Karen rides out the choppy market by trading the ETHUSDT perpetual swap.

- Her BitMEX account wallet has 10,000 USDT.

- She buys 20 contracts of ETHUSDT at the price of $1,000 at 50x Cross Margin.

- The required initial margin is 2% = 400 USDT, and the maintenance margin is 1% = 200 USDT.

- Her Entry price (avgCostPrice) is 1,000.

- Her avgEntry price is also 1,000.

- Her liquidation and bankruptcy prices are 510 and 500, respectively.

- Her available balance is now USDT 9,600.

- The Mark Price moves up to $1,100, hence a profit of 2,000 USDT is realised (remember: this process can happen every 10 minutes).

- The required margin is still USDT 400 (maintenance margin is 200 USDT).

- Her Entry price (avgCostPrice) is still 1,000 (this is the number you will see on BitMEX website).

- Her avgEntry price is now 1,100 (the price at which profit was realised).

- Her liquidation and bankruptcy prices are 510 and 500, respectively.

- Her available balance is now 11,600 USDT.

- The Mark Price moves down to 950. A 3,000 USDT loss needs to be pulled from her Wallet (remember: this process can happen whenever the Mark Price updates, i.e. every 5 seconds).

- The required margin is still 400 USDT, and the maintenance margin is 200 USDT.

- Her Entry price (avgCostPrice) is still 1,000 (this is the number you will see on the BitMEX website).

- Her avgEntry price is still 1,100.

- Her liquidation and bankruptcy prices are 510 and 500, respectively.

- Her available balance is now 8,600 USDT.

- The Mark Price moves down to 900 and Karen buys 10 more contracts of ETHUSDT at 900.

- The required margin is now 2% of 9,000 (add. position) + 2% of 20,000 (first position) = 580 USDT, and the respective maintenance margin is 290 USDT.

- Her Entry price (avgCostPrice) is 966.67.

- Her avgEntry price is 1,033.33.

- Her liquidation and bankruptcy prices are 643 and 633.33, respectively.

- Her available balance is now 7,420 USDT.

- The Mark Price falls even further to 800 and another 3,000 USDT loss needs to be pulled from the Wallet (remember: this process can happen every 5 seconds).

- The required margin remains at 580 USDT, and the maintenance margin remains at 290 USDT.

- Her Entry price (avgCostPrice) is still 966.67.

- Her avgEntry price is still 1,033.33.

- Her liquidation and bankruptcy prices are still 643 and 633.33, respectively.

- Her available balance is now 4,420 USDT.

Finally, Karen’s position starts to pay off when the Mark Price rises to 1,200 when profit realisation happens (every 10 minutes). The profit swing is 12,000 USDT, of which 7,000 pays back funds drawn from the Wallet:

30 ETHUSDT x (avgEntryPrice – 800) = 30 x (1033.33-800) = 7,000 USDT

And the remainder is realised profit (compared to the last avgEntryPrice):

30 ETHUSDT x (1200 – avgEntryPrice) = 30 x (1200 – 1033.33) = USDT 5,000

This means that:

- The required margin is still 580 USDT, and the maintenance margin is 290 USDT.

- Her Entry price (avgCostPrice) is still 966.67.

- Her avgEntry price is updated to 1,200.

- Her liquidation and bankruptcy prices are still 643 and 633.33, respectively.

- Her available balance is now 16,420 USDT.

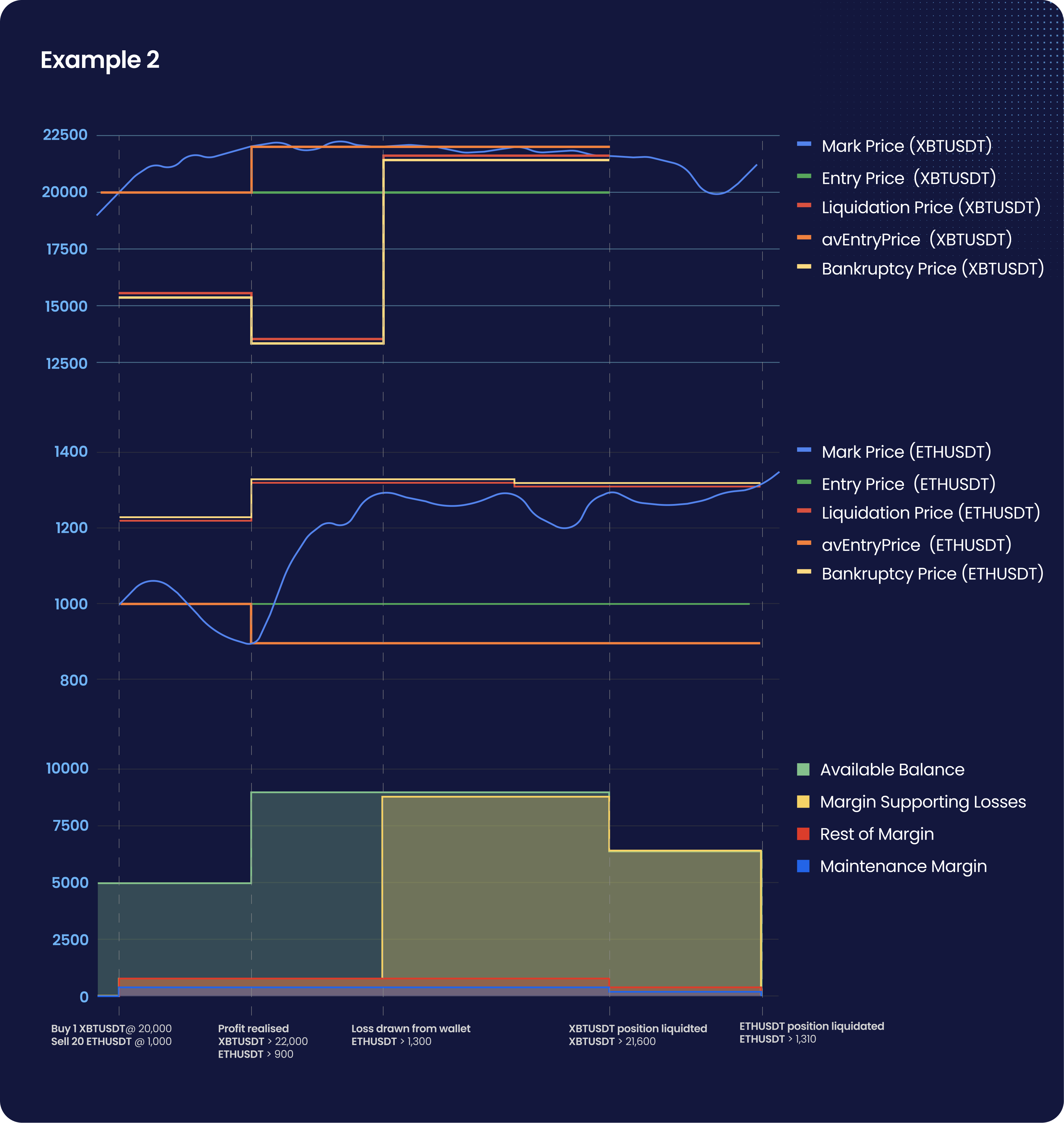

Scenario two: Bryan calls his spread trade right at the start but then gets REKT.

Scenario two: Bryan calls his spread trade right at the start but then gets REKT.

- His BitMEX account wallet has 5,000 USDT.

- He thinks ETHUSDT (Mark Price 1,000) and XBTUSDT (Mark Price 20,000) will diverge with XBTUSDT moving up more than ETHUSDT.

- He buys 1 XBT of XBTUSDT at 20,000 – and sells 20 ETH of ETHUSDT at 1,000, both at 50x Cross Margin.

- The total required margin is 800 USDT, and the maintenance margin is 400 USDT.

- His Entry prices (avgCostPrice) are 20,000 and 1,000.

- His avgEntry prices are also 20,000 and 1,000.

- His liquidation/bankruptcy prices are 15,600/15,400 and 1,220/1,230, respectively.

- His available balance is now USDT 4,200.

- His strategy initially proves right; ETHUSDT goes down to 900 and XBTUSDT goes up to 22,000. Profit is realised on both trades (a total of 4,000 USDT).

- The total required margin is still 800 USDT, and the maintenance margin is 400 USDT.

- His Entry prices (avgCostPrice) are still 20,000 and 1,000.

- His avgEntry prices are now 22,000 and 900.

- His liquidation/bankruptcy prices are 13,600/13,400 and 1,320/1,330, respectively.

- His available balance is now 8,200 USDT.

- But then ETHUSDT rallies to 1,300 and XBTUSDT doesn’t move, which means he has lost 8,000 USDT on this move. This loss is drawn from the wallet to his ETHUSDT position.

- The total required margin is still 800 USDT, and the maintenance margin is 400 USDT.

- His Entry prices (avgCostPrice) are still 20,000 and 1,000.

- His avgEntry prices are still 22,000 and 900.

- His liquidation/bankruptcy prices are now 21,600/21,400 and 1,320/1,330, respectively.

- His available balance is now just 200 USDT.

- XBTUSDT then drops to 21,600, and 200 USDT is taken from the wallet to XBTUSDT, but the position is still at the liquidation price, so it is liquidated.

- The total required margin is now USDT 400, and the maintenance margin is 200 USDT.

- His Entry price (avgCostPrice) is 1,000.

- His avgEntry price is 900.

- His liquidation/bankruptcy prices are now 1,310/1,320 respectively.

- His available balance is now zero.

- Unfortunately for Bryan, ETHUSDT trades up a little bit and hits his liquidation price of 1,310 – and he gets REKT.

Key points to note about Bryan’s experience:

- Bryan got liquidated in a winning long position at 21,600, which is above his original entry price of 20,000 – and well above his original liquidation price of 15,600.

- Bryan got liquidated in his losing short position at 1,310, which is well above his original liquidation price of 1,220.

- The new cross margin feature kept him in his ETHUSDT position longer than the previous version of margining.

- By sharing profit with the losing position from his winning XBTUSDT position, it was liquidated, whereas it would have been intact in the previous version of cross-margining.

- His positions were liquidated at nearly the same time.

The Finer Details

The Finer Details

Please note that the following fields – shown in the position sections of our derivatives trading pages – will exhibit a change in behaviour once PnL realisation is enabled (for an explanation of the fields below, click here):

Prices

- avgEntryPrice will represent the price at which the last PnL realisation took place (using avgCostPrice for trade entry price).

- The marginCallPrice, liquidationPrice, and bankruptPrice will move in a different way when holding multiple positions under Cross Margin.

PnL and Cost

The following will change due to the changed timing and conditions of PnL realisation:

- realisedGrossPnl, realisedPnl, unrealisedGrossPnl, unrealisedPnl, unrealisedPnlPcnt, unrealisedRoePcnt, rebalancedPnl, prevRealisedPnl, prevUnrealisedPnl, realisedCost, and unrealisedCost.

Position Margin and Cost

The following will change due to the changed timing of PnL realisation:

- posCost2, posLoss, and posMargin.

Deleveraging Priority

- deleveragePercentile will change due to smaller unrealised PnL and a lower chance of deleveraging.

The 101 on Margining and Our Mark Price Method

Unrealised vs Realised PnL: What’s the Difference?

Unrealised PnL is calculated based on the current profit and loss from all open positions. Traders’ PnL figures are constantly changing – this is why the Mark Price is used to ensure that the unrealised PnL is calculated correctly.

On the other hand, realised PnL refers to the profit and loss on a trade after the position has been closed. Our new functionality allows for the realisation of profits before closing the position, with subsequent unrealised losses pulled back from the trader’s available balance.

For a more in-depth explanation of these concepts, check out this PnL Guide.

What is Cross Margin?

At BitMEX, we employ two margining methods: cross margin and isolated margin. Cross margin is our default margin setting, this is where margin is shared between open positions with the same settlement currency (e.g. XBT). The new PnL realisation feature applies only to cross margin.

To learn more about our margining methods, read this guide.

What is Position Margin?

It’s the portion of your margin that is assigned to the initial margin requirements (i.e. the minimum initial amount needed to enter a position) on your open positions. This is the entry value of all contracts traders hold – divided by the selected leverage, plus unrealised PnL.

What is Available Margin?

This refers to the funds traders have available to top up existing positions or create new positions, and is calculated as follows: (initial wallet balance + realised PnL) – margin allocated to positions.

Initial vs. Maintenance Margin: What’s the Difference?

The initial margin is the minimum initial amount needed to enter a position, whereas maintenance margin refers to the minimum amount needed to keep that position.

What Does Mark Price Mean?

The Mark Price is the price at which a derivatives contract is marked for Unrealised PNL and Liquidation purposes. We employ a system called Fair Price Marking to avoid unnecessary liquidations – especially when users trade highly-leveraged products.

For the lowdown on our Fair Price Marking Method, click here.

To be the first to know about our new listings, platform updates, and giveaways, you can connect with us on Discord, Telegram, and Twitter. We encourage you to also check our blog regularly.

In the meantime, if you have any questions please contact Support.