Executive Summary

April 30th Saw Historic Volumes Ahead of Bitcoin Halving

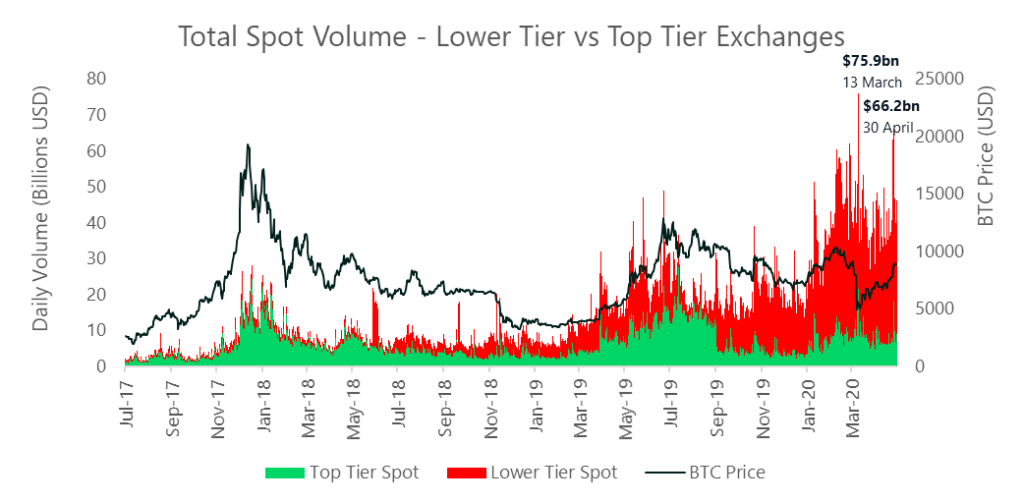

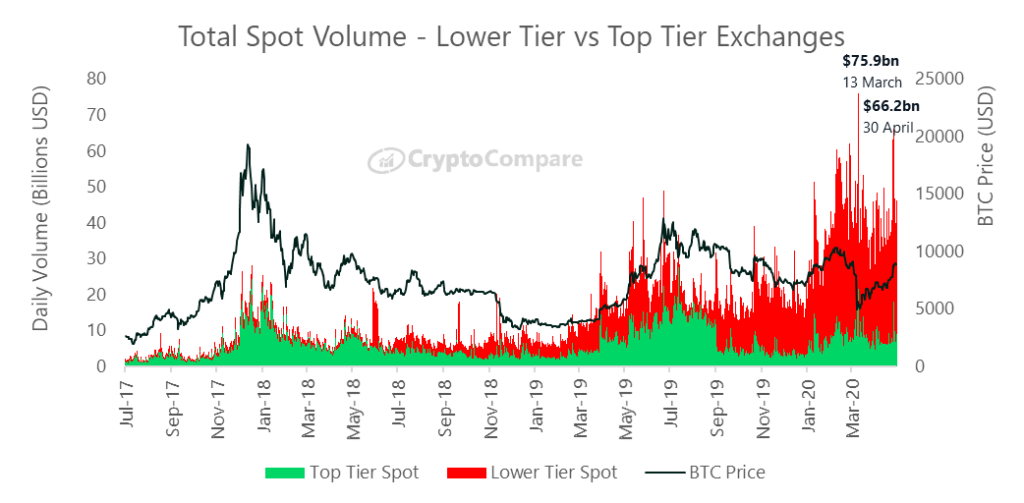

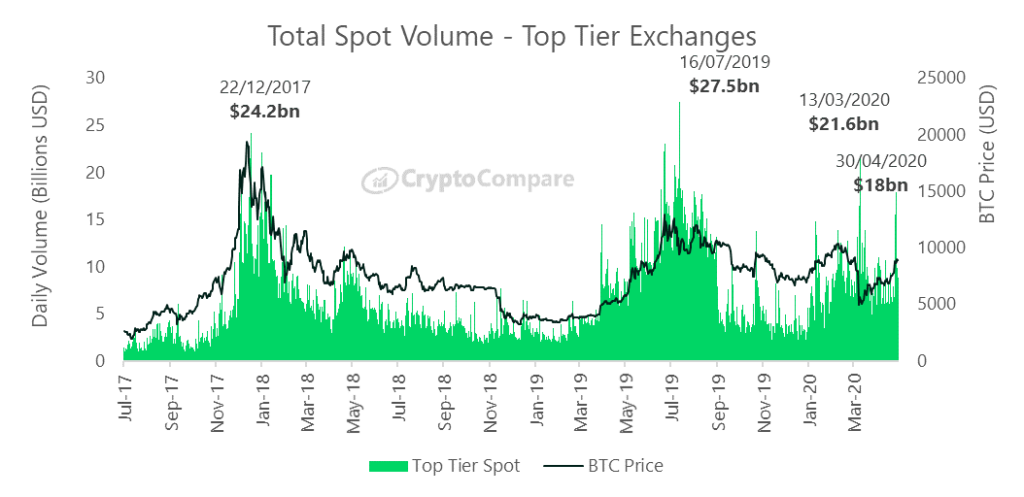

In April, crypto spot markets saw another historic daily volume record, totalling $66.2bn on April 30th – as Bitcoin soared above $9,000. While this doesn’t match the daily volumes seen on March 13th ($75.9bn), it still represents the second highest volumes experienced on record.

The majority of this figure came from Lower Tier exchanges ($48.3bn), with volume from Top Tier exchanges totalling $17.9bn. This figure once again represents one of the highest volume trading days in history for Top Tier exchanges.

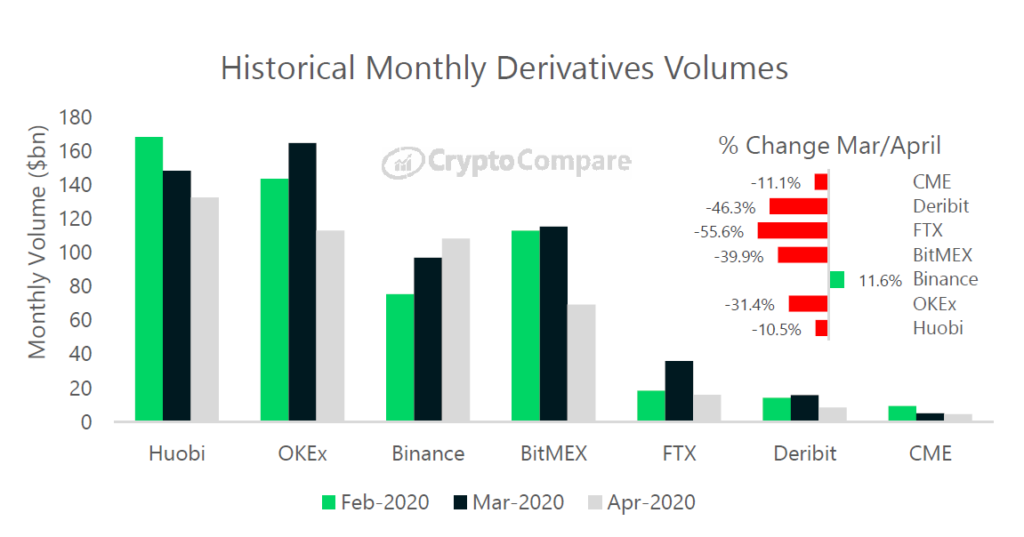

Binance the Only Exchange to See Derivatives Growth in April

In contrast to all other derivatives exchanges, Binance’s derivatives market volumes increased 11.6% in April, to $108bn. Binance overtook BitMEX, which traded $69.3bn, a decrease of almost 40% since March.

Huobi was the largest derivatives exchange in April, and traded $133bn (down 10.5% since March). OKEx followed with $113bn (down 31.4%)

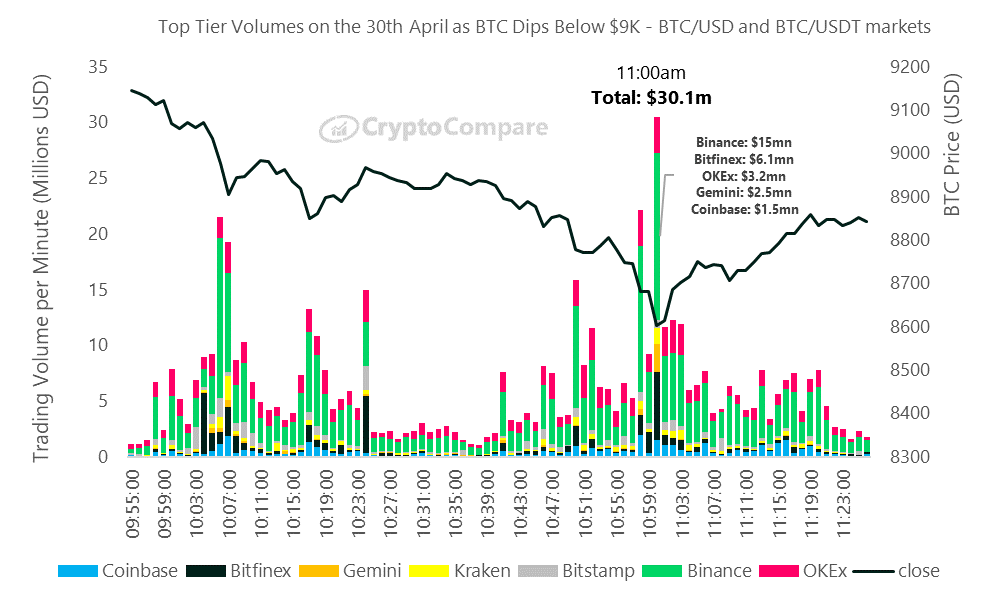

Top Tier Volumes Surged as Bitcoin Dipped Below $9K on the 30th April

As Bitcoin dipped below $9,000 on the morning of the 30th of April, Binance represented the majority of trading volume (BTC/USDT market), trading a total of $15mn at 11am BST. At this moment, it represented approximately 50% of trading volume among 7 of the largest top-tier exchanges.

Binance and OKEx Remained Top Players in terms of Volume

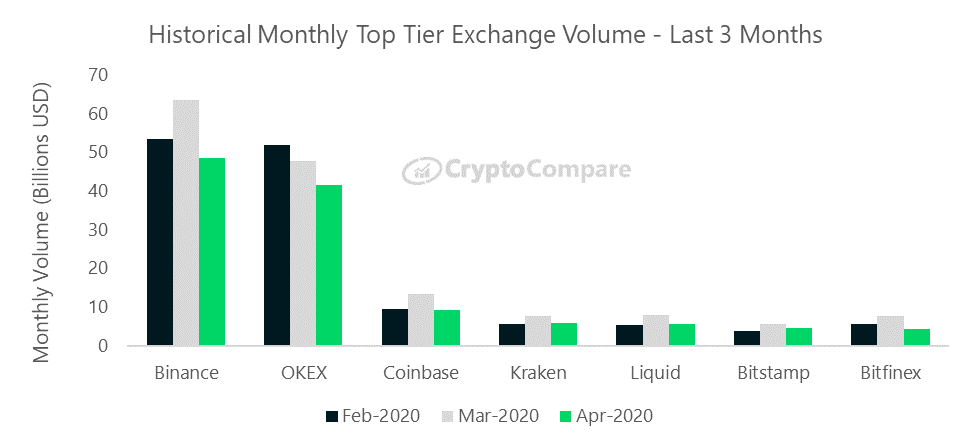

Binance and OKEx remained the top players in terms of volume in April relative to other Top Tier exchanges, capitalising once again on the volatility seen on the 29th and 30th. On the 30th, Binance and OKEx traded $3.6bn and $2.5bn respectively while the next largest exchange (Coinbase) traded $818mn.

Exchange Benchmark Analysis

CryptoCompare’s Exchange Benchmark aims to serve investors, regulators and crypto enthusiasts by scoring exchanges in terms of transparency, operational quality, regulatory standing, data provision, management team, and their ability to monitor trades and illicit activity effectively. Rather than drawing attention specifically to bad actors, we instead highlight those that behave in a manner that is conducive to maintaining an efficient and fair market, ensuring greater safety of investors. We have hence introduced the notion of “Top Tier” vs “Lower Tier” volumes.

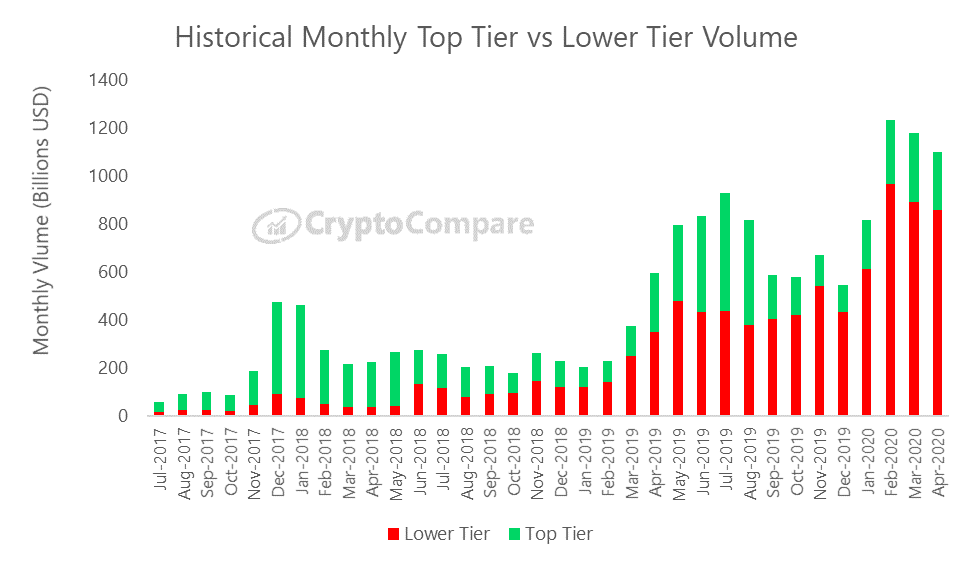

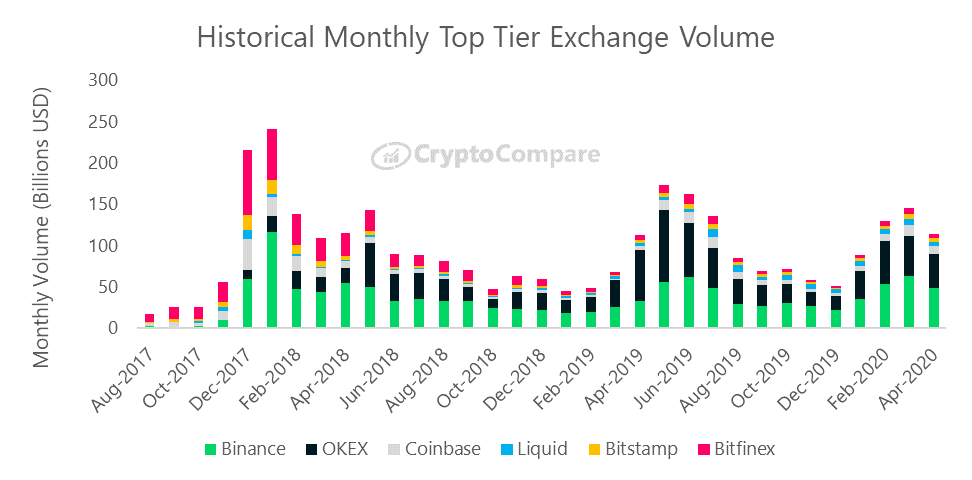

In April, Top Tier volumes decreased 15% to $244bn, while Lower Tier volumes decreased only 4% to $857bn.

In April, spot markets saw another boost in daily volume totalling $66.2bn in a single day (30th April). While this doesn’t match the daily volumes seen on March 13th ($75.9bn), it still represents the second highest volumes experienced on record.

The majority of this figure came from Lower Tier exchanges ($48.3bn), with volume from Top Tier exchanges totalling $17.9bn. This figure once again represents one of the highest volume trading days in history.

Categorising exchanges by tier level based on our rigorous Exchange Benchmark methodology helps capture a more representative picture of where the market has moved.

Macro Analysis and Market Segmentation

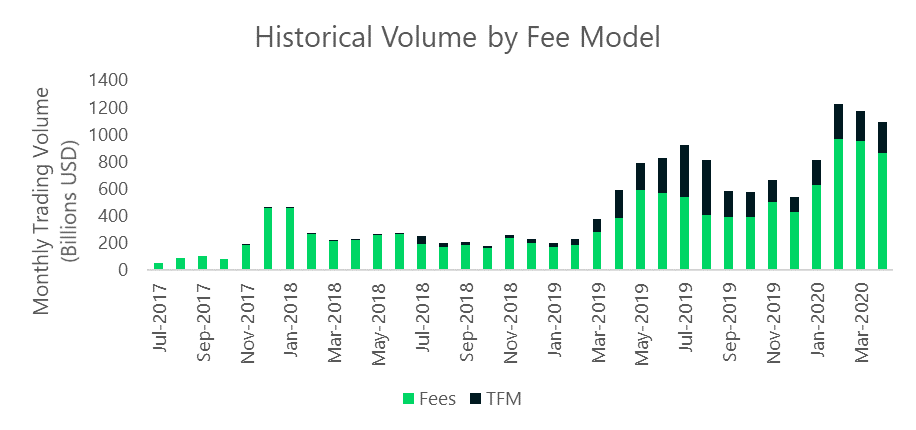

Exchanges that charge traditional taker fees represented 78.1% of total exchange volume in April, while those that implement trans-fee mining (TFM) represented less than 22%. Last month, fee charging exchanges represented 80% of total spot volume.

Fee-charging exchanges traded a total of $860bn in April (down 9% since March), while those that implement TFM models traded $236bn (up 6% since March).

In April, volume from many of the largest Top Tier exchanges decreased 26% on average (vs March).

Binance was the largest Top Tier exchange by volume in April, trading $48.4bn (down 24%). This was followed by OKEx trading $41.4bn (down 13%), and Coinbase trading $9.1bn (down 31%).

Binance and OKEx remained the top players in terms of volume in April relative to other Top Tier exchanges, capitalising once again on the volatility seen on the 29th and 30th. On the 30th, Binance and OKEx traded $3.6bn and $2.5bn respectively while the next largest exchange (Coinbase) traded $818mn.

Top Tier Volumes Surge as Bitcoin Dips Below $9K on the 30th April

As Bitcoin dipped below $9,000 on the morning of the 30th of April, Binance represented the majority of trading volume (BTC/USDT market), trading a total of $15mn at 11am BST. At this moment, it represented approximately 50% of trading volume among 7 of the largest top-tier exchanges.

Bitfinex traded $6.1mn on its BTC/USD market (~20%), followed by OKEx at $3.2mn (~10%) on its BTC/USDT market.

Bitcoin to Fiat Volumes

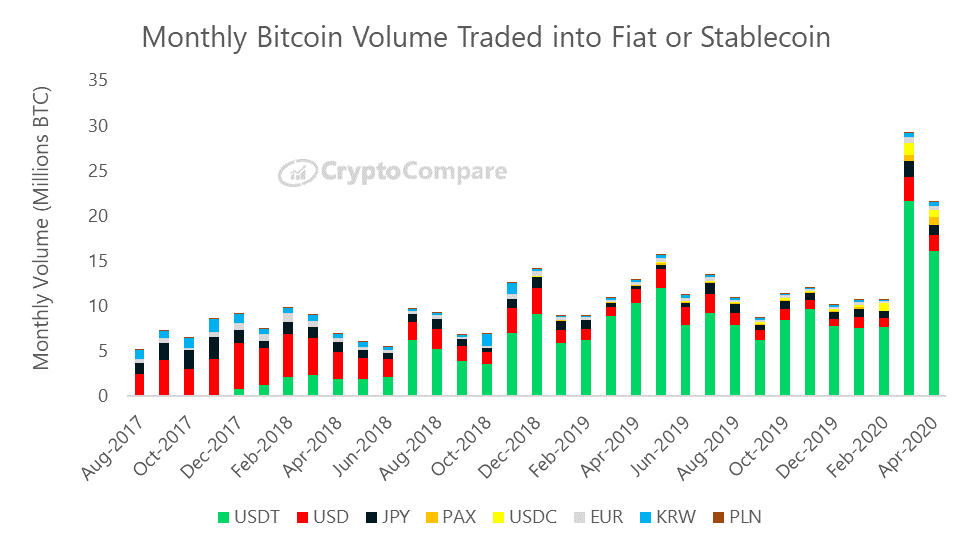

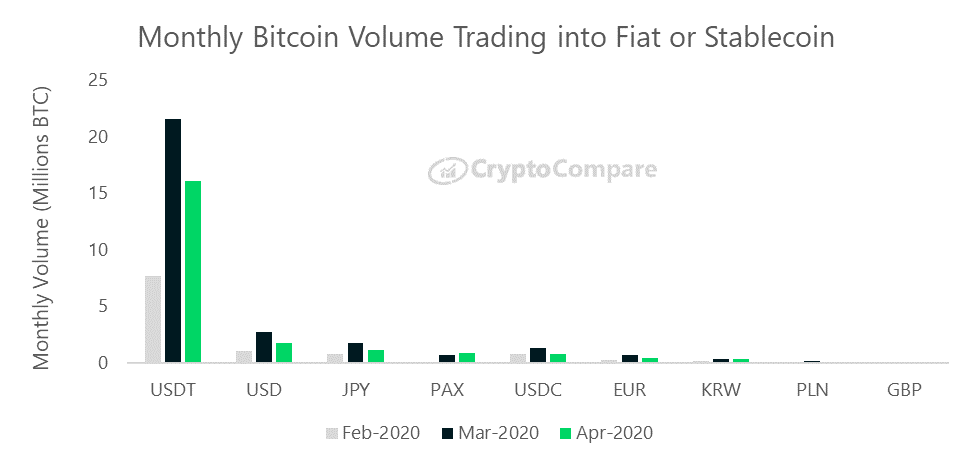

BTC trading into USDT decreased 26% in April to 16.1mn BTC vs 21.6mn BTC in March. Trading into USD and JPY also dropped to 1.8mn BTC (down 35%) and 1.2mn BTC (down 35%) respectively. The BTC/USDT market now represents 74% of total BTC traded into fiat or stablecoin.

Stablecoins PAX and USDC followed in terms of total volume traded into BTC. BTC/PAX and BTC/USDC markets traded 0.85mn BTC (up 27%) and 0.82mn BTC (down 39%) respectively in April, beating the BTC/EUR and BTC/KRW markets in terms of volume.

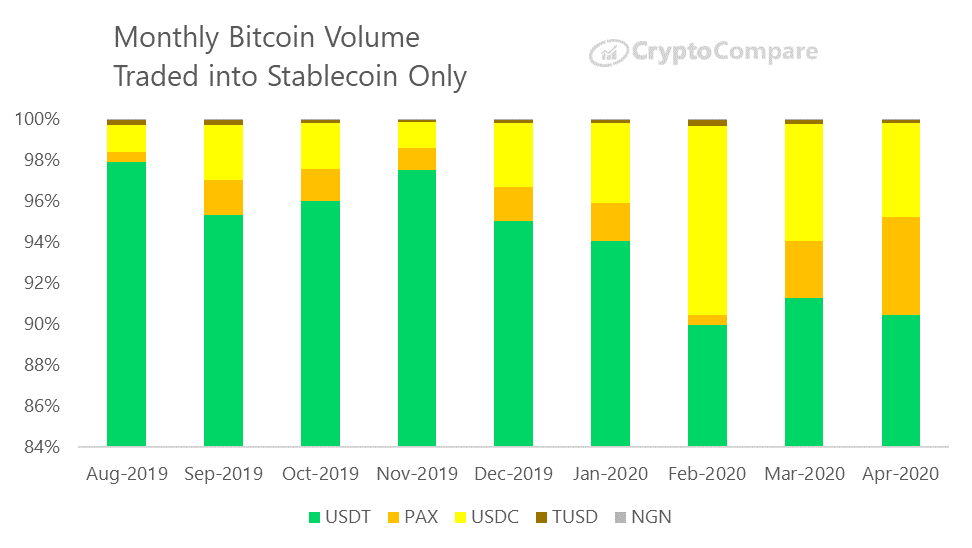

USDC and PAX have maintained popularity in recent months, with both now representing approximately ~4% of BTC volume into stablecoins. Despite their growth, the BTC/USDT pair still represents the majority of BTC traded into stablecoins at ~90%.

Derivatives

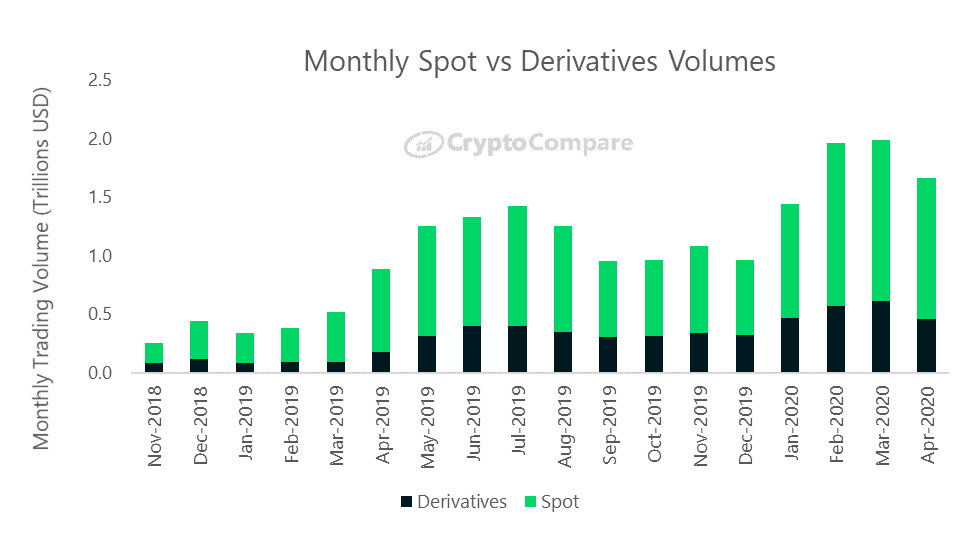

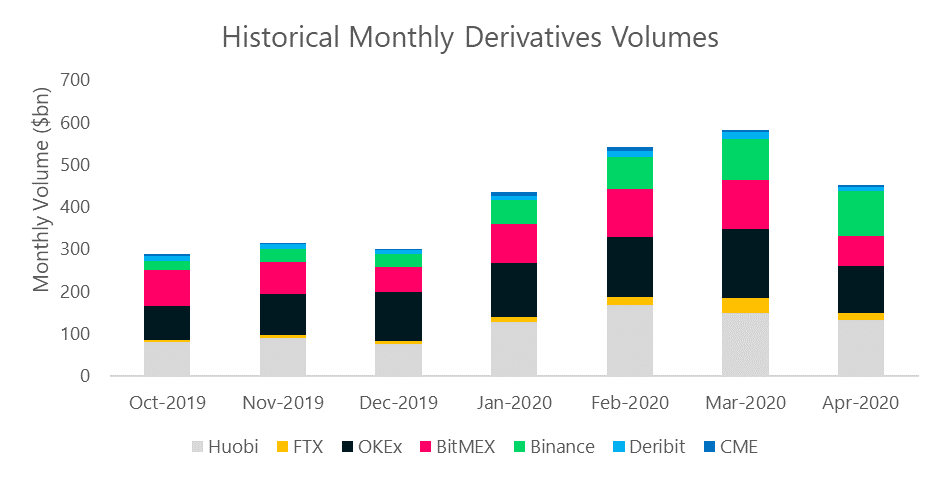

Derivatives volume decreased 25% in April 2020, totalling $456bn. Meanwhile, total spot volumes have only decreased 13%. As a result, derivatives represented 27% of the market in April (vs 30% in March).

Huobi was the largest derivatives exchange in April, and traded $133bn (down 10.5% since March). OKEx followed with $113bn (down 31.4%)

In contrast to all other derivatives exchanges, Binance’s derivatives market volumes increased 11.6% in April, to $108bn. Binance overtook BitMEX, which traded $69.3bn, a decrease of almost 40% since March.

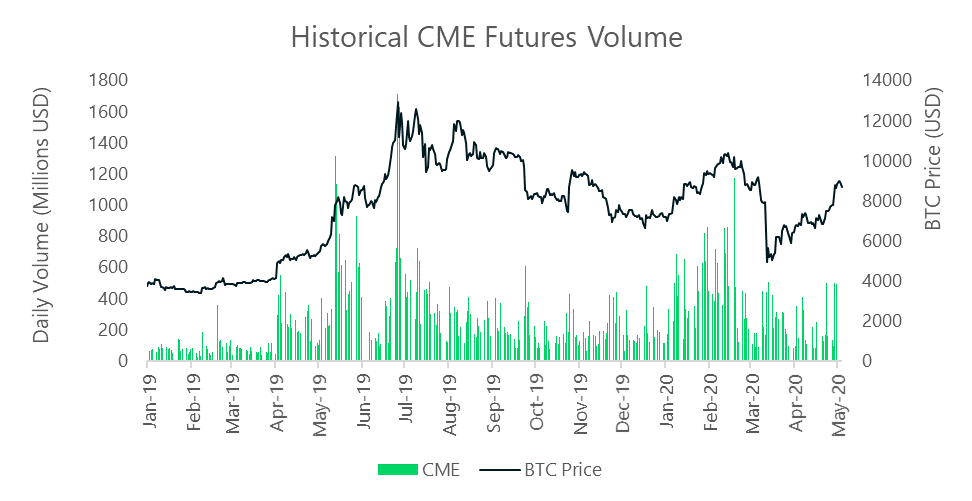

Institutional player CME saw futures volumes decline 11.1% to $4.5bn.

On the 30th of April, daily derivatives trading volume totalled $39.1bn. On this day, OKEx traded the greatest amount at $10.9bn followed by Binance with $10.3bn.

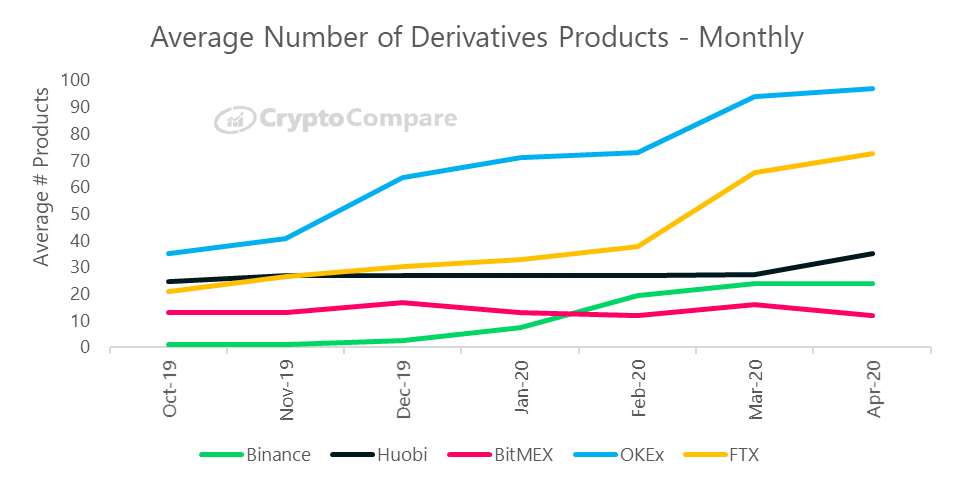

Binance has quickly become a major derivatives player in a short space of time, with volumes increasing steadily since the start of the year. The derivatives space has gradually developed in terms of the number of products available across all market players.

In terms of total futures products, OKEx led in April with an average of 97 products with positive volume, followed by FTX with 72 products. Huobi added perpetual swaps at the end of March and traded the third greatest number of products on average in April, at 35 products.

Options

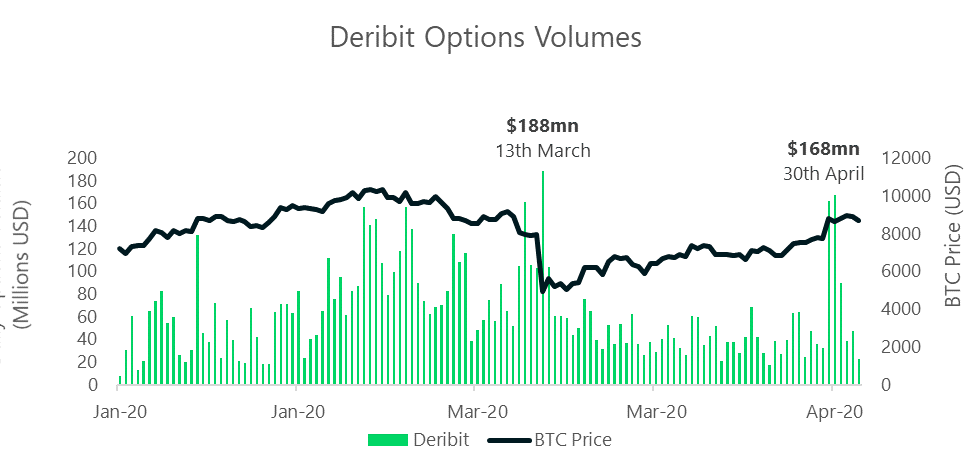

Derivatives exchange Deribit traded $168mn in options on the 30th of April. This represents the second highest volume of options traded since the BTC price crash on the 13th of March.

Despite the volume surge on the 30th of April, Deribit’s options volumes continued to decrease to $1.47bn in April overall (down 29% since March).

CME Institutional Volume

CME futures volumes have continued to decrease since the March 13th price crash. They have decreased a further 11.1% to $4.5bn in April.