ETH’s recent surge, which broke the $2200 mark, has been a surprise for many. As we highlighted in our previous article, there are growing signs of a trend reversal for ETH, as well as an impending altcoin season. But what if you missed the rally so far? Fear not. In this article, we’ll dive into some altcoins that are positioned to thrive in the next phase of the market. Arthur Hayes, in his recent podcast, emphasized that the “altcoin season” is now upon us, and altcoins with strong fundamentals will be the ones to watch. We’ve broken it down into three essential criteria to assess whether an altcoin is worth your attention:

ETH’s recent surge, which broke the $2200 mark, has been a surprise for many. As we highlighted in our previous article, there are growing signs of a trend reversal for ETH, as well as an impending altcoin season. But what if you missed the rally so far? Fear not. In this article, we’ll dive into some altcoins that are positioned to thrive in the next phase of the market. Arthur Hayes, in his recent podcast, emphasized that the “altcoin season” is now upon us, and altcoins with strong fundamentals will be the ones to watch. We’ve broken it down into three essential criteria to assess whether an altcoin is worth your attention:

The Three Pillars of Token Fundamentals

When evaluating cryptocurrency investments beyond price action, we focus on three essential criteria:

- Real user adoption: Does the protocol have genuine users actively engaging with its services?

- Sustainable revenue model: Are users paying for services rather than just speculating?

- Token holder benefit: Does protocol success translate directly to token value?

Let’s examine how each token measures against these standards.

1. Hyperliquid ($HYPE) – Decentralized Perp Exchange with Institutional-Grade Performance

Hyperliquid has rapidly established itself as a leading decentralized perpetual futures exchange, surpassing $1 billion in daily trading volume across 145 pairs and amassing over 200,000 active users.

The HyperBFT consensus mechanism underpins the platform’s proof-of-stake model, ensuring scalability and security. Hyperliquid’s Layer 1 blockchain, optimized for high-frequency trading, supports up to 100,000 transactions per second, providing a robust foundation for its decentralized exchange operations.

Hyperliquid’s revenue streams are primarily derived from trading fees, including maker and taker fees. For instance, maker fees are set at 0.01%, and taker fees at 0.035%, with taker fees decreasing to 0.019% for trades exceeding $2 billion. These fees contribute to the platform’s revenue, which is reinvested into liquidity incentives, staking rewards, and continuous token buyback

What makes Hyperliquid remarkable is its revenue model based on trading fees: 0.01% maker fees and 0.035% taker fees (reducing to 0.019% for high-volume traders). This fee structure creates a sustainable revenue stream directly tied to actual trading activity.

Most importantly for token holders, Hyperliquid distributes value through multiple channels:

- 54% of trading fees fund HYPE token buybacks and burns

- Annual token burns reduce supply by approximately 26%

- 46% of fees go to the Hyperliquidity Provider vault

- Staking rewards of ~2.5% annually

- Governance rights giving token holders control over platform decisions

This creates a direct financial relationship between protocol usage and token value – as trading volume grows, more tokens are burned, potentially increasing scarcity and value.

2. AAVE ($AAVE) The Gold Standard in DeFi Lending

AAVE continues to demonstrate why it’s a cornerstone of decentralized finance with over $5 billion in Total Value Locked across 14 different blockchain networks. This widespread adoption shows genuine utility beyond speculation.

AAVE’s revenue comes from multiple streams:

- Interest paid by borrowers

- Spreads between lending and borrowing rates

- Flash loan fees

- Liquidation fees

These revenue mechanisms are all generated through actual utilization of the protocol’s core services.

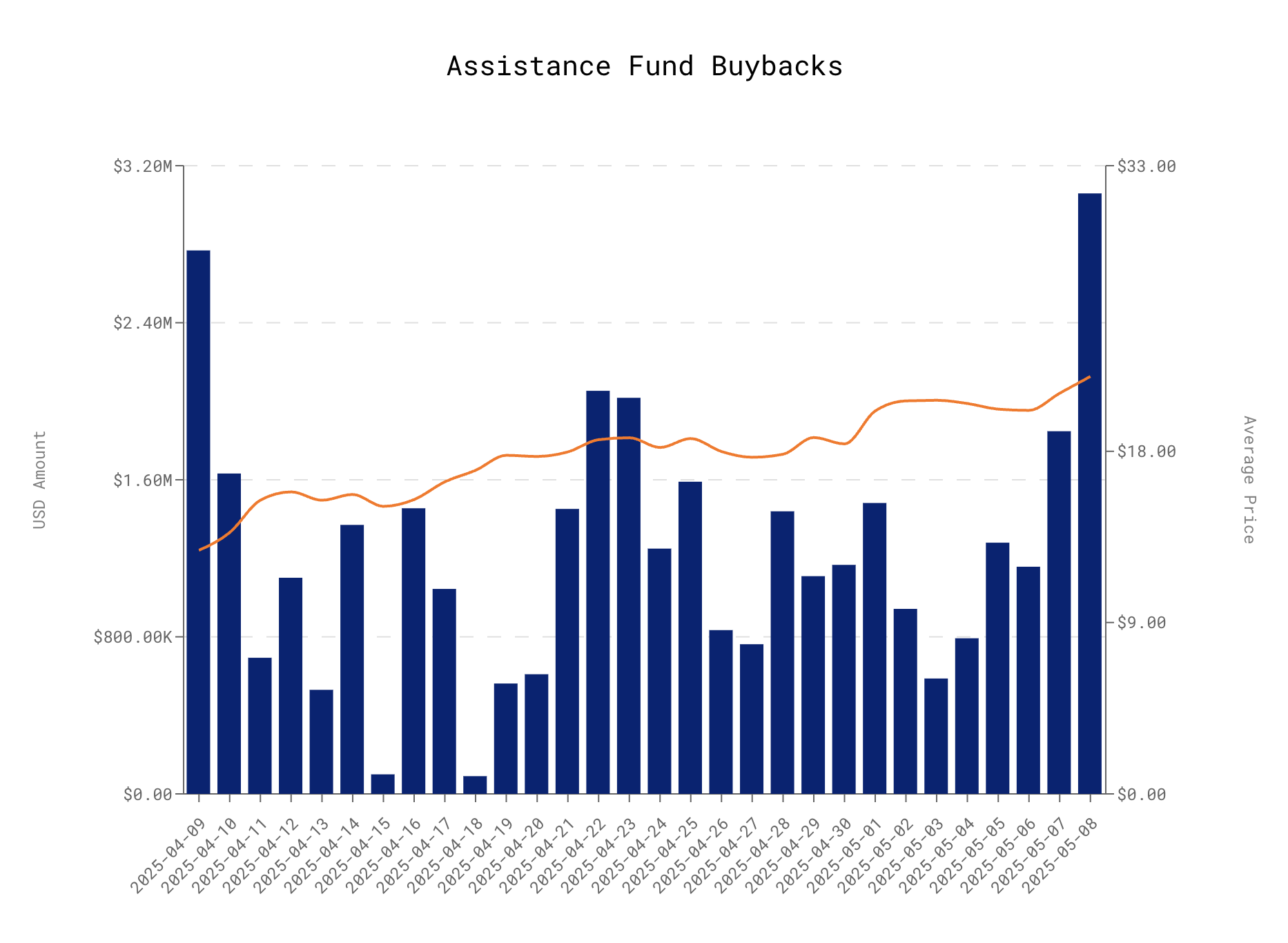

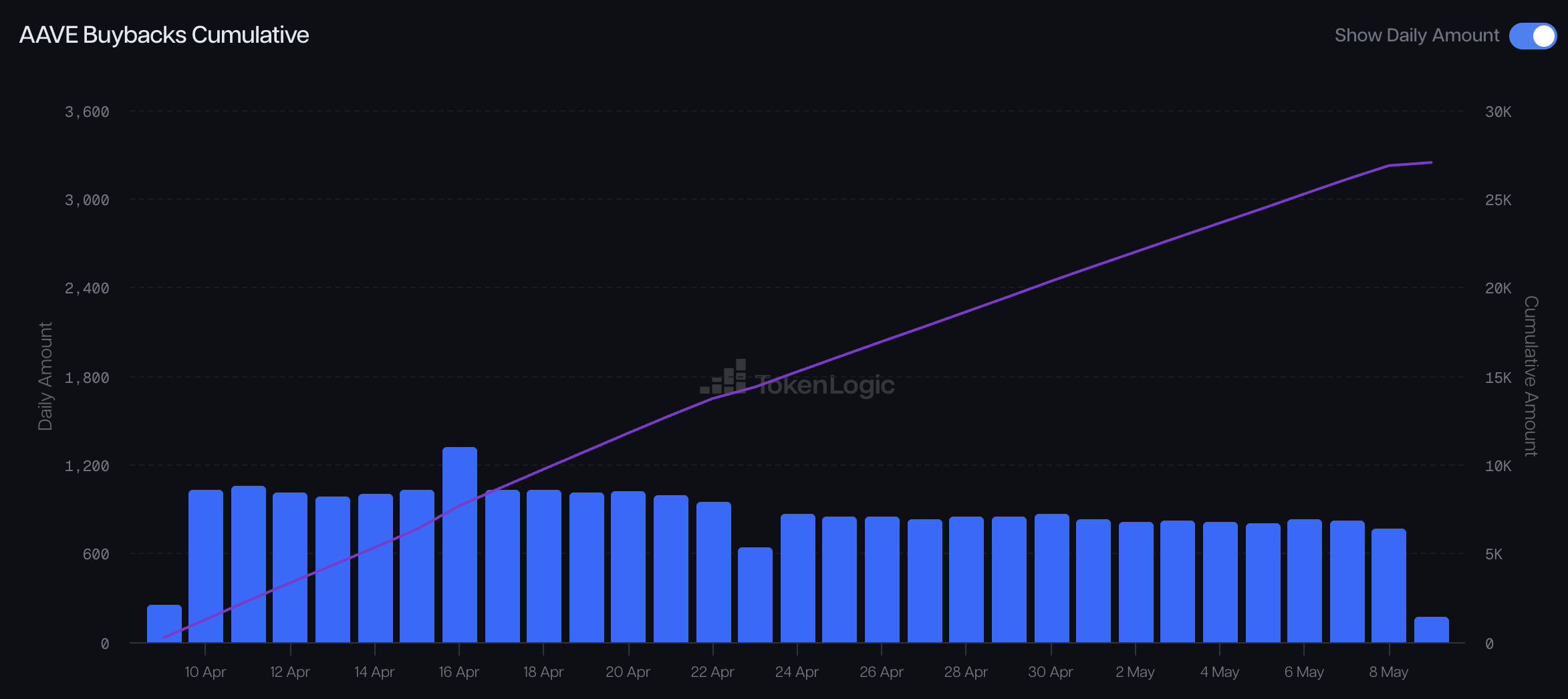

AAVE token holders benefit through the Safety Module – a staking mechanism where holders can stake their tokens and receive:

- A portion of protocol fees (current staking APY ~4.63%)

- Deflationary pressure through buybacks and burns

- Governance rights over risk parameters and platform development

The Safety Module creates an elegant alignment of interests where stakers are compensated for securing the protocol while benefiting from its growth.

3. Pendle ($PENDLE) – Pioneering Yield Trading Infrastructure

Pendle represents the evolution of DeFi yield strategies by enabling the tokenization and trading of future yield. It experienced remarkable 400% user growth in 2024 alongside a 20x increase in TVL, demonstrating product-market fit for its innovative approach.

Pendle generates revenue through:

- Swap fees on its specialized AMM

- 3% yield fees from tokenized yield transactions

- Fees from yield after Principal Token/Yield Token maturity

This creates a sustainable revenue stream from users accessing Pendle’s unique yield management capabilities.

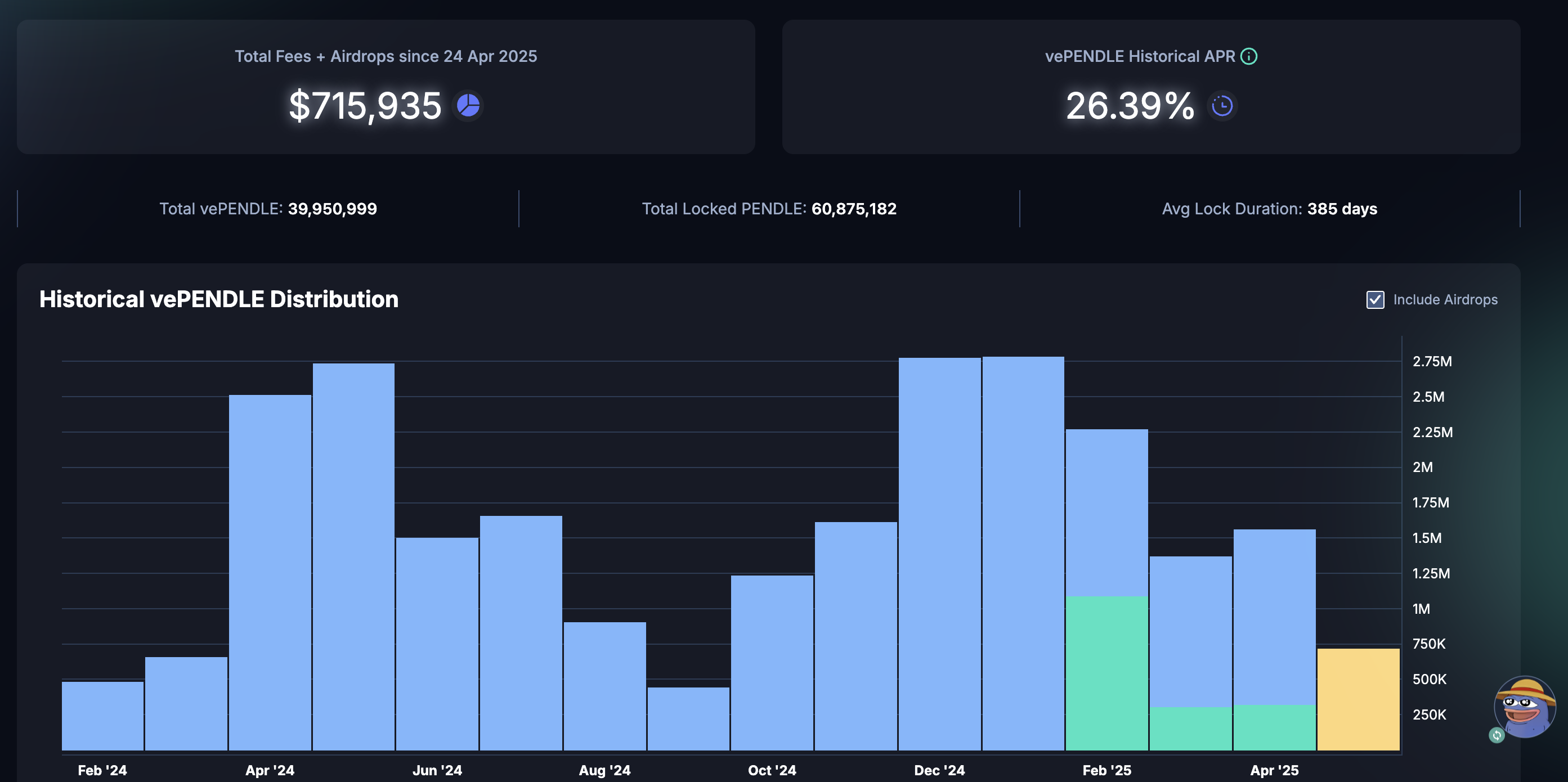

Token holders benefit through the staking (vePENDLE) system:

- 80% of swap fees flow to vePENDLE holders from pools they vote for

- LP reward boosts of up to 250% for stakers

- Governance rights over protocol development

Conclusion

If you’ve missed the recent rally, focusing on fundamentally strong altcoins is a great way to position yourself for the next phase of market growth. Hyperliquid, AAVE, and Pendle have demonstrated consistent real user adoption, robust revenue models, and sustainable governance structures. As Arthur Hayes aptly pointed out, altcoins focused on strong fundamentals are set to thrive in the upcoming altcoin season. Whether it’s Hyperliquid’s liquidity-driven market dynamics, AAVE’s dominance in decentralized lending, or Pendle’s innovative approach to yield tokenization, these projects are well-positioned to capture attention in the market’s next chapter.