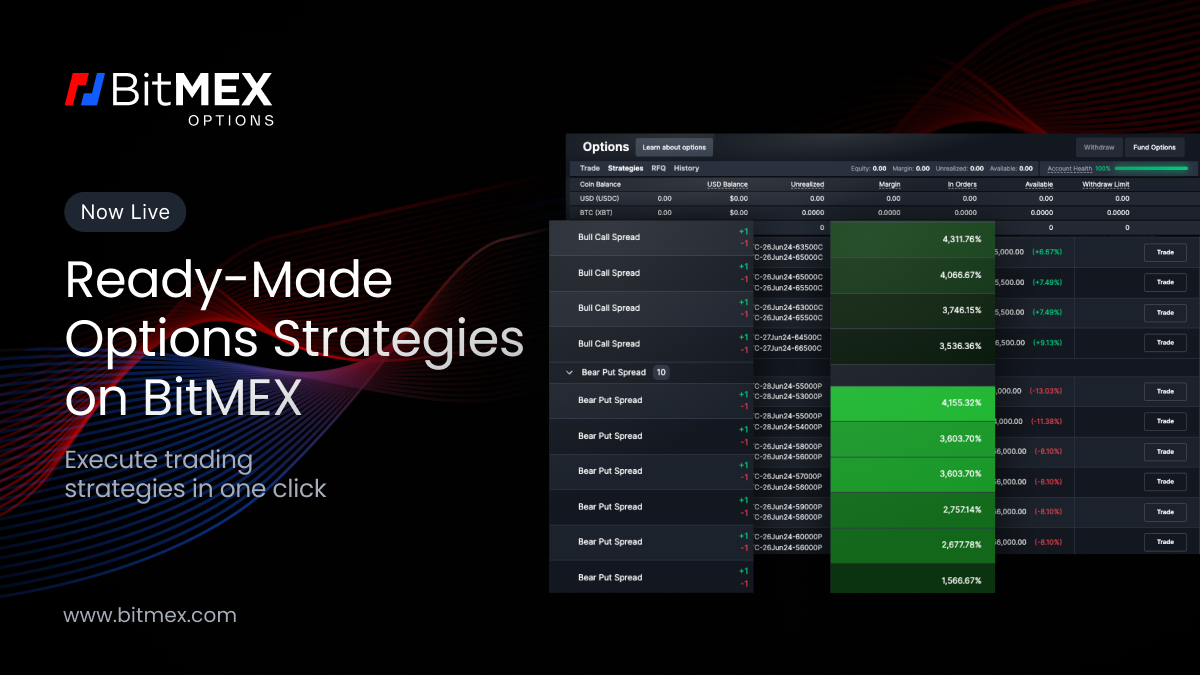

Don’t know where to start with crypto options? Introducing Strategies on BitMEX Options: the place for you to execute ready-made options trading strategies instantly in a few clicks.

The new feature is your comprehensive solution to…

- Quickly scan through a diverse range of trading strategies with the best risk-reward profiles

- Gauge trade payoff details with a strategy simulator

- Trade both legs (call and put) on the orderbooks in one click

- Populate a strategy to quickly get a Request-For-Quote (RFQ) on the strategy

To learn more about Strategies on BitMEX Options and how it works, read on.

If you haven’t signed up for a BitMEX account yet, we’re currently offering $5,000 worth of BMEX Tokens to new users – you can register here.

How to Use Strategies on BitMEX Options

Whether you’re new to options or an advanced trader, Strategies on BitMEX Options is made to provide all traders end-to-end support in executing strategies to maximise your gains in any market condition.

To start using the new feature, simply go to your BitMEX Options trading UI, and click on the ‘Strategies’ tab on the top left corner of the page, as shown below.

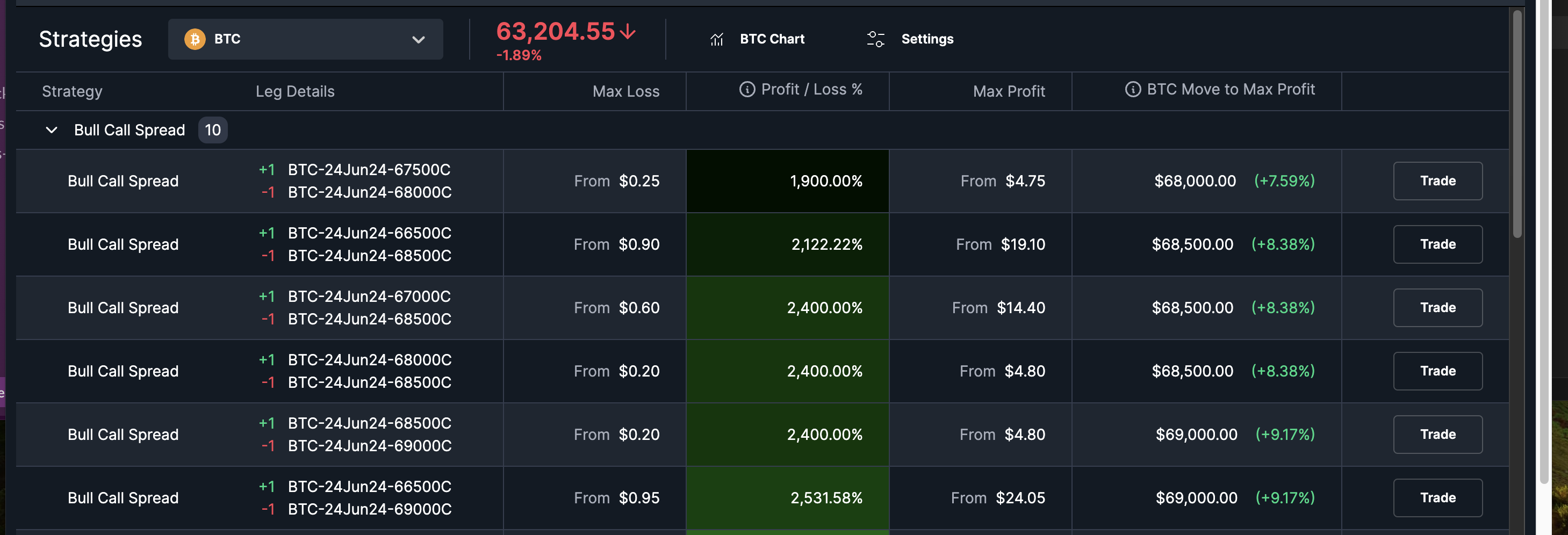

There are strategies customised for each token available on BitMEX Options (e.g. BTC). To view strategies for a particular token (e.g. BTC), open the dropdown menu and click on the particular token you wish to trade.

After selecting the token you wish to trade, you’ll find a list of ready-made strategies, categorised by the strategy type. There are a total of six categories available for each token:

- Bull Call Spread: Bullish vertical spread strategy including a long and short call.

- Bear Put Spread: Bearish strategy used to hold a position until expiry as long as profits are made.

- Iron Butterfly: Neutral strategy that involves combining four options to limit upside and downside risk.

- Iron Condor: Neutral strategy that limits upside and downside risk, with a wider profitable range and lower potential profit.

- Call Butterfly: Neutral strategy using call options to maximise profit in situations of drops in volatility, time decay or lack of market movements.

- Put Butterfly: Neutral strategy using put options to maximise profit in situations of drops in volatility, time decay or lack of market movements.

Under each category, you will find a list of ready-made strategies that you can execute by clicking on the ‘Trade’ button on the right hand side. For each strategy, you will find the following details:

- Leg Details (the call or put positions)

- Max Loss (the cost for executing the strategy)

- Profit/Loss %

- Max Profit (the maximum gains for executing the strategy)

- Token Move to Max Profit (how far the coin must move to obtain the maximum payoff)

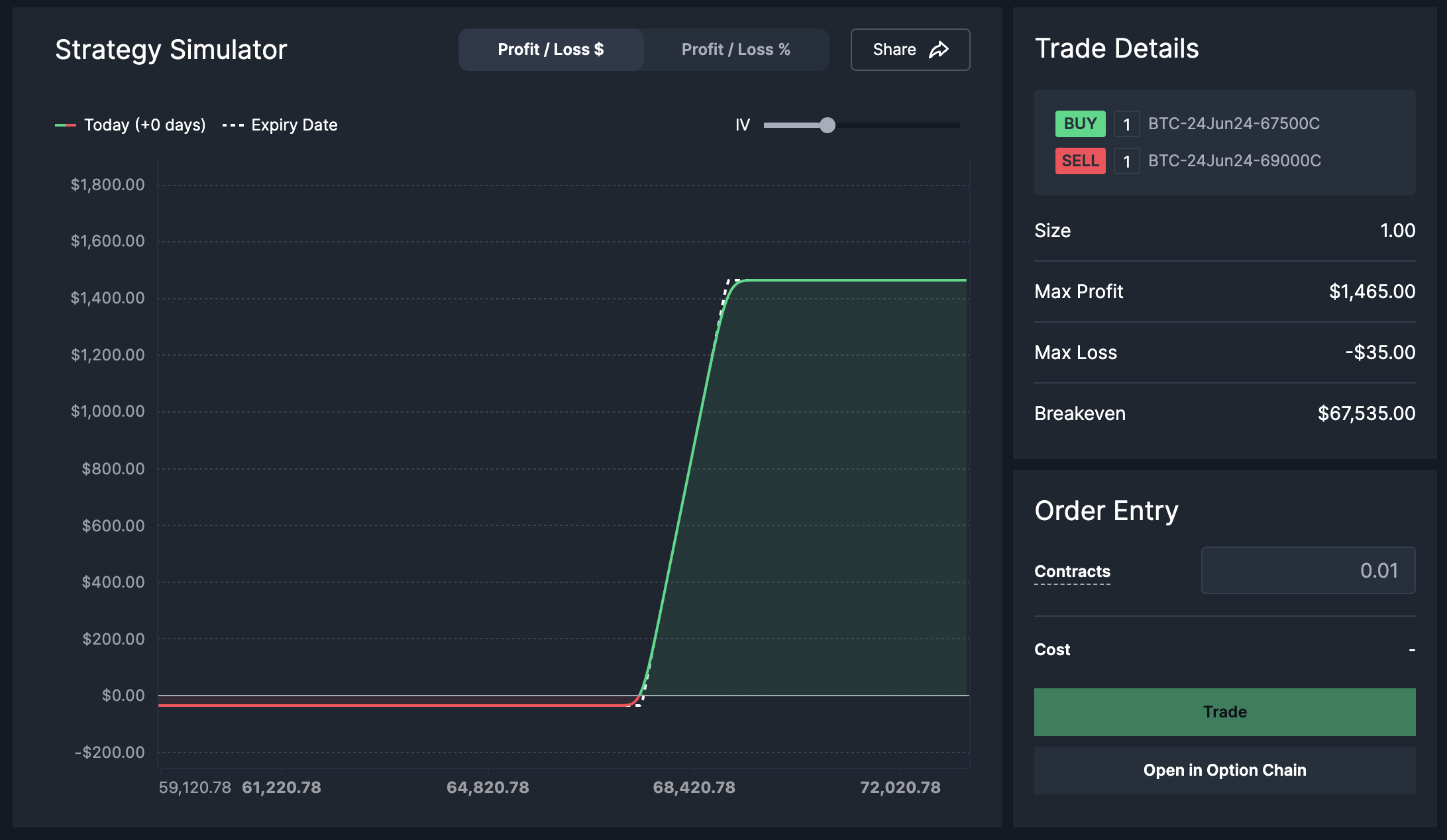

When clicking on a particular strategy, you will be led to a strategy simulator, which displays your potential Profit/Loss (can be shown in dollars or percentage format) in relation to the token price movements.

On the right hand side, you’ll also find the trade details and order entry form, where you can input your contract size and place your legs in one click.

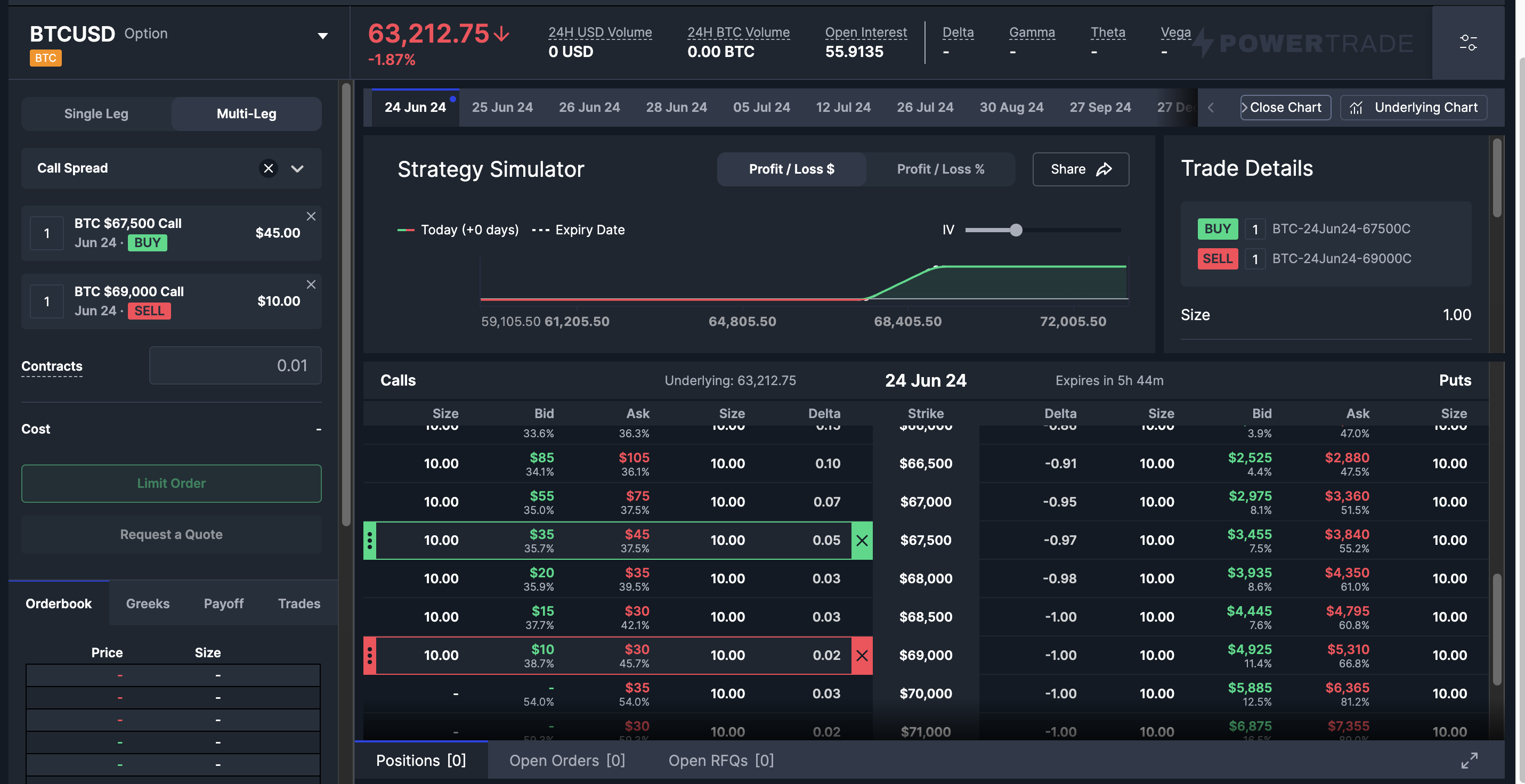

If you wish to view your trade details – specifically your individual trade legs – in the context of the wider market, click on ‘Open in Option Chain’, which will lead you to the following screen, as shown below.

Through this view, you will also have the choice to request an RFQ, which can lead to together pricing.

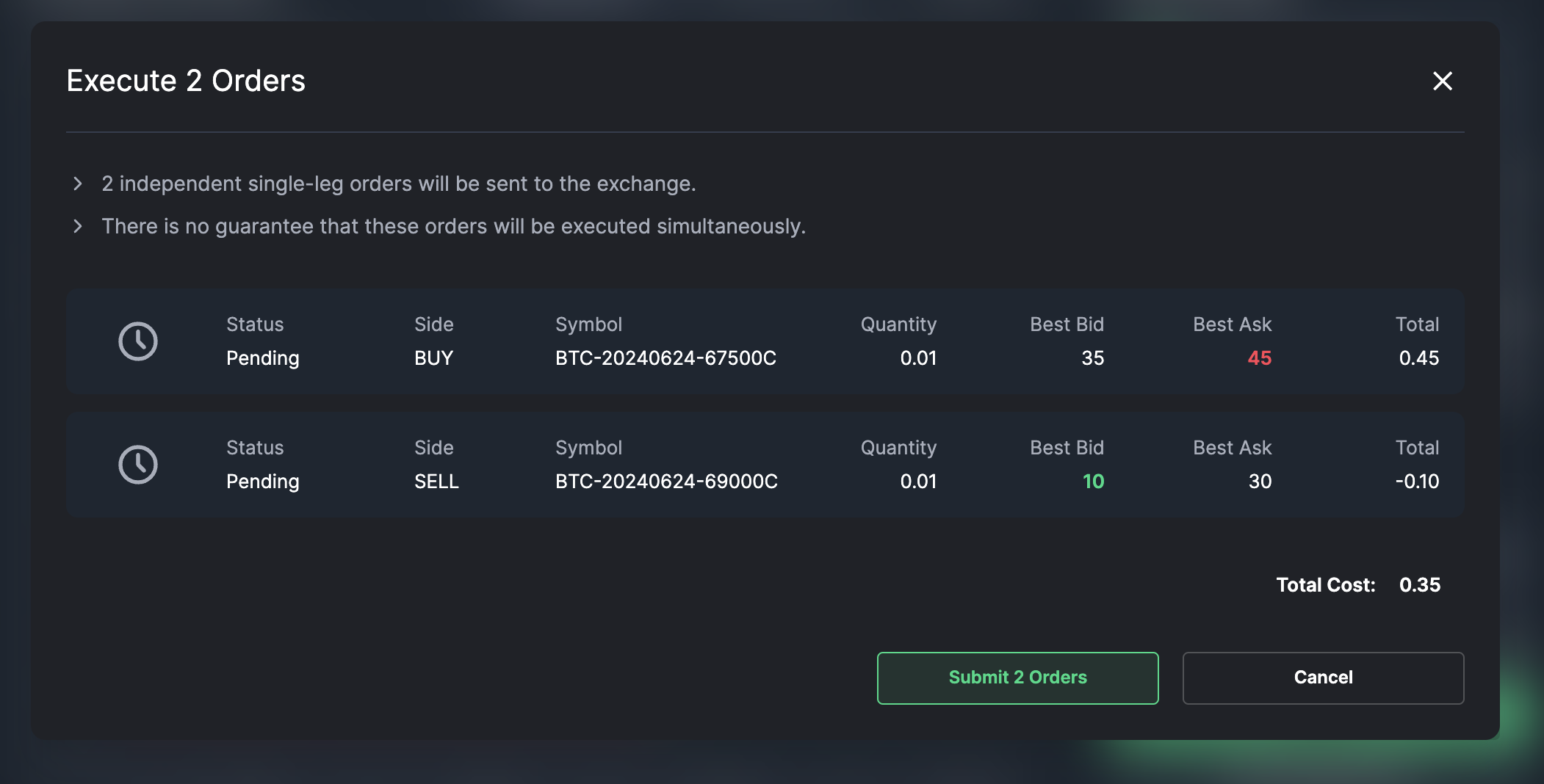

Once you click on ‘Trade’ for the strategy you wish to execute, you’ll be led to the order confirmation page. Here, you’ll find details including the individual orders that were sent to BitMEX and the status of each order.

After checking through your trade details, press ‘Submit x Orders’ to officially execute your selected strategy.

For a detailed view on the new Strategies feature, you can watch the video below.

We’re currently offering our first options traders with up to 350 USDT, as well as a referral bonus of 20 USDT. You can get started on your options trading journey here.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

In the meantime, if you have any questions please contact Support who are available 24/7.