Abstract: In this piece on economics, we look at misconceptions with respect to how banks make loans and the implications this has on the ability of banks to expand the level of credit in the economy. We analyze the inherent properties of money which ensure that this is the case and the impact this could have on the business cycle.

Click here to download the pdf version of this report

Dynamics of Credit Expansion

The core characteristic of the traditional banking system and modern economies, is the ability of the large deposit taking institutions (banks) to expand the level of credit (debt) in the economy, without necessarily needing to finance this expansion with reserves.

An often poorly understood point in finance, is the belief that banks require reserves, liquidity or “cash”, in order to make new loans. After-all where do banks get the money from? It is true that smaller banks and some financial institutions do need to find sources of finance to make new loans. However, in general, this is not the case for the main deposit taking institutions within an economy.

If a main deposit taking institution, makes a new loan to one of their customers, in a sense this automatically creates a new deposit, such that no financing is required. This is because the customer, or whoever sold the item the loan customer purchased with the loan, puts the money back on deposit at the bank. Therefore the bank never needed any money at all. Indeed there is nothing else people can do, the deposits are “trapped” inside the banking system, unless they are withdrawn in the form of physical notes and coins, which rarely happens nowadays.

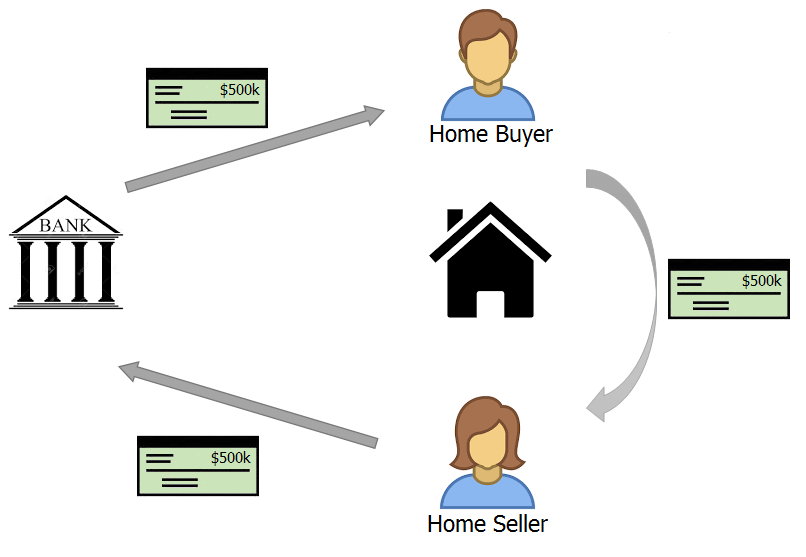

Please consider the following simplified example:

- A large bank, JP Morgan, provides a mortgage loan to a customer, who is buying their first home, for $500,000

- JP Morgan writes a check to the mortgage customer for $500,000

- The mortgage customer deposits the check into his deposit account, at JP Morgan

- The mortgage customer writes a new check, for $500,000 and he hands it over to the seller of the property

- The seller is also a banking client of JP Morgan and as soon as she receives the check, she deposits it into her JP Morgan bank account

Illustrative diagram of a new home mortgage with one dominant bank in the economy

As one can see, the above process had no impact on the bank’s liquidity or reserves, the bank never had to spend any “cash” at any point in the above example. Of course, the seller of the property does not necessarily have to have an account with the same bank as the one which provided the loan. However large deposit taking institutions, such as JP Morgan, HSBC or Bank of America, have large market shares in the deposit taking business, in their local markets. Therefore, on average, these large banks expect more than their fair share of new loans to end up on deposit at their own bank. Actually, on average, new loans in the economy increases the available liquidity for these large banks, rather than decreasing it.

The accounting treatment of this mortgage, for the bank, is as follows:

- Debit: Loan (asset): $500,000

- Credit: Deposit (liability): $500,000

The bank has therefore increased its assets and liabilities, resulting in balance sheet expansion. Although from the point of view of the home seller, she has $500,000 of cash. The above transaction has increased the amount of loans and deposits in the economy. From the customer’s point of view, these deposits are seen as “cash”. In a sense, new money has been created from nothing, apart from perhaps the asset, which in this case is the property. In the above scenario, M0 or base money, the total value of physical notes and coins in the economy, as well as money on deposit at the central bank, remains unchanged. M1, which includes both M0 and money on deposit in bank accounts, has increased by $500,000. Although the precise definition of M1 varies by region.

Cash reserves from the point of view of a bank are physical notes and coins, as well as money on deposit at the central bank. The ratio between the level of deposits a bank can have and its reserves, is called the “reserve requirement”. This form of regulation, managing the reserve requirement, leads to the term “fractional reserve banking”, with banks owing more money to deposit customers than they have in reserve. However, contrary to conventional wisdom, in most significant western economies, there is no regulation directly limiting the bank’s ability to make these loans, with respect to its cash reserves. The reserve requirement ratio typically either does not exist, or it is so low that it has no significant impact. There is however a regulatory regime in place that does limit the expansionary process, these are called “capital ratios”. The capital ratio, is a ratio between the equity of the bank and the total assets (or more precisely risk weighted assets). The bank can therefore only create these new loans (new assets) and therefore new deposits (liabilities), if it has sufficient equity. Equity is the capital investment into the bank, as well as accumulated retained earnings. For example if a bank has $10 of equity, it may only be allowed $100 of assets, a capital ratio of 10%.

The credit cycle

To some extent, the dynamic described above allows banks to create new loans and expand the level of credit in the economy, almost at will, causing inflation. This credit cycle is often considered to be a core driver of modern economies and a key reason for financial regulation. Although the extent to which the credit cycle impacts the business cycle is hotly debated by economists. These dynamics are often said to result in expansionary credit bubbles and economic collapses. Or as Satoshi Nakamoto described it:

Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve

Ray Dalio, the founder of Bridgewater Associates (a leading investment firm), appears to agree that the credit cycle is a major driver of swings in economic growth, at least in the short term, as his video below explains:

The view that the credit cycle, caused by fractional reserve banking, is the dominant driver of modern economies, including the boom and bust cycle, is likely to be popular in the Bitcoin community. This theory is sometimes called Austrian business cycle theory, although many economists outside the Austrian school also appreciate the importance of the credit cycle.

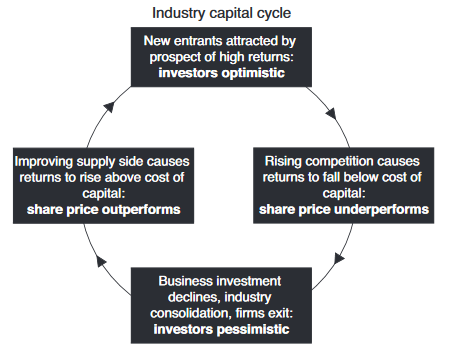

However, there are alternative views. For example another successful investment firm, Marathon Asset Management, identifies the “capital cycle” as the main driver of the business cycle, rather the credit cycle. In their view a cycle emerges with respect to investment in production, as the below diagram illustrates.

The capital cycle

Source: Capital Account

The fundamental cause of the credit expansionary dynamic

The above dynamic of credit expansion and fractional reserve banking, is not understood by many. However, with the advent of the internet, often people on the far left politics, the far right of politics or conspiracy theorists, are becoming partially aware of this dynamic, perhaps in an incomplete way. With the “banks create money from nothing” or “fractional reserve banking” narratives gaining some traction. The question that arises, is why does the financial system work this way? The underlying reasons for this, are poorly understood, in our view.

Individuals with these fringe political and economic views, may think this is some kind of grand conspiracy by powerful elite bankers, to ensure their control over the economy. For example, perhaps the Rothschild family, JP Morgan, Goldman Sachs, the Bilderberg Group, the Federal Reserve or some other powerful secretive entity deliberately structured the financial system this way, so that they could gain some nefarious unfair advantage or influence? Actually, this is not at all the case.

The ability of deposit taking institutions to expand credit, without requiring reserves, is the result of inherent characteristics of the money we use and the fundamental nature of money. This is because people and businesses psychologically and for very logical practical reasons, treat bank deposits in the same way as “cash”, when they could alternatively be considered as loans to the bank. This enables banks to then expand the amount of deposits, knowing they are safe, as customers will never withdraw it, since they already think of it as cash.

Bank deposits are treated this way for perfectly reasonable and logical reasons, in fact bank deposits have some significant advantages over physical cash. Bank deposits are simply much better than physical cash. It is these inherent and genuine advantages that cause fractional reserve banking, not a malicious conspiracy, as some might think.

Advantages of bank deposits compared to physical notes and coins

| Factor | Bank deposit | Physical cash |

| Security |

Keeping money on deposits in financial institutions, increases security The money is protected by multiple advanced security mechanisms and insured in the unlikely event of theft |

Large physical cash balances at home could be vulnerable to theft or damage

Physical cash cannot be insured and storage costs can be expensive |

| Electronic transfers | Using the banking system, it is possible to quickly send money effectively over the internet or by phone, across the world at low cost and at high speed | If physical cash is used, then a slow, inefficient, insecure physical transfer must take place |

| Convenience |

Using a banking system to manage your money, can result in a convenient set of tools. For example the ability to use money using your mobile phone or on your computer Precise amounts can be sent so there is no issue with receiving change |

Handling cash is often a difficult and cumbersome process. Precise amounts cannot be specified and one may need to calculate change amounts |

| Auditability | Traditional banks offer the ability to track, control and monitor all transactions, which can help prevent fraud. This improves reporting and accountability | With physical cash, effective record keeping is less automated, increasing the probability of fraud |

Part 2 is available here