Offered to our top traders, we’re excited to introduce Margin+, a collateral support programme designed to let you trade more, without needing to fund your accounts with your own capital.

It’s a move we’re making so that you can take your PnL gains to the next level – by allowing you to take more/larger positions as well as place more/larger orders.

Some traders may have already received an exclusive invitation to join the new programme as a result of being a top trader. Interested in finding out more about Margin+? Want to know how to get involved? Read on.

If you haven’t signed up for a BitMEX account yet, we’re currently offering 5,000 USD worth of BMEX Tokens to new users – you can register here.

What is the Margin+ Programme?

BitMEX traders that join Margin+ will receive extra collateral in Tether (USDT) or Bitcoin (XBT) to trade more effectively on our platform.

Who is Margin+ Made For?

The Margin+ programme was designed to reward BitMEX’s top traders and communities. It’s a way to trade more without having to fund your accounts with extra capital out of your pocket.

The programme is best suited to non-directional traders whose strategies do not involve taking highly leveraged positions.

As Margin+ has strict trading volume and balance requirements, we advise you to carefully evaluate your need for the programme before reaching out.

How Does the Margin+ Programme Work?

Those already eligible for the Margin+ Programme will be able to locate a Margin+ tab in their BitMEX trading menu. Applications can be submitted via the portal they are led to.

BitMEX will then review applications and provide applicants with an update within 72 hours. If your application is approved, you’ll have your Margin+ funds credited to your BitMEX account shortly after, as long as you meet the minimum balance requirements.

Once you’re in the programme, you must meet the defined trading obligations – otherwise an extension fee will be charged at the end of each month.

To avoid margin call and liquidation, you must maintain a Minimum Balance, as well as limits on your account’s overall leverage via the Maintenance Margin Ratio.

Minimum Balance

Minimum collateral balance refers to the wallet balance in your BitMEX account.

Before getting started with Margin+, you must hold 30% of the collateral value before BitMEX proceeds to drawdown. Otherwise, a margin call shortly after drawdown is possible.

After your Margin+ is activated, your Minimum Balance must remain above 125% of the collateral value to avoid a margin call. Liquidation will occur if one of the following scenarios occurs:

- You’re in margin call for more than 12 hours;

- Your Minimum Balance ever drops below 110% of the collateral value.

Show Me An Example of How the Minimum Balance Requirement Works

Let’s say Joe applies for a Margin+ of 10,000 Tether (USDT).

- To proceed to drawdown, Joe needs to have a minimum of 3,000 USDT (or XBT equivalent) in his wallet.

- To avoid margin call, Joe needs to have a minimum of 12,500 USDT (or XBT equivalent) in his wallet.

- To avoid liquidation, Joe needs to have a minimum of 11,000 USDT (or XBT equivalent) in his wallet.

Maintenance Margin Ratio

Maintenance Margin Ratio is calculated as: Available Funds/Maintenance Margin Requirement (MMR). Simply put, the Maintenance Margin Ratio controls how much leverage you can take in an active Margin+ agreement.

A lower ratio means you have less available funds to cover the MMR tied to your open positions – meaning you are more leveraged. On the other hand, a higher ratio means you have more available funds to cover the MMR and hence are less leveraged.

When getting started with Margin+, you must have a Maintenance Margin Ratio of 12 or above for BitMEX to process the funds’ drawdown. This protects Margin+ users from hitting margin call shortly after their drawdown.

After your Margin+ is activated, you must ensure your Maintenance Margin Ratio remains above 10. A margin call will occur if your Maintenance Margin Ratio remains below 10 for 12 hours or immediately after the ratio drops below 5.

Show Me An Example of How the Minimum Margin Ratio Works

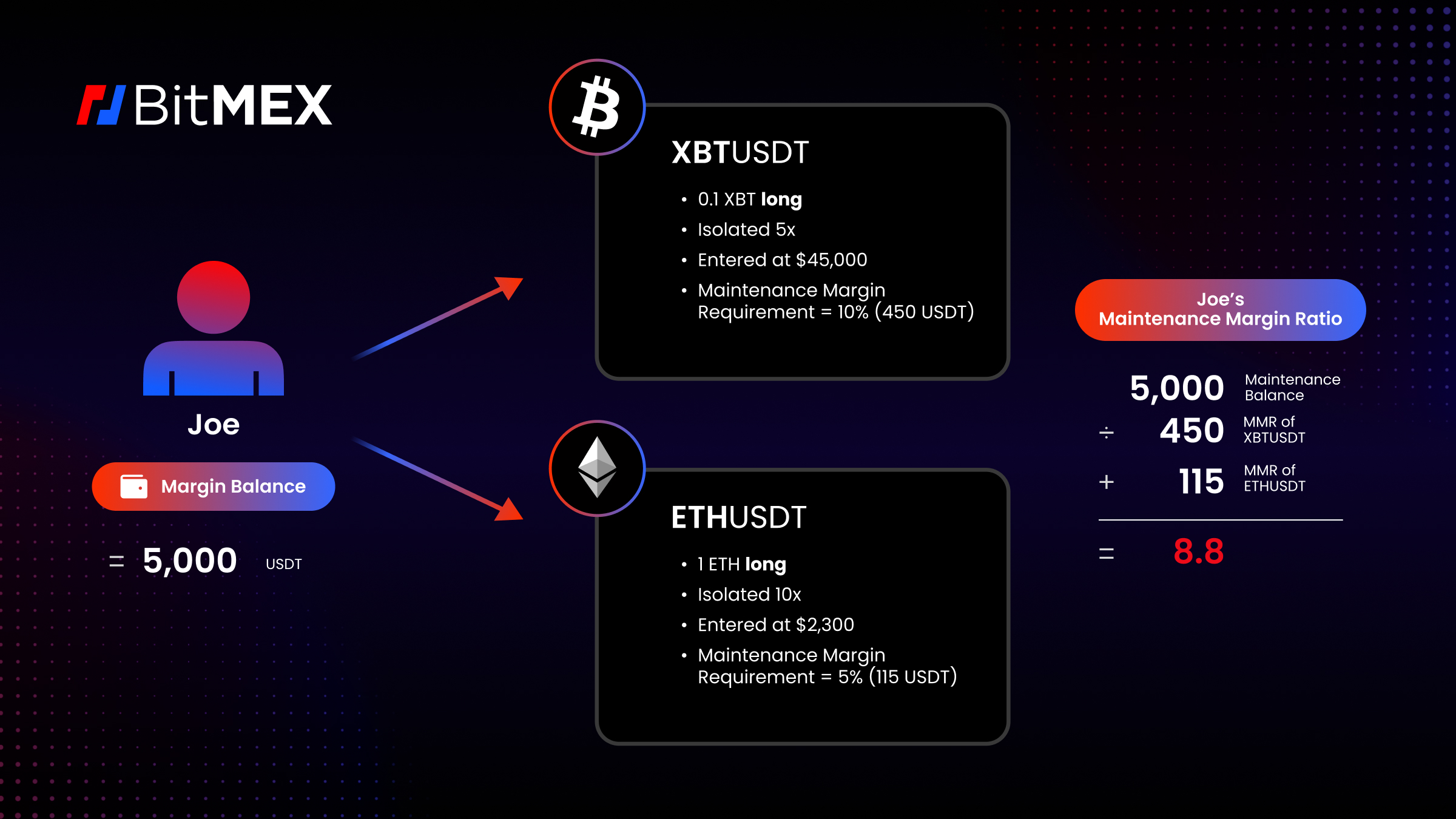

Let’s say Joe has two open positions: a long position on the XBTUSDT contract and a long position on the ETHUSDT contract.

- Joe holds a long position of 0.1 XBT on XBTUSDT (isolated 5x) at 45,000. The maintenance margin requirement for this is 10%, which is 450 USDT.

- Joe holds a long position of 1 ETH on ETHUSDT (isolated 10x) at 2,300. The maintenance margin requirement for this is 5%, which is 115 USDT.

- Assume Joe has 5,000 USDT as margin balance. His Maintenance Margin Ratio is calculated as: Margin Balance/(XBTUSDT Margin Requirement + ETHUSDT Margin Requirement) = 5,000/(450+115).

- His Maintenance Margin Ratio is 8.8.

In this scenario, Joe’s Maintenance Margin Ratio is below 10 – meaning he will be in margin call. Here, he has three options to remedy the situation:

1) Add more funds to his account;

2) Close his positions;

3) Cancel his open orders.

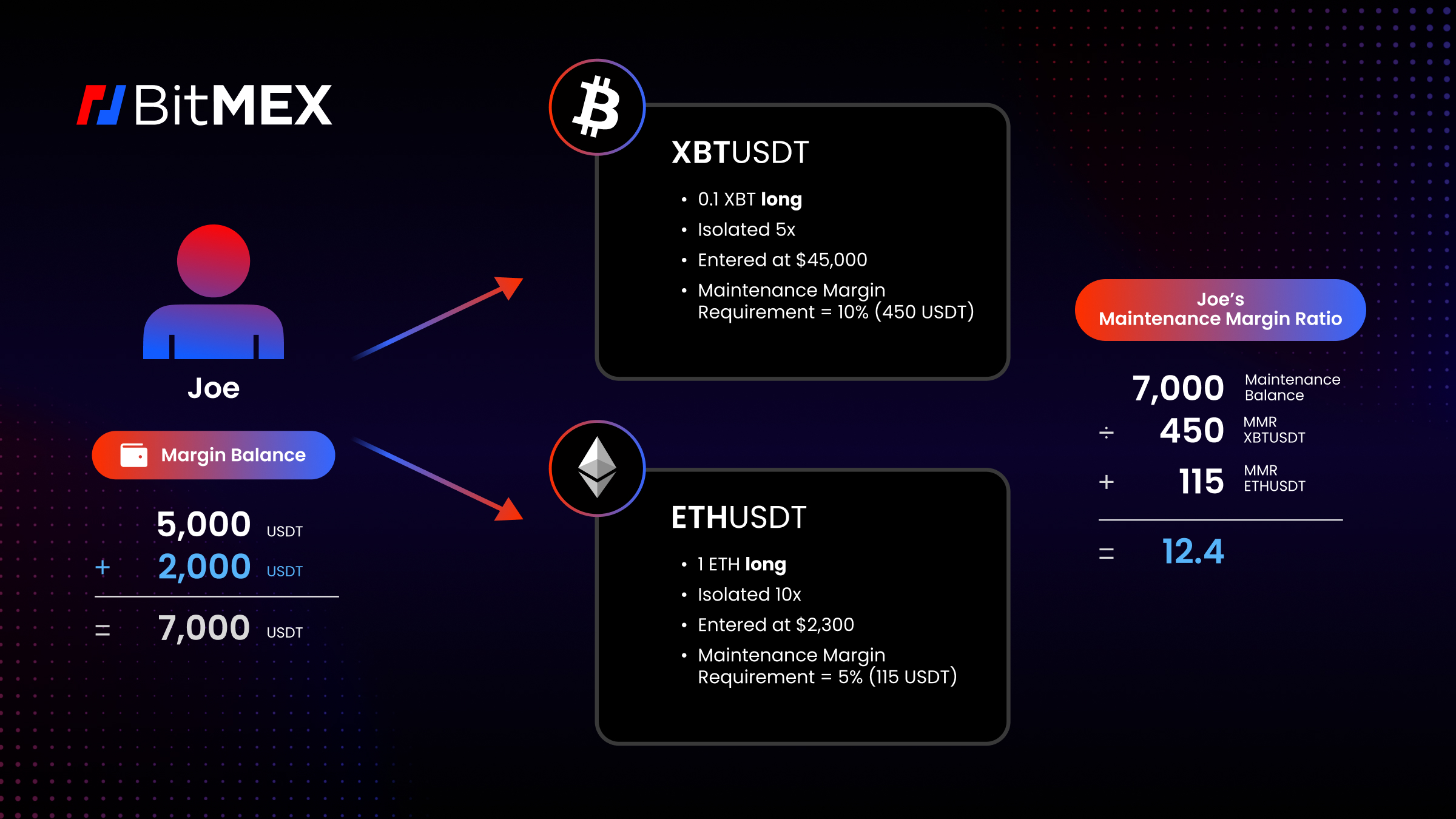

Let’s say Joe opts for option one and decides to fund his account with an extra 2,000 USDT.

- Joe now has 7,000 USDT as margin balance. His Maintenance Margin Ratio is calculated as: Margin Balance/(XBTUSDT Margin Requirement + ETHUSDT Margin Requirement) = 7,000/(450+115).

- His Maintenance Margin Ratio is 12.4.

Joe’s Maintenance Margin Ratio is now above 10 – meaning he will no longer be in margin call.

How Do I Keep Track of My Margin+ Requirements?

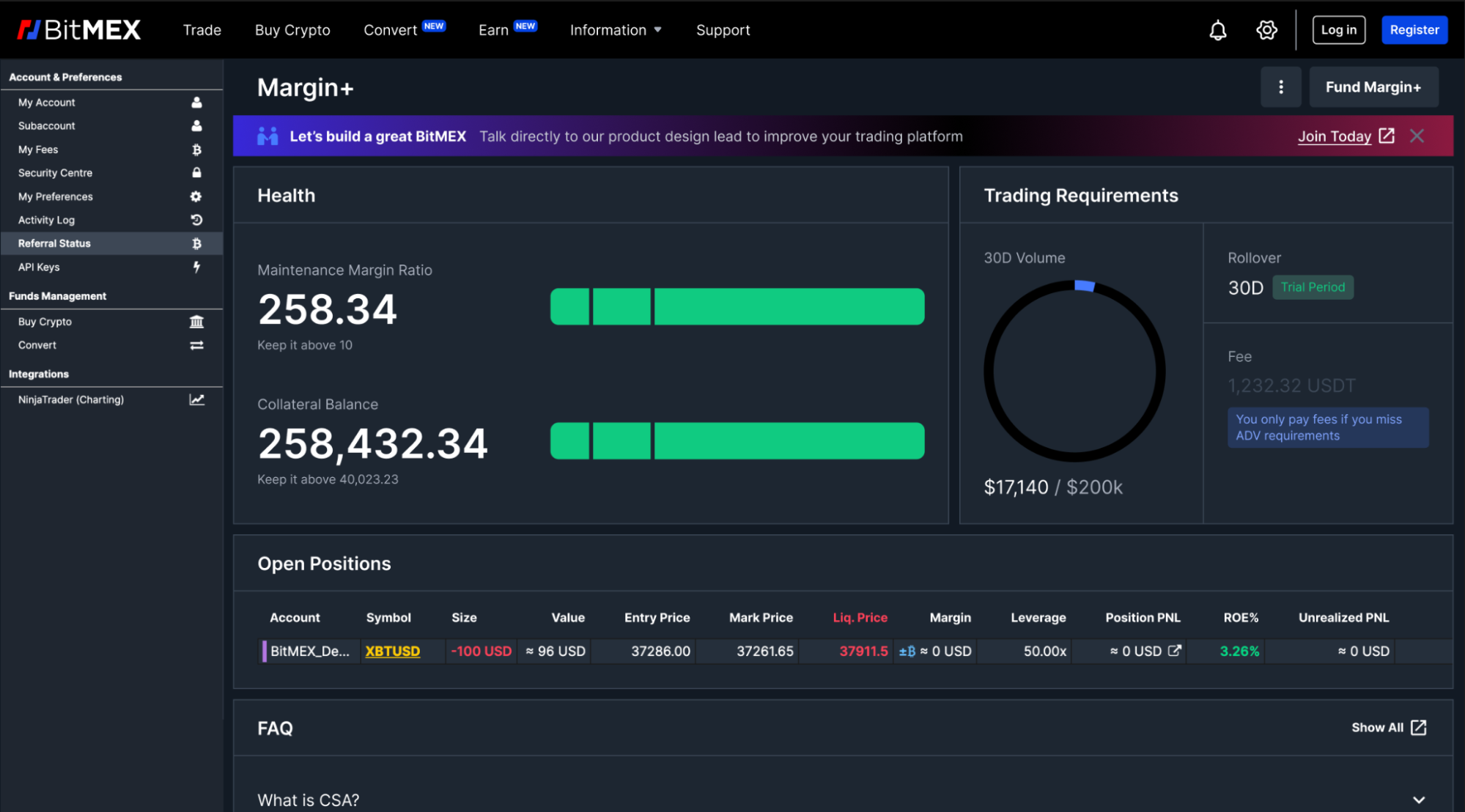

To best support users of Margin+, those in the programme get access to an exclusive dashboard that helps you keep track of your account’s…

- Minimum Balance

- Maintenance Margin Ratio

- Minimum Trading Volume

The dashboard can be found in the dropdown menu when hovering over your account icon on the top right corner of the trading UI.

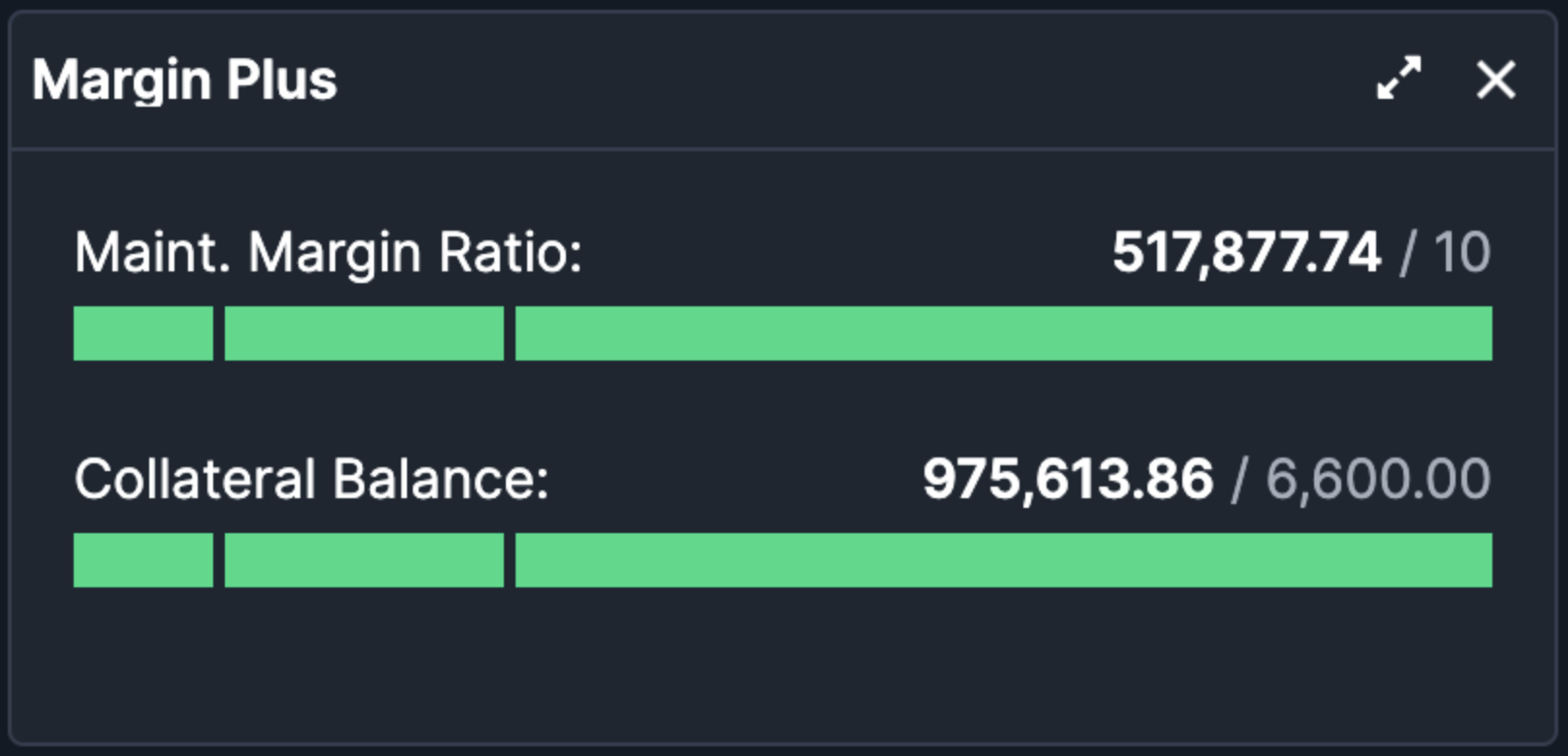

To make it even more accessible, you can add a Margin+ widget directly to your Trading UI where you can see your Margin+ data in one place.

Sounds like the right fit for you? If interested in joining our Margin+ programme, reach out to our Support team who will advise on your eligibility. Please note your enquiry will be subject to approval.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

In the meantime, if you have any questions please contact Support who are available 24/7.