The funding rate mechanism: long hailed as one of crypto’s most pivotal innovations. It propelled bull runs, refined trading costs, and effectively stabilised market movements through efficient arbitrage.

The funding rate mechanism: long hailed as one of crypto’s most pivotal innovations. It propelled bull runs, refined trading costs, and effectively stabilised market movements through efficient arbitrage.

However, as market cycles continue to unfold, are funding rates now signaling a shift in market behaviour?

Pioneered by BitMEX in 2016, XBTUSD is the longest-running Bitcoin perpetual swap, widely used by some of the most sea-soned traders in the crypto industry. This piece provides an in-depth analysis of nearly 9 years of funding rate data from BitMEX’s XBTUSD perpetual swap, covering the period from May 2016 to May 2025.

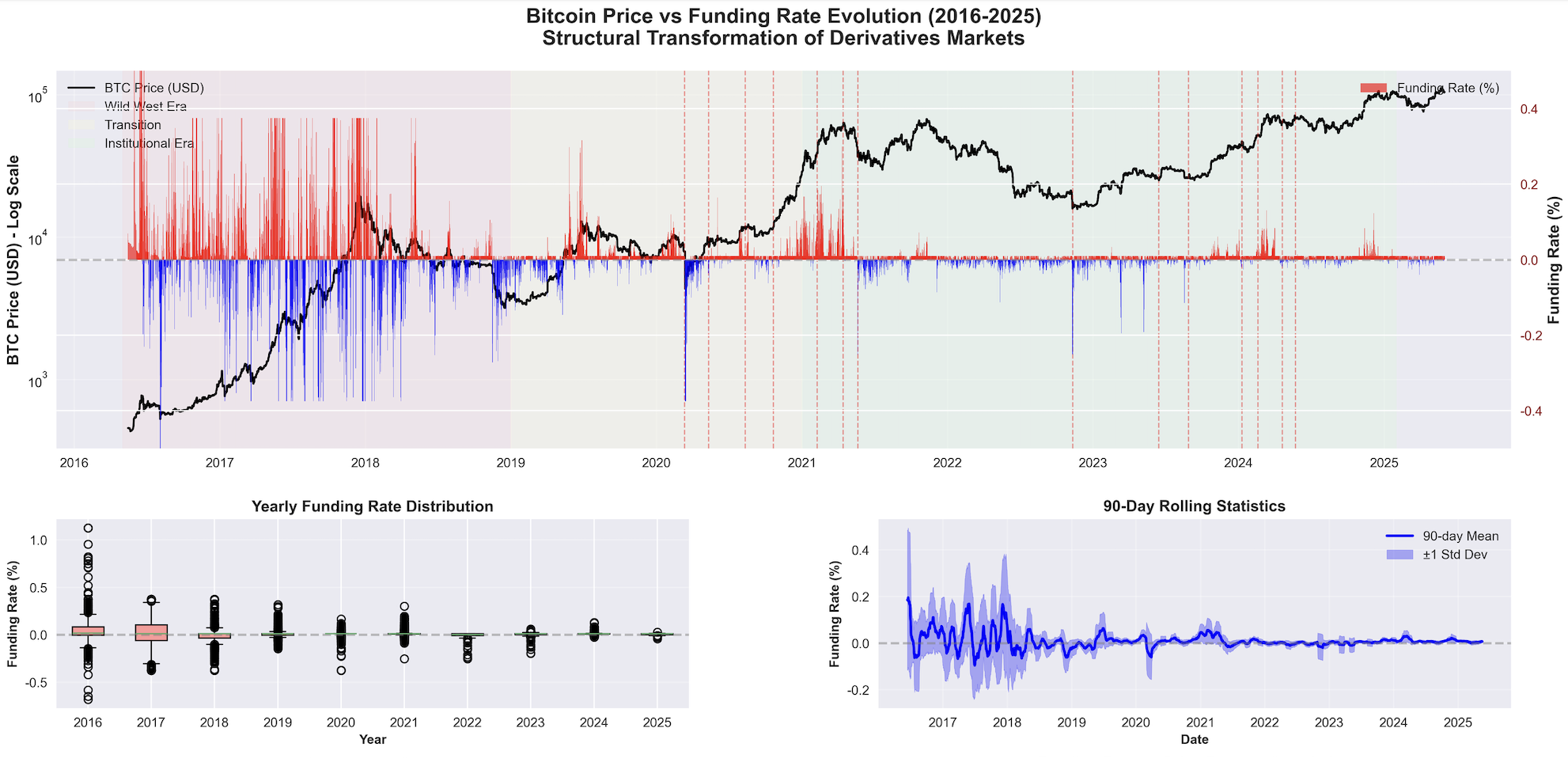

Our comprehensive statistical review reveals XBTUSD’s significant market evolution — having started from consistent volatility to now, institutional-grade stability — highlighted by remarkably subdued funding rates during the 2024-2025 bull market.

Our comprehensive statistical review reveals XBTUSD’s significant market evolution — having started from consistent volatility to now, institutional-grade stability — highlighted by remarkably subdued funding rates during the 2024-2025 bull market.

Let’s dive in.

What are Perpetual Swaps and Funding Rates?

BitMEX’s invention of perpetual swaps changed the game for crypto trading – perpetual swaps are now foundational instruments in crypto derivatives and stand as one of the most commonly traded financial products to this day.

A core component of perpetual swaps is the employment of funding rates, which act as a tool to maintain the alignment between a token’s swap price and spot price. Due to its long-standing history, BitMEX’s XBTUSD contract, launched in May 2016, provides the richest dataset of Bitcoin perpetual funding rates.

Funding rates are periodic payments exchanged between long and short position holders of a perpetual swap contract. When a perpetual contract has a positive funding rate, this means long position holders pay short position holders, and vice versa. Positive funding rates indicate a bullish market, while negative rates suggest a bearish one. Funding rates are crucial for arbitrage opportunities and market sentiment.

This piece dives into the analysis of funding rate patterns of XBTUSD over the past 9 years. Our key findings demonstrate a distinct shift of XBTUSD from previously high volatility towards unprecedented stability, even amidst Bitcoin reaching all-time highs exceeding $100,000 during the 2024-2025 market cycle.

Nine Years of Funding Rates Evolution: From Chaos to Stability

The funding rate market for XBTUSD has progressively shown remarkable stabilisation, with extreme funding rates dropping by 90% compared to historical levels. Funding rates now consistently cluster around minimum levels and are quickly normalised through automated arbitrage activities. Most notably, the annualised volatility has compressed dramatically to a ±10% range, a level of stability never seen before in Bitcoin derivatives history.

The transformation, which took place over nearly a decade, can be broken down into three distinct phases that shaped today’s funding rate landscape:

Phase 1: The Wild West Era (2016-2018)

Throughout the first 2 years of its debut (2016-2018), data reveals a funding rate market characterised by extreme inefficiency and spectacular volatility. Figure 1 shows the dramatic contrast between XBTUSD’s early and current funding rate behaviour:

- Funding rates regularly exceeded ±0.3%, equivalent to annualised rates of over ±1000%.

- The 2017 bull run featured the highest concentration of extreme events in Bitcoin’s history.

- 2017 alone recorded over 250 extreme funding events, representing nearly daily occurrences of market inefficiency.

- Extreme funding periods lasted 6-8+ intervals (2-3 days), indicating sustained market inefficiencies.

Phase 2: Gradual Maturation (2018-2024)

During the period of 2018-2024, the XBTUSD funding rate market began correcting itself:

- Extreme events annually reduced significantly from over 250 in 2017 to approximately 130 by 2019.

- Distribution of funding rates gradually compressed toward normal ranges.

- Key market shocks like COVID-19, the LUNA and FTX collapses triggered notable volatility, albeit less frequently.

Phase 3: Giants Enter the Game (2024-Present)

Two critical developments in early 2024 redefined the market landscape:

January 2024: Bitcoin ETF Launch

- Institutional arbitrage interests surged as spot ETFs enabled large-scale cash-and-carry trades.

- ETFs anchored swap prices closer to spot prices, compressing funding rates and eliminating significant arbitrage gaps.

February 2024: Ethena Protocol Launch

- Ethena introduced systematic funding rate arbitrage through synthetic stablecoins, achieving substantial adoption (over $4 billion TVL).

- Democratised arbitrage was introduced (previously dominated by institutions) and became accessible to everyday retail participants, further stabilising rates.

The Funding Rate Arbitrage Strategy: Did it Work?

Understanding this evolution is probably only fascinating from an academic perspective, but traders care about one thing and one thing only: profits. What were the historical returns for BitMEX traders who engaged in funding rate arbitrage strategies?

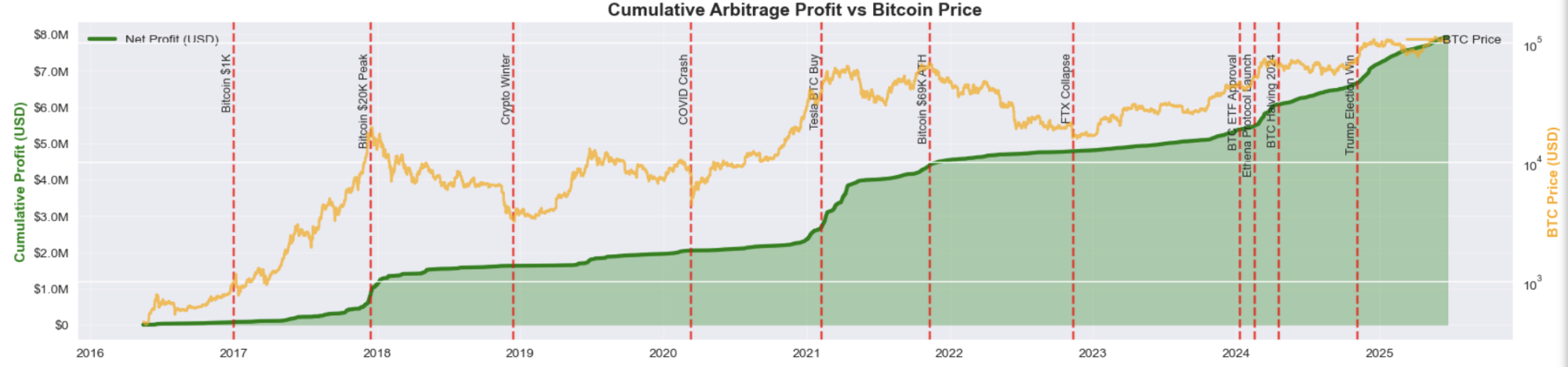

To answer this, we conducted a comprehensive backtest analysis spanning the entire 9-year history of XBTUSD funding rate data. The results uncovered a mind-blowing fact about Bitcoin funding rates: a simple $100,000 investment in funding rate arbitrage in 2016 would have turned into $8 million today.

Figure 2 illustrates the cumulative profit comparison between funding rate arbitrage (green) and simple Bitcoin buy-and-hold (orange) from 2016 to present. While the market is often busy chasing Bitcoin’s drastic price swings, the opportunity that lay with funding rate arbitrage would have returned one of the best risk/reward profits. The strategy provided an extraordinary 873% annualised return, with a perfect track record—no losing years, no major drawdowns, just consistent profit accumulation that turned a modest six-figure investment into generational wealth.

BitMEX’s Bitcoin Payment Multiplier Effect

For XBTUSD, BitMEX pays funding rates in Bitcoin rather than USD stablecoins, which creates a wealth multiplier opportunity for arbitrageurs. Any funding payments received at $500 Bitcoin in 2016 have 200x more after Bitcoin hit $100,000 in 2024.

Had BitMEX paid funding in USDT like other exchanges, the $8 million profit would have been closer to $800,000 – still impressive, but falling short of the Bitcoin payments which created a compounding effect that turned funding arbitrage into one of crypto’s most lucrative historical strategies.

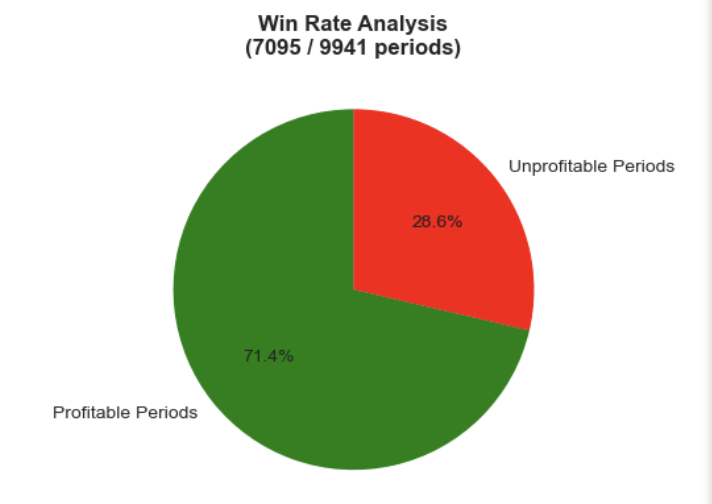

Figure 3 breaks down the risk-adjusted metrics that reveal why funding rate arbitrage achieved such impressive results. Out of the 9,941 funding periods, XBTUSD had a positive funding rate 71.4% of the time, meaning roughly 3 out of every 4 funding periods were profitable.

While these historical returns paint an almost too-good-to-be-true picture, experienced traders know that past performance rarely predicts future results – especially when market structure undergoes fundamental changes.

This paints a good picture for the current state of funding rates. Many are noticing that its outsized opportunities appear to be vanishing. Despite Bitcoin having shattered its all-time highs in 2024, funding rates refused to spike.

Given market developments and Bitcoin’s increased establishment, the lack of high funding rates is creating a critical question for basis traders, yield farmers, and Ethena YT/sUSDe holders: Are funding rates a thing of the past?

The Funding Squeeze: Are the Glory Days Over?

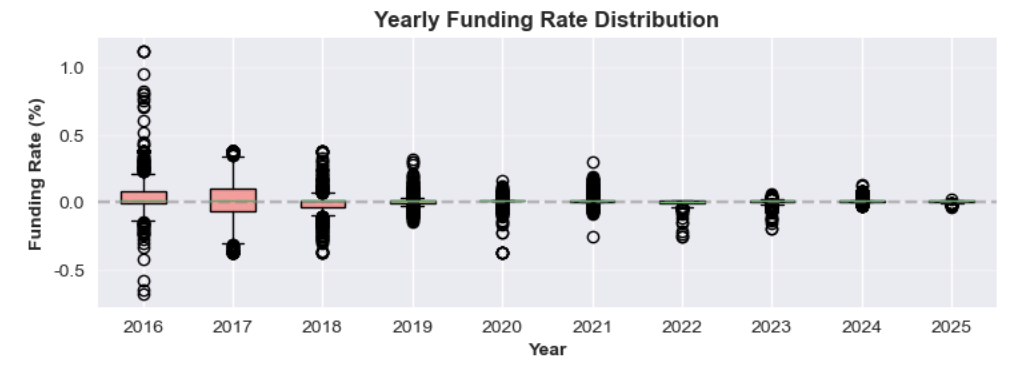

Previous Bull Market Performance:

- 2017 Bull Run: Funding rates regularly exceeded 0.2%, with peaks above 0.3%

- 2021 First Peak: Sustained rates around 0.2-0.3% for weeks

- 2021 Second Peak: Still hitting 0.07-0.1% during rallies

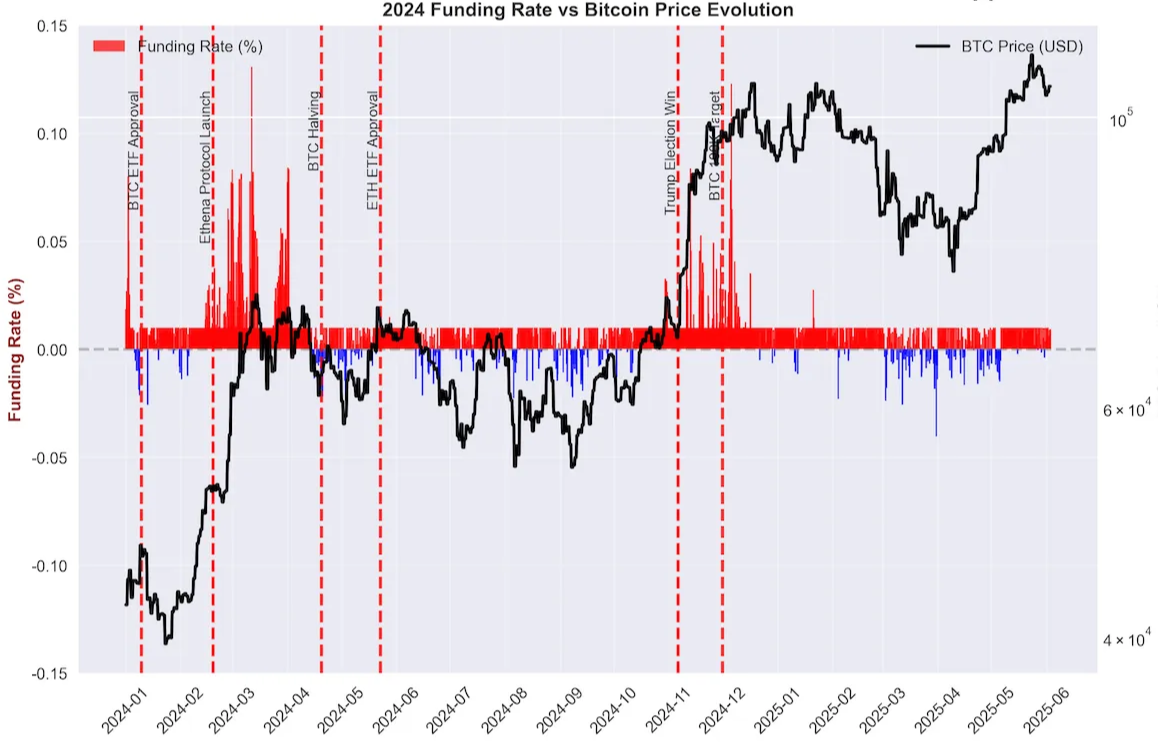

2024’s Disappointing Reality

- Maximum Rate: 0.1308% (less than half of previous bull markets)

- Sustained High Rates: Virtually non-existent

- Mean Rate: 0.0173% (despite Bitcoin prices reaching $70k+)

Figure 4 clearly visualises this transformation – how the majority of funding rates now cluster tightly around the zero line with far fewer extreme outliers compared to historical periods.

This has left arbitrage traders questioning their future profitability or yield-generating protocols wondering if the “funding rate alpha” has been permanently stored away.

So what could explain this behaviour? Two leading theories attempt to explain why the funding rate goldmine appears to be drying up:

Theory 1: The Institutional Invasion

- Massive institutional and DeFi arbitrage capital swiftly neutralises funding deviations.

- ETF launches and protocols like Ethena are rapidly correcting funding anomalies, causing market saturation and rapid reversion to neutral funding rates.

Theory 2: The Efficiency Revolution

- Market structure has permanently evolved towards institutional-grade efficiency.

- Improved market depth, liquidity, and cross-market arbitrage have eliminated persistent extreme events.

The Current State of Funding Rates: What the Data Reveals

Before declaring funding arbitrage as dead, our analysis uncovered three interesting findings:

Finding 1: High Funding Rates Become Short-Lived

2024 vs. 2021 Bull Market Comparison at $53,000 Bitcoin:

High funding rates still occur, but they’re shorter-lived and more predictable. The opportunity hasn’t disappeared—it’s evolved.

Finding 2: Funding Rate Opportunities Still Exist Post-ETFs

Contrary to the “saturation” theory, Bitcoin’s ETF approval actually increased funding rates for the first 3 months, showing funding rates can be still persistent amid more institutional arbitrage.

- Pre-ETF Period: October 2023 – January 2024 (0.011% average)

- Post-ETF Period: January 2024 – March 2024 (0.018% average)

- Net Impact: +69% increase in funding rates

Institutional adoption creates systematic demand imbalances that generate consistent, if smaller, arbitrage opportunities.

Finding 3: Persistently Positive Funding Rates

As indicated in Figure 5, funding rates have been persistently positive despite increasing institutional participation and the introduction of major basis trading opportunities like Bitcoin ETFs and DeFi protocols.

This suggests that the market has found a new equilibrium – one where consistently positive funding rates coexist with sophisticated arbitrage activity. While the magnitude of these rates is more modest compared to previous cycles, their stability and persistence demonstrate the market’s acceptance of this new normal.

The Bottom Line: Evolution, Not Extinction

After nearly a decade of maturation, Bitcoin funding rates have evolved from speculative volatility to stable, institutional-grade market conditions. The data from XBTUSD funding rates from 2024 onward clearly demonstrates that the crypto derivatives market has transitioned from a speculative playground to a systematically efficient financial ecosystem.

This evolution, driven by ETF-enabled institutional arbitrage and DeFi-native systematic funding rate arbitrage protocols like Ethena, signifies a fundamental milestone. Bitcoin derivatives markets have now fully integrated into mainstream finance, marking the definitive end of crypto’s Wild West era and the beginning of institutional sophistication and stability.

Whether you’re a trader that wants exposure to BitMEX XBTUSD’s unique funding rate opportunities or want to get new market research content – follow us on Twitter and Telegram to stay up to date with our latest.

To be the first to know about our new promotions, giveaways, listings, and product launches, you can visit https://www.bitmex.com/ or connect with us on Discord, Telegram, and Twitter. We encourage you to also check our blog regularly.

In the meantime, if you have any questions please contact Support.