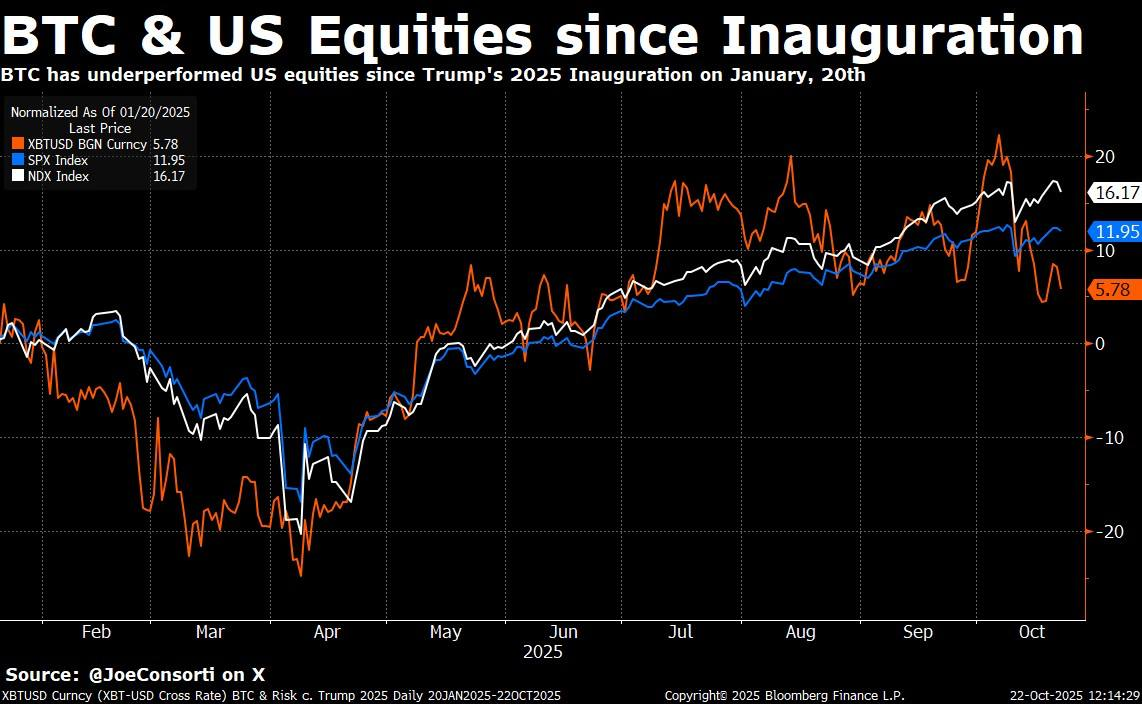

This year, Bitcoin has underperformed in comparison to virtually every major asset class. Heading into the final quarter of 2025, Bitcoin’s performance has notably lagged behind gold, Nasdaq, S&P 500, Hang Seng Index, and the Nikkei 225. Investors who bought Bitcoin around the 2025 inauguration expecting favourable price action from president Trump’s support, are now grappling with a modest gain of just over 5%.

This year, Bitcoin has underperformed in comparison to virtually every major asset class. Heading into the final quarter of 2025, Bitcoin’s performance has notably lagged behind gold, Nasdaq, S&P 500, Hang Seng Index, and the Nikkei 225. Investors who bought Bitcoin around the 2025 inauguration expecting favourable price action from president Trump’s support, are now grappling with a modest gain of just over 5%.

This article will take a deep dive into Bitcoin’s recent underperformance, with a focus on key supply-demand dynamics. Specifically, we will explore the behaviour of Bitcoin’s long-term holders, the shift in mining activity, and the ETF inflows to decomplexify Bitcoin’s ever evolving price action.

The Year of Bitcoin Underperformance

The above chart shows how Bitcoin has underperformed US equities since Trump’s 2025 inauguration, with Nasdaq and S&P 500 displaying outperformance by over 100% compared to Bitcoin’s relatively flat trajectory.

The above chart shows how Bitcoin has underperformed US equities since Trump’s 2025 inauguration, with Nasdaq and S&P 500 displaying outperformance by over 100% compared to Bitcoin’s relatively flat trajectory.

If you bought Bitcoin on inauguration day (20 January 2025), your investment would have returned a modest 5.78%. In comparison, major indices like the Nasdaq and S&P 500 have significantly outperformed Bitcoin within the same period. Gold, traditionally seen as a safe-haven asset, also eclipsed Bitcoin’s performance.

The Selling Pressure: Long-Term Holders and Miners

$100k – A Psychological TP Level for OGs

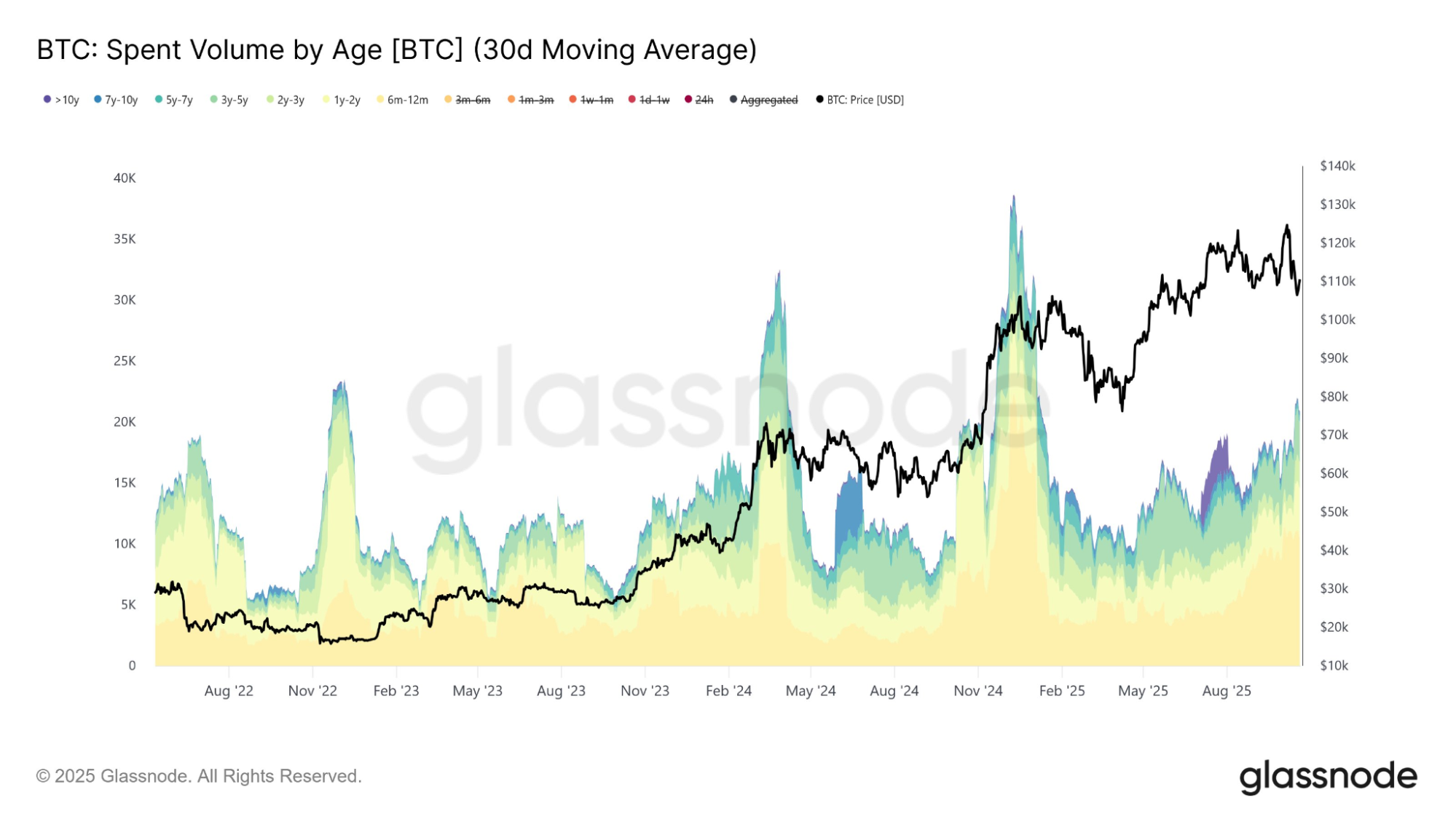

Bitcoin has been hovering near the psychological price point of $100,000. Long-term holders seem to be de-risking as the price stagnates around this level.

Increased Selling from OGs everytime BTC > $100k

The above chart shows an uptick in spent volume by long-term holders, indicating that more Bitcoin OGs are selling the token after holding it for years, noted by the purple and blue colors in the chart. The chart reveals periods of heightened activity where older coins were spent; there is a significant uptick in spent volume when BTC is above $100k reinforcing the idea that Bitcoin’s OG holders are unloading their positions at current prices.

The above chart shows an uptick in spent volume by long-term holders, indicating that more Bitcoin OGs are selling the token after holding it for years, noted by the purple and blue colors in the chart. The chart reveals periods of heightened activity where older coins were spent; there is a significant uptick in spent volume when BTC is above $100k reinforcing the idea that Bitcoin’s OG holders are unloading their positions at current prices.

We suspect that with other asset classes surging this year, particularly growth in the AI sector, many tech-focused OGs seem to be rotating out of Bitcoin to diversify and take part in new opportunities. This shift has created a persistent overhead supply, capping every rally we had this year.

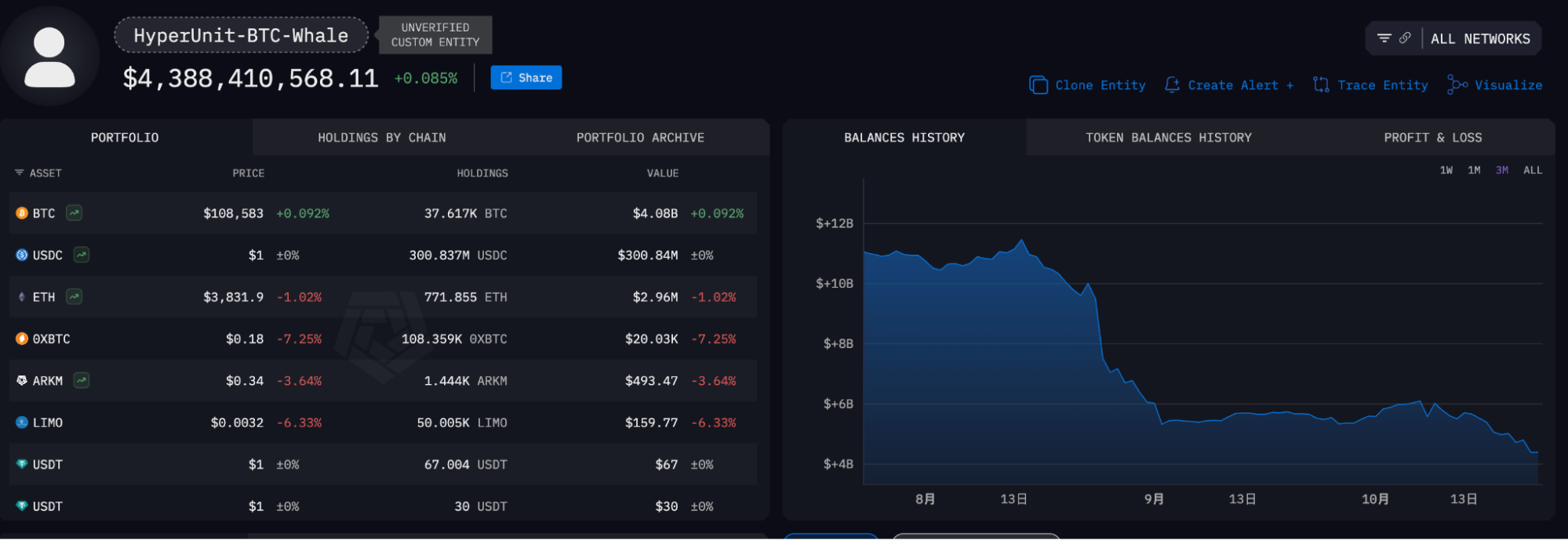

Tracking the Bitcoin Whales

This selling pressure could lead to a frustrating market environment, where Bitcoin experiences choppy price action rather than meaningful rallies. To trigger a potential upward move, Bitcoin may need to break below the $100,000 support level first to effectively flush out these sellers.

One of the most significant wallets driving this behaviour can be tracked on Arkham Intelligence. In October alone, this wallet deposited more than $600 million worth of Bitcoin into different exchanges, acting as a key marker to monitor for signs of market relief. You can explore the wallet here.

One of the most significant wallets driving this behaviour can be tracked on Arkham Intelligence. In October alone, this wallet deposited more than $600 million worth of Bitcoin into different exchanges, acting as a key marker to monitor for signs of market relief. You can explore the wallet here.

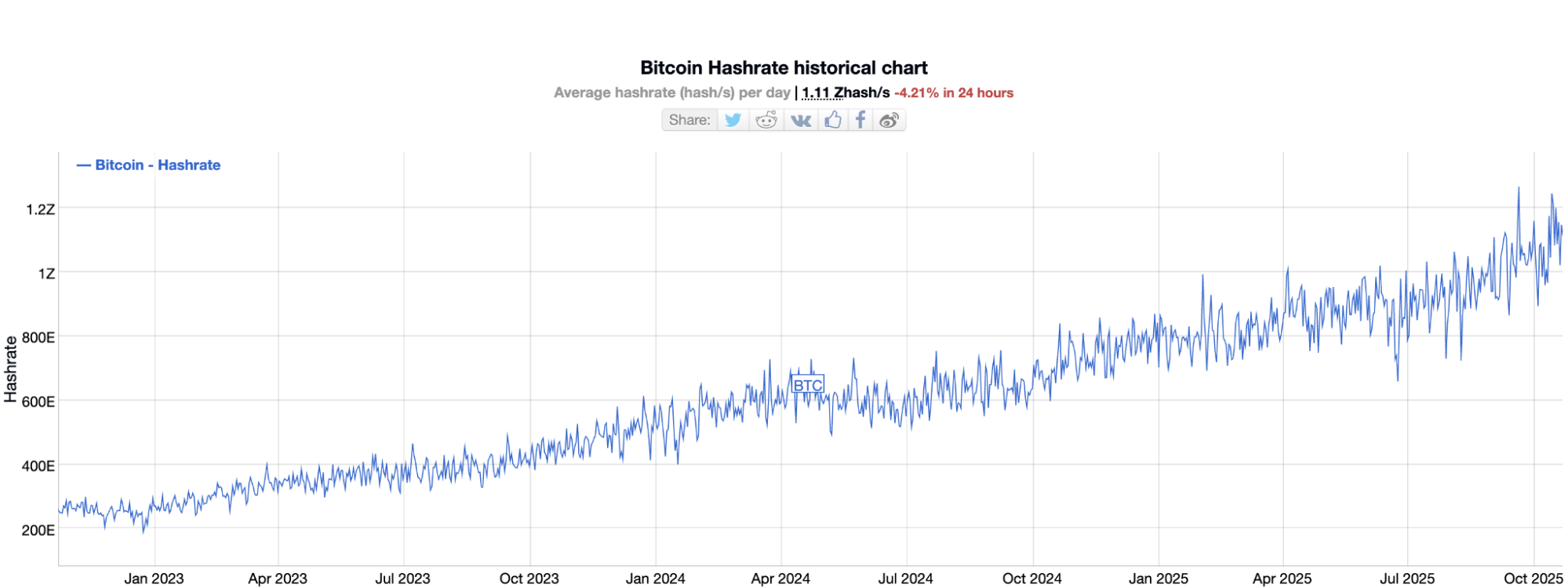

Bitcoin Miners Pivoting from Securing the Network to AI Data Centers

As Bitcoin miners continue to migrate a portion of their operations away from Bitcoin mining and into high-performance data centers driven by AI, Bitcoin’s security could face new risks. The pivot of miners to AI may weaken Bitcoin’s decentralised network, decreasing its hash rate over the long term.

- Core Scientific ($CORZ) signed a 12-year HPC hosting deal with CoreWeave, converting 100 MW of existing infrastructure and paving the way for a broader merger vote at month-end.

- Iris Energy ($IREN) has expanded its AI Cloud to over 23,000 NVIDIA GPUs, gaining Preferred Partner status with NVIDIA.

- TeraWulf ($WULF) secured a 10-year, >200 MW AI hosting contract worth up to US $8.7 billion.

- Bitdeer ($BTDR), one of the most aggressive players, plans to repurpose part of its Norwegian Tydal site (175 MW) and its Ohio Clarington facility (570 MW capacity) into AI data centers by late 2026, targeting >200 MW of AI IT load.

- Even traditionally pure-play miners like CleanSpark ($CLSK) and Riot Platforms ($RIOT) are hiring “Chief Data Center Officers” and designing new campuses around dual-use computers.

Implications of a Weakened Bitcoin Network: Not Shown

A reduced hash rate, resulting from miners moving away from securing the Bitcoin network, could lead to a less secure network. A less secure Bitcoin network is less appealing to institutional investors, possibly resulting in decreased demand and, ultimately, lower prices.

Miners, who once provided critical support to Bitcoin’s infrastructure, are now shifting their focus toward more profitable ventures in AI and cloud services. This migration raises potential concerns about Bitcoin’s future as a store of value and a decentralised asset.

Demand-Side Dynamics: Bitcoin ETF Inflow and Government Seizures

ETFs as the Biggest Demand Factor

This chart illustrates the correlation between Bitcoin ETF inflows and price movements. When ETF inflows were strong, Bitcoin saw price increases, but the lack of inflows since mid-July has led to stagnation in Bitcoin’s price, underscoring the important role these financial instruments play in driving demand.

The below chart compares Bitcoin ETF inflows with Bitcoin price in 2025. It indicates that Bitcoin ETF inflows provided a notable boost to Bitcoin’s price earlier in the year – however, from 10 July, inflows have stagnated as well as Bitcoin’s price.

Limited Growth of ETF Inflows

Limited Growth of ETF Inflows

While the entry of institutional capital via Bitcoin ETFs has been seen as a strong indicator of Bitcoin’s maturation as an asset class, the lack of continued inflows suggests that institutional interest may have plateaued.

US Government Seizures and Impact on Bitcoin’s Viability

Government Seizures and Bitcoin’s Core Value

One of Bitcoin’s key promises has been the ability to escape government control. However, recent seizures of Bitcoin by the US government, which now holds billions in Bitcoin, have led to concerns about the underlying security of Bitcoin.

The idea of holding Bitcoin as a hedge against government overreach is increasingly being questioned, as government actions seem to challenge the very premise of Bitcoin’s financial autonomy.

Potential Bearish Sentiment

This rise in government scrutiny is a growing concern for long-term Bitcoin holders. If Bitcoin’s role as a decentralised store of value is undermined, it could lead to a further loss of confidence in its future. This could also be contributing to the selling pressure from OGs.

Privacy Coins as an Alternative

ZECUSDT/BTCUSDT Chart Shows Zcash(ZEC) could Benefit from Bitcoin’s Viability Concern

ZECUSDT/BTCUSDT Chart Shows Zcash(ZEC) could Benefit from Bitcoin’s Viability Concern

The increased monitoring of Bitcoin’s blockchain and the rise in government seizures have led to renewed interest in privacy-focused cryptocurrencies like Zcash. Investors who are looking for an asset that offers more anonymity and protection from government surveillance are flocking to privacy coins.

Conclusion: What’s Ahead for Bitcoin?

Bitcoin has underperformed in comparison to major asset classes this year, largely due to a combination of supply-side and demand-side factors. Long-term holders are selling their Bitcoin, while miners are migrating their operations to AI data centers, potentially weakening Bitcoin’s network security in the long term. On the demand side, Bitcoin ETFs haven’t driven meaningful inflows since mid-July, and the growing risk of government control has raised concerns about Bitcoin’s future as a decentralised and resilient asset.

The key question moving forward will be whether Bitcoin can regain its former momentum or if we are in for a prolonged period of sideways action as the supply-side pressures persist. With ongoing uncertainty around both supply and demand dynamics, two key factors should be observed: BTC whales stop depositing into exchanges and ETF NAVs start picking up again.