TL;DR

TL;DR

- BitMEX keeps paying shorts – not just on SOL, but across a basket of majors (AVAX, XRP, DOGE, etc.).

- Short-BitMEX / long-Hyperliquid delivered an annualised return of ~15.6% on SOL and ~15.7 % on AVAX in H1 2025 — before any leverage.

- Both legs are perpetuals, so running 2-3× leverage pushes headline yield toward 25-30 %+, while still delta-neutral.

Funding rate arbitrage is considered crypto’s equivalent of the classic cash-and-carry trade — sell the expensive funding leg and buy the cheap one to lock in a delta-neutral yield that accrues every few hours. A popular arbitrage strategy is cross-exchange arbitrage – where the funding rate discrepancy between different exchanges can be leveraged for profit.

In this piece, we introduce a profitable funding rate arbitrage strategy using the SOL perp that leverages BitMEX’s structural long bias and Hyperliquid’s relative neutrality over the past 6 months.

BitMEX vs. Hyperliquid

BitMEX’s trader base skews directionally long and is willing to “pay up” for perpetual exposure. On the other hand, Hyperliquid’s traders tend to short more often, resulting in a near-zero funding rate on the platform.

Using the SOLUSDT and AVAXUSDT trading pairs, we analysed data from 1 January 2025 to 30 June 2025 to compare funding rates across BitMEX and Hyperliquid. The result showed a structural premium on BitMEX, as shown below.

|

Coin |

BitMEX Average Funding Rate |

Hyperliquid Average Funding (converted to 8hr) |

Funding Yield |

|

SOL |

0.00871% |

0.00030% |

15.6% |

|

AVAX |

0.00927% |

0.00036% |

15.7% |

SOL Perpetual Funding Rate Arbitrage

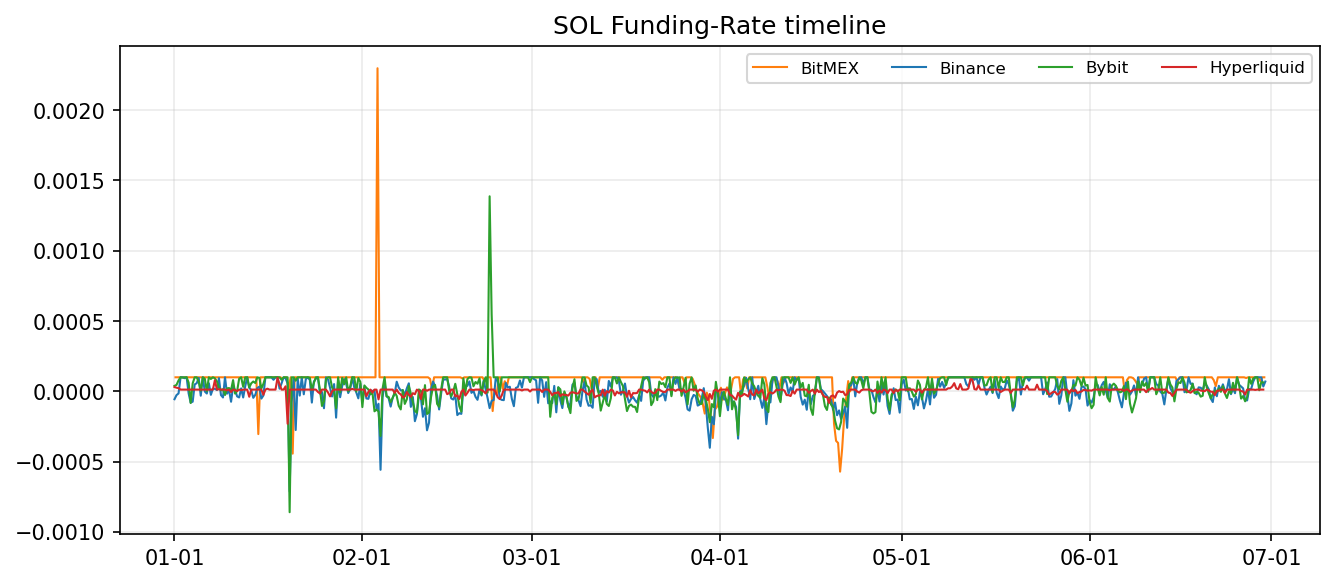

As indicated in Figure 1, BitMEX’s SOL perpetual funding rate remains consistently above its peers, while Hyperliquid’s hovers near zero, creating a reliable long-Hyperliquid/short-BitMEX trade opportunity.

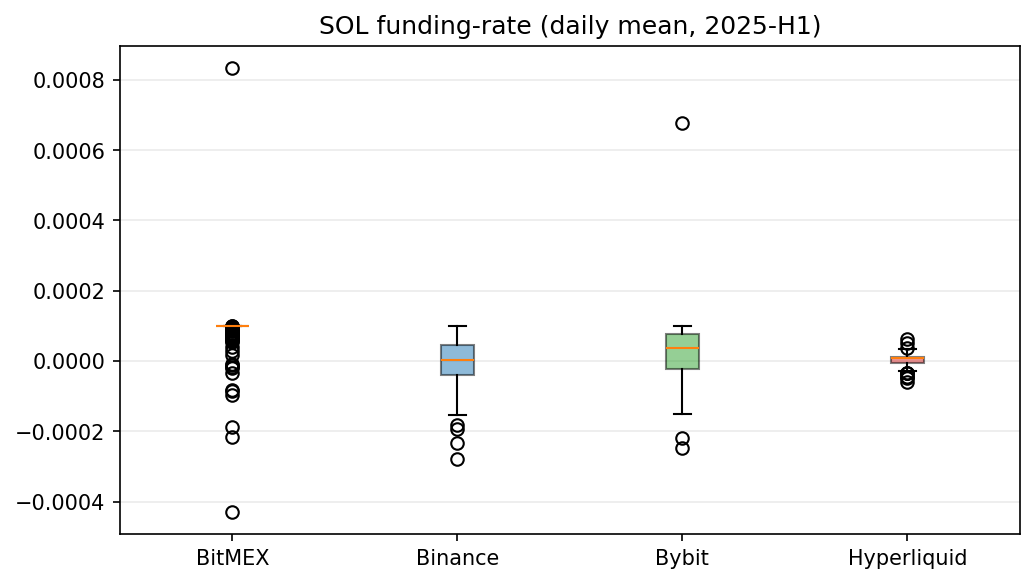

The plotted graph highlights consistent higher levels of SOL perp funding rates on BitMEX that scarcely appear on other platforms. Figure 2 reinforces this point by showing a positively skewed distribution on BitMEX, whereas other exchanges’ funding rates cluster around zero.

This persistent gap in funding rates compounds well – the cumulative PnL curve rises almost linearly through the first half of 2025, illustrating how harvesting the differential can add up to mid-teens returns without heroic leverage or directional risk.

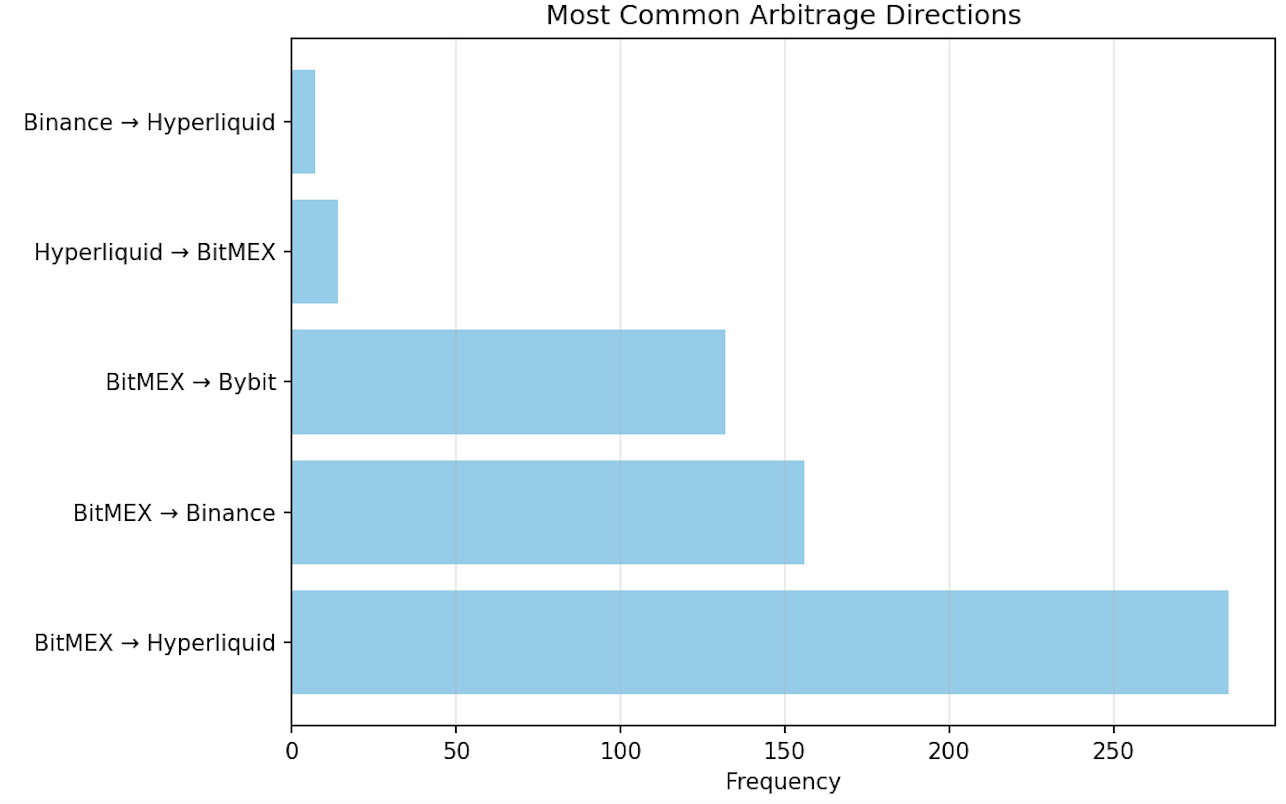

Finally, Figure 3 confirms the intuition — by far, the dominant trade is short BitMEX versus long Hyperliquid, with far fewer opportunities flowing the other way or ones involving Binance and Bybit.

The conclusion? Traders chasing steady basis yield can use BitMEX as the engine and Hyperliquid as the hedge – with SOL perp offering a textbook case of why this pair should be at the top of any funding-rate arbitrage playbook.

How to Execute the Opportunity?

- Short the SOLUSDT perp on BitMEX – Lock in the side that’s paying the juicy funding.

- Mirror-hedge: longing the SOLUSD perp on Hyperliquid – Hyperliquid’s funding payment usually stays near flat, meaning your hedge will require little to no payment.

- Track the live funding payment – BitMEX posts funding rates every 8 hours, while Hyperliquid does so every 1 hour. Make sure to stay ahead of funding rate changes on both platforms.

Need a refresher on cross-exchange funding arbitrage? Learn more under the “Multi-Venue Basis” section on https://blog.bitmex.com/crypto-basis-trading-strategies/.

What’s the Profit Potential?

The exact profit isn’t possible to predict as funding rates swing with the market.

However, the above data from 2025 shows BitMEX’s funding rates averaged meaningfully above competing platforms while Hyperliquid hugged zero. If this relationship remains consistent, the recommended trade would allow you to skim funding every cycle with no delta risk.

Add moderate leverage (e.g. 2× on each side) and you’ll be able to compound your basis yield into >20% annualised returns.

What Do I Need to Consider?

- Fees & slippage: Two perp contracts on two different exchanges means more work. Make sure the funding you earn is more than the friction you pay.

- Execution lag: Make sure to hit both orderbooks together; wide markets during volatility can blow the hedge open.

- Margin requirements: Use USDT (or USDt collateral) for Hyperliquid, BTC, USDT for BitMEX. Make sure to keep buffers on both sides.

- Liquidation risk: Even while hedging, each leg carries its own liquidation price. High leverage boosts yield and headaches. Size accordingly.

- Rate inversion: If BitMEX’s funding rates cool or turns negative, staying long means you pay; unwind fast or flip the stack.