Abstract

We look at Bitmain’s new Ethereum miner and notice that it may be less energy efficient than one might expect for an ASIC. We explore the possibility that this miner contains a new more advanced form of technology, which is less efficient than ASICs, but potentially partially immune to PoW algorithm changes. We then conclude that whether this particular Ethereum chip is capable of this or not, this type of technology may eventually end the era of anti-ASIC PoW changes designed to improve decentralisation, such that crypto-coin communities may have to accept the inevitability of ASICs.

Overview

Bitmain have recently launched a new Ethereum miner, widely believed to be an ASIC, and it is expected to ship in late July 2018. However, many in the Ethereum community oppose ASICs and prefer GPU mining, since GPU companies are primarily concerned with gaming rather than crypto-coins, which should mean that the hardware is distributed more widely and fairly, improving decentralisation. Therefore a risk to Bitmain could be that the Ethereum community decide to hardfork to change the PoW algorithm, which could devalue the Bitmain machines and result in a large wasted investment.

In this report, we speculate that Bitmain may already be one step ahead of the Ethereum community. Bitmain may have already learnt a lesson with Monero, two coins which recently conducted PoW changes, potentially resulting in large devaluations of Bitmain’s ASIC chips. Developing a custom chip requires a considerable financial investment and therefore we think Bitmain may have taken some countermeasures to avoid another loss. Bitmain could have designed a new type of mining chip, less efficient that ASICs, but immune to PoW changes. This could make an Ethereum hardfork PoW change mostly pointless.

The recent Monero anti-ASIC PoW change

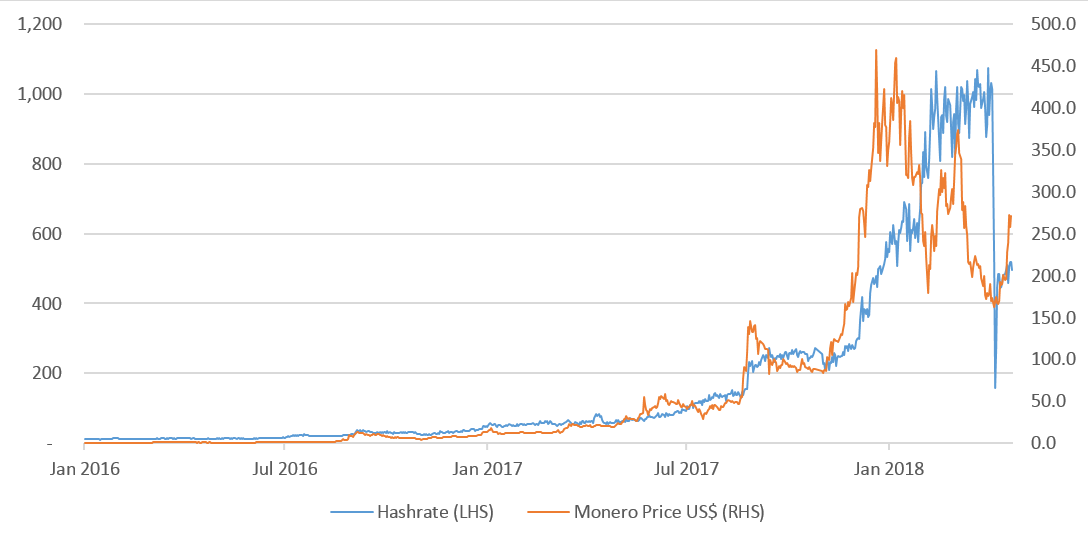

At the start of April 2018 the Monero community decided to hardfork and change the PoW algorithm, in an attempt to “brick” ASICs and make Monero more GPU-friendly. Due to sharp increases in hashrate, illustrated by Figure 1 and 2 below, the Monero community believed that ASIC manufacturers had developed Monero ASICs, in secret, and were mining the coin.

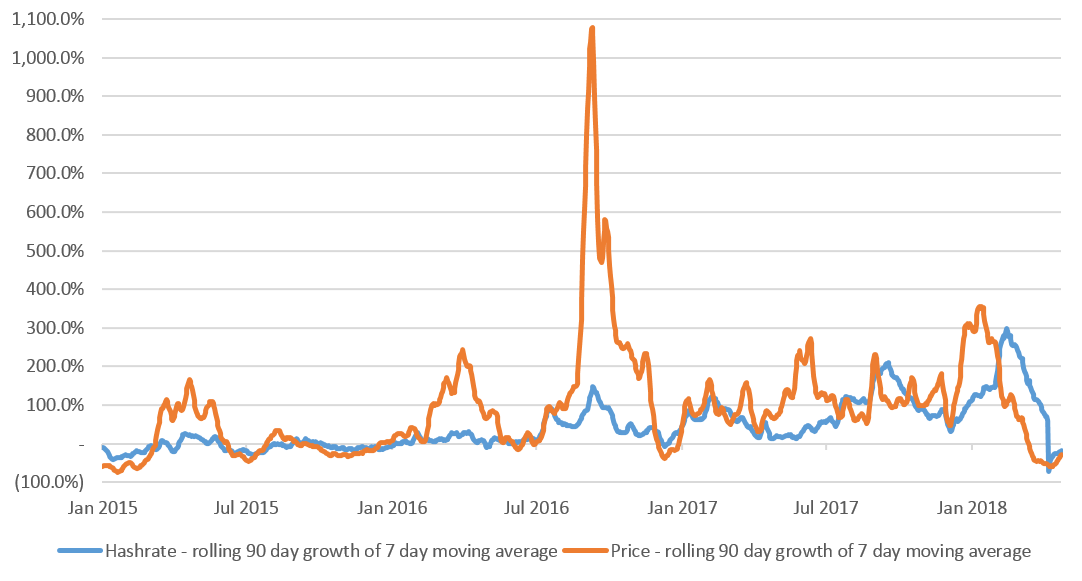

As Figure 2 shows below, the rolling 90-day hashrate growth rate reached c. 300% in the early part of 2018 (based on 7-day rolling averages). Even after factoring in the sharp increase in value of the Monero coin, this is an extraordinary growth rate. After Monero developers announced plans for a hardfork, Bitmain began to sell Monero ASICs on their website, indicating that they could indeed have been mining in secret. After the PoW change, as Figure 1 shows, the Monero hashrate dropped off significantly.

After the hardfork, the Monero chain split into two, with the original rules coin being called Monero Original (XMO). Although this coin had a lower value than Monero, it had a higher hashrate, since there was little else for the Monero ASICs to mine. There was no replay protection implemented for the split, however Monero increased the ring signature limit, therefore one can split Monero and Monero Original by first initiating a transaction on the Monero Original chain with fewer ring signatures than are allowed on Monero (less than 7).

Figure 1 – Monero hashrate compared to Monero price

Source: Coinmarketcap, BitMEX Research

Figure 2 – Monero hashrate compared to Monero price – Rolling 90-day percentage growth of 7-day moving average

Source: Coinmarketcap, BitMEX Research

Note: In the 7 days following the PoW hardfork, the hashrate rolling average excludes the period prior to the hardfork

Bitmain’s new Ethash miner

As we mentioned above, Bitmain has recently launched a new Ethereum miner, which is expected to ship around late July 2018. Given the history with Monero and the fact that many in the Ethereum community, including those mining Ethereum at home on GPUs, are likely to be unhappy at a new Bitmain product, Bitmain may be concerned. One downside to the new miner could be increased miner centralization, but in addition to this, the product may also receive hostility from some in the Ethereum community due to their financial interests in the existing Ethereum miners, GPUs. Bitmain’s management is not stupid, and therefore in our view the company is likely to act with caution and may have taken measures to mitigate against some of these risks.

Figure 3 – Bitmain’s new Ethereum miner: the Antminer E3

Specifications:

- Power consumption: 800W

- Hashrate: 180MH/s

Source: Bitmain

The advertised specification of the product is disclosed above. As the table below illustrates, a back -of-the-envelope calculation could imply this new Ethereum miner is less efficient than one would expect if it was an ASIC, based on comparisons with the efficiency gain measured on some of the other ASICs related to other coins. For instance a Bitcoin ASIC is c. 521x more efficient than an FPGA, while the Monero ASIC is c. 88x more efficient than a GPU. In contrast the new Ethereum miner is only c. 1.4x more efficient than a GPU. This could indicate that the new Ethereum miner is not an ASIC at all, but merely a new device more efficient than the existing GPU miners. However, we appreciate that the below table is a crude approximation which ignores many crucial variables and factors, such as the memory-intensive nature of the Ethereum mining algorithm. But although the calculation is inaccurate, the figures can still potentially illustrate a point:

Figure 4 – Approximate miner efficiency calculations

| Miner | Hash rate (GH/s) | Power (W) | Energy per hash (J/GH) |

| Bitcoin (SHA256) | |||

| CPU | 0.0005 | 100 | 200,000 |

| High end GPU | 0.5 | 300 | 600 |

| FPGA | 0.8 | 40 | 50 |

| High end ASIC | 14,000 | 1,340 | 0.096 |

| Efficiency gain | 521x | ||

| Ethereum (Ethash) | |||

| High end GPU | 0.032 | 200 | 6,250 |

| Antminer E3 | 0.18 | 800 | 4,444 |

| Efficiency gain | 1.4x | ||

| Monero(CryptoNight) | |||

| High end GPU | 0.0000001 | 200 | 2,000,000,000 |

| ASIC | 0.000022 | 500 | 22,700,000 |

| Efficiency gain | 88x | ||

Source: BitMEX Research, Bitmain

Note: Figures are approximations

Mining chip types & Vector processors (VPs)

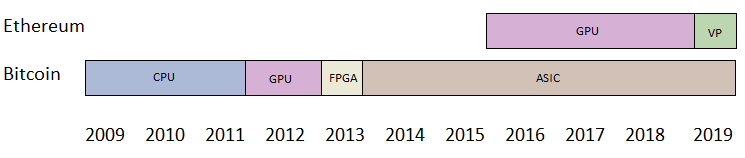

As Figure 5 below illustrates, when Bitcoin launched in 2009, mining was conducted using CPUs. However, the architectures of GPUs and FPGAs are more efficient at processing repetitive hash operations. Therefore the network shifted, first to GPUs and then to FGPAs. In 2013, ASICs designed for specific hash functions emerged. Compared to CPUs, GPUs and FPGAs, ASICs are far more efficient at running a particular algorithm, however excluding this, ASICs are far less efficient or actually totally useless.

Figure 5 – Crypto-coin chip type timeline

Source: BitMEX Research

Note: The inclusion of Vector Processors (VPs) towards the end of 2018 is speculative

It might be possible that Bitmain has developed a new type of chip, a Vector Processor. The architecture of this chip could be designed for PoW hash functions in general, but not for a specific hash function. These chips could then be more efficient than GPUs and FPGAs, but less efficient than ASICs. The advantage over ASICs is that they could be, in some respects, immune to PoW changes. It is possible that the new Ethereum miner falls into this category of chip, although this is mostly speculation on our part.

Figure 6 – The evolution of crypto-coin chip types

| Chip type | Central Processing Unit (CPU) | Graphics Processing Unit (GPU) | Vector processor (VP) | Application Specific Integrated Circuit (ASIC) |

| Example crypto-coins | Bitcoin (BTC) – 2009 to 2011 | Bitcoin (BTC) – 2012 to 2013 Ethereum (ETH), Monero (XMR) |

Ethereum (ETH) – 2018 onwards |

Bitcoin (BTC) – 2014 to present, |

| Manufacturers | Intel, AMD | NVIDIA, AMD | Bitmain | Bitmain, Canaan Creative, Ebang, Innosilicon |

| Foundry |

TSMC, Samsung, | TSMC, Samsung, Global Foundries, SMIC | TSMC | TSMC, Samsung, Global Foundries |

| Primary use | Computing | Gaming | Crypto-coin mining | Crypto-coin mining |

| Immune to PoW change | Yes | Yes | Potentially | No |

Higher efficiency

It is possible that Bitmain’s new Ethereum miner is tailored for Ethash, in that the components inside the miner such as the electric circuits, power control devices, memory and control modules could all be specifically calibrated for mining Ethereum. However the chip itself, which is the area that requires by far the most financial investment, could be more general and not specifically designed for Ethereum. Therefore if Ethereum conducts a PoW change, it could be possible to direct the chips into a new device as they leave the foundry or perhaps even recover the chips from the old device put them into a new Ethereum miner. Although again, at this point we are speculating.

Artificial Intelligence (AI) technology

At TSMC’s latest set of quarterly results on 19th April 2018, Co-CEO Mark Lie said the following:

[Bitmain] is doing a lot of things on blockchain technology, like AI. They are doing very well. We expect them to slowly move to the AI area.

Source: Q1 2018 earnings call

“AI” is a term with many meanings. Although at this point the situation is unclear, it is possible that any new Vector Processor chips could be what TSMC mean by AI technology. Since any such chip may be able to switch between hashing algorithms, at a stretch, one could argue this falls within the scope of AI. It remains to be seen if the chip is merely programmable, like modern GPUs, or if there is a trick up its sleeve that could give it an efficiency gain vs. GPUs in most cases. If present, this advanced technological capability is likely to be seen as a major achievement for Bitmain. Such technology may also be even more expensive to develop and more specialised than the technology in ASICs, which could make the decentralisation problem even worse.

Ethereum hashrate growth – No evidence of deployment of the new chips

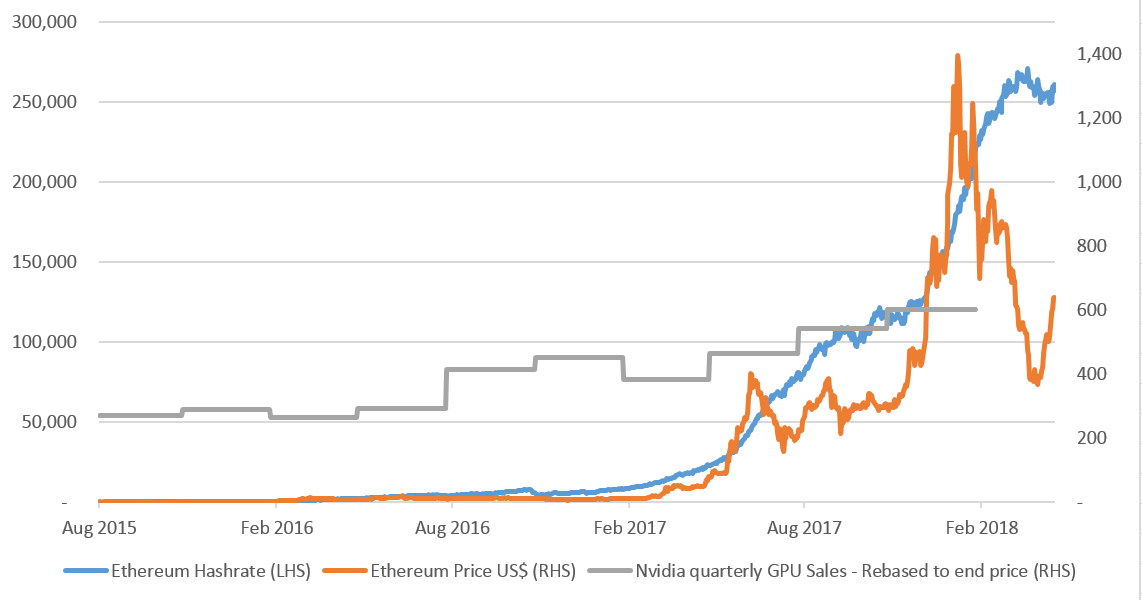

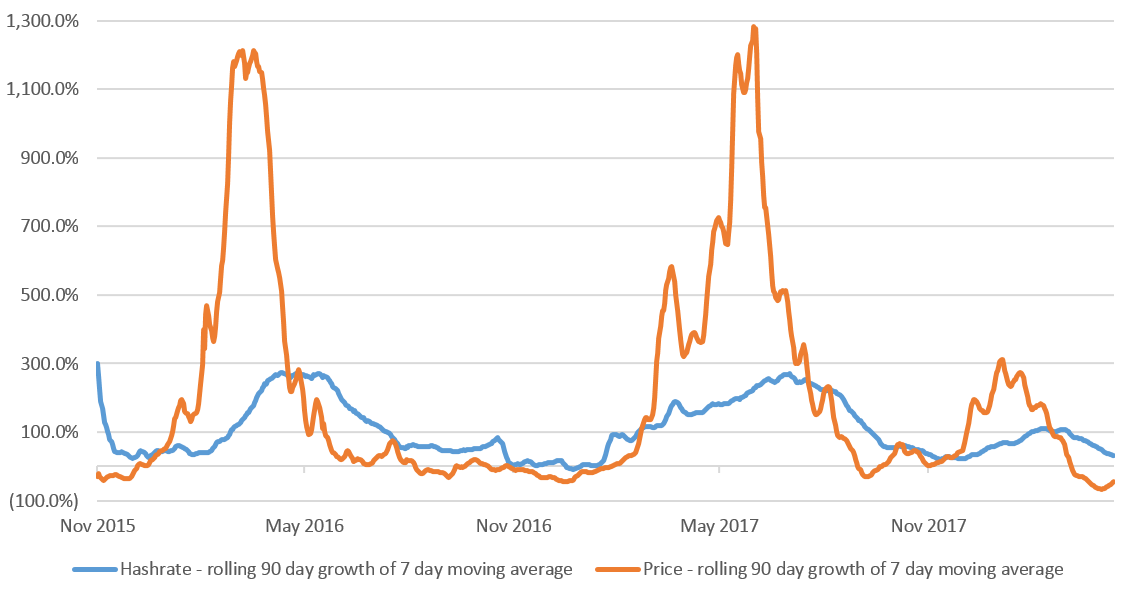

Despite the above, we have not yet seen any strong indications of the deployment of the new chips on the Ethereum network. As Figures 7 and 8 below indicate, Ethereum’s hashrate appears, broadly speaking, to be following a normal trend given the price volatility.

Figure 7 – Ethereum hashrate compared to Ethereum price and NVidia GPU sales

Source: Bloomberg, Etherscan.io, Coinmarketcap, Nvidia, BitMEX Research

Figure 8 – Ethereum hashrate compared to Ethereum price – Rolling 90-day percentage growth of 7-day moving average

Source: Bloomberg, Etherscan.io, Coinmarketcap, BitMEX Research

Conclusion

When discussing the possibility that Bitmain’s new Ethereum miner isn’t an ASIC and that the new chip may be somewhat immune to PoW changes, Vitalik Buterin told us:

I have a very similar impression myself

Despite what we have said above, most of the content in this article should be considered guesswork. However, even if we are wrong about this particular chip, we still think it is reasonably likely that at some point in the future, Bitmain or another company, will develop a general-purpose hashing chip, which is more efficient than GPUs for almost all hashing algorithms. At this point the era of anti-ASIC PoW changes could be over, with crypto-coin communities having to make a choice between two potentially unfavourable outcomes:

- Allowing ASICs, or,

- Allowing general purpose hashing chips, where technologies and production capabilities could be even more concentrated.

Unless of course proof-of-stake systems prove robust enough.

Disclaimer

Whilst many claims made in this note are cited, we do not guarantee accuracy. We welcome corrections.