Overview

The launch of the spot Bitcoin ETFs in the US looks to be just days away. According to a recent Reuters article, the products could launch as early as 10 January 2024. In preparation for the launch of these products, we have been publishing some data on the exchange traded product (ETP) space and the existing crypto ETPs available. We compiled a list of 168 crypto related ETP products, which is available here.

In the last few weeks, the SEC has informed the potential providers of spot Bitcoin ETFs that the creation and redemption process will be on a “cash-only” basis rather than “in-kind”. We have been asked about this and whether this is something that only ETF industry geeks should care about or whether this could materially impact the effectiveness of the products. Some argue that this is only an issue for industry geeks, however we think this could impact the attractiveness and effectiveness of the products to some extent. That is not to say we think these ETFs will be a failure, it is just that the products may not be as strong as they could be. The products may be marginally weaker.

How did we get here?

First the SEC only allowed non-redeemable Bitcoin Trusts like Grayscale’s GBTC. While this product was great for Grayscale, it was terrible for investors. The product has traded with a premium as high as 132.5% and a discount as much as 48.9%. Not exactly the SEC protecting investors!

We even have the mug to prove it!

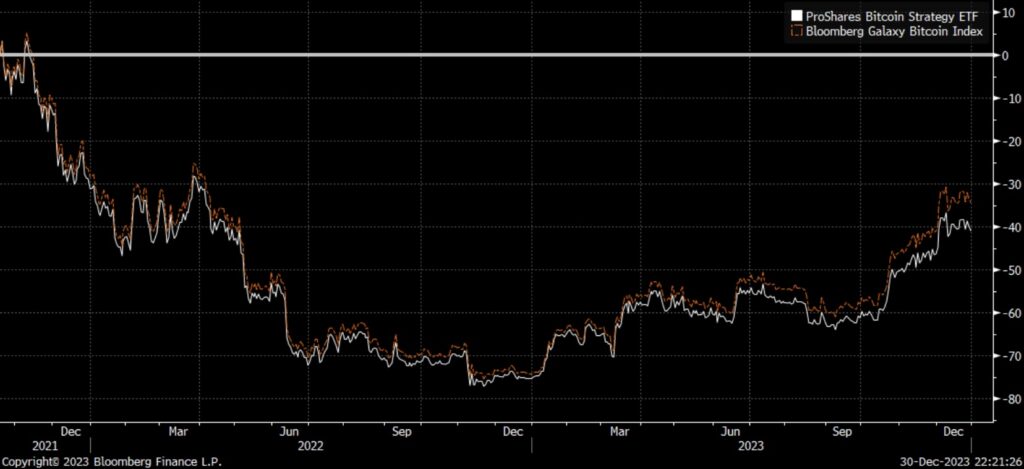

Then the SEC allowed Bitcoin ETFs that can only participate in the Bitcoin futures markets, rather than holding the underlying Bitcoin. The Proshares BITO ETF is an example of such a product. However, using futures to get the returns of Bitcoin can be more expensive, the ETF has underperformed Bitcoin by around 6.5% since it launched, or by around 4% when including the impact of product fees. So again, due perhaps to the SEC, investors may have lost out while the financial services industry wins.

Of course, it’s the alleged hypocrisy of the SEC for allowing the futures based products but preventing the spot based products, which may now have forced the SEC to approve a spot Bitcoin ETF. Ironically for a third time, the SEC could be harming Bitcoin investor interests yet again, although this time in a much more limited way, by allowing cash creations only. The supposed reasoning is that the SEC does not want the Authorised Participants (typically Investment Banks), to deal in Bitcoin, where they may believe it increases the risk of AML type violations.

It now seems likely that there will be more regulatory and legal battles with the SEC in 2024, post the launch of these products. The ETF issuers are likely to fight for the right to conduct in-kind creations and redemptions.

In-kind vs Cash Creation Process – Explanation

We attempted to explain what the difference between cash and in-kind creations are in this Tweet:

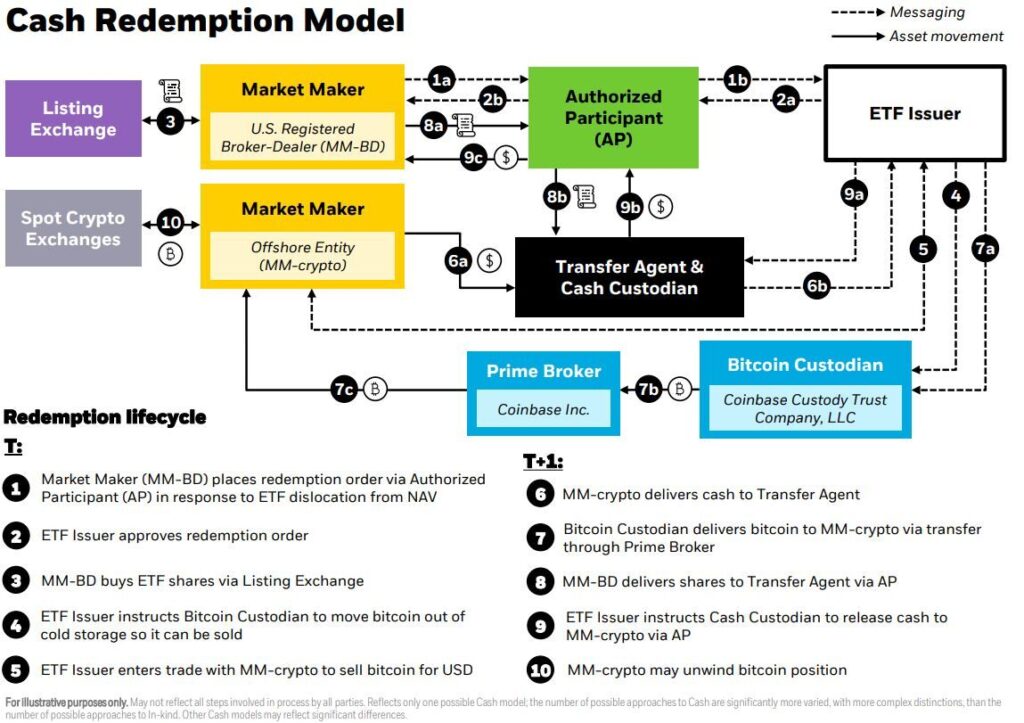

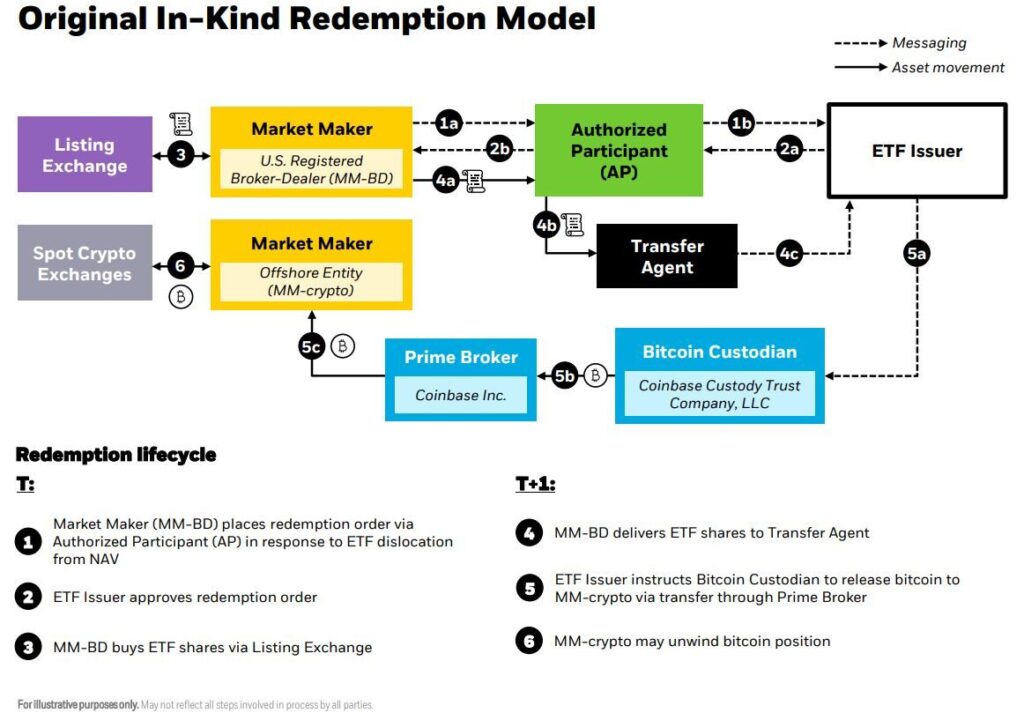

Blackrock provided the below images to explain the difference, if one can make sense of them.

The key disadvantage of only allowing cash creations is that the process has more steps than the in-kind model, this added complexity can increase costs for investors.

In-kind vs Cash Creation Process – Market Data

We have analysed a database of over 10,180 ETF products across the world and attempted to determine what creation and redemption processes are available in each case.

By number of products, cash only products are reasonably common, at 21.7%. This represents 2,208 ETFs. As far as we know, many of these are cash only due to the choice of the issuer, not a requirement from the regulator.

Source: BitMEX Research, Bloomberg

When the data is broken down by assets, cash only products are far rarer, at just 7.4%. This represents US$862 billion in assets in the US$11.6 trillion industry.

Source: BitMEX Research, Bloomberg

We have also looked at the tracking error for the ETFs, which is one measure for the effectiveness of the products. The tracking error is a measure of how closely the ETF tracks the benchmark, which in the case of the Bitcoin ETFs, would be an index of the Bitcoin price, derived from the activity of spot exchanges. The data shows that the cash only ETFs tend to have inferior tracking errors compared to products which allow in-kind creations.

Source: BitMEX Research, Bloomberg

The data shows a similar story for the 1,286 ETFs with over US$1 billion in assets, cash-only ETFs have higher tracking error.

Source: BitMEX Research, Bloomberg

We have not extensively analysed this and we are not ETF industry experts. There could be statistical biases impacting the above charts which we have not assessed. For example, the cash only creation process might not cause the higher tracking error, there could just be a relationship. The conclusions from data here may not transfer over perfectly to the Bitcoin ETF, where the market stucture may be different. Also, using a median as a statistical measure is not perfect.

Conclusion

In the grand scheme of things, this is still a relatively minor and technical issue. There are many spot Bitcoin ETFs set to launch and therefore the level of competition among issuers will be high. The issuers will therefore be incentivised to provide strong products and this incentive should be sufficient to keep the tracking error low and the level of liquidity on offer is likely to be high. For such high profile products, this is definitely something the issuers can solve if they put the effort in. The issuers may even take on the extra costs of the cash only model themselves. Let the Cointucky Derby begin!