Abstract: In this week’s piece, we look at the world of ICOs. We present an interactive visualization, that illustrates the entire ICO landscape and the interconnections between people officially affiliated with each ICO.

Interactive ICO team member network map

[No Longer available]

Source: BitMEX Research, ICO websites, icoHunt own and provided the raw data (Do not use the data without their permission). Data is primarily based on information provided from ICO websites, which may contain false claims of involvement from particular individuals.

Network map notes

- Blue circles represent ICOs

- Yellow circles represent ICO team members, advisers or backers

- Circle size is weighted by number of links to other ICOs

- Data includes around 500 ICOs & around 4,900 team members

- We apologies for any errors, omissions or spelling mistakes

ICO network map viewing tips

- Modify the number of nodes to around 1,000

- Alternatively, start with 5 nodes, then gradually press the up arrow to add 10 nodes at a time

- Displaying all 5,388 nodes may use up significant amounts of system resources

- An illustration of the type of visualization which can be produced is provided here

The negative implications of the extent of ICO team member interconnections

The above network visualization illustrates the high degree of interconnections between the ICOs, with a few dominant individuals involved in many projects. Skeptics may therefore argue that it is not feasible for any one individual to be involved in this many ICOs, and this is an indication of misleading marketing, bad practice or inadequate disclosure.

Comparing ICOs & IPOs

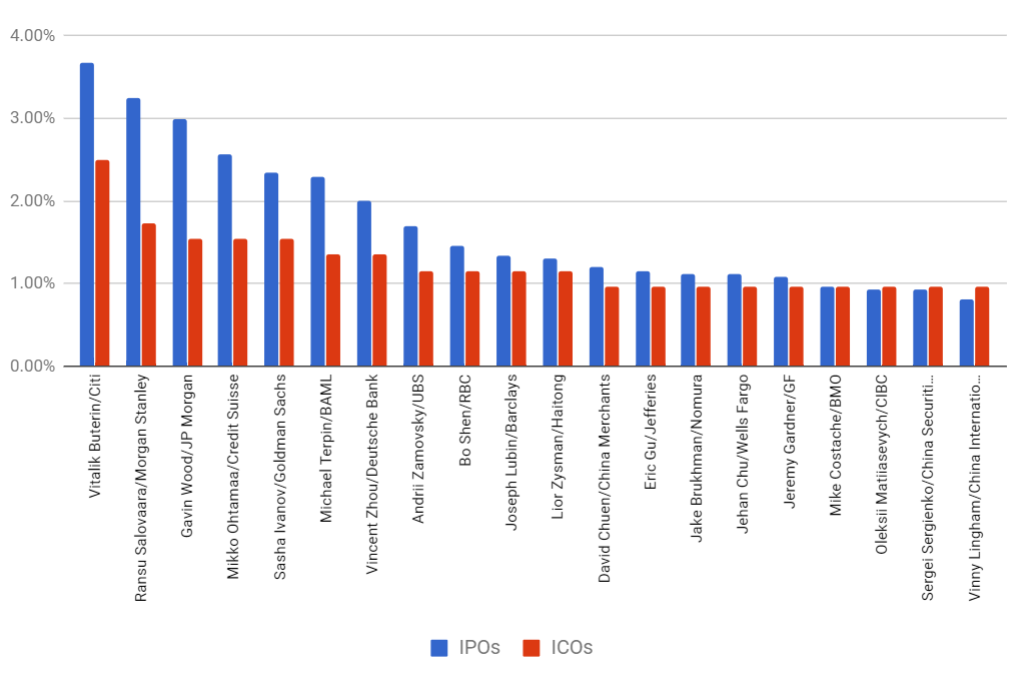

Many of the individuals listed in multiple ICOs are often listed as a backer or adviser, rather than as an individual involved in day to day management. In some ways they may be more of an ICO “sponsor” than someone actively involved in project development. For example, as the chart below illustrates, the concentration of individuals involved in multiple ICOs compares reasonably well to financial advisers or book-runners involved in IPOs.

Vitalik Buterin is the most prolific person when it comes to ICO involvement. Our analysis shows he has involvement in at least 13 projects, around 2.5% of the total. Although if you think of Vitalik’s role as more of a sponsor, then Vitalik has a lower market share than Citibank when it comes to IPOs, which has been the lead bookrunner in 3.7% of the IPOs in the last 12 months.

Market share of advisers (Top 20) – ICO/IPO comparison

Source: BitMEX Research, icoHunt, ICO websites, Bloomberg IPO database

Notes: The above dataset is from around 520 ICOs and 3,266 IPOs which have occurred in the last 12 months. The market share is based on the number of offerings, not value of the offerings.

The role of a lead bookrunner in an equity IPO, may be to do the following:

- Underwrite the offering,

- Ensure the offering complies with regulations,

- Ensure price stability and liquidity after the stock lists,

- Prepare marketing materials for the IPO,

- Bring management of the company on a tour to see potential investors in a roadshow,

- Use its investment sales staff to promote the offering to its clients,

- Assist in the allocation of the shares to the offering participants.

In many ways these responsibilities are similar to the roles of some of the most prominent individuals in our ICO analysis above, certainly with respect to marketing and promotion. However, in the world of ICOs the role of the “sponsor” is a lot more murky. The individual in question is sometimes said to be the person who originated the idea, is involved in management or even the development of the product. The ICO market therefore lacks clarity with respect to the roles and responsibilities of the individuals involved.

The initial allocation

The initial allocation of shares during an IPO is often an opaque process. Typically the bookrunner/adviser decides the allocation on a discretionary basis, with the largest institutional and hedge fund clients favored first, rather than a fair random process or auction driven mechanism. It is somewhat surprising that financial regulators have not clamped down on this practice. Although a counter argument to regulation is that listing companies should have the freedom to decide who their new shareholders are, if their are multiple bidders. Unfortunately the bookrunner/adviser seems to have a significant influence on the allocation process.

Despite the opportunity to improve on what IPOs do in this area, the initial allocation process when it comes to ICOs does not appear to be much better. The initial allocation of ICOs is also a murky process, but in some ways even worse than for IPOs, since earlier or better connected investors sometimes get lower prices. The allocation process can be based on who is friends with the people in the team or other industry connections. Therefore on balance, despite poor practice, IPOs appear to have a somewhat fairer process when it comes to allocation than ICOs.

Although one could cynically say there is a key difference in the offering process between ICOs and IPOs, this time we are the ones in control.