Strong signs of an alt season are starting to show up — and not the memes this time. We believe an early alt season is starting to take shape. Here’s why:

Strong signs of an alt season are starting to show up — and not the memes this time. We believe an early alt season is starting to take shape. Here’s why:

➡️ Market Structure: TOTAL3 holds vs. BTC/ETH; breadth is improving without a major breakout.

➡️ Leadership: SOL/ETH ****trends up on tame funding—real bid, not a squeeze.

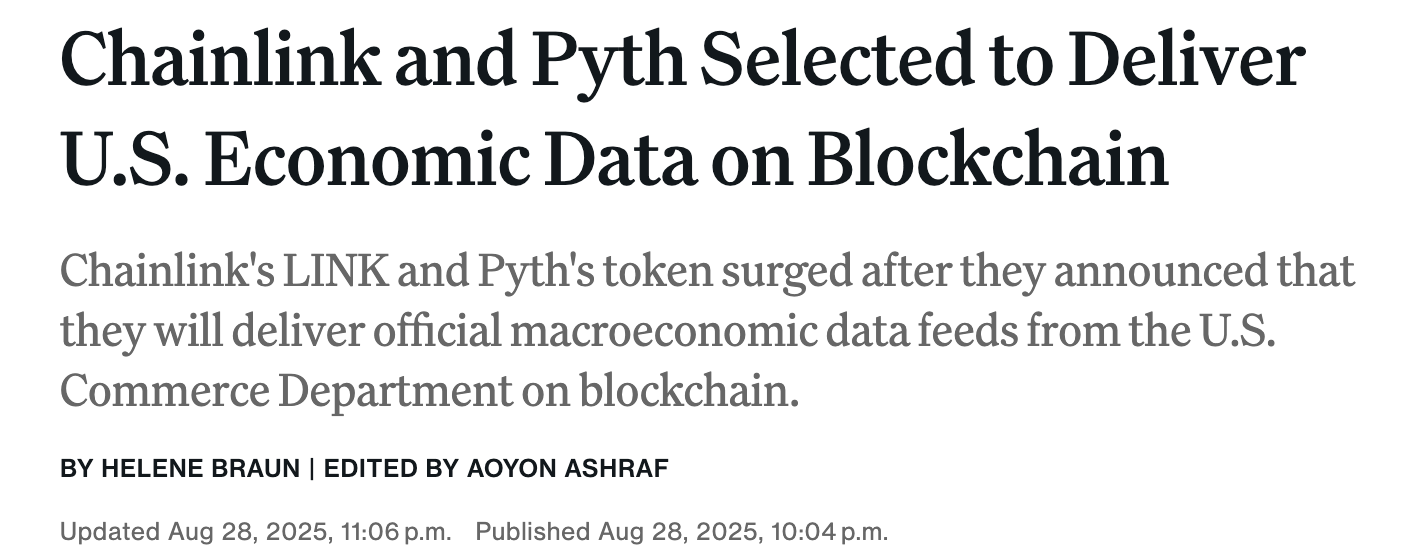

➡️ Catalysts: Support of Blockchain adoption from U.S. Commerce, exchange tokens re-rate, etc.

➡️ ETF Flows: ETF prints positive but cooler; ETH-DAT thin mNAV→ less accretive issuance, there may be more room for alts.

Signal 1: Market Structure and TOTAL3 Resilience

Across the past 5 days, the market has behaved like the opening phase of an alt season rather than a simple majors-only rotation. TOTAL3 refused to make new relative lows against BTC and ETH while majors chopped, and derivatives stayed orderly with neutralish funding and limited forced selling. That combination points to spot-led demand in the alt complex. For an exchange desk, the implication is straightforward: breadth can expand without a heroic breakout in BTC or ETH, which makes selective alt risk attractive on a pair-trade basis.

Signal 2: Rotation Towards SOL (over ETH)

Leadership has rotated cleanly to alt L1s like Solana, which is a common trend for alt seasons. The SOL/ETH ratio has been rising with funding mostly tame and without the footprint of an aggressive short squeeze, which means the bid is genuine rather than mechanical. Historically, this pattern precedes pair-led rotations in liquid mid-caps and function-driven subsectors. It also gives traders a lower-beta way to express risk: long SOL against short ETH.

Signal 3: Majors Feel “Stable but Uninspiring”

Signal 3: Majors Feel “Stable but Uninspiring”

While the fundamentals for majors remain positive, the pace has clearly cooled for both ETH and BTC. That keeps a bid under dips—majors still command the most attention and find buyers on weakness—yet there isn’t enough incremental demand to push new highs.

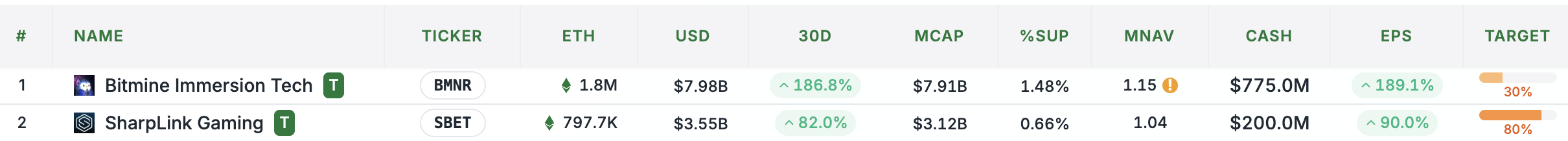

For example, ETH-linked DATs sit around 1.0–1.1× m/NAV and continue to lag ETH, leaving little premium to finance accretive issuance and the mechanical spot bid that helped earlier this month. We think that majors have ****ample dip-buyers, thin chase-buyers—so marginal risk is drifting down the stack toward alts with live catalysts.

Signal 4: Tangible Catalysts

Tangible catalysts for alt season are present this cycle, with President Trump’s strong support for crypto adoption. This week, the U.S. Commerce Department announced that it will publish its official macro series—real GDP and the PCE price index as examples—on-chain via Chainlink and Pyth, across multiple networks including Arbitrum, Avalanche, and Base. Oracles reacted immediately as on-chain, authoritative data unlocks real use cases for data-driven DeFi, tokenised-asset risk controls, and event markets.

Separately, Numerai, an AI-powered hedge fund driven by its $NMR token, disclosed a $500 million capacity commitment from JPMorgan Asset Management after a strong year.

Platform tokens also re-rated, with $OKB responding to structural tokenomic changes and $CRO attracting investments from the Trump family. None of these moves required BTC or ETH to make new highs, which is a strong early signal for the development of alt season.

The Bottom Line

It seems there are glimmers of an alt season incoming: majors are orderly, ETF flows are positive but cooling, DAT premia are thin, and verifiable catalysts are pulling capital down the stack.

Keep the stance pairs-first and news-first—long SOL against ETH as the core, with a disciplined, catalyst-driven alt overlay—until the flows, funding, or proxies tell you the regime has changed.