A deeper look into candlesticks – another type of chart pattern and how they help traders identify trends and prices.

What are Candlesticks?

Candlesticks are a common chart type that helps traders to identify relevant asset prices — the opening, high, low and closing (OHLC) prices within a defined and constant time frame.

There are two parts of a candle – the shadow, also known as the wicks of the candle which represent the lowest and highest price, and the body, which represents the difference between the opening and closing price for that time period. The colour of the candlestick indicates whether the observed period was an uptrend or a downtrend. On BitMEX’s platform, uptrends are coloured in green and downtrends are coloured in red.

Periods: When observing candlestick charts, a trader must always define the period of observation for each candle, either short term or long term. For short term observations common durations are five min or 15 min. For mid-term observations, 1h candles are most common while for long term observations, a candle duration of 12h or one day.

If the shadows of the candlestick are far stretched out, traders had varying price expectations within that period and may test those expectations in a subsequent period. If the shadows are very close to the body of the candlestick, the price movement from the candle is very indicative for the subsequent period.

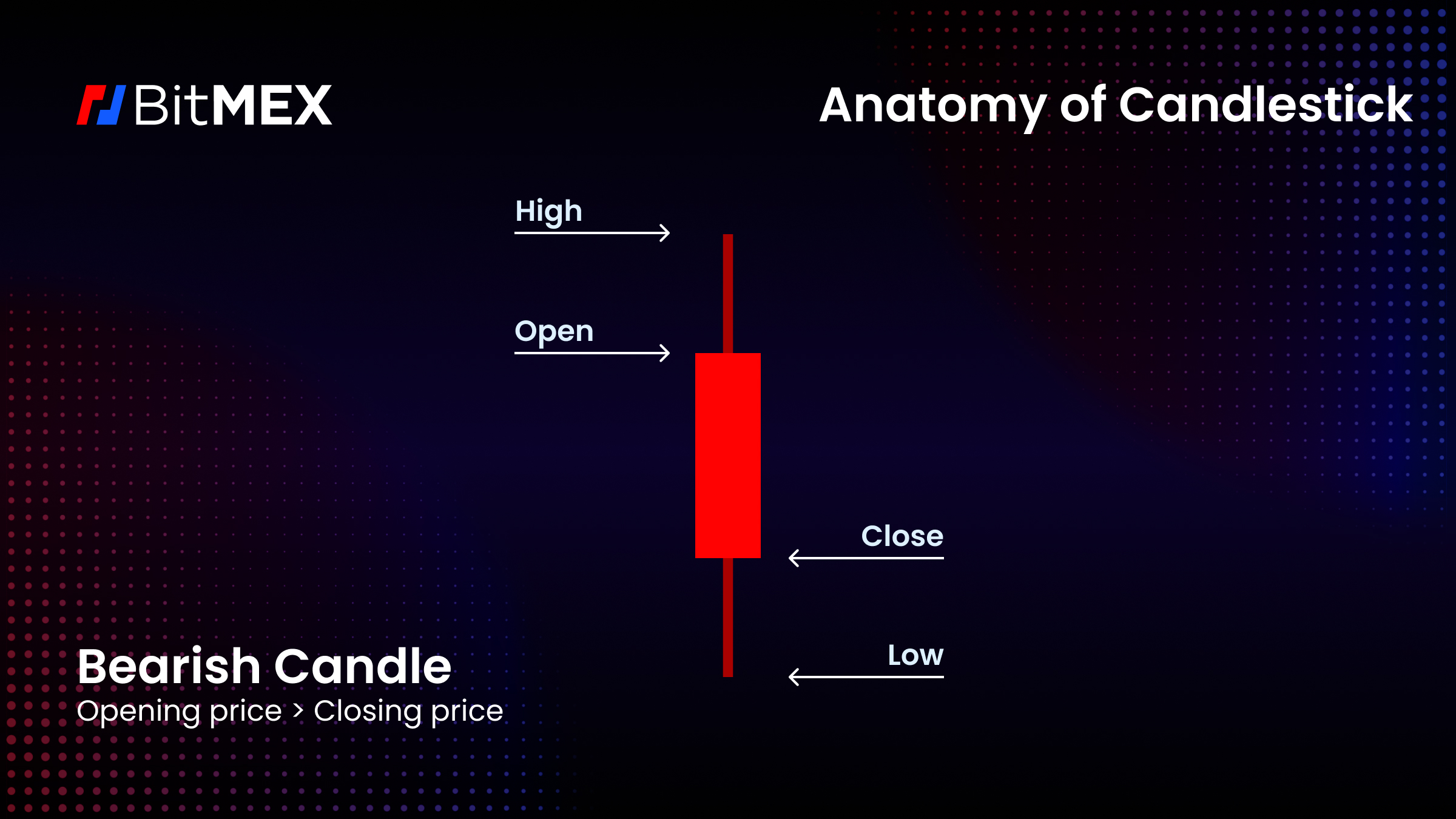

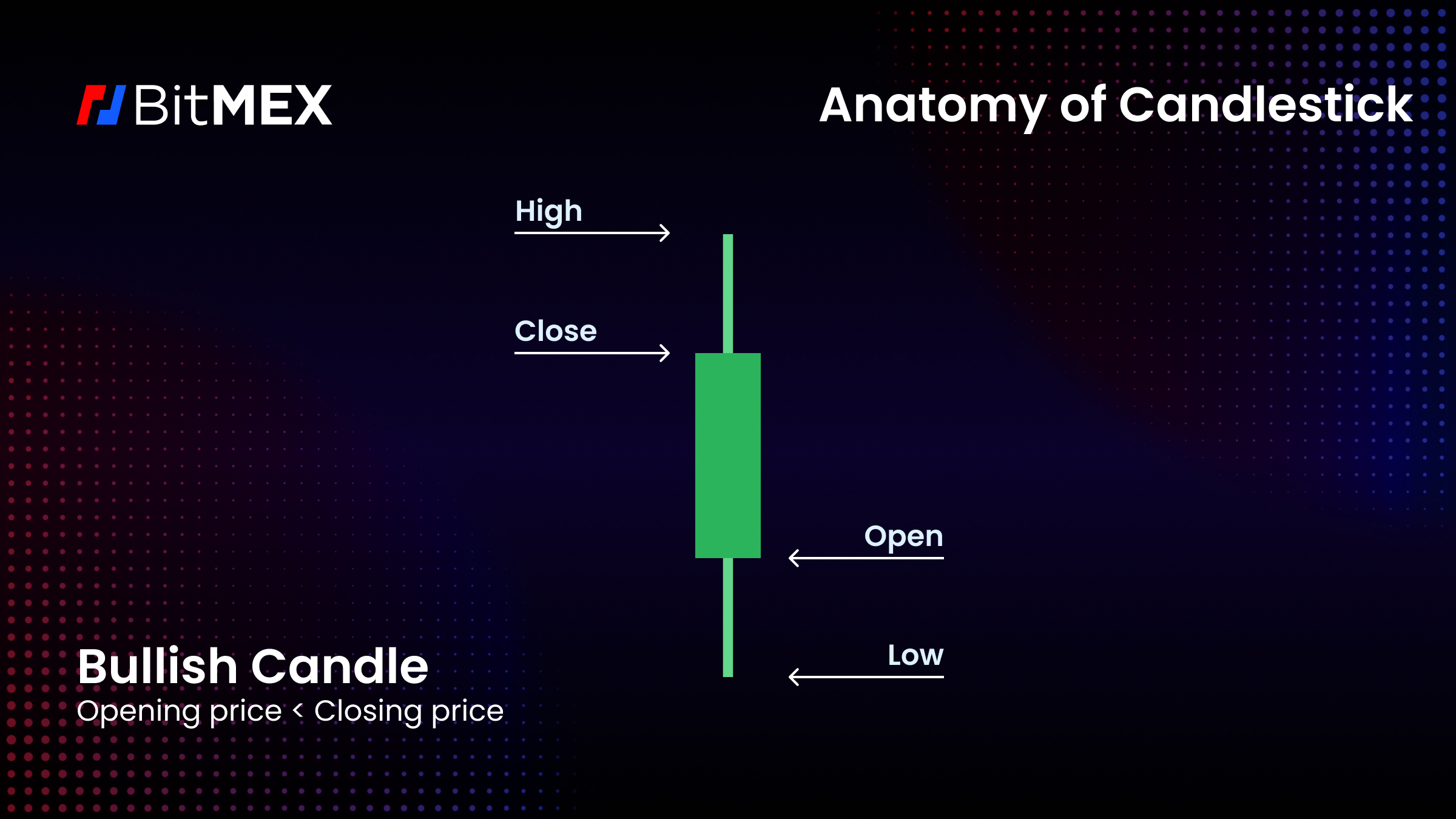

The Anatomy Of Candlesticks

What Does a Bearish Candle Look Like?

What are the Characteristics of a Bearish Candle ?

- Red colour on BitMEX

- The opening price was higher than the closing price within the timeframe

- The longer the red body, the more bearish the price movement was.

What Does a Bullish Candles Looks Like?

What are the Characteristics of a Bullish Candle ?

- Green colour on BitMEX

- The opening price was lower than the closing price within the timeframe

- The longer the green body, the more bullish the price movement was.

Later we will explore the different types of candlestick patterns, specifically bullish candlestick patterns.

Theoreticals aside, if you wish to begin trading crypto derivatives or spot on BitMEX, you can find all our existing products here. For more educational resources on trading at BitMEX, particularly derivatives, visit this page.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.