BitMEX Token (BMEX) is the native utility token of the BitMEX platform—a long-established name in crypto derivatives trading.

In this article, we explore $BMEX’s key fundamentals, how its tokenomics (especially its monthly burn mechanism) support a deflationary model, and what technical indicators reveal about its price performance and potential upside.

Remember When BitMEX Revolutionised Crypto Trading?

Back in 2016, BitMEX introduced the concept of perpetual swaps—futures contracts that never expire— which remains the most popular crypto product traded to date.

What’s more, BitMEX has maintained a strong security track record with 0 customer funds lost, having thrived through multiple market cycles. Adding to its resilience, the platform boasts one of the largest insurance funds in the crypto industry of over 35,000 BTC (exceeding US$3 billion) — designed to protect users from losses due to auto-deleveraging.

This combination of product innovation, operational security, and strong risk management infrastructure has cemented BitMEX’s status as a trailblazer and leader in the crypto derivatives space.

BitMEX Never Left

BitMEX remains one of the elite, top-ten cryptocurrency exchanges globally, handling billions of dollars in daily trading volume. Often hailed as the “Ferrari of crypto derivative exchanges,” BitMEX offers a high-octane trading environment where its cutting-edge infrastructure, lightning-fast execution, and innovative products—like perpetual swaps—set the industry standard.

While not everyone may know how to drive a Ferrari, those who master BitMEX’s advanced tools consistently outpace the competition, capitalising on the market’s volatility with precision. Its unmatched liquidity, robust risk management framework, and proven track record over more than a decade underscore why seasoned traders continue to rely on BitMEX to deliver exceptional performance in the fast-paced world of crypto trading.

$BMEX Token Fundamentals

$BMEX plays a central role in the BitMEX ecosystem. Beyond providing holders with benefits such as trading fee discounts, free withdrawal privileges, and staking rewards, BMEX is also instrumental in fostering user engagement on the platform. With over one-third of its supply staked (with a typical 7-day lock-up period), BMEX is designed to reward long-term commitment on the BitMEX platform.

Perhaps the most important aspect of $BMEX is its deflationary mechanism. BitMEX executes a monthly burn process— permanently removing a portion of the revenue from circulation each month. This frequent burn schedule creates scarcity, potentially driving up the token’s value if demand holds or increases.

This approach contrasts with many other exchange tokens that operate on quarterly burns, thereby giving BMEX a unique edge in its tokenomics model.

Tokenomics

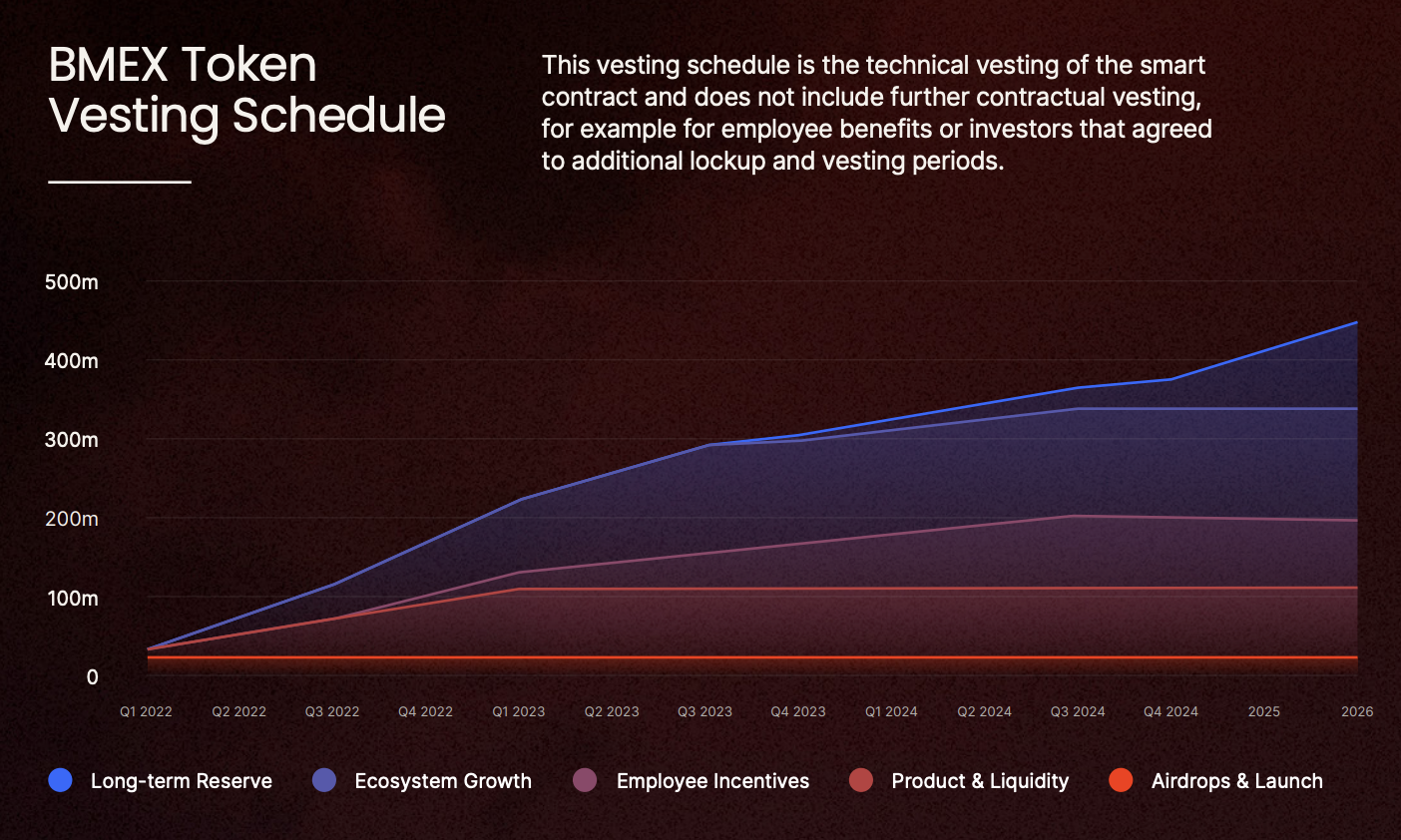

The BMEX token vesting schedule gradually releases tokens allocated to long-term reserves, ecosystem growth, employee incentives, product and liquidity, and airdrops or launches over several years. Starting with a relatively small portion of the total supply in early 2022, the vesting ramps up each quarter, crossing key milestones along the way.

By 2025, the schedule indicates that most of the BMEX supply will have been fully vested, giving the market access to nearly the entire token allocation. This structured approach is designed to align incentives among stakeholders, maintain orderly market conditions, and foster a sustainable growth path for the BMEX token and the BitMEX ecosystem as a whole.

The burn mechanism is a cornerstone of BMEX’s value proposition. Every month, BitMEX allocates:

- 4% of net fees from its derivatives markets,

- 8% of net fees from its spot markets, and

- 50% of net fees from BMEX trading pairs

…to burn BMEX tokens to this address—effectively removing them from circulation. With an annualised burn rate estimated at approximately US $1.5 million and a current market capitalisation of around US $23 million, the annualised deflation rate for BMEX is about 7.5%. Such deflationary pressure can support the token’s price over time if trading volumes and overall demand continue to grow.

Key Highlights (As of 1 April, 3.30PM HKT):

- $BMEX Burnt to date: 11,740,592

- Annualised Burn Rate: 7.5%

- Market Cap: $30.39 million

Competitor Comparisons and Token Valuation

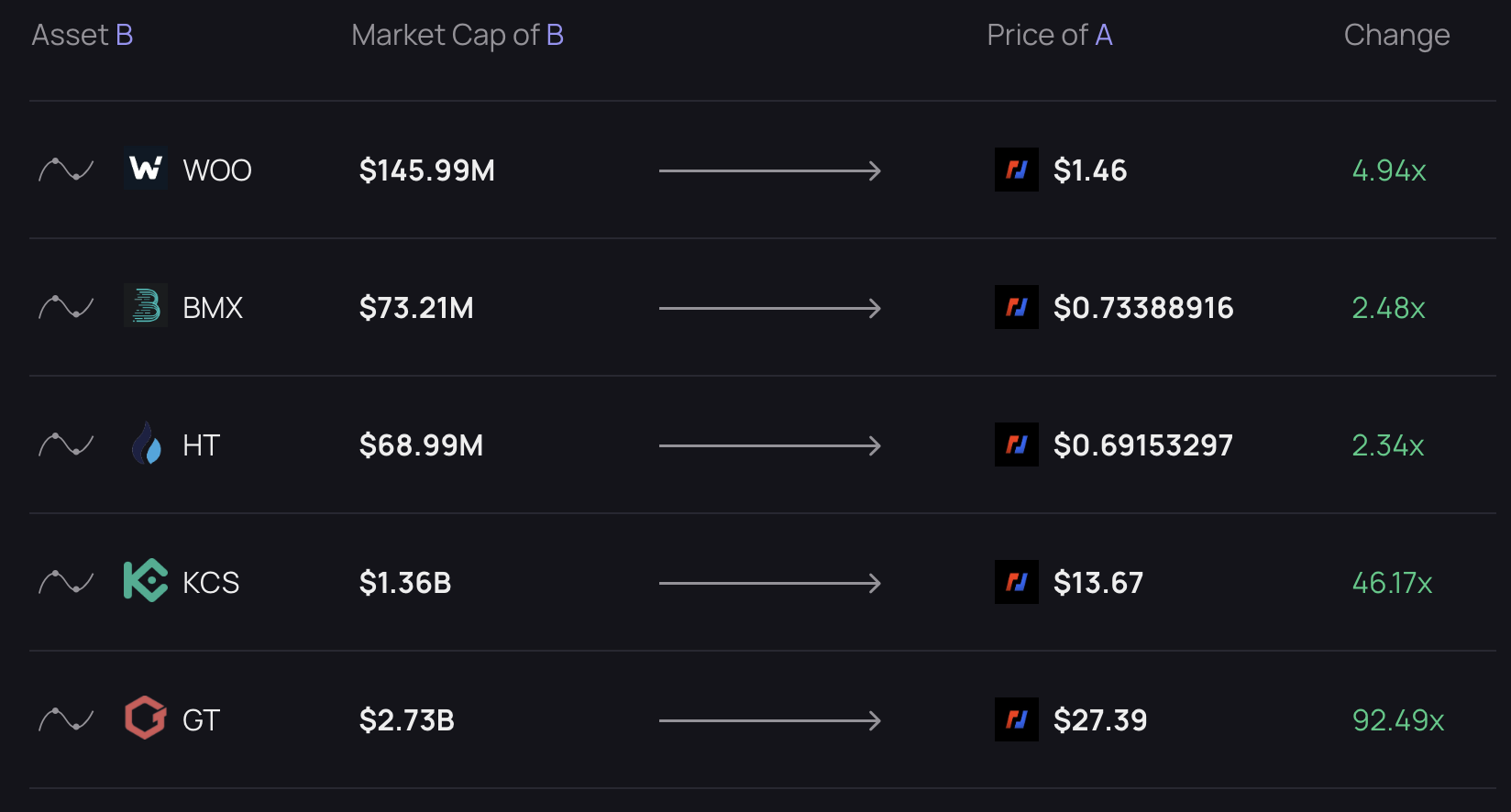

A notable characteristic of BMEX is its relatively low market capitalisation (around $30.39 million) compared to other centralised exchange tokens.

If BMEX were to reach WOO’s market cap of $146 million, its price could climb to $1.46—a 4.94× multiple. Matching KuCoin’s $KCS at $1.36 billion would push BMEX’s price to $13.67 (a 46.17× increase), while achieving Gate.io’s $GT market cap of $2.73 billion implies a potential price of $27.39 (an impressive 92.49× gain).

These comparisons make BMEX’s undervaluation clear. It also suggests that as BitMEX continues to grow its user base and volume, BMEX could be significantly re-rated by the market—offering a compelling proposition for long-term investors seeking to capitalise on BitMEX’s reputation for security, risk management, and innovation.

The Bottom Line

$BMEX’s low market cap relative to its burn rate and potential expansion of BitMEX’s platform creates room for meaningful appreciation. For investors looking to diversify into exchange tokens with strong fundamentals and innovative tokenomics, BMEX offers a compelling case—provided that broader market conditions and competitive dynamics remain favourable.