Abstract: A few weeks ago, we published a piece on Bitcoin Cash and how one can analyse transaction data on the two blockchains involved in the split to draw conclusions about the potential investment flows between the two chains. Here is a similar analysis of Bitcoin Gold.

Please click here to download the pdf version of this report

Bitcoin Gold overview

Bitcoin Gold (the BTG token) is a Bitcoin chainsplit token, similar to Bitcoin Cash. Anyone who held Bitcoin on block 491,406 (which occurred 24 October 2017) was allocated an identical amount of Bitcoin Gold. Some exchanges allowed customers to trade their Bitcoin Gold from this date based on customer balances at the time of the fork. However, the Bitcoin Gold blockchain itself did not appear to become usable until 14 November 2017, 21 days after the snapshot point.

Bitcoin Gold appears to aim to improve mining centralisation by switching the hashing algorithm from SHA256 to Equihash, which is currently more GPU-friendly than the ASIC-dominated SHA256.

Allocation of BTG to coin founders

Although the Bitcoin Gold project team does not always appear to want to make this fact well known, 100,000 coins were created then allocated to the team members. This consists of the block reward for 8,000 blocks, which with a block reward of 12.5 BTG amounts to 100,000 coins.

Based on the current spot price of BTG of US$450 per coin, this balance is worth approximately US$45 million. In the eyes of many, this seemingly unnecessary allocation is likely to damage the integrity of Bitcoin Gold. Bitcoin Cash, for example, did not have such an allocation. One could argue that Bitcoin Cash’s initial difficulty-adjustment mechanism also allowed an unusually large number of coins to be created in the initial period following the fork, although this seems somewhat fairer than what Bitcoin Gold did, as anyone could have mined the Bitcoin Cash tokens and they were not directly allocated.

Total coins spent

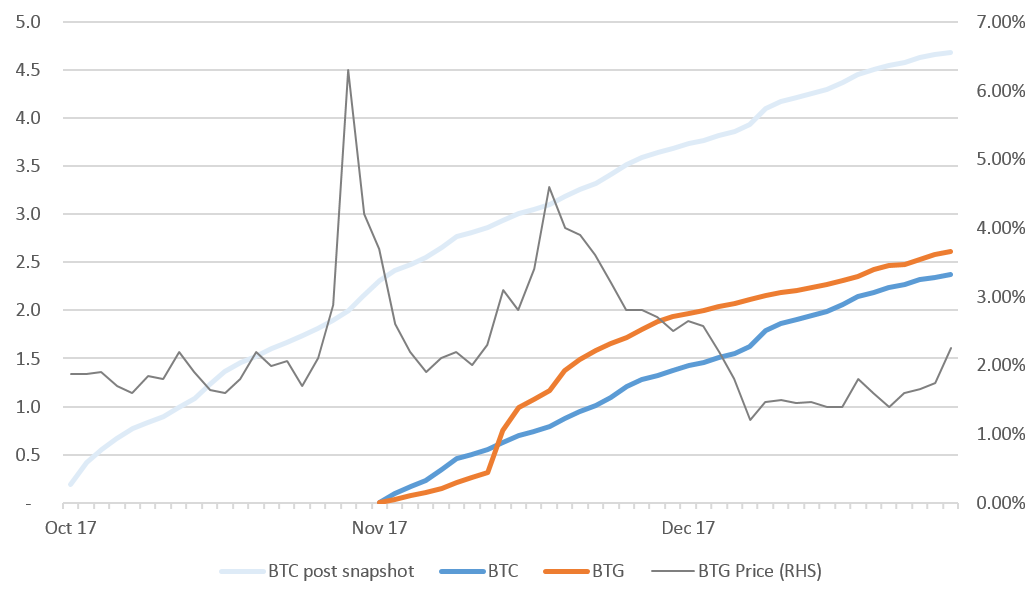

As of 20 December 2017, 2.61 million BTG have been spent at least once. In comparison, 4.7 million BTC have been spent since the snapshot point and 2.4 million BTC have been spent since Bitcoin Gold transactions became possible. Similarly, 4.1 million Bitcoin Cash was spent over an equivalent number of days following that token’s fork point.

The 2.61 million BTG that has been spent represents about 15.8% of all BTG. This is likely related to the level of divestment from Bitcoin Gold, mainly because this 2.61 million BTG is higher than a comparable first-time spend in Bitcoin over the same period.

Millions of coins of Bitcoin Gold (BTG) and Bitcoin (BTC) spent at least once since the chain split compared to the BTG price. (Source: BitMEX research, Bitcoin blockchain, Bitcoin Gold blockchain, Bitfinex price data)

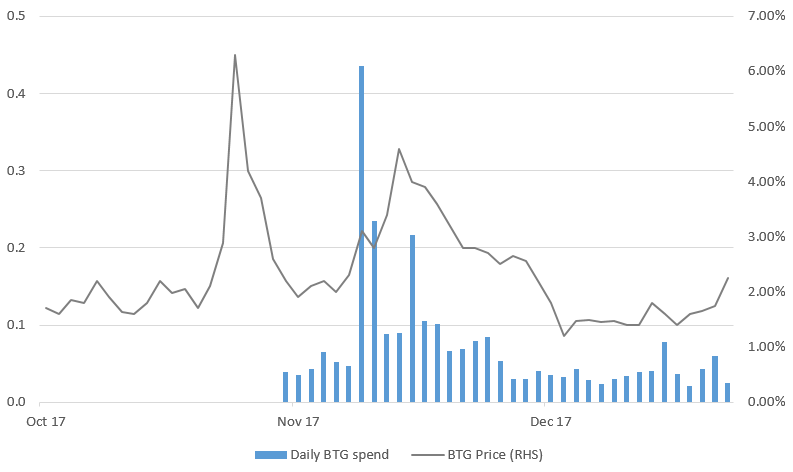

Daily Bitcoin Gold spend for the first time

The average daily spend for the first time on Bitcoin Gold is falling slightly, compared to the initial period after the launch. In the last 10 days, the average daily spend for the first time was 44,000, compared to around 110,000 in the first 10 days.

Bitcoin Gold spent for the first time since the split (in daily millions) compared to the BTG price (Source: BitMEX research, Bitcoin Gold blockchain, Bitfinex price data)

Security incident

The official Bitcoin Gold GitHub repository may have been hacked for 4.5 days from 21 November to 25 November 2017, when the official website pointed to a malicious wallet. According to an announcement from the Bitcoin Gold team, the hacked wallet allowed the malicious entity to access funds sent to new Bitcoin Gold addresses provided by the wallet. Bitcoin was not affected as existing private keys were not compromised. It is not clear exactly what happened, but the Bitcoin Gold team claims that at least 80 BTG were stolen. Given the severity of this incident, the impact could have been far worse.

This incident illustrates why it’s important to handle these new fork tokens with caution. In particular, we would strongly advise you not to import your Bitcoin private key into these new fork token wallets without first spending the Bitcoin to a new output associated with a different private key after the token snapshot point, so that your Bitcoin is not at risk.