The XBTETH perpetual swap – the first of its kind – is available to users on BitMEX. It’s a move that means traders can now speculate on the ratio between XBT* and ETH, margined in Bitcoin, with up to 100x leverage.

The addition of this unique derivative to our expanding product suite, makes new trading and hedging opportunities available to our users.

For a deeper dive into this new crypto derivatives product, and how it works, read on.

Alternatively you can begin trading the XBTETH perpetual swap here.

*XBT is what we call Bitcoin at BitMEX, exactly the same as what some other platforms call BTC.

ICYMI, we’re offering 10,000 BMEX Tokens to new users. You can sign up here.

Our New Crypto Derivative, the XBTETH Swap, Explained

XBTETH is an inverse perpetual swap that will allow traders to long or short the XBT/ETH exchange rate with leverage opportunities.

As with all inverse contracts, XBTETH is crypto-margined – in this case, XBT. The contract itself is priced as the ratio between the two currencies – XBT/ETH.

Each XBTETH contract on BitMEX will be worth a fixed amount of 0.01 ETH, the smallest contract value that a trader must commit. To open a position, a trader must hold XBT, the margin currency. Any profits or losses incurred at the time of closing the position will also be paid or subtracted in XBT.

Like all crypto derivative contracts on BitMEX, it will be possible for XBTETH traders to take a leveraged position (i.e. trade XBTETH with up to 100x leverage). Traders can also hold a position as long as they wish, given they allocate enough margin to satisfy the maintenance margin requirement. However, once the maintenance margin is not satisfied, then the trader will get liquidated.

For a rundown on the types of perpetual swaps, and their mechanics, click here.

XBTETH Contract Specs

- Symbol: XBTETH

- Margin Currency: XBT

- Contract Size: 0.01ETH

- Lot Size: 1

- Minimum Trade Amount: 0.01 ETH

- Underlying: .BXBTETH Index

- Max Leverage: 100x

- Risk limit: 75 XBT

- Maker Fee: 0.02%

- Taker Fee: 0.075%

- Base Initial Margin: 1.00%

- Base Maintenance Margin: 0.50%

Who is XBTETH Made For?

XBTETH may be suitable for any BitMEX user who expects the increase/decrease of XBT relative to ETH, and wishes to long/short the asset respectively.

It could be those seeking to trade on the dominance of XBT relative to ETH (and the potential flippening of ETH), recent regulatory rhetoric on Bitcoin’s status as a security, or institutional participation in Bitcoin through ETFs.

The pair is also a relatively low volatility one in the crypto market, which presents an ideal scenario for traders to take up higher leverage, or keep positions open for the medium to longer-term.

In addition, the contract will unlock an opportunity for XBT holders to earn yield on the token, while using the XBTETH contract as a hedge.

How to Use XBTETH to Earn Yield?

Say a trader has two idle XBT in their BitMEX account, and is seeking to earn low-risk yield through staking ETH. To do so, the trader chooses to sell one XBT into ETH.

The trader will be able to then long the XBTETH contract using the remaining XBT in their account – as the contract is margined in the currency. Their position in the XBTETH contract recreates the XBT long, and acts as a hedge against ETH’s spot price movements.

Next, the trader can withdraw their purchased ETH and deposit the tokens into a DeFi staking platform to generate yield. By executing such, the trader will maintain a long position for two XBT while simultaneously earning a staking yield through ETH.

This is amongst several trading opportunities for users that will be made available with the introduction of XBTETH, a unique derivative yet to be offered on crypto platforms.

Four Examples of How the XBTETH Contract Works

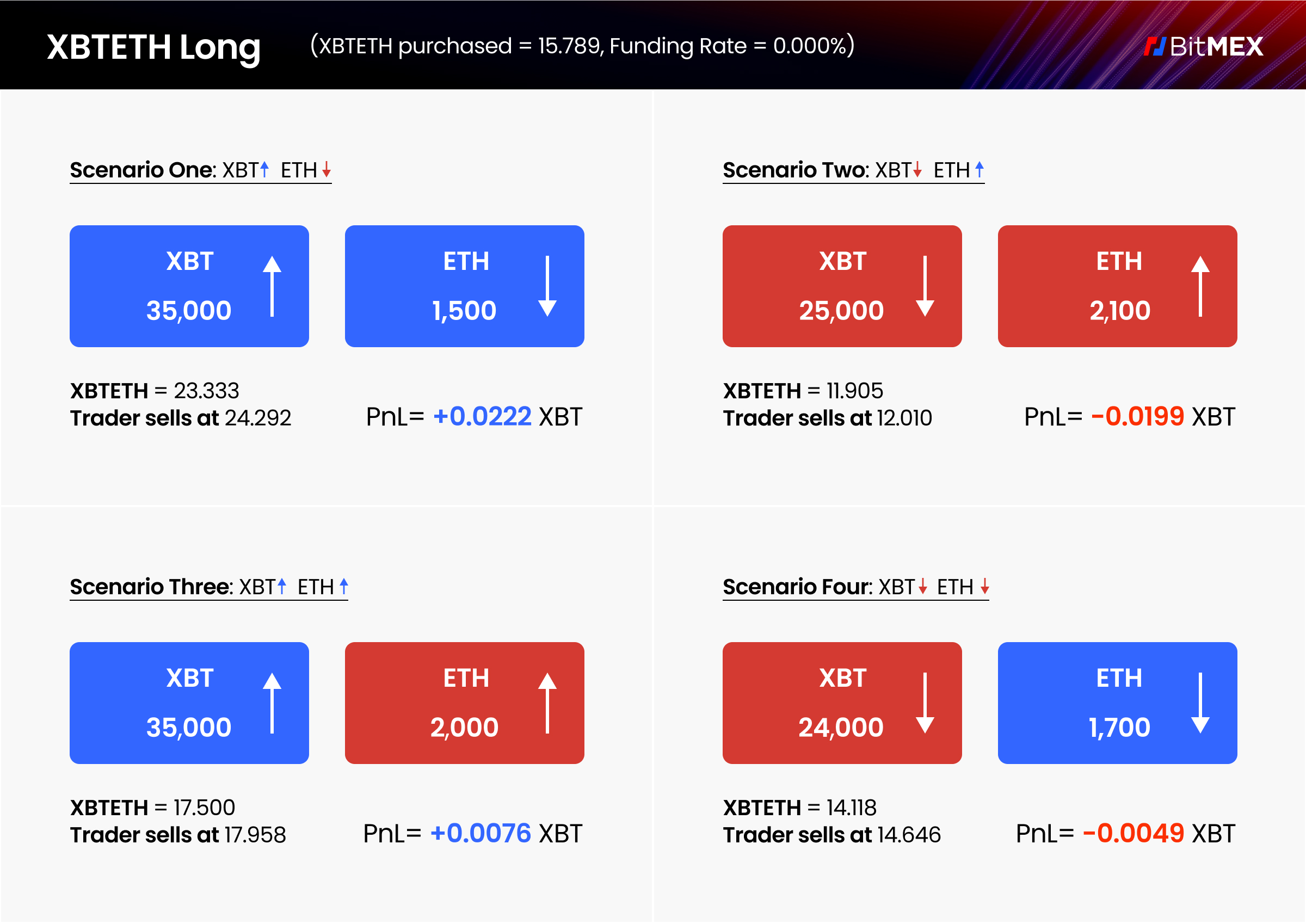

To illustrate the mechanics of the new XBTETH contract, we’ve included four example scenarios below. For all examples, the trader purchases 100 contracts of XBTETH at 100x leverage. Each contract is worth 0.01 ETH, so the total value of the trader’s position equals one ETH.

At the time of entering the position, XBT_USD spot = 30,000 and ETH_USD spot = 1,920. The .BXBTETH index price is 15.625, and the trader buys XBTETH at 15.789.

The required initial margin is 1.00% = 0.0006 XBT, and the maintenance margin is 0.50% = 0.0003 XBT.

The funding rate is assumed as 0%, meaning index price equals mark price for PnL calculations.

Scenario One: XBT Goes up, ETH Goes Down (vs USD)

- The spot prices change to XBT_USD = 35,000 and ETH_USD = 1,500. The mark price of XBTETH is now = 23.333.

- The trader decides to take profit, and sells XBTETH at 24.292.

- The trader’s PnL is calculated as: Number of contracts * Multiplier * (1/Entry Price – 1/Exit Price) = 100*0.01*(1/15.789 – 1/24.292).

- Their PnL equals 0.0222 XBT.

Scenario Two: XBT Goes Down, ETH Goes Up (vs USD)

- The spot prices change to XBT_USD = 25,000 and ETH_USD = 2,100. The mark price of XBTETH is now = 11.905.

- The trader decides to exit the position, and sells XBTETH at 12.010.

- The trader’s PnL is calculated as: Number of contracts * Multiplier * (1/Entry Price – 1/Exit Price) = 100*0.01*(1/15.789 – 1/12.010).

- Their PnL equals -0.0199 XBT.

Scenario Three: XBT and ETH Goes Up (vs USD)

- The spot prices change to XBT_USD = 35,000 and ETH_USD = 2,000. The mark price of XBTETH is now = 17.500.

- The trader decides to take profit, and sells XBTETH at 17.958.

- The trader’s PnL is calculated as: Number of contracts * Multiplier * (1/Entry Price – 1/Exit Price) = 100*0.01*(1/15.789 – 1/17.958).

- Their PnL equals 0.0076 XBT.

Scenario Four: XBT and ETH Goes Down (vs USD)

- The spot prices change to XBT_USD = 24,000 and ETH_USD = 1,700. The mark price of XBTETH is now = 14.118.

- The trader decides to exit the position, and sells XBTETH at 14.646.

- The trader’s PnL is calculated as: Number of contracts * Multiplier * (1/Entry Price – 1/Exit Price) = 100*0.01*(1/15.789 – 1/14.646).

- Their PnL equals -0.0049 XBT.

The below diagram summarises the PnL outcomes for all the scenarios outlined above.

For more on inverse perpetual swaps, check out this guide referencing the XBTUSD perpetual contract here.

To be the first to know about our new listings, product launches, and giveaways, you can connect with us on Discord, Telegram, and Twitter. We encourage you to also check our blog regularly.

In the meantime, if you have any questions please contact Support.