(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

How does society adjudicate scarcity given that humanity hasn’t reached a sci-fi utopian post-scarcity existence? Infinitely abundant energy does not allow us to consume whatever we want whenever we want, which obviates the need for money. Therefore, we must use this devilish construct called money to allocate scarce resources. Money and markets combine to produce the best tool to inform society what to produce, in what quantities, and who should receive it. The market price of a good adjudicates scarcity. It follows, then, that the price of money and its quantity are the two most important variables in any society. Perversion of one or both variables leads to societal dysfunction. Every economic “ism” offers a theory of how to denigrate or glorify markets, and all contain a modicum of monetary manipulation.

While a free market is the perfect way to adjudicate scarcity, it doesn’t follow that the more market freedom given results in a linear progression towards economic Valhalla. The people desire to dampen economic volatility through regulating markets and money. That is the primary purpose of a government. The government provides goods and services that the people believe are best left under collective control. Or the government restrains markets from producing immoral outcomes like human slavery. Along with these powers, the government must exert some amount of control over the price and quantity of money. Sometimes governments are benevolent and other times despotic monetary dictators. Because governments legally can murder their citizens for violations of their laws, they can force the use of a type of money. This results in good and bad outcomes.

Invariably all governments, regardless of which theory on governance guides them, always debase their money supply in the search of a teleportation device to a post-scarcity society. Achieving post-scarcity will not result from clever ways of printing money, but will require a deeper understanding of the physical universe and an ability to manipulate this construct to our advantage. However, a politician can’t wait decades or centuries to achieve a scientific revolution. And thus, the people’s palliative cure for a volatile and uncertain universe is always to print more money.

While governments are powerful, the people always find ways to retain their sovereignty. In many cultures that experienced endemic inflation over centuries of successive governments or dynasties, cultures created gifting rituals marking major life milestones (birth, marriage, and death) that involve the exchange of hard money. In this way, the people save through cultural rituals. No politician dares subvert these rituals lest they lose their mandate to lead and find themselves headless.

In the modern era, when the power of centralized governments — whether a democracy, socialist republic, communist state, etc. are all powerful because of the advances of thinking machines and the internet, how can we the people preserve our rights to sound money? The gift that Satoshi gave to humanity via their Bitcoin whitepaper is a technological miracle that was launched at a very important time in history.

Bitcoin in the current state of human civilization is the best form of money ever created. Like all money, it has a relative value. Given that Pax Americana quasi-empire rules via the US dollar, we value Bitcoin relative to the dollar. Assuming the technology works, Bitcoin’s price will ebb and flow because of the price and supply of dollars.

The point of this philosophical preamble is to provide the context that produces my guiding light as to the duration of the Bitcoin/USD price cycle. There have been three cycles, where the all-time high (ATH) occurs every four years. As the four-year anniversary of this fourth cycle is upon us, traders wish to apply the historical pattern and forecast an end to this bull run. They apply this rule without understanding why it worked in the past. And without this historical understanding, they miss why it will fail this time.

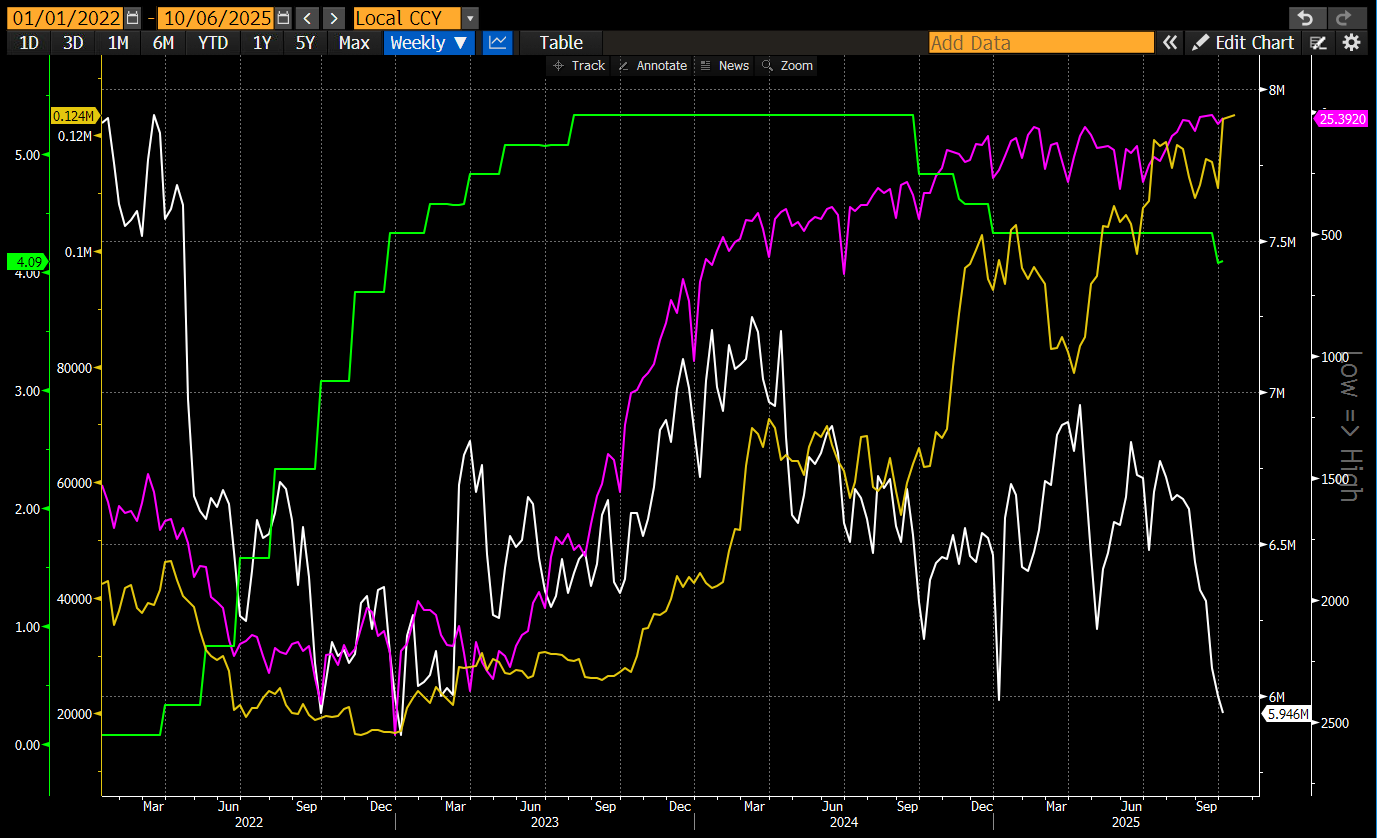

To illustrate why the four-year cycle is dead, I want to conduct a simple study of two charts. The primary theme is the price and quantity of money, e.g. dollars. Therefore, I will analyze a chart of the Effective Fed Funds rate and the supply of dollar credit. The secondary theme is the price and quantity of yuan emanating from China. For most of human history, it was the wealthiest squiggly line enclosure on the map. It took a half-millennium break, 1500 to 2000, but they are back to reclaim the global economic throne. The question is, are there any obvious turning points at the various Bitcoin ATH levels that can roughly explain the peak and subsequent collapse of the price? For each four-year period, I will provide a synopsis of the monetary trends at the time that explains the charts.

US Dollar:

The white line is a gauge of the price and supply of dollar credit. This is a combination of banking reserves held at the Fed and the US banking system’s total other deposits and liabilities. The Fed publishes both numbers weekly.

The green line represents the Effective Fed Funds rate, which is set by the FOMC.

The gold line is the Bitcoin/USD price.

Yuan:

China’s economy is even more credit dependent than America’s therefore, I used the Bloomberg Economics China Credit Impulse % 12 Month Change index. You would get a similar chart if you looked at the YoY% change in nominal GDP.

Back to the past.

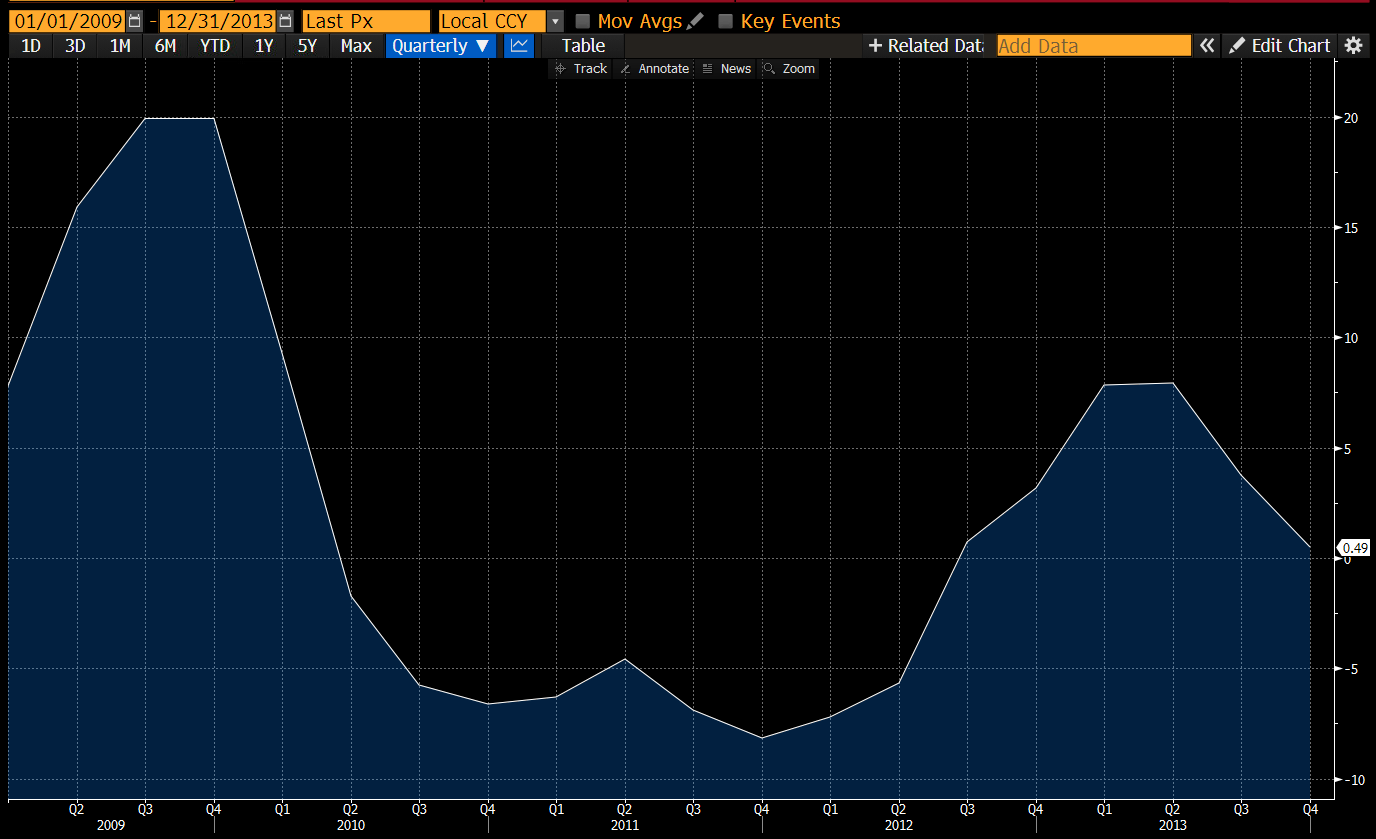

Genesis Cycle: 2009 to 2013

On 3 January 2009, Bitcoin produced its first block, called the genesis block. The 2008 Global Financial Crisis (GFC) raged, destroying financial institutions globally. The banksters aided and abetted by the bought and paid for US government almost destroyed the world economy but Fed chairperson Ben Bernanke “saved” the system by enacting unlimited QE, which was announced in December 2008 and started in March 2009. The Chinese helped the world economy by ramping up credit fueled infrastructure spending. By 2013, both the Fed and PBOC wavered in their support for an infinitely expanding money supply. As you will see, that caused a deceleration in credit growth or outright contraction in the supply of money, which ultimately ended the Bitcoin bull run.

US Dollar:

The price of dollars was effectively 0%. The supply of dollars rose sharply and peaked and rolled over at the end of 2013.

The price of dollars was effectively 0%. The supply of dollars rose sharply and peaked and rolled over at the end of 2013.

Yuan:

The massive increase in credit growth flooded the world with yuan, trillions of which escaped from China into Bitcoin, gold, and global real estate. By 2013, while the credit growth was impressive, it was much less than before, and the deceleration coincided with that of dollar credit growth.

The massive increase in credit growth flooded the world with yuan, trillions of which escaped from China into Bitcoin, gold, and global real estate. By 2013, while the credit growth was impressive, it was much less than before, and the deceleration coincided with that of dollar credit growth.

This deceleration in dollar and yuan credit growth popped the Bitcoin bubble.

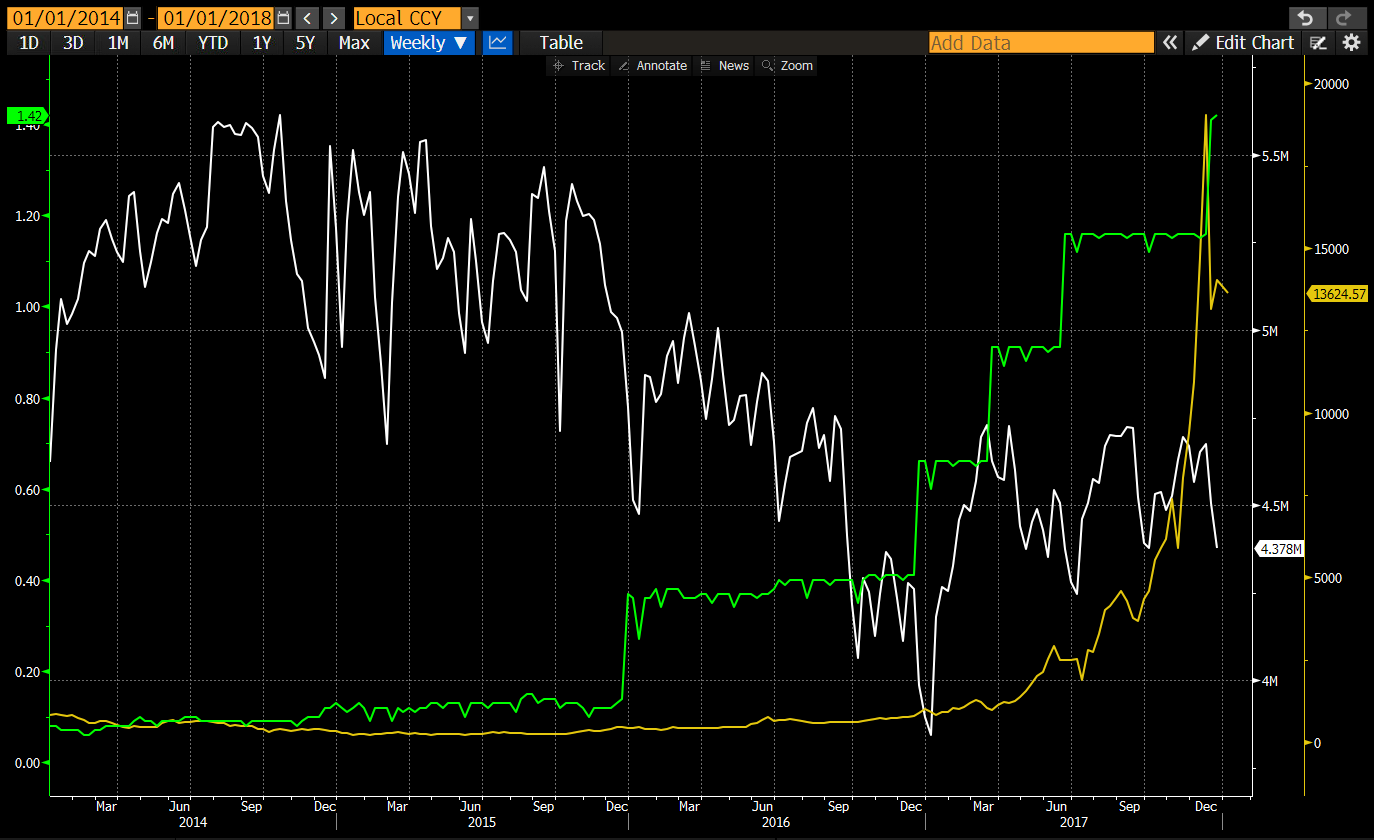

ICO Cycle: 2013 to 2017

This was the ICO cycle because during this time period the Ethereum mainnet went live and ushered in a growth of new issues funded by subscribing via public blockchain using smart contracts. Bitcoin rose from the ashes because of an explosion in yuan supply, not dollars. As you can see below, the China credit impulse accelerated in 2015 alongside a devaluation of the yuan versus the dollar. The supply of dollars fell and the interest rate rose. Bitcoin skyrocketed because of a fuck ton of yuan sloshing around the global money markets. Ultimately, as yuan credit growth decelerated from its 2015 highs, the tighter dollar monetary conditions bit into the bull market and gnashed it to the floor by late 2017.

Yuan:

US Dollar:

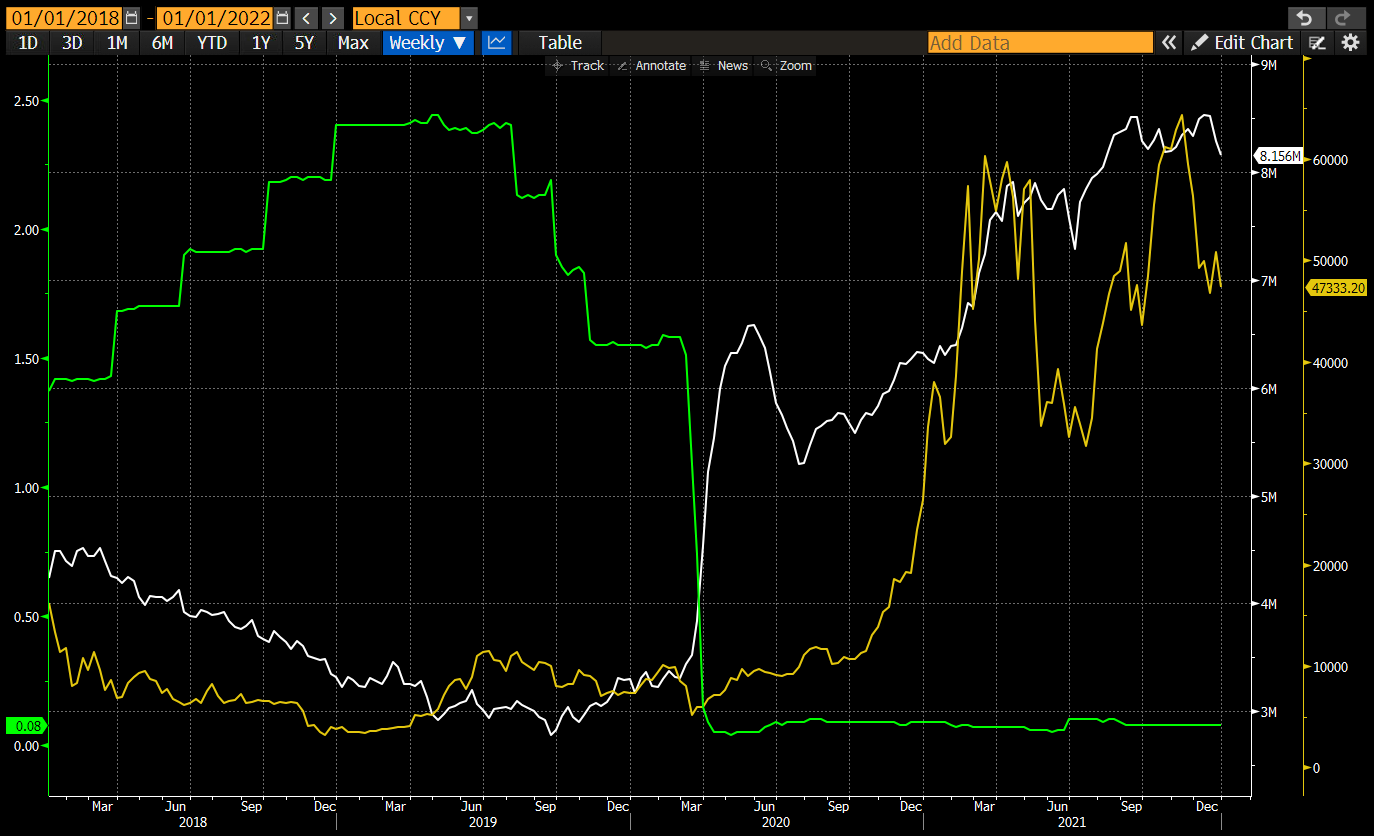

COVID Hoax: 2017 to 2021

While COVID definitely killed millions, the crisis was exacerbated by poor government policy. COVID was the ruse to condition the population to accept its loss of freedoms, and this transcended whatever type of government theory ruled in a particular locale. In the spirit of throwing shit at the wall and seeing what stuck, COVID was the perfect opportunity for Pax Americana to unleash helicopter money whereby then-US President Donald Trump provided the largest populist government handout since Franklin Delano Roosevelt’s New Deal. The trillions of dollars printed found their way into crypto. Trump ran it hot, and every market was up only.

US Dollar:

The supply of dollars doubled, and the price of money quickly fell to 0%.

The supply of dollars doubled, and the price of money quickly fell to 0%.

Yuan:

While the Chinese credit impulse rose during COVID, President Xi Jinping did not go all out. He used COVID as the time to launch an attack on China’s property bubble. This level of yuan credit growth did not forestall a collapse in local property prices started by the “Three Red Lines” policy. But this was by design, and with no one allowed to enter or leave China at this time, it was very easy to control capital flight and social discontent on the mainland. As a result, China’s monetary policy did not materially contribute to this Bitcoin bull market.

While the Chinese credit impulse rose during COVID, President Xi Jinping did not go all out. He used COVID as the time to launch an attack on China’s property bubble. This level of yuan credit growth did not forestall a collapse in local property prices started by the “Three Red Lines” policy. But this was by design, and with no one allowed to enter or leave China at this time, it was very easy to control capital flight and social discontent on the mainland. As a result, China’s monetary policy did not materially contribute to this Bitcoin bull market.

The inflation produced by Trump and subsequent US President Biden’s economic policy of running it hot was too much to handle by the end of 2021. Inflation spiked, and those without a horde of financial assets felt cheated. The federal government stopped handing out stimmies, the Fed began shrinking its balance sheet, and announced it would quickly raise interest rates. This marked the end of the bull market.

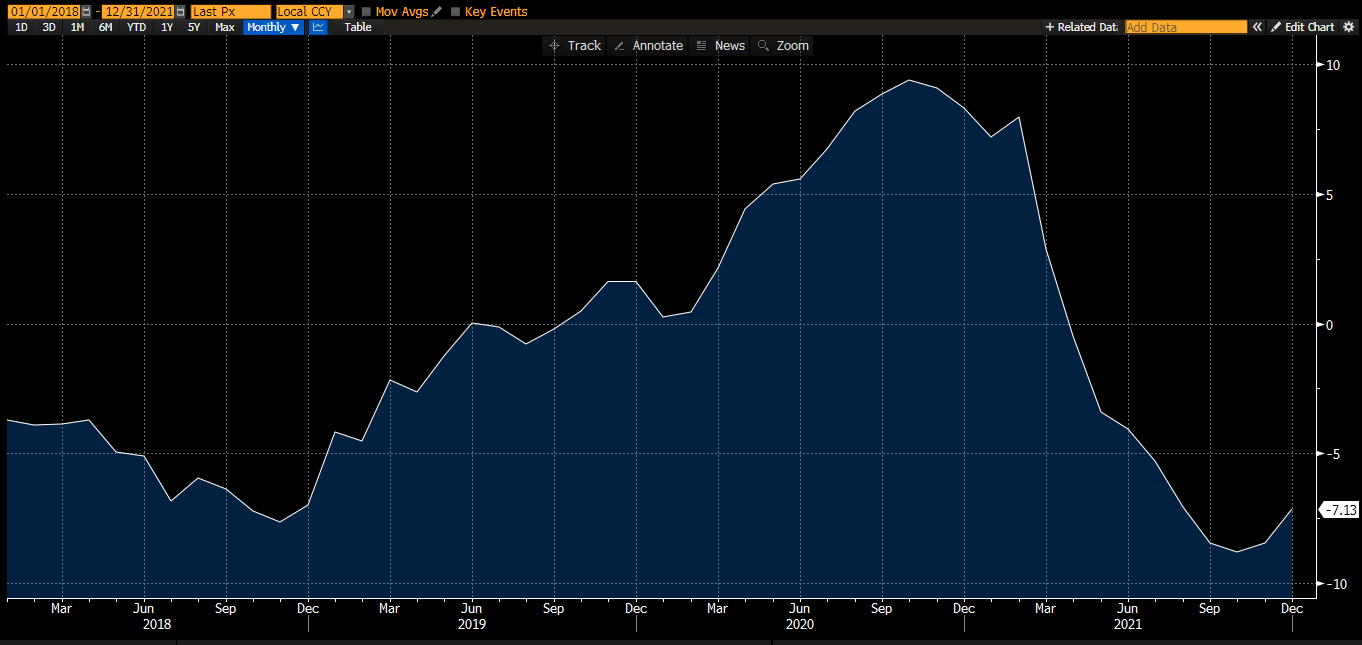

New World Order: 2021 -?

The Pax Americana quasi-empire is but a nostalgic dream. What comes next? This is the question with which global leaders wrestle. Change is not good nor bad, but change creates economic winners and losers. Sometimes the losers are politically and economically powerful, which creates issues for ruling parties. In order to shield the negative effects of change from the populace, politicians print money.

This time around, the engine of credit growth came from the Fed’s Reverse Repo Program (RRP in magenta with the y-axis inverted). The price of money increased. The supply of money fell. But Biden needed to juice markets. Therefore, his henchwoman, US Treasury Secretary Bad Gurl Yellen, issued more treasury bills than notes/bonds in order to drain the RRP. This unleashed ~$2.5 trillion of liquidity into the markets. Her successor, Buffalo Bill Bessent, continued the policy until the RRP fell to its current value near zero. China entered bouts of deflation as judged by a negative credit impulse. Xi remained committed to reducing the price of housing and its importance to the Chinese economy. And with no other guidance or changes in the outlook for US and Chinese monetary policy, I would agree with many crypto traders that the bull run is over. But the rhetoric and recent actions by the Fed and PBOC augur otherwise.

US Dollar:

Yuan:

Yuan:

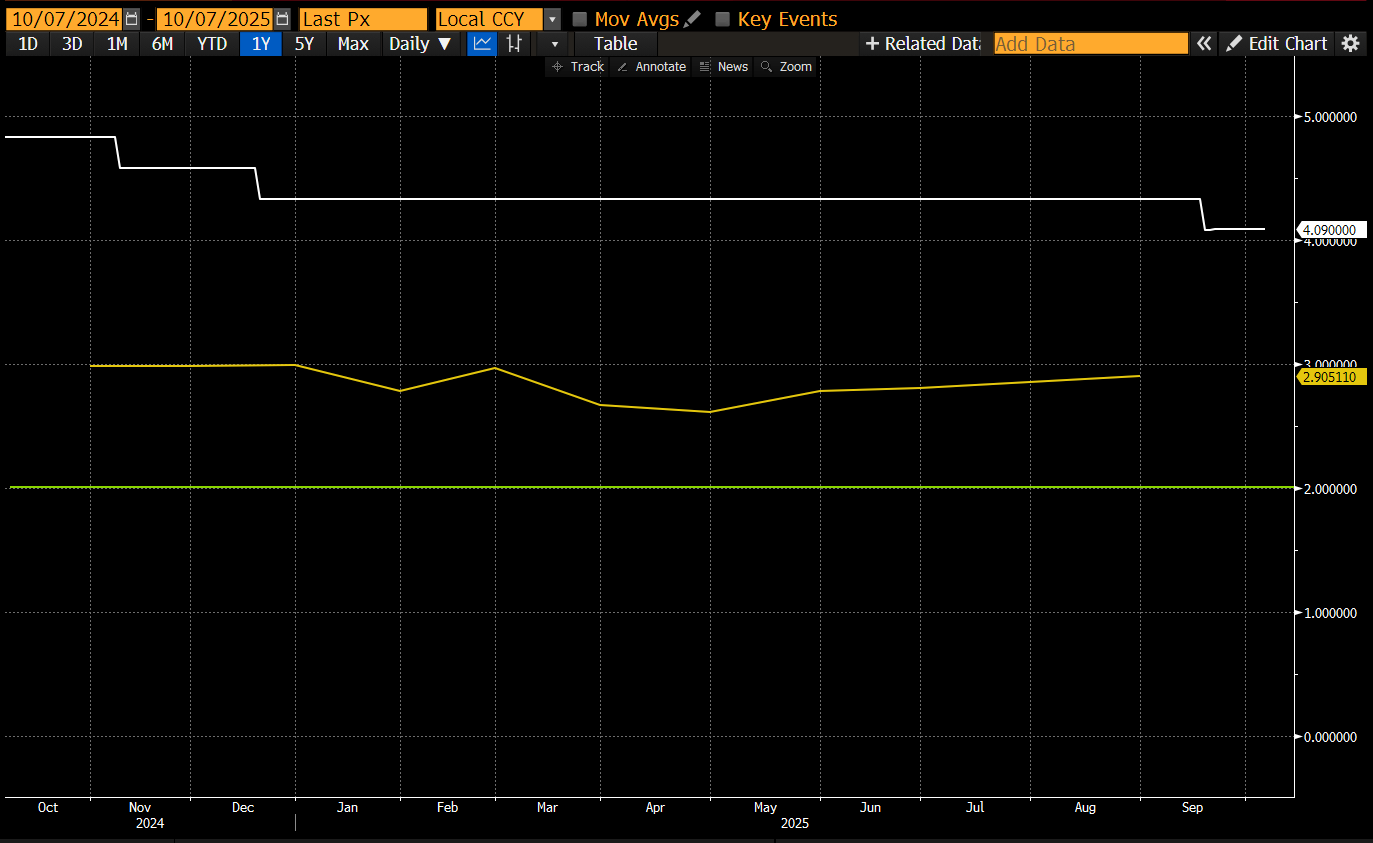

In the US, newly elected President Trump wants to run the economy hot. He routinely speaks about America growing in order to reduce its debt load. He lambasts the Fed for a too-tight monetary supply. His desire is generating action. The Fed resumed cutting interest rates in September even though inflation is above its own target.

In the US, newly elected President Trump wants to run the economy hot. He routinely speaks about America growing in order to reduce its debt load. He lambasts the Fed for a too-tight monetary supply. His desire is generating action. The Fed resumed cutting interest rates in September even though inflation is above its own target.

The white line is Effective Fed Funds rate, the yellow line is Core PCE, and the green horizontal line is the Fed’s 2% target.

The white line is Effective Fed Funds rate, the yellow line is Core PCE, and the green horizontal line is the Fed’s 2% target.

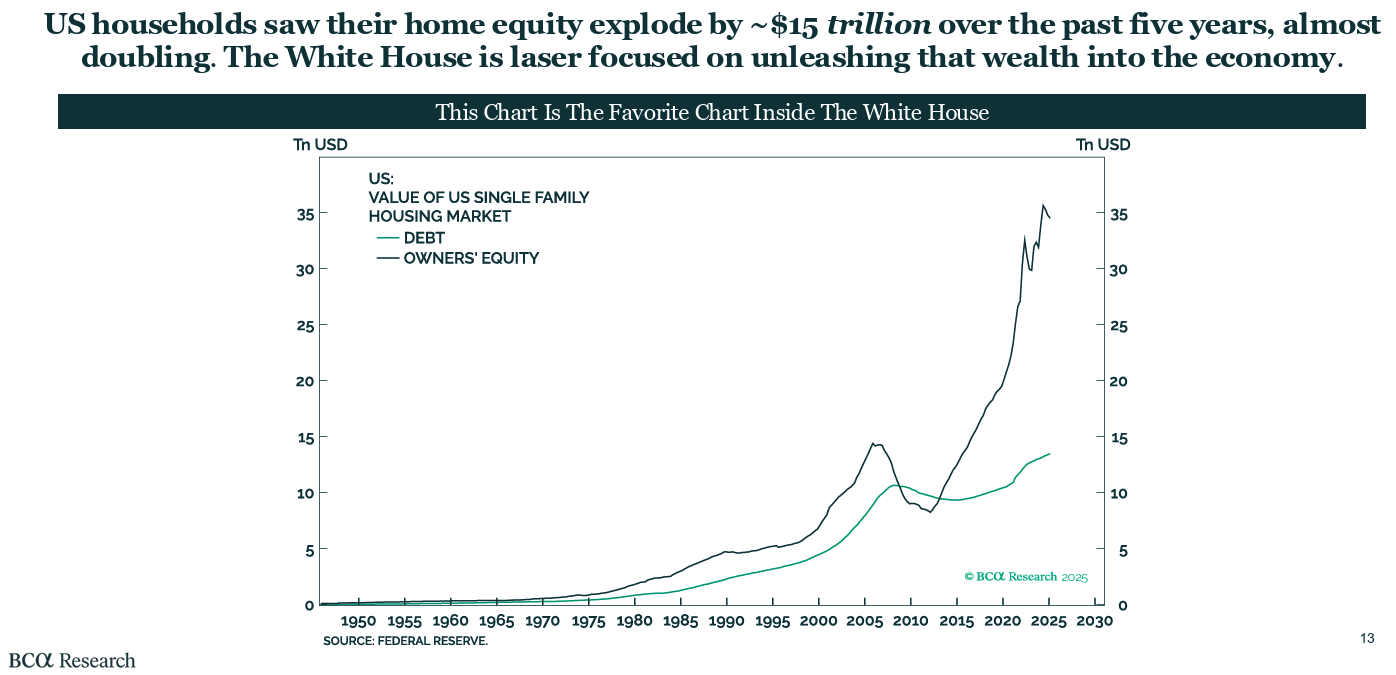

Trump also speaks about lowering the cost of housing to release trillions of dollars of trapped home equity because of the rapid rise in housing prices post-2008.

Finally, Buffalo Bill Bessent will deregulate banks so that they can increase loans to critical industries. The future as painted by the ruling political elite points to lower, not higher, interest rates and higher, not lower, growth in the money supply.

Finally, Buffalo Bill Bessent will deregulate banks so that they can increase loans to critical industries. The future as painted by the ruling political elite points to lower, not higher, interest rates and higher, not lower, growth in the money supply.

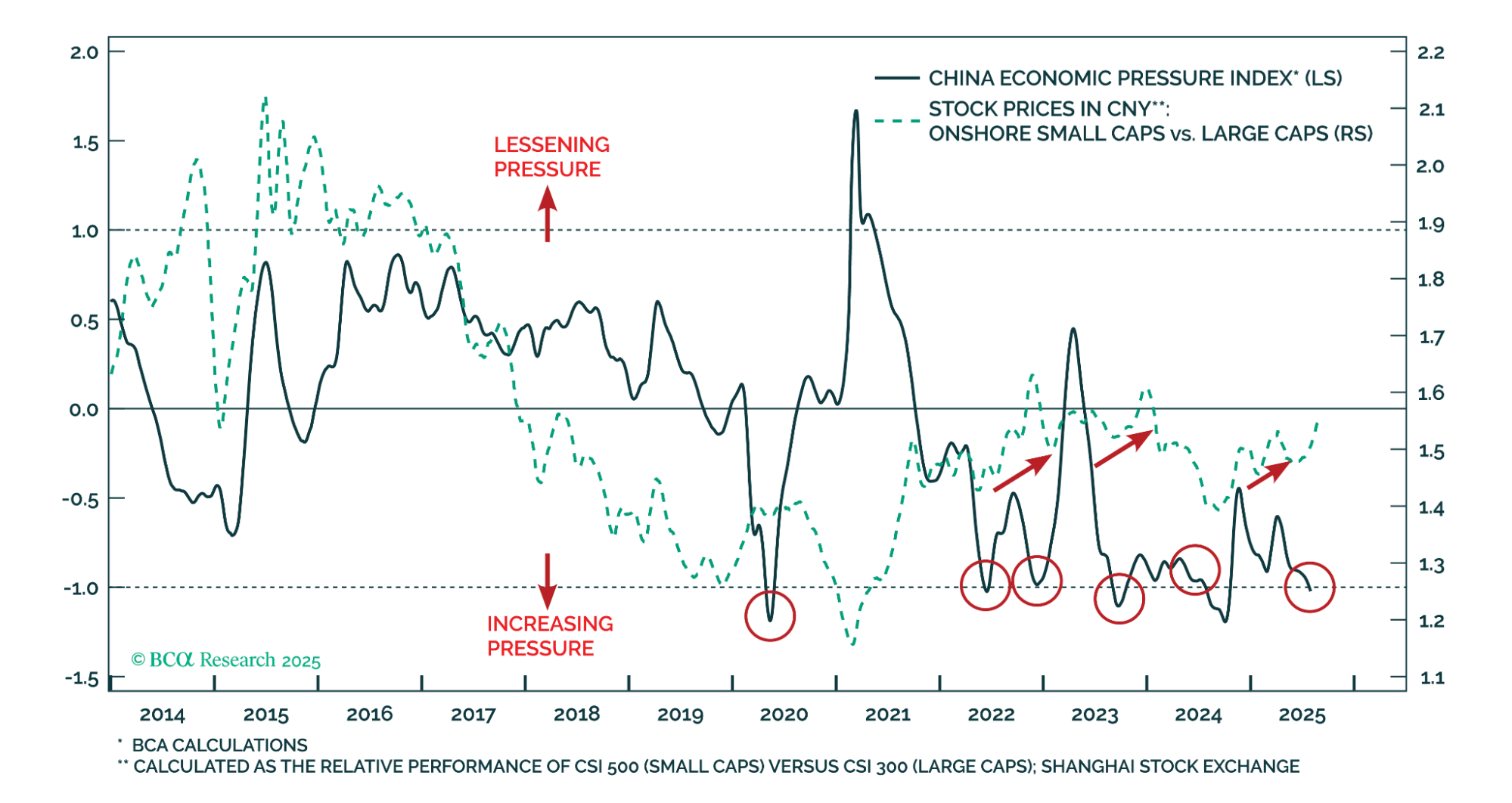

While Xi does not want to issue credit in the quantities of 2009 and 2015, he does want to end deflation. When the economic pressure proves too intense, as the above BCA chart indicates, Chinese policymakers print money. I don’t believe that China currently will be the driver of global fiat credit growth, but it won’t hinder it either.

While Xi does not want to issue credit in the quantities of 2009 and 2015, he does want to end deflation. When the economic pressure proves too intense, as the above BCA chart indicates, Chinese policymakers print money. I don’t believe that China currently will be the driver of global fiat credit growth, but it won’t hinder it either.

Listen to our monetary masters in Washington and Beijing. They clearly state that money shall be cheaper and more plentiful. Therefore, Bitcoin continues to rise in anticipation of this highly probable future. The king is dead, long live the king!

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar