TL;DR

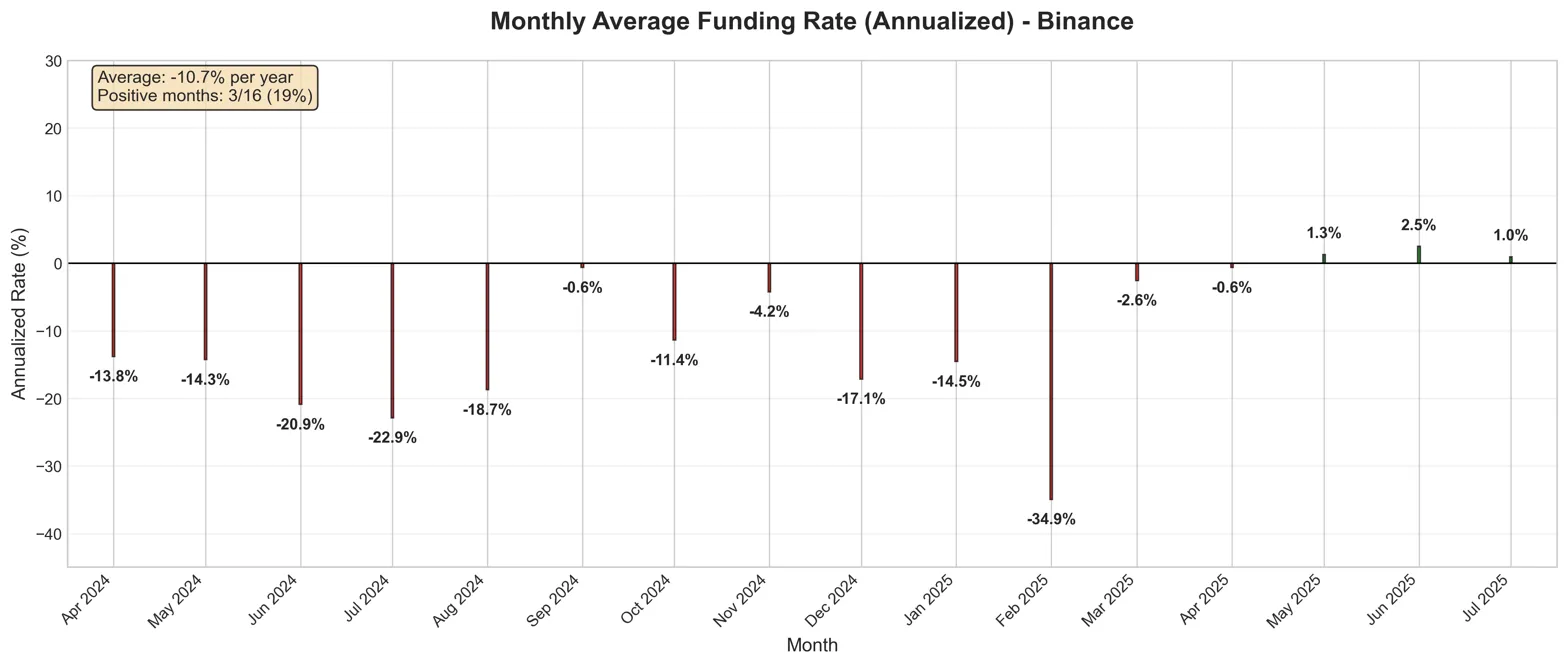

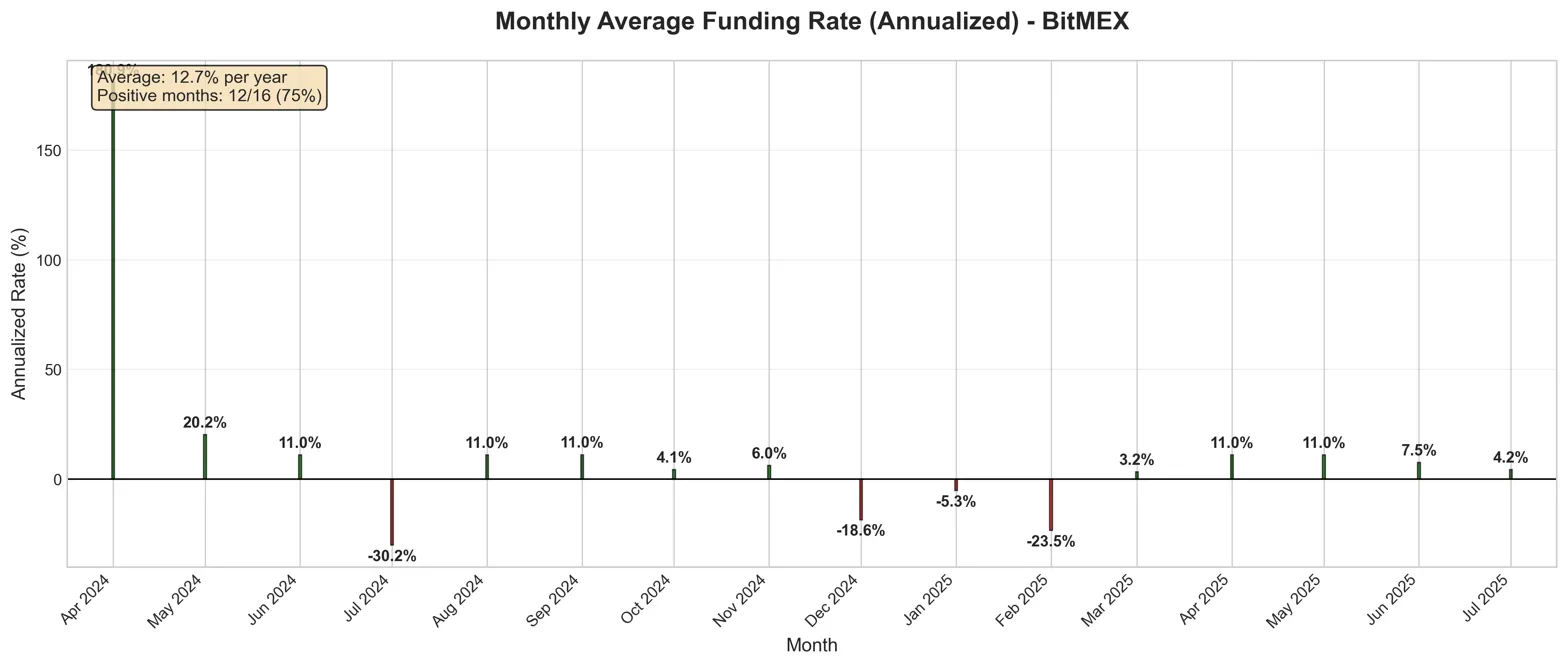

- BitMEX has been consistently paying positive funding rates on ENAUSDT, contrasting sharply with Binance and other CEX’s constant negative funding rates.

- Pairing a BitMEX short position with Pendle’s PT sENA tokens generates a market-neutral yield exceeding 20% APY.

- BitMEX’s ENAUSDT funding rate has remained positive 75% of historical months compared to only 19% on Binance, underpinning the stability of this strategy.

The Strategy Explained

The Strategy Explained

The strategy capitalises on BitMEX’s structural funding premium and Pendle Finance’s PT sENA.

The strategy capitalises on BitMEX’s structural funding premium and Pendle Finance’s PT sENA.

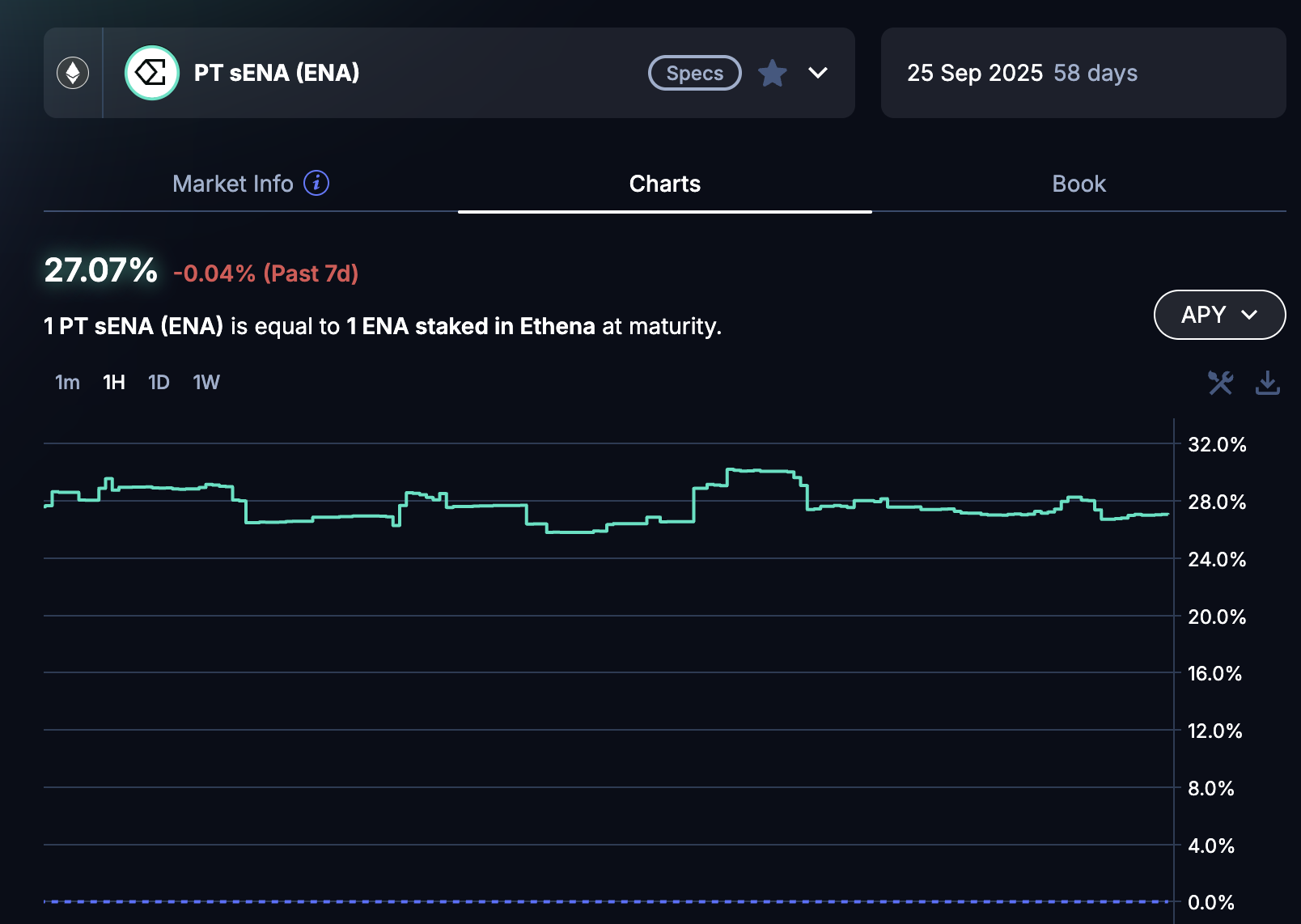

PT sENA tokens represent the principal component of staked ENA (sENA). Pendle splits a yielding token into yield-bearing tokens (YT) and principal tokens (PT). PT sENA tokens provide investors with a fixed yield (currently 27% APY) by locking in future airdrop rewards at a discounted upfront price until maturity (September 25, 2025). Essentially, Pendle enables arbitrage traders to sell discounted future yields, providing predictable, stable returns independent of market condition changes.

By combining these two complementary sources of income—Pendle’s fixed yield and BitMEX’s positive funding—you achieve stable, delta-neutral returns significantly above typical market yields.

Funding Landscape: BitMEX’s Advantage

We analyzed ENAUSDT funding rates across major exchanges from April 2024 to July 2025. The results reveal a striking divergence:

The data tells a clear story. BitMEX traders remain directionally bullish on ENA, consistently paying positive funding to maintain leveraged long positions. Meanwhile, Binance has become a haven for farmers and hedgers, driving funding deeply negative. This persistent spread creates our arbitrage opportunity.

Breaking Down the Strategy

1. Purchase ENA (Spot)

Acquire $ENA tokens on any preferred exchange, establishing your baseline asset exposure. You can withdraw USDT to the Ethereum mainnet and purchase via CowSwap

2. Stake & Mint PT Tokens

- Stake $ENA tokens through Ethena Earn to receive sENA

- Deposit sENA into Pendle Finance, minting PT sENA tokens that lock in a guaranteed fixed yield of 27% APY until maturity (September 25, 2025). You can do this here.

3. Short ENA Perpetuals on BitMEX

Open an equivalent-sized short ENAUSDT perpetual position on BitMEX to hedge price risk and simultaneously capture the consistently positive funding rate on BitMEX ENAUSDT.

Profit Estimation:

Let’s walk through a concrete example with $100,000 capital:

Yield Components:

- BitMEX’s predicted funding income: 11% × $60,000 = $6,600 annually (assuming $40k initial margin, 1.5x leverage)

- Pendle PT sENA yield: 27% × $60,000 = $16,200 annually

- Gross total: $22,800 (22.8% APY)

With conservative 1.5x leverage on the BitMEX short position, you could get a net returns above 20% APY for the next two months until the PT ENA expiration.

Helpful Tips

Entry Sequence:

- Check that the BitMEX funding rate is positive

- Buy spot ENA

- Immediately short an equivalent notional amount on BitMEX’s ENAUSDT

- Stake ENA for sENA on Ethena

- Deposit sENA to Pendle and mint PT tokens

Position Management:

- Monitor funding rates daily (BitMEX updates every 8 hours)

- Maintain 50% excess margin to weather volatility

Exit Strategy:

- Close your BitMEX short during low-volatility periods

- Sell PT tokens on Pendle or hold to maturity

- Unstake sENA (note: 7-day waiting period)

Risk Considerations

No strategy is without risks. Here’s what to watch:

Liquidation Risk Even with hedged positions, each leg has its own liquidation price. A sudden spike could liquidate your short before you can add margin. Solution: Use modest leverage (2-3x max) and maintain generous margin buffers.

Funding Regime Change If BitMEX funding turns persistently negative, you’ll be paying instead of receiving. Monitor daily and be ready to unwind if the regime shifts.

Smart Contract Risk Both Ethena and Pendle involve smart contract risk. While both protocols are audited, bugs or exploits remain possible. Size positions accordingly.

Liquidity Constraints The 7-day sENA unstaking period means you can’t exit instantly. Plan position sizes with this constraint in mind.

Why BitMEX?

This strategy showcases BitMEX’s unique position as a better place to hedge:

- Persistent funding premiums

- Reliable infrastructure with no downtime during funding calculations

- Flexible multi-asset collateral for margin efficiency

The Bottom Line

The BitMEX-Pendle ENA strategy offers something rare in crypto: equity-like returns with bond-like risk. By combining BitMEX’s structural funding premium with Pendle’s guaranteed yield, traders can harvest over 20% APY without taking directional risk.

The data speaks for itself. BitMEX pays, others don’t. Add Pendle’s yield, stay delta-neutral, and collect your yield. Sometimes the best trades are the simple ones.