If you’ve always been curious about how to trade crypto options, you’ve come to the right place. This is a series on crypto options trading where we share some basics as well as several ready-made strategies that you can implement today.

Whether you’re a new crypto trader, an existing perps trader, or even an advanced options trader – we hope you find this series useful.

Part 1: What are Options: A beginner’s guide to crypto options

Part 2: How to Hedge Your PnL Gains: Using crypto options to hedge your perpetual contract positions

Part 3: How to HODL and Generate Yield: Using crypto options to generate yield while hodling your favourite token

Part 4: How to Leverage Market Volatility: Using crypto options to profit during market volatility

Part 1: What Are Options?

Crypto options are a great way to unlock alternative trading strategies, maximise profits in uncertain market conditions, and can be used to manage risk.

If you’re looking to learn the basics of trading crypto options including what they are, the different types, and how they work, we’ve got you covered.

Let’s dive in.

What Are Crypto Options?

Like any other derivatives product, crypto options allow you to speculate on the future price of an underlying asset.

More specifically, crypto options are derivatives instruments that give you the right – but not the obligation – to buy or sell an underlying asset (e.g. crypto) at a predetermined price, also known as the strike price, at a specified date and time or range of dates and times.

The strike price of a crypto option remains fixed throughout the contract. The cost of an option is referred to as the premium, which is charged in USDC. The premium is also the maximum loss one can face when buying an option.

The right to buy an asset at the strike price is called a call. The right to sell an asset at the strike price is called a put.

When an option reaches its expiry, it will either be in the money or out of the money. When an option is in the money, the option holder will usually choose to exercise their right, which means there will be a settlement. Options settlement can be physical, whereby the underlying asset is delivered against the other currency or settled in cash upon exercising (with the profit going to the option holder’s account).

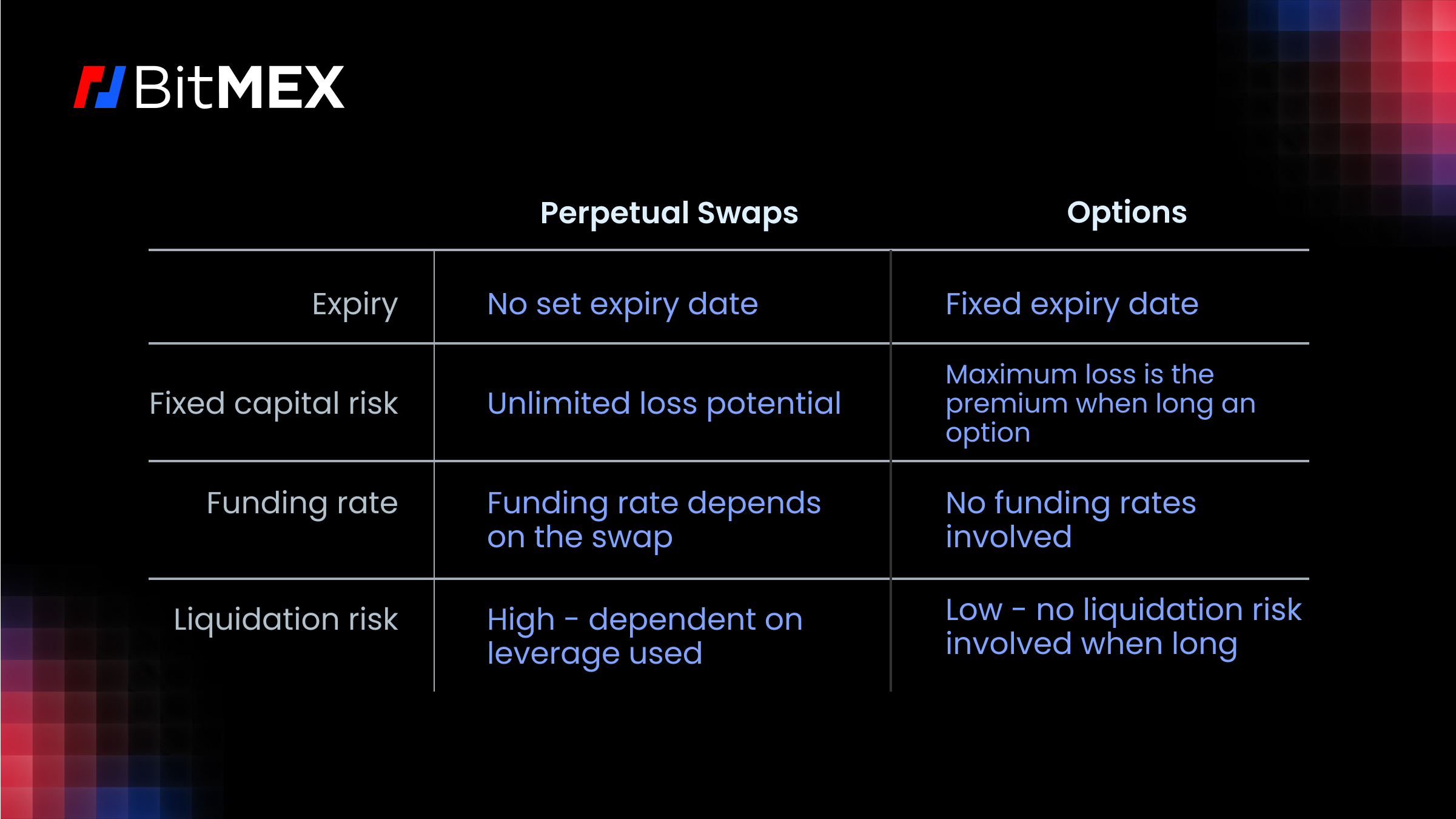

The Difference Between Perpetual Swaps and Options

Perpetual swaps and options are both derivatives instruments, but each product offers its own set of advantages and disadvantages. Which choice you trade depends on the type of trader you are and what you’re looking for in your product.

In particular, long options are the product to explore when it comes to risk management and cost.

Perps are made for those who can handle uncertain market movements with potential losses. But if you’re a trader looking to avoid anxiety around sudden liquidations or additional costs, options are the place to look.

How Do Crypto Option Markets Work?

Like many crypto derivatives, options can be traded through a Central Limit Order Book (CLOB) or a Request for Quote (RFQ).

Trading options via a CLOB works just like order book trading for perpetual swaps, where you can market buy/sell or place a limit order. However, rather than having a single market for an option contract (e.g. BTCUSD), option order books have a market for each permutation of put/call, strike, and expiry, and the order books are usually shown in a grid format.

The main thing to remember is that option buyers pay a premium while the option sellers receive the premium (and must post margin for their position). The option grid may look daunting to newer option traders, but once you find your expiry, strike, and call/put, options trading via an order book works the same as it does for trading perpetual swaps.

A pro tip: to double-check your calls and puts, the In-The-Money (ITM) option should cost more than the Out-The-Money (OTM) option.

If you choose to trade options via an RFQ, it’s up to you to specify the option you’d like to buy or sell and the respective market maker panel will provide a quote – also known as price. From there, you choose whether to trade the option or pass.

States of Crypto Options

The relationship between the current price of the underlying asset (for delivery on the settlement date) and the strike price determines whether the option is classified as one of the following:

In-the-Money (ITM)

A call option becomes ITM when the current market price of an underlying asset is above the strike price.

A put option becomes ITM when the current market price of an underlying asset is below the strike price.

An example: BTC price at $60,000

- A trader purchases a call option with a $55,000 strike price.

- It would ITM by $5,000.

- The trader has the right to buy BTC at $55,000.

- A trader buys a put option with a $65,000 strike price.

- It would ITM by $5,000.

- The trader has the right to sell Bitcoin at $65,000.

At-the-Money (ATM)

For both call and put options, the option is ATM when the strike price is equal to the current market price of an underlying asset.

Out-the-Money(OTM)

An option is OTM when the strike price is not favourable compared to the current market price of the underlying asset.

An example: BTC price at $60,000

- A trader purchases a call option with a $65,000 strike price.

- It would be OTM by $5,000.

- It would not be advantageous to the trader to exercise the right to buy Bitcoin at $65,000.

- A trader purchases a put option with a $55,000 strike price.

- It would be OTM by $5,000.

- It would not be advantageous to the trader to exercise the right to sell Bitcoin at $65,000.

What are the Benefits of Trading Crypto Options?

The main benefit of crypto options is that traders can generate significant profits with market movements in any direction. Which means you can make money in periods of market downturns or sideways movement too.

Options serve as a hedge to various market positions – functioning as insurance to safeguard against other portfolio positions from potential downturns.

Where to Trade Crypto Options?

BitMEX Options, launched in partnership with PowerTrade, is a platform for traders of all types – beginners and advanced – to tap into crypto options.

With BitMEX Options, you can trade a wide range of crypto options which are…

- Priced and settled in USDC, removing the need for tedious asset conversions.

- Multi-collateral, so users can deposit any spot token (USDC, BTC, ETH, SOL, AVAX) to use as collateral for their options trading.

And much more.

Ready to start trading crypto options?

Like what you’ve read? We’ve got a range of educational resources on trading crypto options as well as other derivatives, which you can find here.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements for the absolute latest.