Note: Anything expressed below is not considered financial advice – they are only suggestions for users to learn more about trading strategies. Users are always encouraged to do as much research as possible before executing any trades. The content below is not intended to express any guaranteed return, and BitMEX does not take responsibility should your trades not perform as expected.

Note: Anything expressed below is not considered financial advice – they are only suggestions for users to learn more about trading strategies. Users are always encouraged to do as much research as possible before executing any trades. The content below is not intended to express any guaranteed return, and BitMEX does not take responsibility should your trades not perform as expected.

TL;DR

- HyperBeat’s beHYPE pre-deposit vault pays ~2.2% staking APY and 10M Hearts (≈ 20% of supply) for just 2.5M HYPE of deposits —

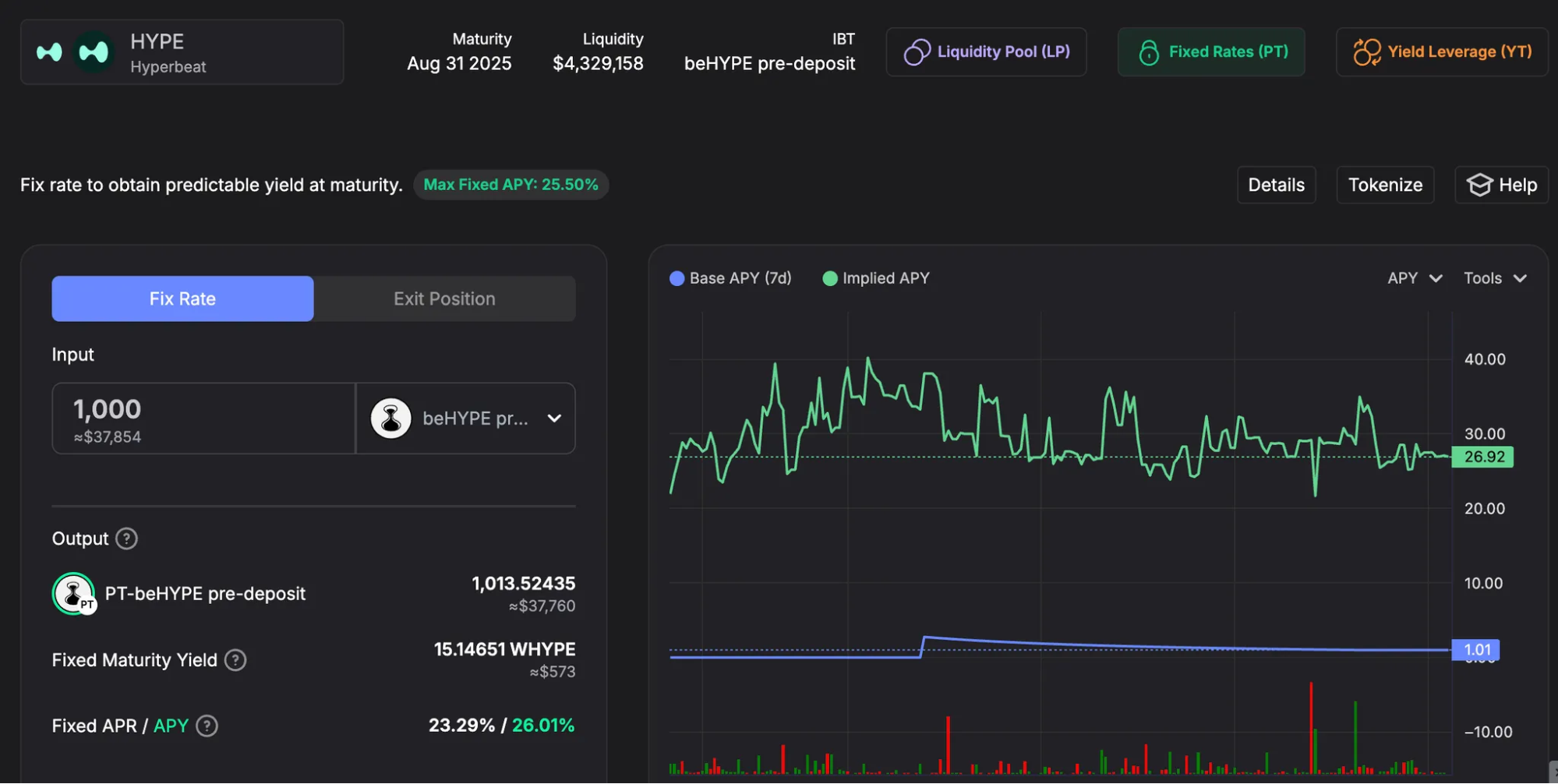

- You can lock in ~25–27 % fixed APR today by swapping beHYPE → PT-beHYPE on Spectra; 1 000 beHYPE maturing on August 31.

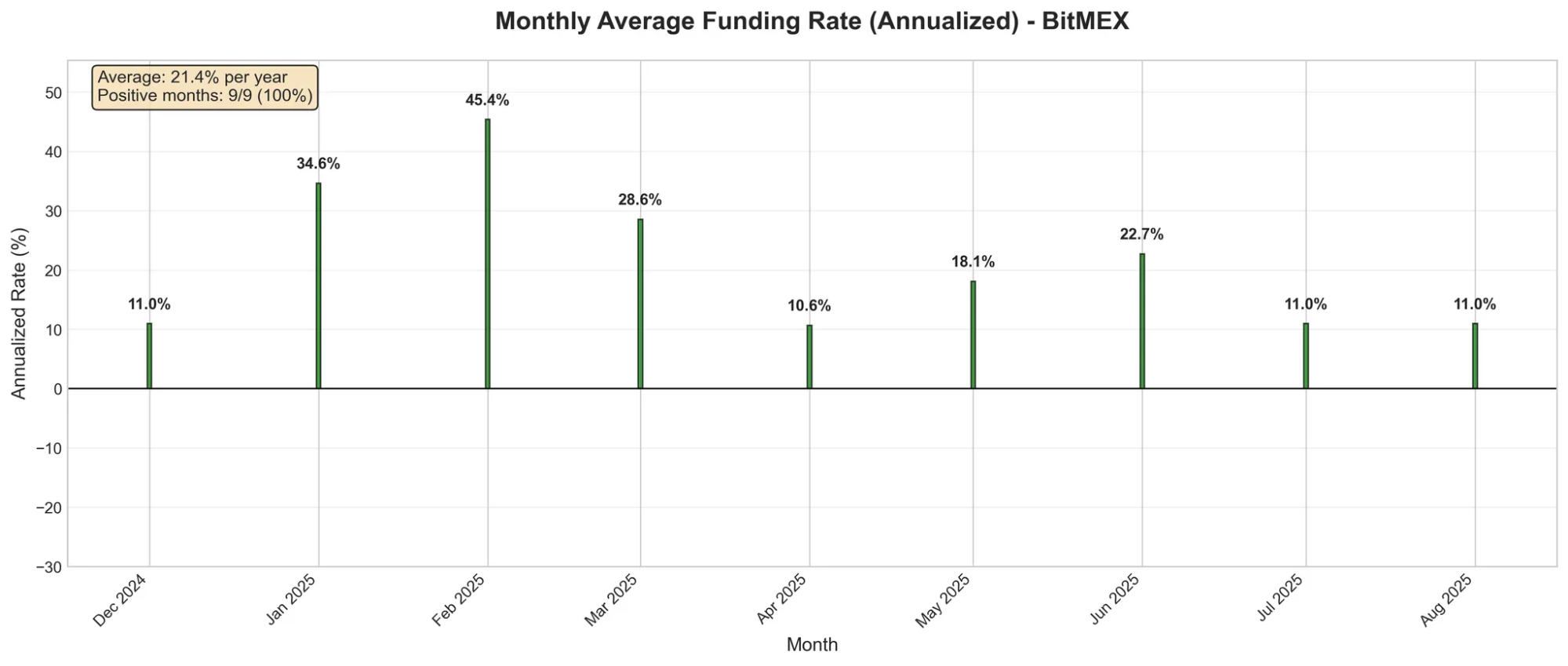

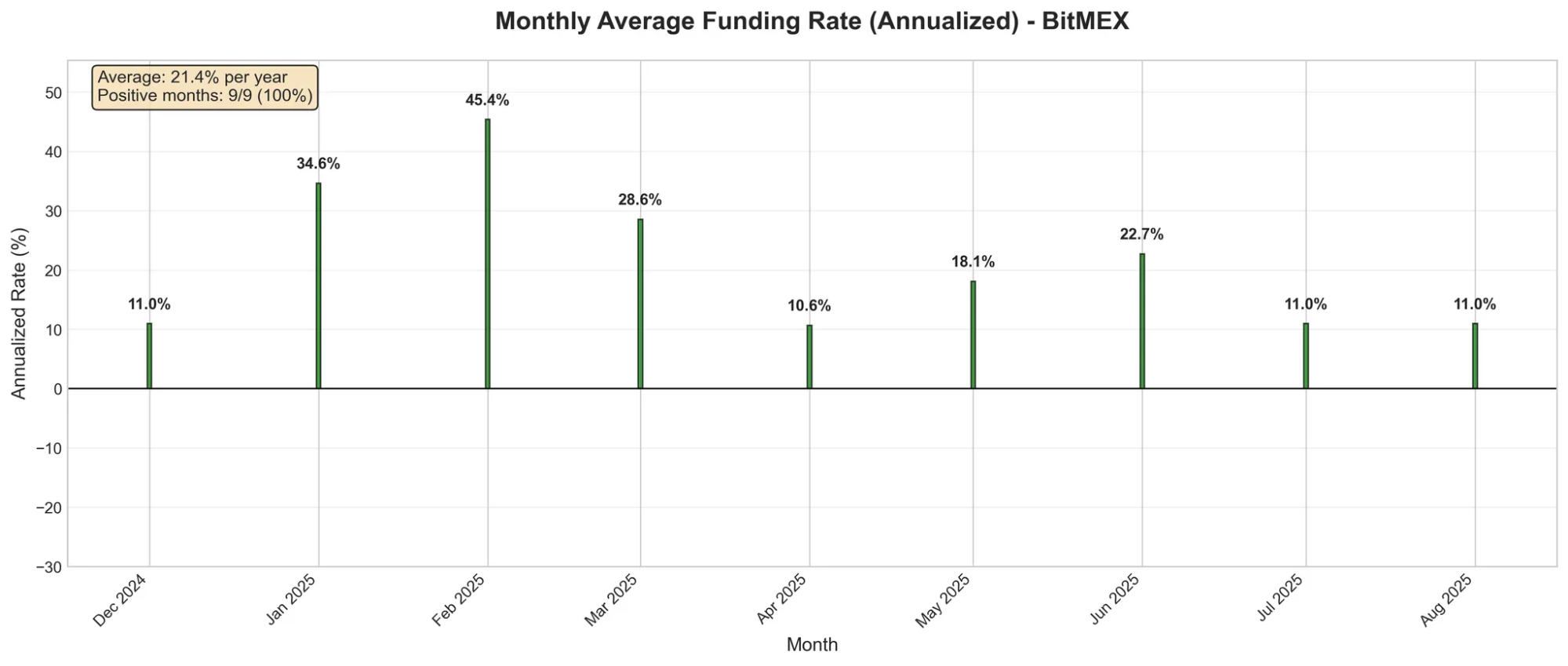

- Short-hedging HYPE-PERP on BitMEX is the secret sauce: BitMEX funding has averaged +0.03% / 8h this quarter, that is multiples higher than other exchanges — so the hedge gets paid.

- Stack the two legs (Hearts/fixed PT yield + BitMEX funding) for returns north of 20% APR with zero directional risk.

The Strategy Explained

beHYPE is a LST of HYPE launched by HyperBeat, which is currently in phase 1 of pre-deposit vault, promising depositors a large portion of the supply of its native token. The vault is capped at 2.5M HYPE (~$100M). Hyperbeat is currently one of the biggest in terms of TVL and working with Ether.fi, it might be one of the most promising ecosystem projects on Hyperliquid.

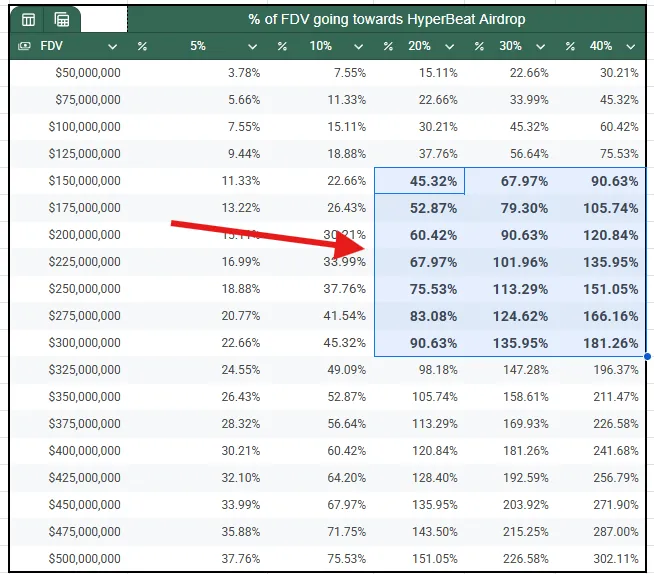

For the Hyperbeat airdrop, 10M of a total 51M “hearts” (points) are going to this pre-deposit campaign. Given the total points and TVL cap is fixed, if we estimate the total airdrop will be 20% of the initial supply with a FDV of 150M, beHYPE could yield over 45% worth of HyperBeat token airdrops.

You can also opt-in for a fixed yield with your beHYPE. Spectra lets you “sell the future” by minting Principal Tokens (PT-beHYPE) at a discount — effectively pre-paying the yield. Hedge the spot delta by shorting HYPE-perps on BitMEX and collect their structural funding premium. Result: three uncorrelated cash flows rolled into one market-neutral position.

Strategy Breakdown:

Strategy Breakdown:

- Acquire and Stake HYPE on Hyperbeat.

- Farm Hearts + ETHFI points automatically.

- Optional: mint PT-beHYPE on Spectra for a fixed yield.

- Delta-hedge HYPE exposure (e.g., short HYPEUSDT-perp on BitMEX) ; the funding skew on BitMEX has stayed consistently positive, so the hedge itself earns a small yield.

- The vault will conclude on August 31 with an unstaking period of 9 days.

Why hedge on BitMEX?

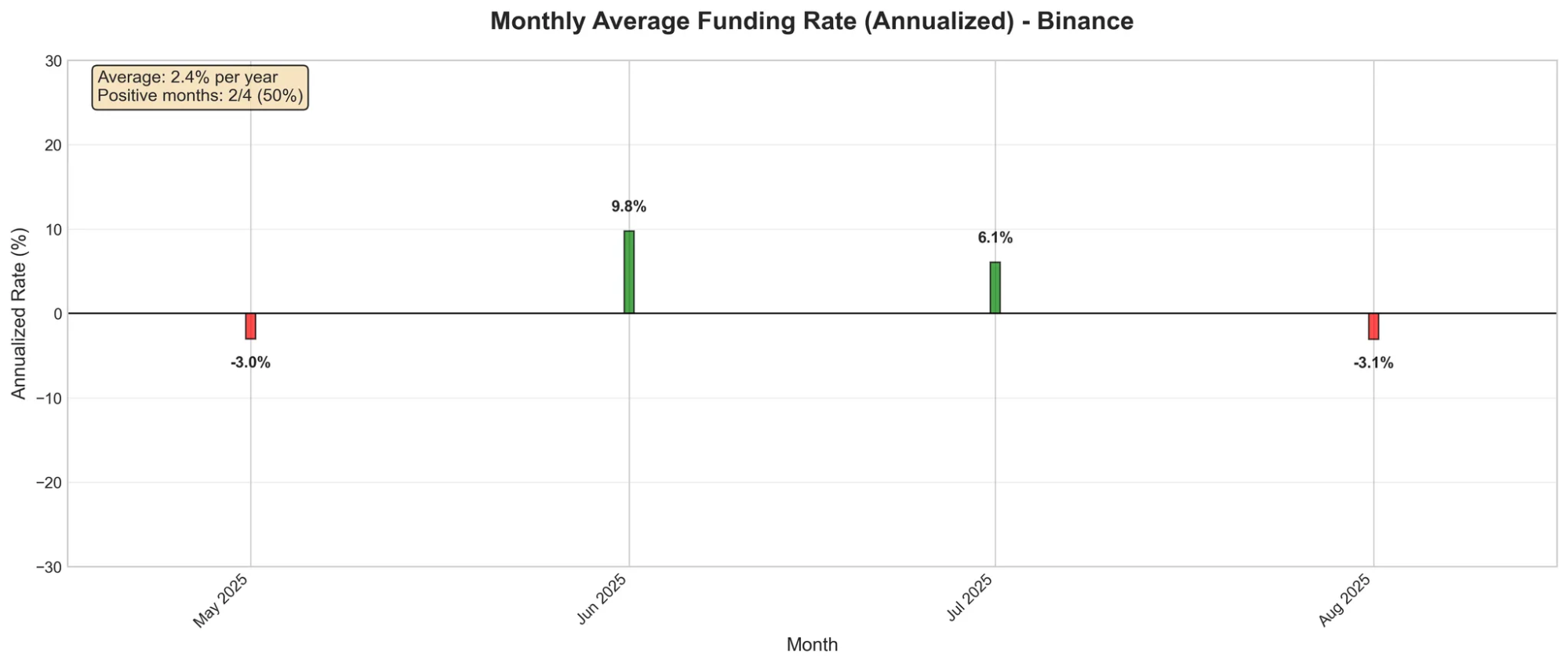

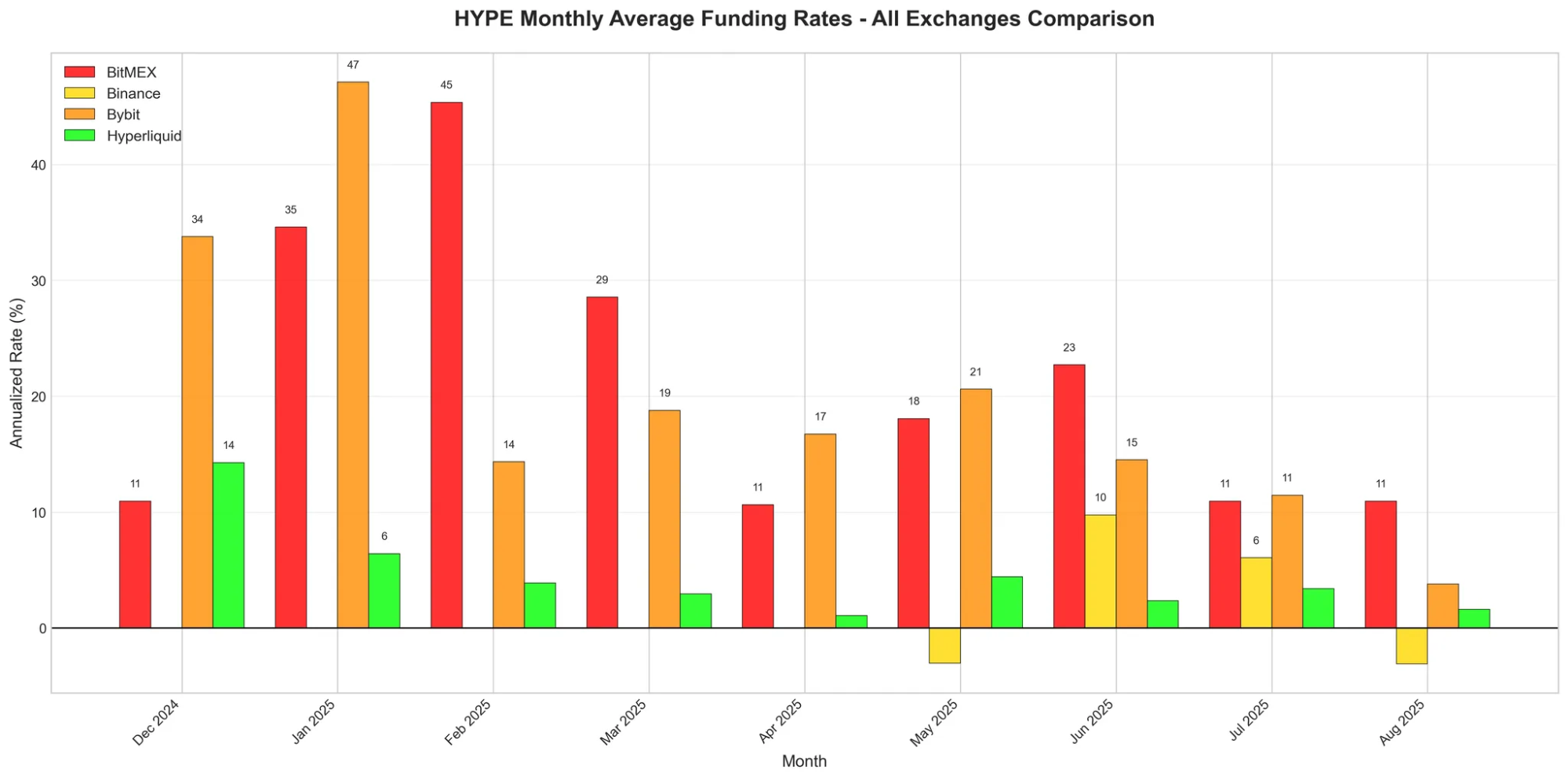

The funding rate comparison charts below tell the whole story. Across every month since $HYPE’s PERP listing, BitMEX has never flipped negative and has averaged 21% APR to the short side. By contrast:

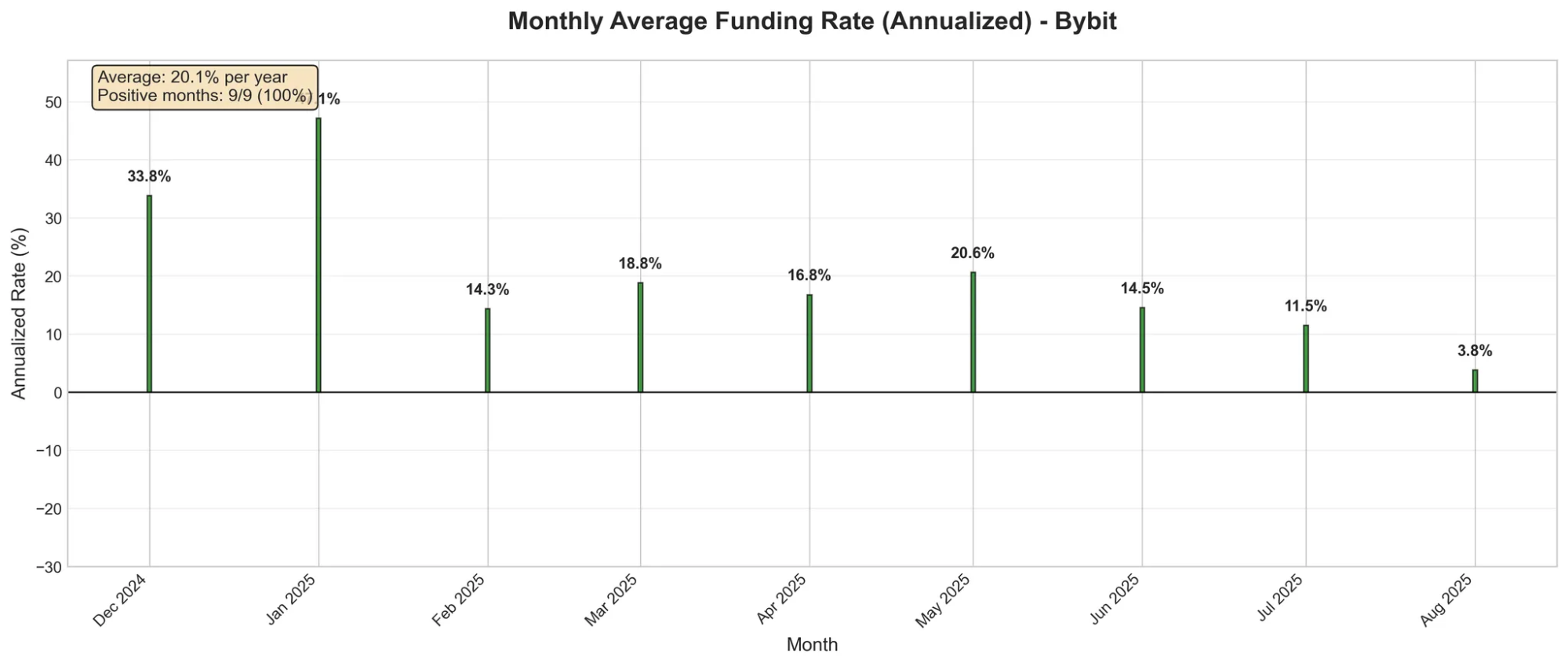

- Bybit is positive but fades fast — average 20%, already sliding to 3.8% in August.

- Hyperliquid stayed positive yet grinding at a modest 4.5% average.

- Binance is outright an unreliable source for harvesting positive funding rates, flipping negative half the time and netting a meagre 2.4%.

When you’re running a delta-neutral strategy, every funding payment matters. Shorting on BitMEX not only provides delta neutrality — it consistently pays you to hold the hedge, juicing returns on top of your Hearts points or Spectra’s fixed 25% yield. BitMEX is the best venue where the hedge is a profit centre rather than a cost line.

The Bottom Line

Combine HyperBeat’s points machine or Spectra’s pre-paid ~25% annuallised yield and BitMEX’s funding premium, you get equity-like returns with bond-like risk. Delta-neutral, two-leg income — BitMEX pays, Spectra/HyperBeat pays. Your only job is to size smart and collect.