Key Market Insights

Spot and Derivatives Volumes Double to All-Time Monthly Highs – New Daily Volume Records Set on the 11th of Jan.

Derivatives volumes increased 101% in January to an all-time monthly high of $2.89tn. Meanwhile, total spot volumes increased by 97% to $2.34tn. Across January, volume from the 15 largest Top-Tier exchanges increased 151.6% on average (vs December).

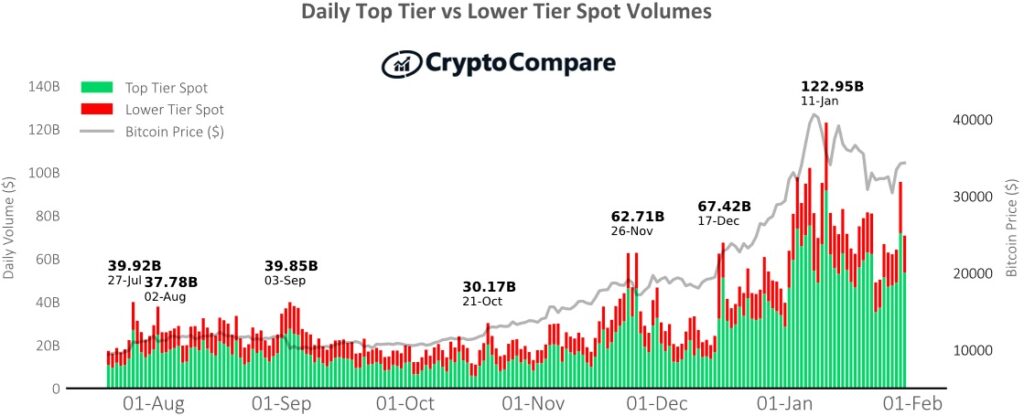

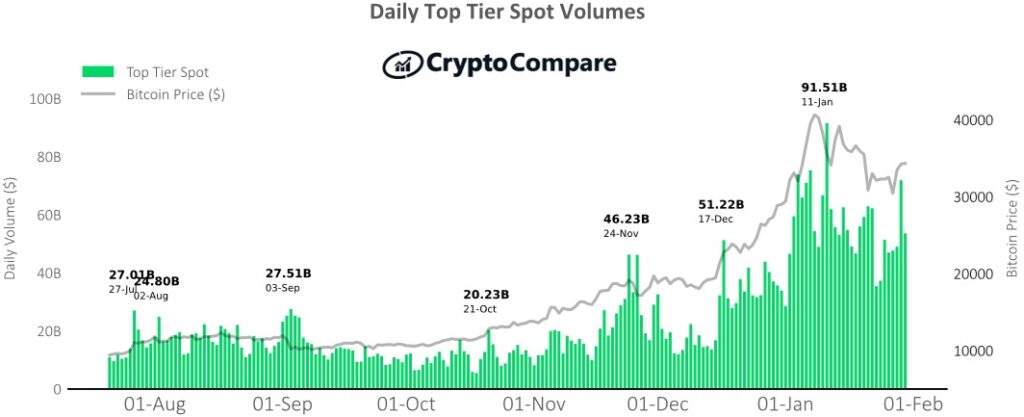

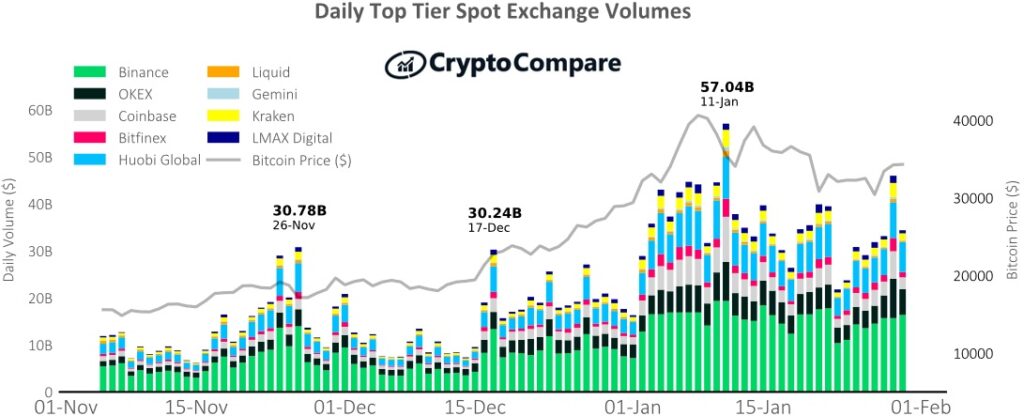

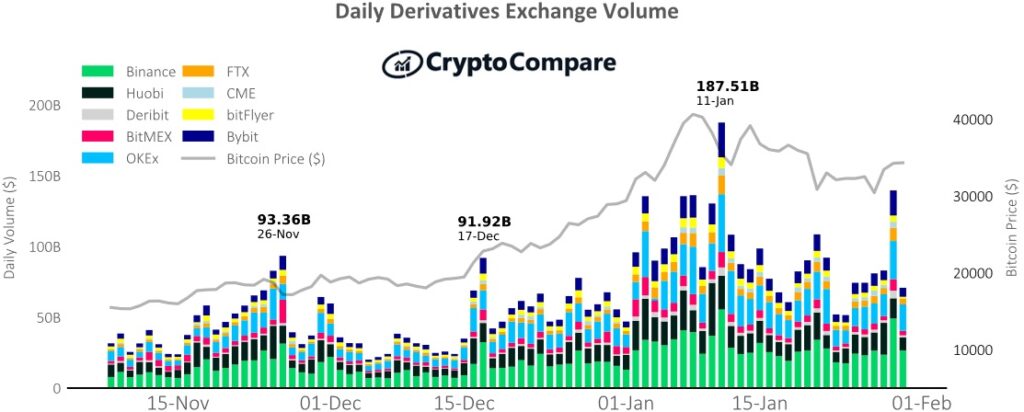

Spot markets set a new daily volume maximum of $122.95bn on the 11th of January, double that of December’s $67.42bn. This occurred during a sharp 25% correction in Bitcoin’s price to $30,000 following its all-time high. Meanwhile, derivatives markets saw a new daily record of $187.5bn, which is double that of the previous monthly record set on the 26th of November ($93.36bn).

CME Sets Record Number of Monthly BTC Futures Contracts Traded and Maintains Highest Open Interest

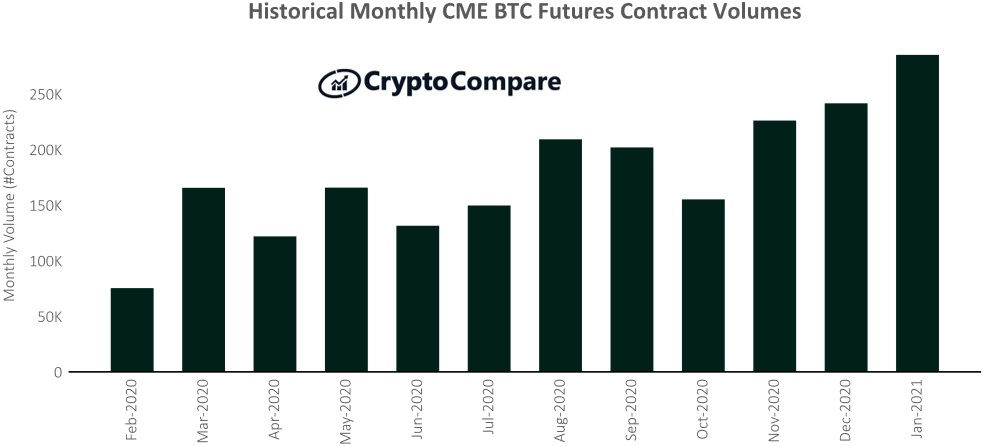

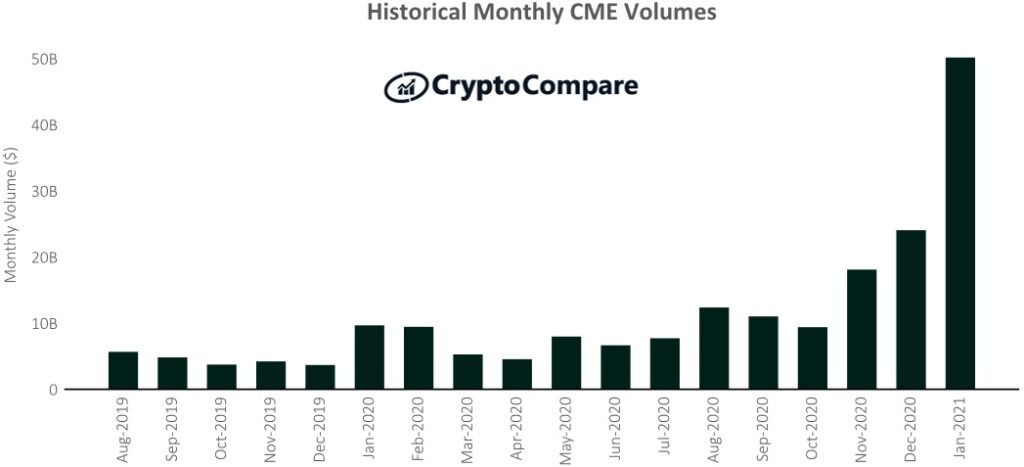

In terms of monthly contract volumes, roughly 285,000 contracts were traded in January (up 18.0% since December) to a new monthly record. In dollar terms, CME’s BTC volumes increased by 108.6% to $50.1bn.

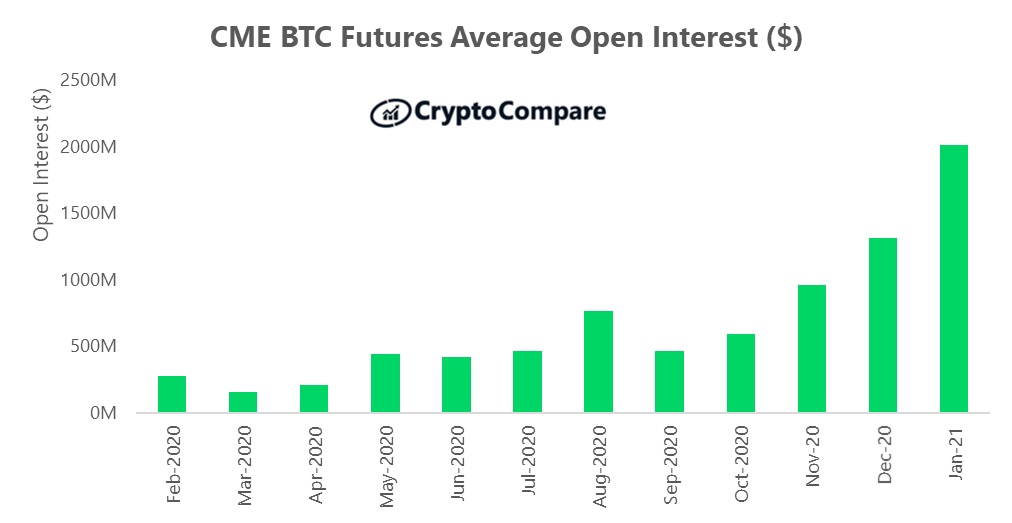

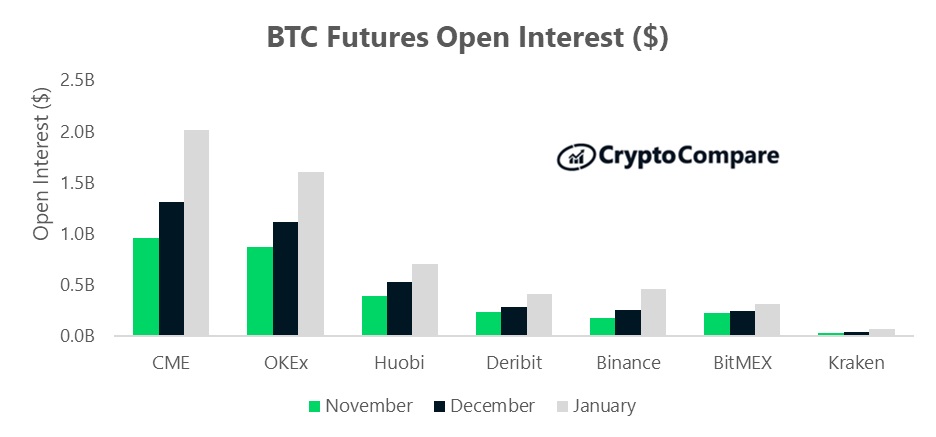

CME also maintained the highest open interest for BTC futures at $2.0bn (up 53.2%) followed by OKEx at $1.6bn (up 44.1%).

Binance Tops Derivatives Open Interest Across All Aggregate Products

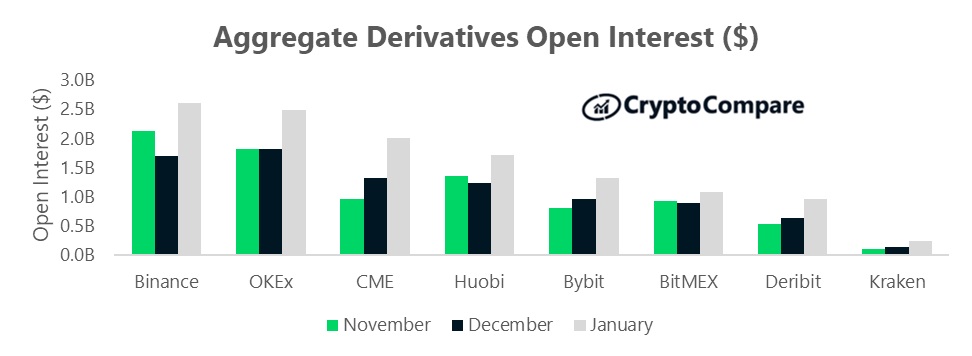

In January, Binance had the highest open interest across all derivatives products on average at $2.6bn (up 53.7% since December). This was followed by OKEx ($2.5bn, up 36.4%) and CME ($2.0bn, up 53.2%).

Top Tier Exchanges Continue to Gain Market Share Over Lower Tier Exchanges

Exchange Benchmark Analysis

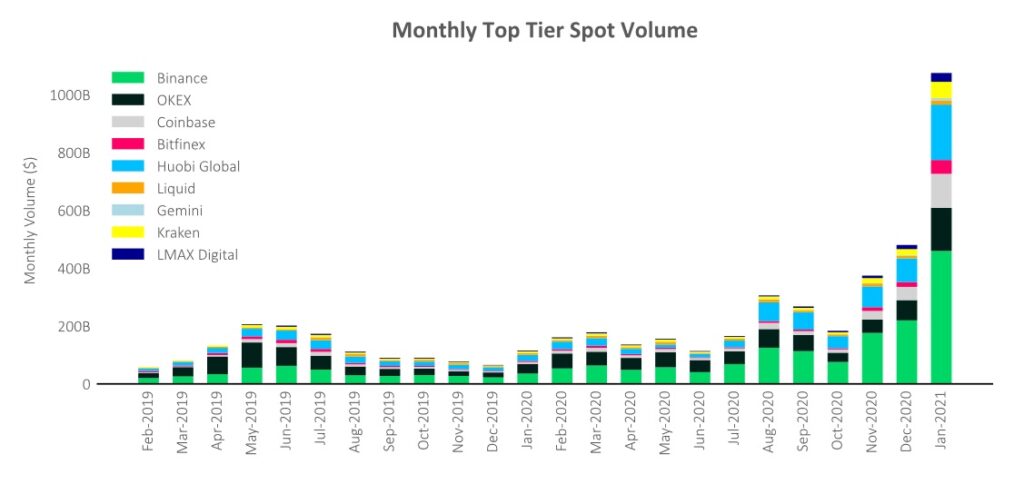

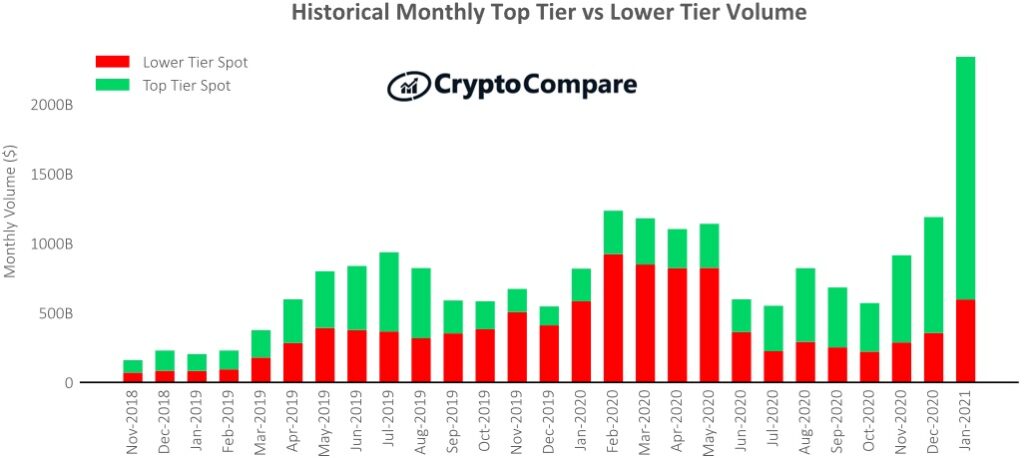

In January, Top-Tier volumes increased 109.4% to $1.71tn while Lower-Tier volumes increased 67.6% to $596bn. Top-Tier exchanges now represent 74.2% of total volume (vs 69.7% in December).

Trading activity across all spot markets throughout January dwarfed that of the previous month as Bitcoin peaked to a new all-time high of just under $42,000. A daily volume maximum of $122.95bn (and new all time high) was traded on the 11th of January, which is double that of December’s $67.42bn. This occurred during a sharp 25% correction in Bitcoin’s price to $30,000 following its all-time high.

The previous all-time high for daily spot volume occurred on the 13th of March 2020 at $72.5bn.

Most trading activity was driven by Top-Tier exchanges, which achieved a new all-time high of $91.51bn on the 11th of Jan 2021. The previous all-time high was $51.2bn traded on the 17th December 2020. Top-Tier exchanges are selected based on our rigorous Exchange Benchmark Methodology.

Macro Analysis and Market Segmentation

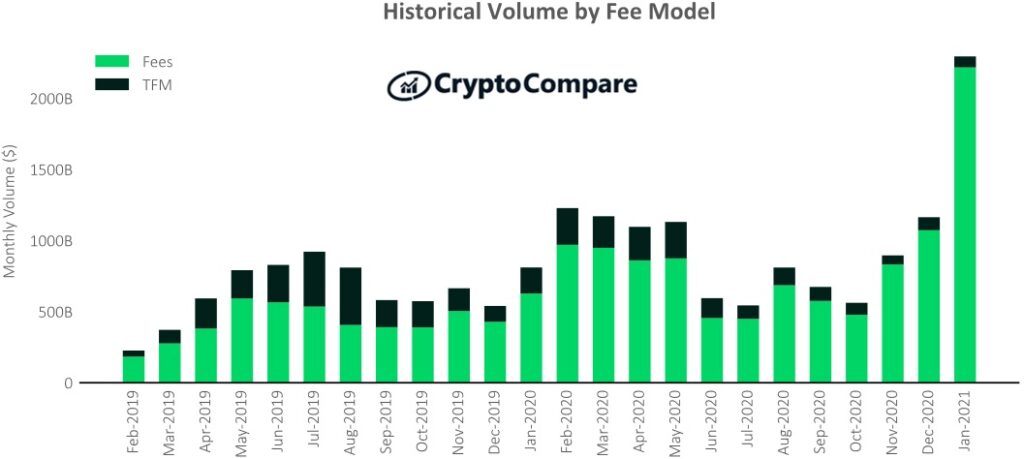

Exchanges that charge traditional taker fees represented 96% of total exchange volume in January (vs 92.12% in December), while those that implement Trans-Fee Mining (TFM) represented less than 4%.

Fee-charging exchanges traded a total of $2.22tn in January (up 107% since December), while those that implement TFM models traded $77.4bn (down 16% since December).

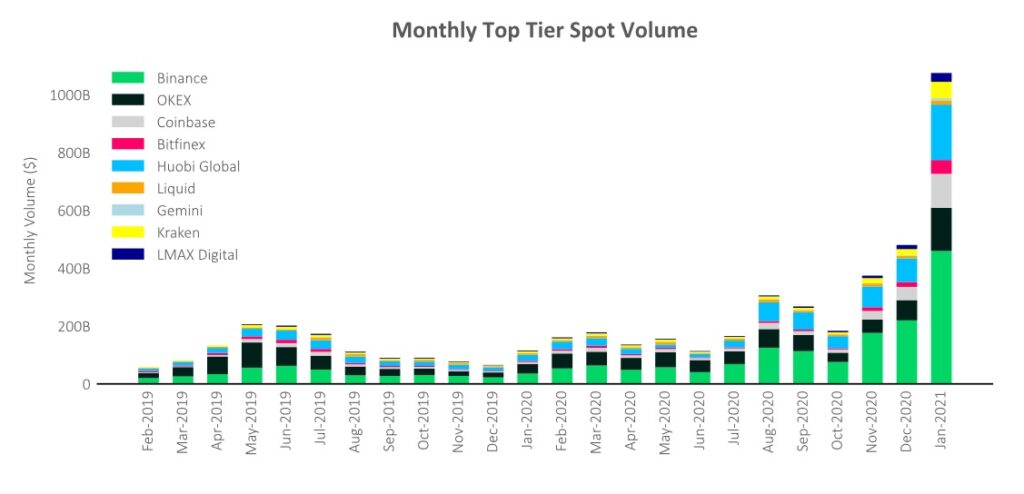

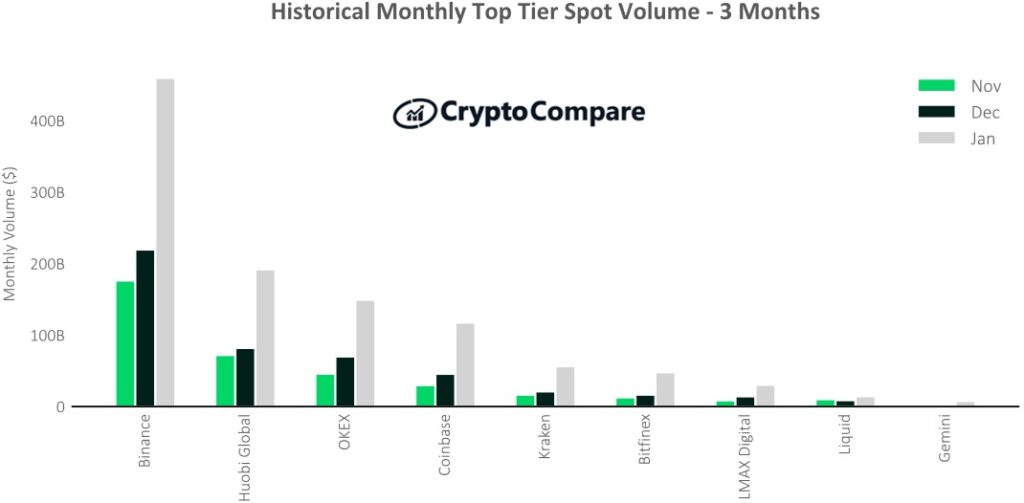

In January, volume from the 15 largest Top-Tier exchanges increased a massive 151.6% on average (vs December).

Binance (Grade A) was the largest Top-Tier exchange by volume in January, trading $459.6bn (up 109%). This was followed by Huobi Global (Grade BB) trading $191.7bn (up 134%), and OKEx (Grade BB) trading $149.3bn (up 113%).

Exchanges Coinbase (AA), Kraken (A), and Bitfinex (A) followed with $117.4bn (up 157%), $56.3bn (up 167%) and $47.8bn (up 189%).

Binance (A), OKEx (BB) and Huobi Global (BB) remained the top players in terms of volume in January relative to other Top-Tier exchanges. Among the top 15 Top-Tier exchanges, they represented approximately 65% of the volume (vs 70% in December).

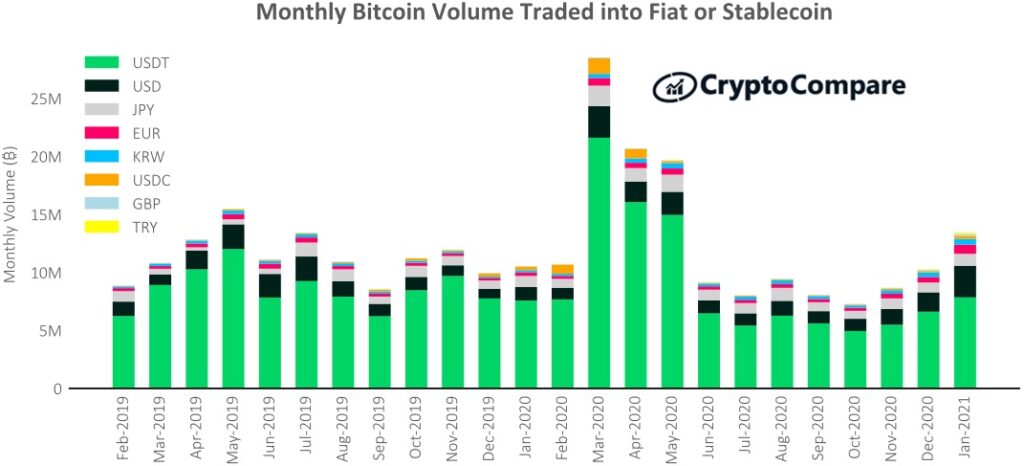

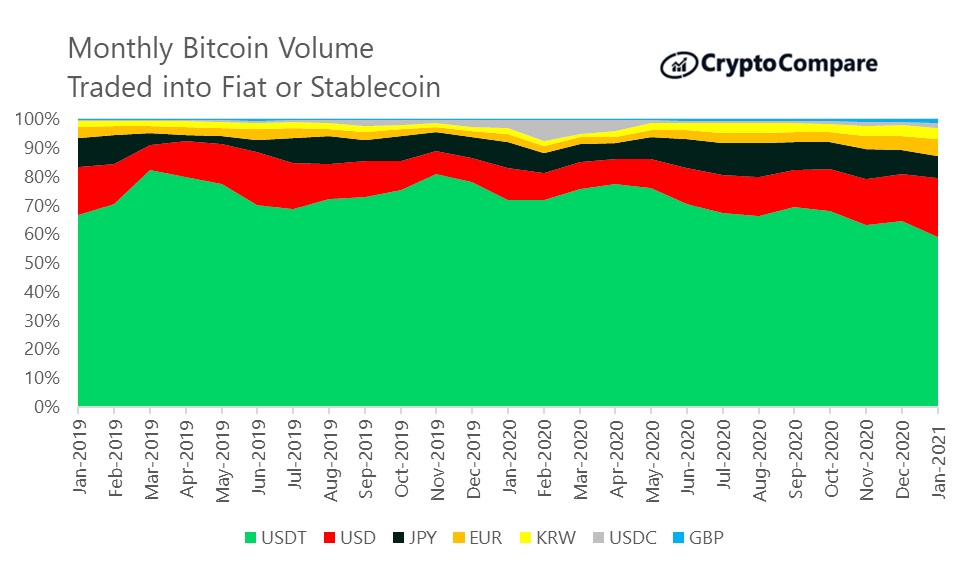

Bitcoin to Fiat Volumes

BTC trading into USDT increased by 18.7% in January to 7.9mn BTC, while trading into USD increased to 2.7mn BTC (up 63.2%) and trading into JPY increased to 1.03mn BTC (up 20.5%). EUR markets increased 67%, while BTC trading into KRW increased 26%.

Stablecoin markets BTC/USDC and BTC/PAX traded 253,227 BTC (up 111%) and 31,670 BTC (up 55%) respectively in January.

BTC/USDT trading still represents the majority of BTC traded into fiat or stablecoin in January at 57.4% (vs 63% in December). BTC/USD trading has gained market share and now represents almost 20% of BTC volume (vs 15.9% in December).

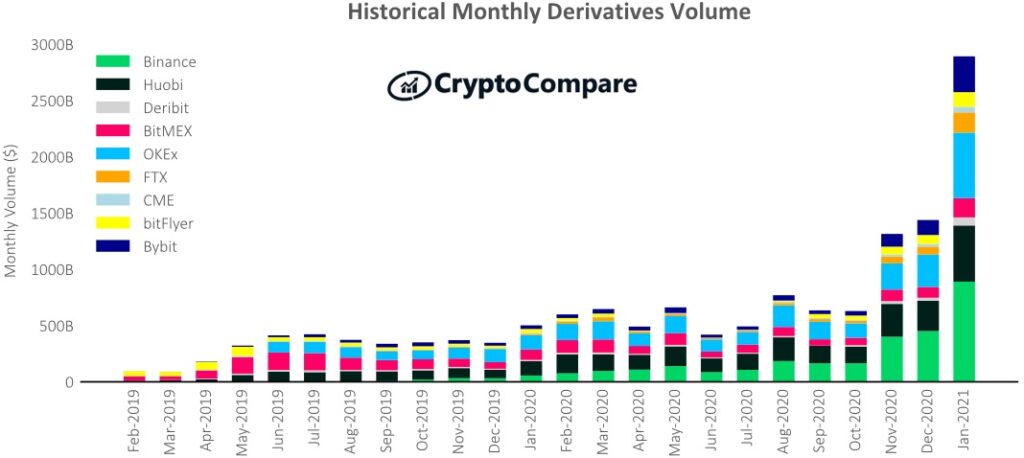

Derivatives

Derivatives volumes increased 101% in January to an all-time monthly high of $2.89tn. Meanwhile, total spot volumes increased by 97% to $2.34tn. The derivatives market now represents 55.3% of the total crypto market (vs 54.8% in December).

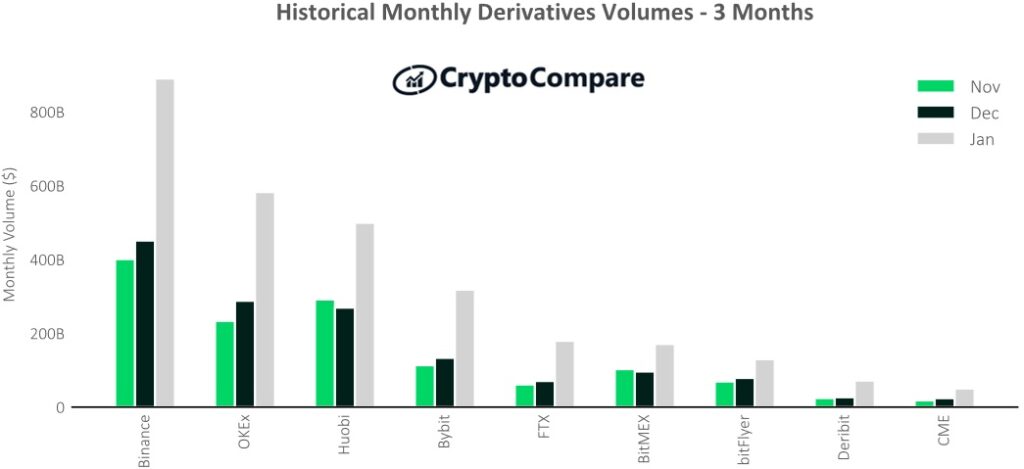

Binance was the largest derivatives exchange in January by monthly trading volume with $890bn (up 97% since December).

OKEx (up 102.2%), Huobi (up 85.4%) and Bybit (up 138.9%) followed with $582bn, $499bn and $318bn traded respectively.

Derivatives exchanges traded a new all-time daily maximum of $187.5bn on the 11th of January 2021. This doubles the previous record set on the 26th of November ($93.36bn).

Open Interest

In January, Binance had the highest open interest across all derivatives products on average at $2.6bn (up 53.7% since December). This was followed by OKEx ($2.5bn, up 36.4%) and CME ($2.0bn, up 53.2%).

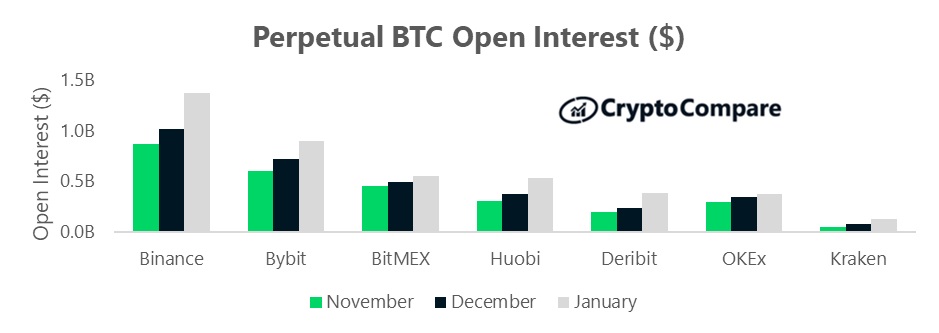

In terms of BTC perpetual futures, Binance had the highest open interest at $1.4bn (up 35.0%) followed by Bybit at $0.9bn (up 24.4%).

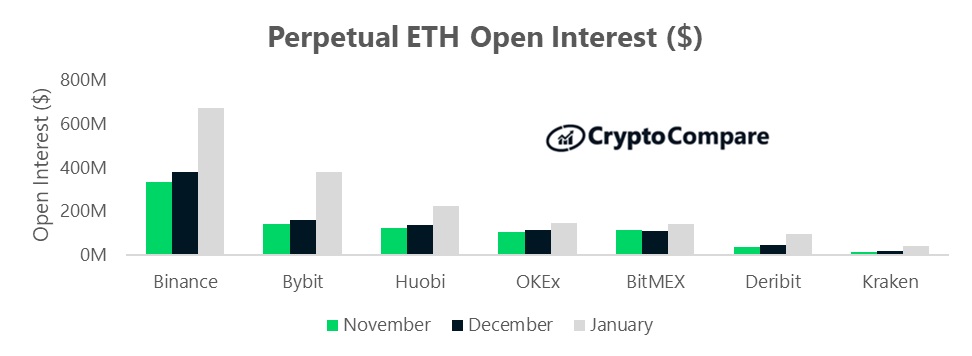

Binance also has the highest open interest figures for ETH perpetual futures contracts at $675mn (up 78.2%), followed by Bybit at $381mn (up 136.2%).

Meanwhile, regulated futures exchange CME maintained the highest open interest for BTC futures at $2.0bn (up 53.2%) followed by OKEx at $1.6bn (up 44.1%).

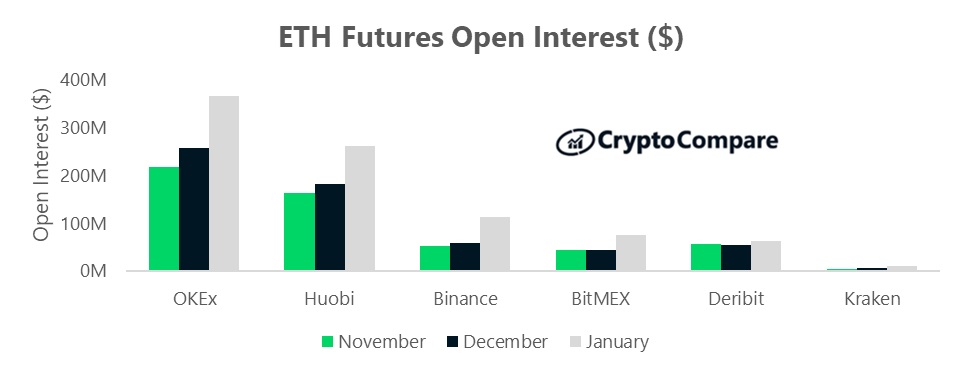

OKEx had the highest open interest figures for ETH futures contracts at $368mn (up 43%), followed by Huobi with $263mn (up 44%).

CME Institutional Volume and Open Interest

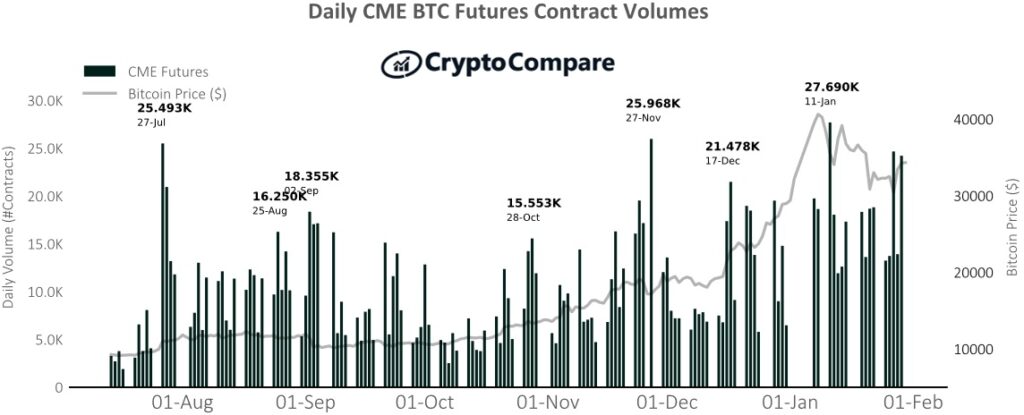

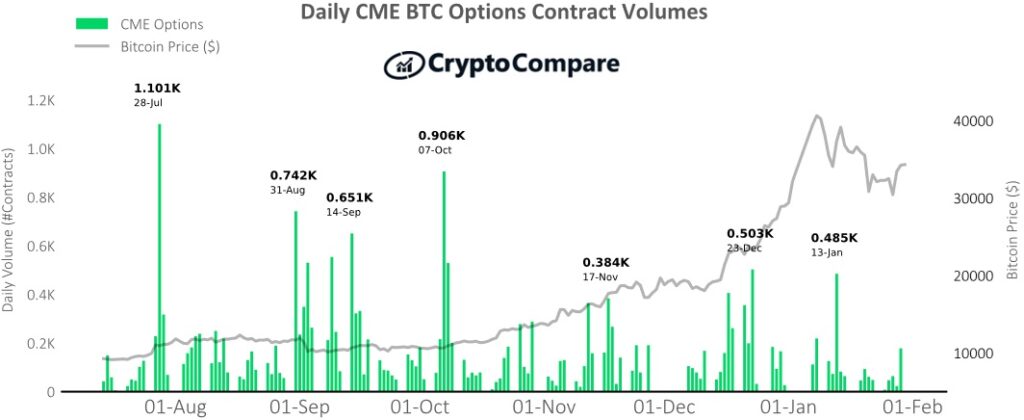

A daily maximum for the month was achieved on the 11th of January where 27,690 BTC futures contracts were traded following Bitcoin’s correction from its all-time high of under $42,000.

In terms of monthly contract volumes, roughly 285,000 contracts were traded in January (up 18.0% since December).

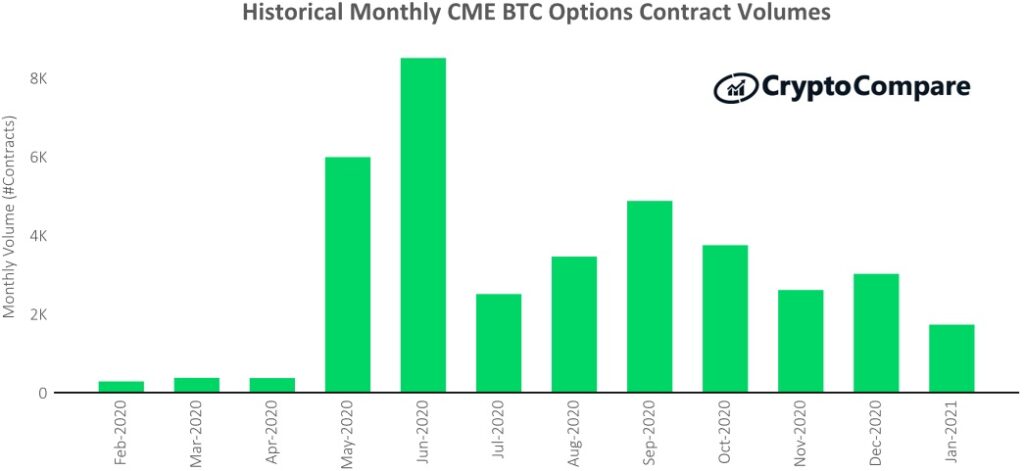

CME options contract volumes decreased 42.7% in January to over 1,700 contracts traded. Options contract volumes reached a daily maximum of 485 contracts traded on the 13st of January.

In terms of total USD trading volume, CME’s crypto derivatives volumes increased by 108.6% to $50.1bn in January.

CME’s average open interest figures increased by 53.2% to $2.0bn on average in January.