Abstract: We look at the history of Bitcoin mining ASIC manufacturers, in particular the reported energy efficiency of the mining machines. We analyse the five main players in the market today, with a focus on Canaan and its profit warning right after its IPO. We then evaluate Ebang’s recent IPO prospectus and comment on the challenges the group faces with respect to its market positioning, profitability and geo-politics. We assess MicroBT, who are gaining significant traction in the market, obtaining share from Bitmain, who appear to be facing an almost comically abysmal corporate governance situation. In conclusion we think that post the 2020 Bitcoin halving, further industry consolidation is likely in both the ASIC manufacturing sector and mining farm operating sector.

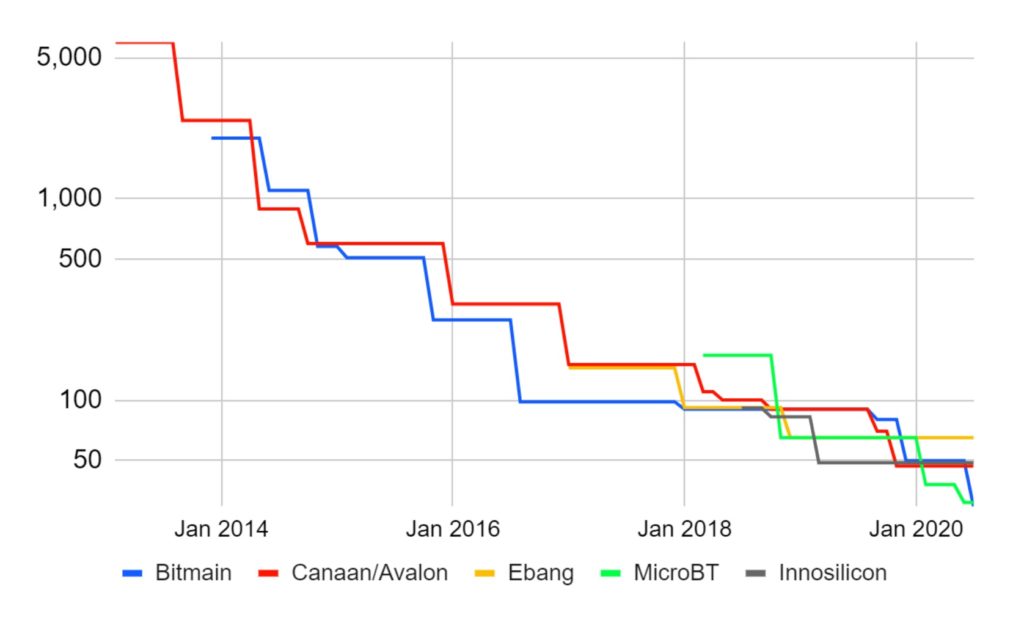

Figure 1 – Reported Miner Efficiency (J/TH) vs product launch date

(Source: Manufacturer websites, BitMEX Research)

(Notes: Only includes ASIC manufacturers who are still producing machines as at June 2020)

Overview & Brief History

It was just over fours years after the launch of Bitcoin, at the start of 2013, when the first Bitcoin mining ASIC was shipped, the Avalon 1. However it was Butterfly Labs who announced the first Bitcoin mining ASIC, in June 2012. Butterfly Labs generated tens of millions of dollars in orders and then failed to deliver. When attending Bitcoin conferences and meetups in the late 2012 to early 2013 period, the place was full of frustrated Butterfly Labs customers asking when their miners would arrive. In 2014 the company was eventually shut down on request of the US courts. This left Avalon as the clear market leader in 2013. However, from the start of 2015 to 2018, it was Bitmain who had the most efficient products and therefore it was Bitmain who built up a dominant position in the market. At the height of Bitmain’s power during the 2017 bull market, its market share was around 75%.

Figure 2 – Mining ASIC Estimated Market Share by Manufacturer (TH/s sold)

(Source: Bitmain IPO prospectus, Canaan IPO prospectus, MicroBT presentation slides, BitMEX Research)

Today competition is increasing, with strong products from new players like MicroBT gaining traction and eating into Bitmain’s lead. MicroBT’s 2019 share is believed to have been around 35%. However, Bitmain remains the number one player and a force to be reckoned with.

Canaan

As we mentioned in our December 2019 piece on the Canaan IPO, Canaan acquired the Avalon name in 2014. Canaan is the first Bitcoin ASIC manufacturer to make it to the public markets, in what we considered at the time to be an extremely shrewd and well executed piece of corporate finance, at least from the company’s point of view.

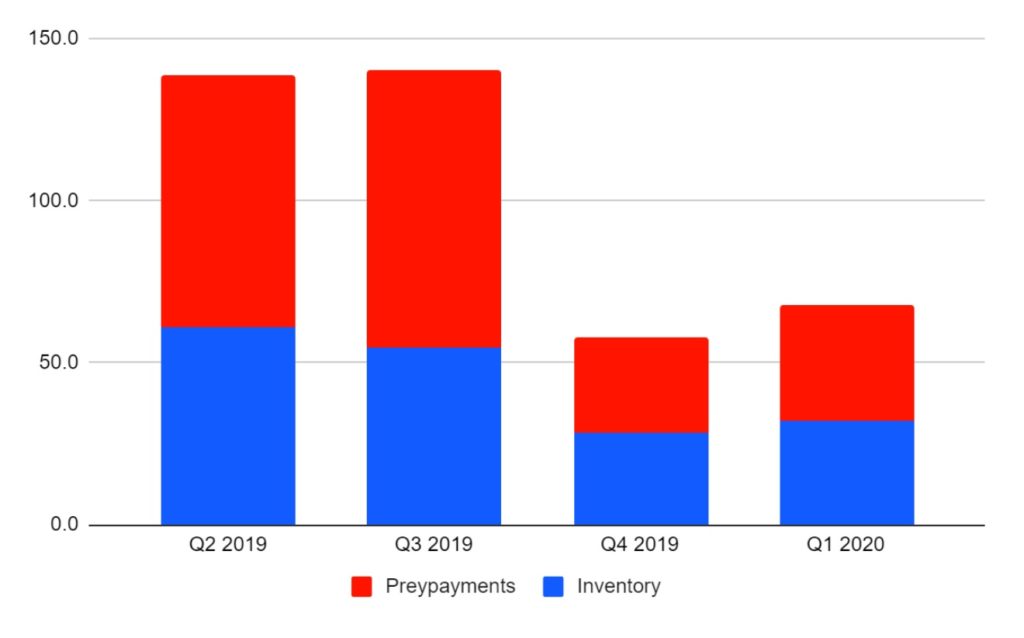

The company performed worse than we expected since the IPO, generating a full year net loss of US$149.8 million in 2019, compared to our estimates of a US$30 million loss. This large miss was due to significant inventory and prepayment write-downs, totalling around US$103 million in 2019. The IPO prospectus included provisions for write-downs in the first 6 months of 2019 of only US$0.1 million, in comparison to the full year charge of US$103 million. Figure 3 below shows the large decline in the inventory and prepayment balance in Q4 2019.

Figure 3 – Canaan selected balance sheet items (US$ million)

(Source: Company data, BitMEX Research)

The fact that this write-down was so large and happened so soon after raising US$90 million in the IPO is likely to raise a few eyebrows to say the least. Due to the difficult situation in the markets, with the halving, reasonably weaker prices and overinvestment in the 2017 bubble, we had expected slow sales and moderate write-downs, but the extent of it took us by surprise. Investors seem unimpressed, with the shares down 77% since the IPO, compared to Bitcoin which is up 17%, as Figure 4 below illustrates.

Figure 4 – Canaan share price vs Bitcoin (Rebased)

(Source: Bloomberg)

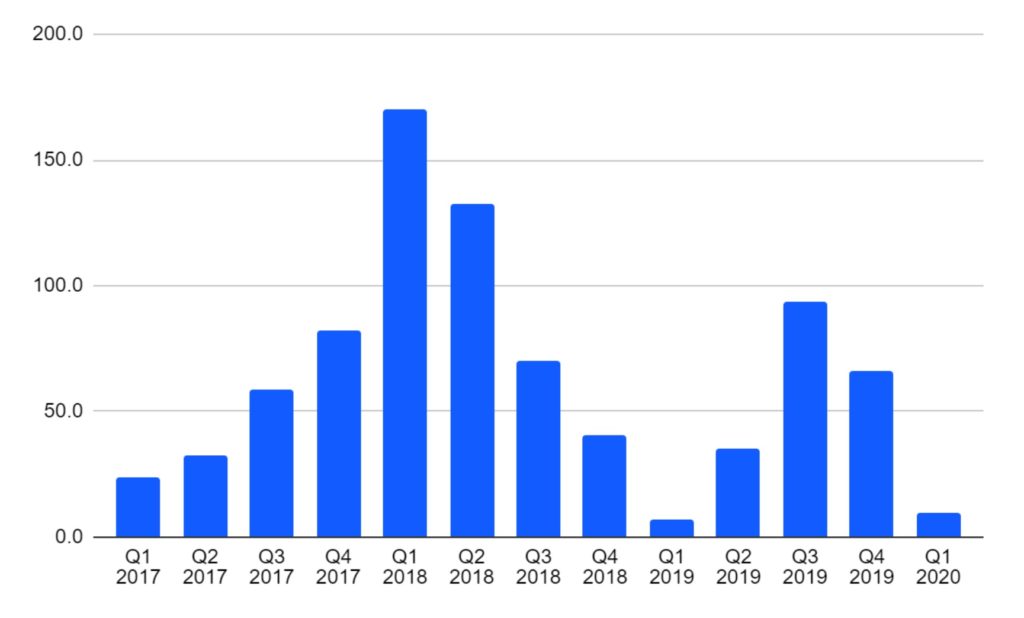

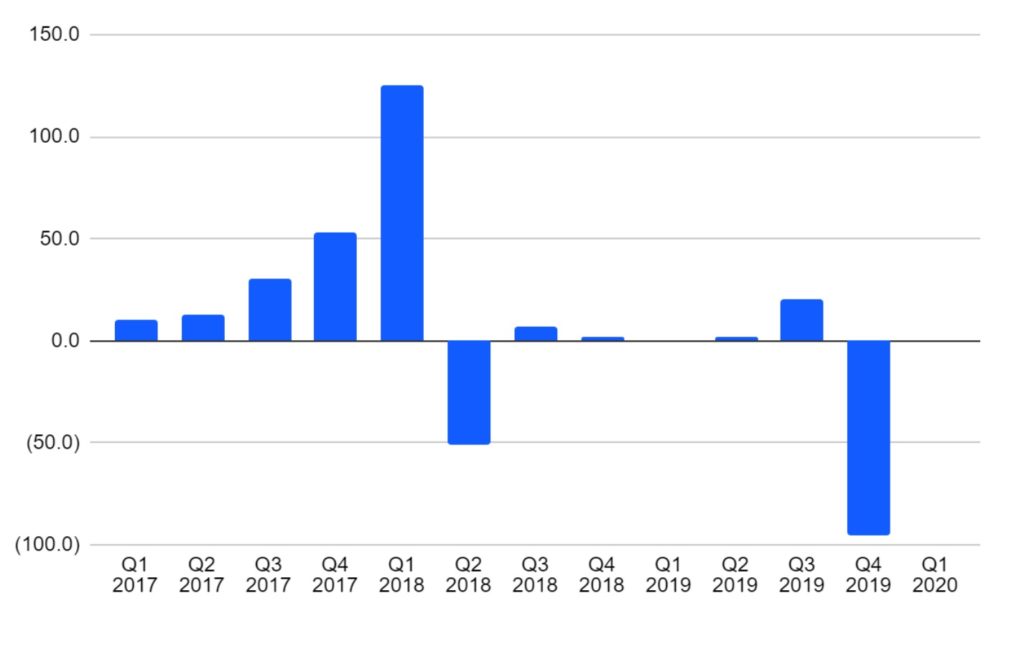

On 22 May 2020, the company announced its results for Q1 2020. Canaan reported revenue of US$9.8 million, up 44.6% YoY and a net loss of US$5.7 million.

Figure 5 – Canaan Quarterly Revenue (US$ million)

(Source: Company data, BitMEX Research)

Figure 6 – Canaan Quarterly Gross Profit (US$ million)

(Source: Company data, BitMEX Research)

Perhaps the most interesting part of results was the earnings call, where management provided an update on the market situation and outlook for the next generation of its products. To some extent the company blamed COVID-19 on the relatively weak sales in Q1.

Since February this year, we all understand that the outbreak of COVID-19 and this has negatively impacted us in China during that period, especially the logistics side of it. Between February and March, we see some BTC price increases, but still the COVID-19 outbreak remains, which is heavily impacting us during this period so we still see our prices dropping. But we have confidence that in the coming months, especially in the last two quarters of 2020 and in quarter three and quarter four we will have new products.

(Source: Q1 2020 Canaan earnings call Q&A session)

The company also indicated that the average order size is increasing, as the mining industry becomes more and more consolidated. We heard this same message from discussions with MicroBT and Bitmain.

Even after the halving, we see more and more inquiries and they are in large amounts, large potential order inquiries. We see sales are more and more key clients or big clients.

(Source: Q1 2020 Canaan earnings call Q&A session)

As for the state of technology, Canaan indicated that 5 nanometer products could be on the market by 2021. Management also mentioned the new Avalon 1146 pro, which will have an efficiency of 42 J/TH, this compares to the Avalon A1166 which is currently on sale, at 47J/TH. The new Avalon 1146 pro would still place the company behind MicroBT and Bitmain, who have products at the 30 J/Th range. Therefore it is these two companies which appear to be building somewhat of a lead, leaving their competitors to play catch up.

We believe with 5-nanometers, which is a more advanced technology, which takes [a] longer cycle to be mass-produced. So we believe next year will probably see this kind of product reaching mass production. Our star product will be 1146 pro, which is about 42 J/TH. This is the product that we will have in the second semester. And we are working with all the three foundries, SMIC, Samsung and TSMC.

(Source: Q1 2020 Canaan earnings call Q&A session)

Going forward it may be challenging for the company to regain trust from investors following on from the write-down so shortly after the IPO. At the same time the geo-political environment may also present a challenge. Canaan has a US listing and it looks likely to become much harder for Chinese names to maintain US listings in the future, given the political tensions over trade, COVID-19 and Hong Kong.

On the other hand the company has already successfully raised US$90 million from US markets. The net cash position of the group was US$59.9 million at the end of 2019 following the successful IPO, however by Q1 2020 this had already fallen to US$12.5 million. As we have said before, ASIC manufacturing is a cash intensive and tough industry, given the technical lead MicroBT and Bitmain have, without a strong bull run for Bitcoin, the road ahead for Canaan may be challenging. However, unlike its peers, Canaan’s financials are out there for everyone to see. It is likely that all of Canaan’s peers are also struggling to generate free cash flow and the transparency Canaan provides due to its listing is extremely welcome and can remove a lot of uncertainty from the point of view of customers and other stakeholders.

Ebang

In April 2020, the Chinese ASIC manufacturer Ebang filed for an IPO in the United States, after a previous attempt to list in Hong Kong failed in 2018. After reviewing the recent filling, we can see that just like Canaan, the company is struggling with declining sales and inventory write-downs driving large losses. The prospectus shows that Ebang generated a gross loss of US$30.6 million in 2019 on revenue of US$109 million. This is a revenue decline of 66% in 2019, more severe than Canaan at 47%. However, the losses at Ebang were not as severe when compared to Canaan, with a negative net income margin of 38%.

Ebang Financial Overview (US$ million)

| 2018 | 2019 | |

| Revenue | 319.0 | 109.1 |

| Growth | (65.8%) | |

| Gross Profit | 24.4 | (30.6) |

| Margin | 7.7% | (28.0%) |

| Net Income | (11.8) | (41.1) |

| Margin | (3.7%) | (37.7%) |

| Net Cash/(Debt) | (2.6) | (16.8) |

| Total shareholders’ equity | 67.8 | 25.6 |

(Source: IPO prospectus, BitMEX Research)

As for the risk of further write-downs, the risk here is lower than Canaan in our view, since there have already been significant write-downs. Perhaps more importantly than this, is the lower level of risk on the balance sheet. As at 31 December 2019 the company had US$13.1 million and US$13.3 million of inventories and prepayments on the balance sheet respectively. While the risk of write-dows is still high in our view, the magnitude of these losses will not match what Canaan reported in Q4 2019.

In 2018 and 2019, as a result of the significant drop in the Bitcoin price, we recorded write-down for the potentially obsolete, slow-moving inventory and lower of cost or market adjustment of US$61.8 million and US$6.3 million in cost of revenues, respectively, which in turn had a significant negative impact on our profitability. If the Bitcoin price drops significantly in the future, we may need to make similar write-downs again.

(Source: Ebang 2020 IPO prospectus)

Ebang launched its first product in late 2016, the Ebit E9+. As Figure 1 above indicates, the company has never really been a market leader with respect to energy efficiency, for a significant period of time. Ebang’s latest product has an efficiency of around 57 J/TH, ranking behind all of the other 4 players mentioned in this report. As for the market outlook, in the prospectus the company admits the environment is challenging given the COVID-19 situation.

The recent market panics over the global outbreak of COVID-19, however, have caused a drastic drop in the Bitcoin price in March 2020. We expect our business and results of operations may be materially and negatively affected by the global market panics in the near term. The recent global coronavirus COVID-19 outbreak has caused significant disruptions in our business, which we expect will materially and adversely affect our results of operations and financial condition.

(Source: Ebang 2020 IPO prospectus)

Given the current political tensions between the US and China, the Canaan profit warning after their IPO and Ebang’s relatively weak market positioning with respect to the energy efficiency of its products, we think it will be difficult for Ebang to successfully pull off this IPO in the United States. But in these current volatile market conditions, who knows what will happen.

Bitmain

The largest player in the space, Bitmain, remains a private company, having unsuccessfully attempted to IPO in 2018. An IPO appears to remain on the agenda, however this has been overshadowed by a power struggle between the two company co-founders, Micree Zhan and Jihan Wu. Understanding the full sequence of events in this power struggle is almost impossible to ascertain from publicly available information, however based on media reports the below timeline may be a reasonable summary of the conflict.

| Date | Event | Source |

| 29 October 2019 | In a letter to staff, Jihan Wu dismissed his co-founder Micree Zhan. A notice Jihan sent to staff stated: “Bitmain’s co-founder, chairman, legal representative and executive director Jihan Wu has decided to dismiss all roles of Micree Zhan, effective immediately. Any Bitmain staff shall no longer take any direction from Zhan, or participate in any meeting organized by Zhan. Bitmain may, based on the situation, consider terminating employment contracts of those who violate this note“ | Coindesk |

| 7 November 2019 | Micree Zhan describes Jihan’s takeover as a coup and threatened to go to court if needed to resolve the situation | Coindesk |

| 8 May 2020 | There was a physical fight for control over Bitmain’s Beijing business license | Caxin |

| 3 June 2020 | Micree Zhan takes over the Beijing office using private guards, supposedly successfully seizing power back from Jihan Wu | Finance Magnets |

| 11 June 2020 | Micree Zhan takes over the Shenzhen factory and blocks shipments of miners | The Block |

As a reminder, according to the 2018 IPO prospectus, Micree Zhan owns 36.00% of Bitmain’s equity through his “Cosmic Frontier Limited (BVI)” holding company, while Jihan Wu holds 20.25% of the shares, through his “Victory Courage Limited (BVI)” vehicle.

It seems almost impossible to imagine Bitmain conducting a successful IPO until the above management difficulties have been resolved. In our original 2018 piece on their planned IPO, we alluded to other mistakes the management team appeared to have made, such as investing too much of the group’s free cash flow into Bitcoin Cash. Public markets are likely to be even less tolerant of this kind of power struggle. Allocating capital in this industry can be very difficult and we believe the management team needs to improve in order for the right long term decisions to be made.

As for the technology side of the business, as Figure 1 above shows, Bitmain has lost its lead with respect to energy efficiency in the last year or so, falling behind MicroBT, and to a lesser extent Innosilicon and Ebang in some periods. We think this may have been driven by some failed tape-outs from Bitmain. Despite the less efficient products, Bitmain maintained its leading position in the market, as it has powerful manufacturing capability and strong relationships with key players in the supply chain. Bitmain’s latest product, the Antminer S19 Pro has a reported efficiency of 30 J/TH and will move Bitmain back up to the cutting edge alongside MicroBT. Therefore, due to Bitmain’s scale and manufacturing capabilities, despite the almost comically abysmal corporate governance issues the group appears to be facing, we still think it is likely Bitmain will be one of the key players in the industry moving forwards.

MicroBT

MicroBT (with their products branded as Whatsminer) is relatively new to the space. The company was founded in 2016 and the first product was launched in early 2017. The company was founded by Dr Yang Zuoxing, former director of design at Bitmain, who many consider as instrumental in driving Bitmain’s early success. We believe that Dr Yang is the largest shareholder in MicroBT. When Dr Yang left Bitmain, he was sued for allegedly violating Bitmain’s patents and in December 2019 Coindesk reported that he was arrested for embezzlement of about US$15,000, perhaps related to his time at Bitmain. However, as far as we can tell, these issues are now resolved. The company informed us that they completed a round of financing in January 2019 at a valuation of US$510 million, however the amount of money raised or the identity of the investors was not disclosed to us.

History of MicroBT tape-outs

| Date | Event | Size | Eventual product | Foundry |

| December 2016 | Tape-out | 28 nanometer | M3 | TSMC |

| April 2018 | Tape-out | 16 nanometer | M10 | TSMC |

| January 2019 | Tape-out | 8 nanometer | M20 | Samsung |

| September 2019 | Tape-out | 8 nanometer | M30 | Samsung |

(Source: Discussion with company representative Elsa Zhao, BitMEX Research)

The company appears to have performed well in the last couple of years, taking considerable share from Bitmain. MicroBT has a market share of around 35% by Bitcoin network hashrate (Please see Figure 2 above). At the same time, unlike many of the competitors the company has a 100% track record with respect to tape-outs, with all 4 tape-outs resulting in products (please see the above table).

MicroBT’s products have been more energy efficient than Bitmain throughout most of 2019 up until today, with the Whatsminer M30S++ operating at around 31 J/TH. However, this is marginally behind Bitmain’s brand new Antminer S19 Pro product at 30 J/TH. Given MicroBT’s lead in the last 18 months, it seems reasonably likely that the next MicroBT product will be able to take the lead back.

MicroBT Factbox

| Staff numbers | 80 |

| R&D staff | 32 |

| Hardware R&D base | Beijing |

| Software R&D base | Shanghai and Shenzhen |

(Source: Discussion with company representative Elsa Zhao, BitMEX Research)

MicroBT Sales Volume (number of mining machines sold)

(Source: Discussion with company representative Elsa Zhao, BitMEX Research)

As for the industry outlook, in an interview with BitMEX Research, MicroBT marketing manager Elsa Zhao, reiterated a similar message to Canaan about consolidation in the mining industry.

The customer base is moving more and more out of China. Since the halving the return on investment period is growing, it is now much longer than six months, based on the current difficulty and price. At the same time the average customer size is now growing considerably, customers are now larger funds, and no longer small businesses or individuals. Three to five years ago, there was one leading company in the industry, and some top companies competed in the last one or two years. But there will be 2 or 3 leading companies in the industry from now on. After the Bitcoin halving, competition is getting more serious and only the most competitive mining machines will survive. Further consolidation is likely.

Conclusion

One key takeaway from this report may be that corporate governance in the ASIC mining industry has considerable room for improvement. However, for a highly volatile and capital intensive industry like Bitcoin ASIC manufacturing, which can appear mysterious and opaque to traditional investors, perhaps it is not too surprising that these governance issues arise.

Based on our analysis of the above-referenced IPO prospectuses, the financial results of Canaan and discussions with industry insiders, we conclude the following:

- Competition has tightened within the ASIC manufacturing industry and Bitmain’s dominance has been significantly reduced in the last 18 months or so.

- The ASIC manufacturing industry will continue to consolidate. We think it is likely that only 2 to 3 players will survive into the longer term.

- The mining farm operating industry is also becoming increasingly consolidated post halving. With new investments coming from an increasingly small number of well financed entities.

- The lifespan of an ASIC mining machines is likely to extend considerably and the current generation of products may remain in operation for several years.

- While China is still dominant with respect to ASIC manufacturing, geographically China is losing share in the mining farm operator business to Europe and North America.

Please feel free to hover over the interactive chart below to evaluate how ASIC miners have improved in energy efficiency over the last 6 years or so.

Reported Miner Efficiency (J/TH) vs product launch date

(Source: Manufacturer websites. BitMEX Research)

(Notes: Only includes ASIC manufacturers who are still producing machines as at June 2020)