Abstract: The prices of crypto-related assets like Bitcoin have skyrocketed in recent months and many speculative investors understandably appear to want upside exposure to the space. However, the risk of a downwards correction is high, in our view. In this piece, we look at a potentially lower-risk method of obtaining upside by presenting a selection of listed equities which have some exposure and businesses in other areas.

![]()

Please click here for a PDF version of this report

Overview

The price of Bitcoin is up over 1,600% YTD, while many alternative coins such as Ethereum and Litecoin have appreciated in value to an even greater extent, leading, in our view, to significant downside price risk. For example, potentially another four-year cycle of weak prices could be driven by the Bitcoin halving schedule. Existing investors in the space may wish to take some profits but still retain some upside exposure, and new investors in the space may wish to obtain some upside exposure while mitigating some of the downside risks.

Here is a list of public companies with some business segments driven by crypto-related areas, which may benefit from further crypto price appreciation but which have other businesses that could mitigate the downside risks. Before investing in any of these, you should obviously do more research on your own: the information below is intended only as an introduction to the companies.

| Stock | Website | Comment |

|

|

http://www.tsmc.com | Potentially a solid investment opportunity, with a strong high-margin business and good crypto upside linked to the core business. |

|

http://www.alchip.com | More work may be required to determine the significance of the crypto-related business. |

|

|

https://www.gmofh.com | Could be an interesting investment, although the crypto exchange is new and currently small in scale. |

|

http://www.globalunichip.com | Strong ASIC design business, however the stock is expensive. |

|

|

https://www.gmo.jp | Possible lack of focus on one crypto area. |

|

|

https://www.overstock.com | Possible lack of focus on one crypto area. |

|

|

https://squareup.com | Not clear if this business model has strong earnings power. |

|

|

https://www.ig.com | Crypto trading may just cannibalize the existing clients. |

|

|

https://www.plus500.com | Crytpo trading may just cannibalize the existing clients. |

|

http://www.garage.co.jp | The link to crypto is weak. |

|

|

http://premiumwater-hd.co.jp | The link to crypto is weak and it’s not clear how shareholders may benefit from an ICO. |

|

|

http://www.cmegroup.com | Crypto business may not be significant. |

|

|

http://www.cboe.com | Crypto business may not be significant. |

|

|

http://www.sbigroup.co.jp | A link to the “fake Satoshi” may be worrisome. |

A slightly more detailed look into the companies

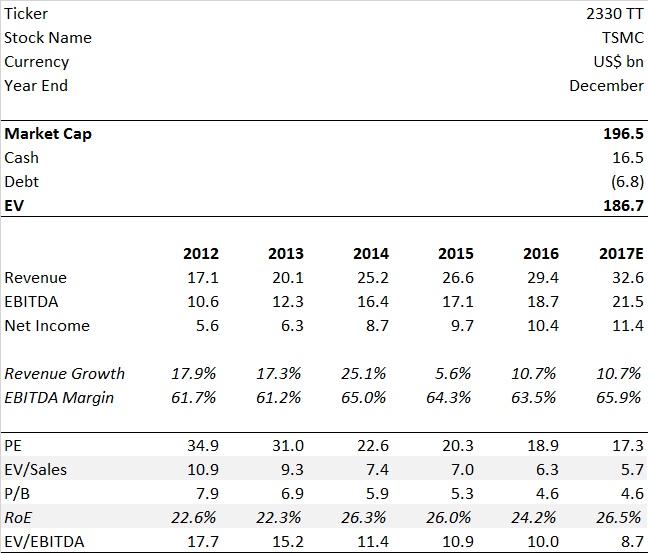

TSMC

Investment conclusion:

- Investing in TSMC is likely to be a good way of obtaining some moderate upside exposure to crypto while significantly mitigating or eliminating the downside risk.

Overview:

- This Taiwanese company is the world’s largest semiconductor foundry. TSMC is a pure play, focusing entirely on integrated-circuit fabrication.

- According to the most recent quarterly earnings call, the crypto-mining-related business is $375 million per quarter, which represents 5.1% of group sales. However, with crypto prices continuing to appreciate, it is likely that this business segment is growing very fast.

Investment case:

- TSMC has extremely high profit margins, with an EBITDA margin of about 66% expected in 2017. In our view, the company is likely to be able to achieve similar margins in the crypto business.

- With current crypto prices, miners and ASIC designers are likely trying to make very large orders with TSMC, which could mean significant sales growth next year. If the crypto prices increase significantly, orders in 2018 could be very strong. If one is convinced 2018 is going to be a big year for crypto, TSMC could be a relatively less risky way of obtaining such exposure.

- Crypto mining is a challenging and competitive business, and much of the profit could end up at the company supplying the key equipment. TSMC is well positioned to benefit regardless which mining company becomes dominant. As Mark Twain once said, “When everyone is looking for gold, it’s a good time to be in the pick and shovel business.”

- TSMC also pays a healthy dividend, yielding c3.1%. The company has never cut its dividend and this should support the share price if the market weakens.

- TSMC is very focused on the core business as a semiconductor foundry and will not be distracted by investing in other blockchain related areas like ICOs or Ripple. In our view, companies with focus tend to perform better over the long term.

Investment risks:

- TSMC are believed to currently have only one crypto-mining client, Bitmain, so there is significant customer concentration risk.

- The company has high exposure to Apple (APPL US) and the iPhone.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

Alchip

Investment conclusion:

- Alchip may merit further investigation to establish the significance of the crypto business.

Overview:

- Alchip is a Taiwanese ASIC design and manufacturing company, of smaller scale than GUC (mentioned below).

- We do not know how significant crypto mining is for this company. A page in a recent company presentation explained some of the Bitcoin-mining-related products and in 2015, the company completed the first mining 16-nm tap out for the now defunct KNC miner.

Investment case:

- This company is less well known and therefore the upside from strong crypto growth in 2018 could be significant.

Investment risks:

- The scale of the company’s Bitcoin business is not known.

- The earnings track record is unreliable, with the company making loses in 2016.

- The order outlook is said to have poor visibility relative to some other companies.

- The stock is up 171% YTD, indicating the crypto exposure may already be reflected in the valuation.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

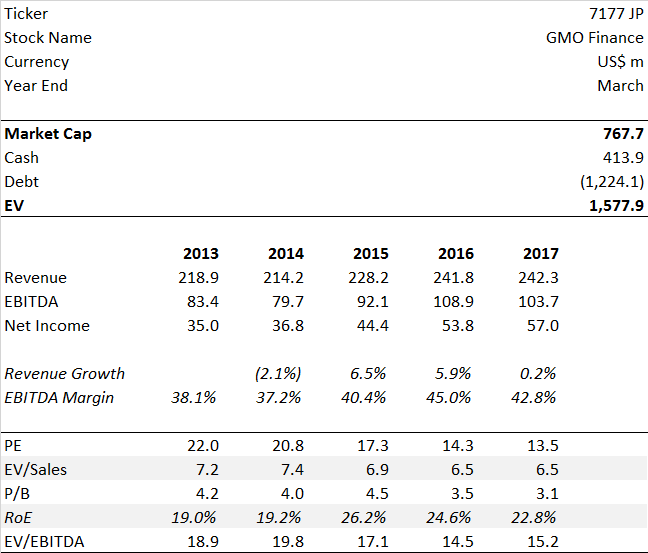

GMO Financial Holdings

Investment conclusion:

- GMO Coin may become a successful crypto exchange in Japan due to the company’s existing infrastructure and expertise. Therefore, GMO Financial could represent an interesting investment opportunity.

Overview:

- GMO Financial are a listed subsidiary of GMO Internet, with GMO Internet owing 80.8% of GMO Financial. Therefore, the shares are not very liquid.

- This business includes a retail FX platform as well as the new GMO Coin exchange, which is 58% owned by GMO Financial.

- The crypto-mining business and ICO will not occur within this subsidiary, but will occur at group level inside GMO Internet.

Investment case:

- GMO Financial offers more direct exposure to the crypto-exchange business than the parent. The exchange business is reasonably new and therefore has considerable growth potential.

- The FX trading-platform business is the largest retail platform in Japan, therefore GMO Financial may already have the infrastructure and expertise to build a successful crypto exchange.

- The exchange plans to offer a leveraged product shortly.

Investment risks:

- We have not been able to identify any trading-volume data at GMO Coin, therefore the market share is likely to be low. However, a recent company presentation indicates that growth is strong.

- The company does publish monthly volume data for the non GMO Coin exchange businesses.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

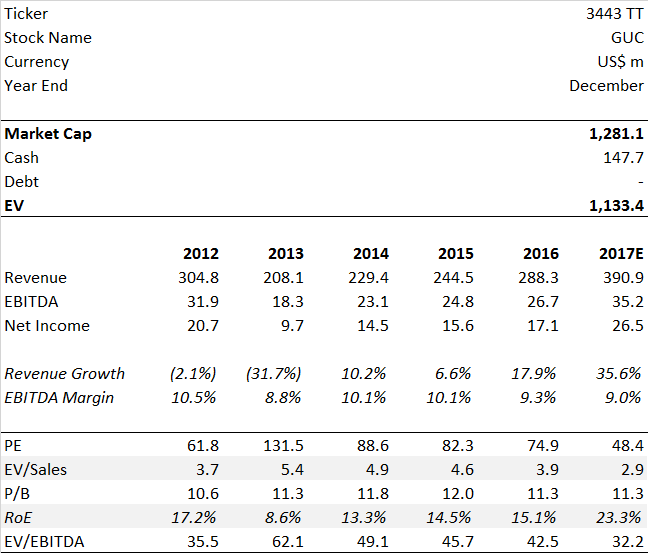

Global Unichip

Investment conclusion:

- Valuation ratios appear reasonably expensive and the stock price may already reflect the benefits of crypto.

Overview:

- Global Unichip (GUC) is a Taiwanese fabless ASIC design company. TSMC holds about 34% of the shares in GUC, and the chairman of GUC also has a role at TSMC China. However, TSMC’s technology library is open to other competing fabless companies.

- Crypto-mining-related sales are believed to account for around 20% of GUC sales in 2017, and this is likely to grow significantly in 2018, in our view.

Investment case:

- At 20%, the crypto business is a significant part of sales. The mining business could become more competitive in 2018, making ASIC design key. If crypto prices increase in 2018, GUC is likely to perform well.

Investment risks:

- The stock price is already following crypto markets to some extent, with the shares up over 300% in USD this year. There is significant downside risk if crypto markets collapse but this is still less risky than actually holding crypto tokens.

- The stock is expensive on a forward EV/EBITDA of 34.7x.

- GUC is also reliant on machine-learning/AI areas for growth in addition to crypto.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

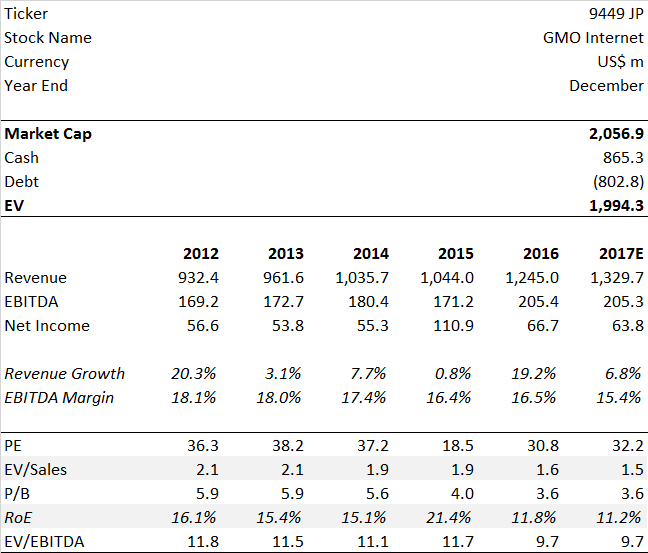

GMO Internet

Investment conclusion:

- GMO Internet appears to lack focus in their crypto endeavors, therefore GMO Financial may represent be a better investment opportunity.

Overview:

- GMO Internet is a group of Japanese companies based in internet infrastructure and digital payments. The main business lines of the company are online credit-card transaction processing, domain-name services, and SSL certificates.

- In October 2017, the company announced the launch of a Bitcoin-mining business and a potential ICO.

- The company also has a subsidiary called GMO Coin, a crypto exchange.

Investment case:

- GMO offers broad exposure to different areas in crypto, ICOs, mining, and the operation of exchanges.

- The core business of SSL certificates is enjoying strong growth, with sales up about 90% in 2017.

Investment risks:

- The company is entering competitive fields and GMO appear to lack focus by trying many different areas at the same time. They may not succeed in all ambitions.

- GMO plans to launch a 7-nm mining chip next year, which may be ambitious, especially as Bitmain is likely to be a strong competitor and it’s not clear who GMO’s mining-chip manufacturing partners are.

- The effective ownership of the exchange business (GMO Coin) is low, at only 46%.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

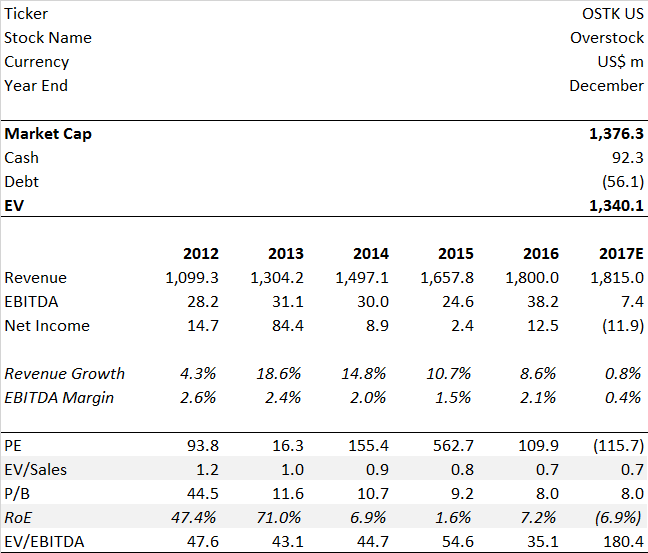

Overstock

Investment conclusion:

- The company may lack focus in the crypto space and the stock may already be rallying as a result of the crypto exposure.

Overview:

- Overstock is an American e-commerce company focused on furniture and bedding.

- For several years, company CEO and founder Patrick Bryan has enthusiastically supported Bitcoin. This may stem from his anti-Wall Street stance, which itself grew after several prominent investment banks and hedge funds were accused of targeting Overstock with a naked short selling campaign in 2005. Bryan was eventually mostly vindicated after winning a payout in a settlement of the issue.

- Overstock first accepted Bitcoin payments in 2014 and became involved in several projects, including the Counterparty platform in 2014 and then the tZERO platform, which first launched Overstock stock as an instrument in 2016 and is currently building a distributed ledger system.

Investment case:

- Overstock offers broad exposure to the space.

Investment risks

- Like many of the companies mentioned in this list, Overstock seems to lack focus and is experimenting with various crypto related ideas.

- The shares are up 214% YTD, partly as a result of the crypto theme.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

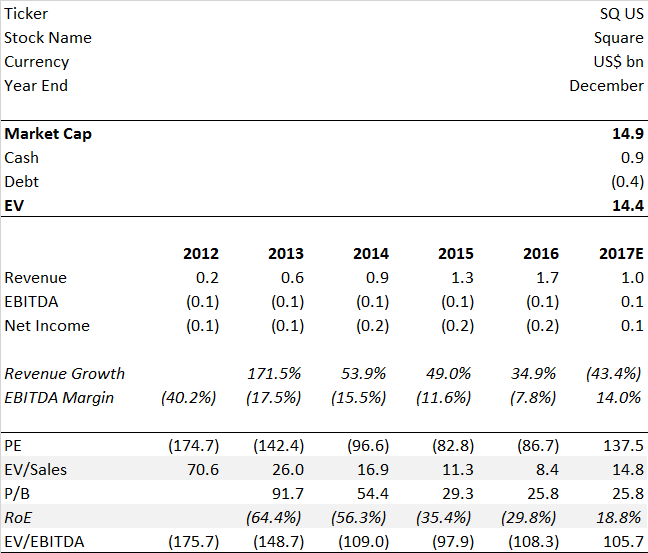

Square

Investment conclusion:

- The crypto story may already be well understood by the investment community and there may be considerable downside risk due to the valuation rating.

Overview:

- Square is a digital-payment-solutions company based in the US.

- Square recently announced the launch of a new product that allows users to buy and sell Bitcoin on a mobile application.

Investment case:

- The new Bitcoin application has received positive feedback since the launch for its ease of use.

Investment risks:

- The stock is very expensive based on traditional valuation metrics.

- The Bitcoin application does not offer users the ability to send payments on the Bitcoin network by itself.

- It is not clear if the business model of buy/sell Bitcoin inside a mobile application is profitable.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

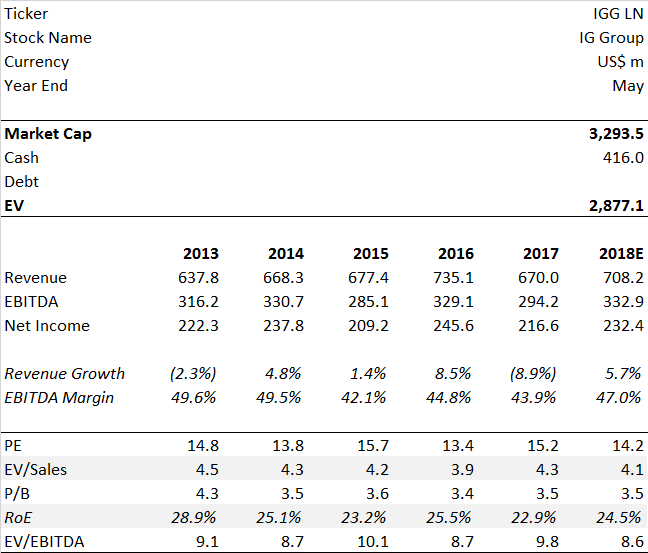

IG Group

Investment conclusion:

- A strong crypto business may cannibalise earnings from other areas, so the crypto-related upside may be limited.

Overview:

- IG Group is a UK-based CFD and spread-betting-platform company.

- Due to their high volatility, crypto-related trading products are offered and are likely to be contributing to earnings as the volatility of other products is lower.

Investment case:

- IG is one of the largest and strongest CFD companies in the retail space.

Investment risks:

- One of the big challenges for the company is the regulatory environment in the UK and Europe. The retail leveraged trading industry is under close scrutiny by regulators.

- While the crypto business may perform well, it’s not clear that this will result in new clients or whether IG’s existing clients will merely enjoy trading and switch to whichever product offers volatility.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

PLUS 500

Investment conclusion:

- Similar to IG, Plus 500’s stronger crypto sales may cannibalize earnings from other areas.

Overview:

- Plus 500 is a UK-based online retail trading platform.

Investment case

- Plus 500’s technology platform lets it roll out new instruments faster than many of its peers, so it may be able to capitalise on new trends faster in the volatile crypto space.

- Plus 500 trades at a discount to IG, due to IG’s stronger reputation and longer track record. However, customer retention at Plus 500 is improving and there is increased focus on loyal, higher-value customers rather than on speculative clients who may lose all their money and leave.

Investment risks:

- Regulation and possible stricter rules related to CFDs are a major risk, just like for IG.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

Digital Garage

Investment conclusion:

- One could consider a pair trade, long Digital Garage and short Kakaku.com, although the link to a real crypto business seems insignificant and unlikely.

Overview:

- Digital Garage is a Japanese technology investment fund, with the primary asset being a price-comparison website called Kakaku.com (2371 JP).

- Digital Garage also has an investment in the blockchain-infrastructure company Blockstream.

- In theory, one could go long Digital Garage and short Kakaku.com to increase exposure to Blockstream.

Investment case:

- Blockstream has rolled out a satellite product, broadcasting Bitcoin blocks all over the world.

Investment risks:

- Blockstream’s business model appears unclear. The company seems focused on technology and infrastructure rather than on commercialisation and therefore may not be able to generate earnings.

- The link to Blockstream is very limited.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

Premium Water Holdings

Investment conclusion:

- The link to the crypto space may be too weak.

Overview:

- Premium Water is a high-growth mineral-water delivery company in Japan, delivering water to the home and office markets.

- According to page 10 of the COMSA whitepaper, the company will conduct an ICO, perhaps to raise funds to invest in business expansion. COMSA is a Japanese centralized ICO solutions company that recently conducted a token sale themselves.

Investment case:

- It is possible that the company could raise a significant amount of funds in an ICO and there is a chance that existing shareholders may benefit from this.

Investment risks:

- It is not clear how existing shareholders will directly benefit from the ICO, if at all.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

CME Group

Investment conclusion:

- Crypto is not likely to be a significant earnings driver.

Overview:

- CME Group operates an institutional derivatives exchange that deals with futures contracts and options. The instruments are related to interest rates, stock indexes, FX, and commodities.

- The company recently announced the launch of Bitcoin futures contracts.

Investment case:

- Financial speculation appears to be one of the main activities Bitcoin is used for and the launch of a Bitcoin product could therefore lead to significant volume growth for the CME.

Investment risks:

- The Bitcoin product is new and it is not clear whether there will be significant demand relative to the CME’s other products.

- On a forward EV/EBITDA of 21.0x, the stock is already reasonably expensive.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

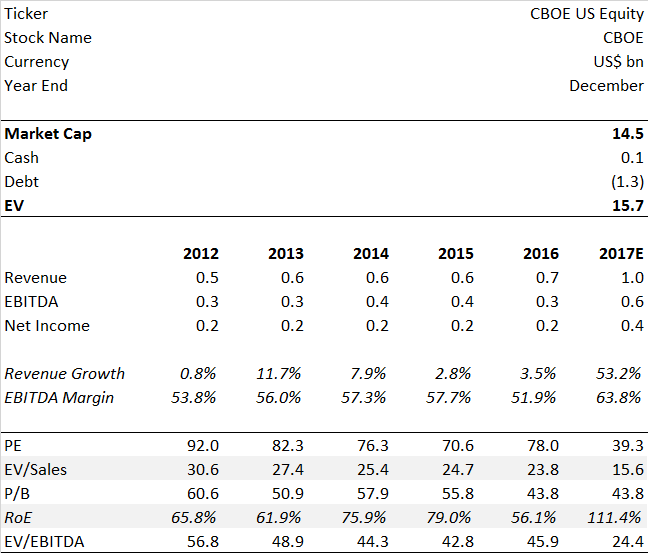

CBOE

Investment conclusion:

- Crypto is not likely to be a significant earnings driver.

Overview:

- CBOE operates an institutional financial-options-trading platform. The main instruments are related to FX and stock indexes.

- The company recently announced the launch of Bitcoin futures contracts.

Investment case:

- Similar to the CME, financial speculation appears to be one of the main activities Bitcoin is used for, and the launch of a Bitcoin product could therefore lead to significant volume growth for CBOE.

Investment risks:

- The Bitcoin product is new and it is not clear whether there will be significant demand relative to CBOE’s other products.

- On a forward EV/EBITDA of 24.4x, the stock is already reasonably expensive.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

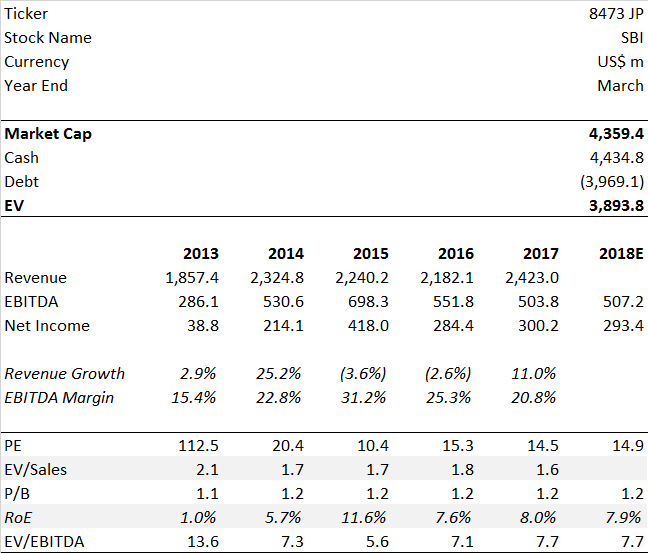

SBI Holdings

Investment conclusion:

- A partnership with “fake Satoshi”, Craig Wright, is a significant concern. We do not recommend investing in SBI.

Overview:

- SBI Holdings is a Japanese financial company whose main business is the domestic online stock-trading platform. SBI can be considered a peer to GMO.

- SBI holdings appears enthusiastic about the crypto space. The company has a crypto fund, with investments in Ripple, R3, Orb, Coinplug, Wirex, Veem, and bitFlyer (source).

- SBI plans to make further investments, including into Bitcoin mining. SBI also has a blockchain consulting business, including advising on ICOs.

Investment case:

- SBI Holdings offers broad exposure to many areas in the space.

Investment risks:

- SBI recently announced a strategic partnership with nChain, the company run by Wright, known inside the Bitcoin community as the “fake Satoshi”. This may indicate that SBI has limited knowledge about the crypto space or that the company may be wasting shareholder funds, by partnering with Wright.

- SBI also appears to lack focus in its blockchain strategy.

Valuation metrics:

(Source: Bloomberg, BitMEX Research)

Other listed crypto-related names

| Ticker | Name | Market cap (million USD) | 2017 YTD return (USD) | Description | Blockchain pure play |

| Japan | |||||

| 4751 JP | Cyberagent | 4,814 | 50.0% | Operates a media website, Ameba, and provides an advertising agency, foreign-exchange-trading website, and PC and mobile content. Potentially preparing for its own cryptocurrency exchange. | No |

| 3774 JP | Internet Initiative Japan | 841 | 16.2% | Provides Internet connection services for businesses. Preparing Bitcoin services. | No |

| 6172 JP | Metaps | 365 | (24.6%) | Develops advertising platforms for smart phones. Potentially preparing for its own cryptocurrency exchange. | No |

| 3825 JP | Remixpoint | 322 | 359.9% | An electricity retail business, energy-saving consulting. and used-car business. BITPoint Exchange business. | No |

| 2315 JP | CAICA | 231 | (7.7%) | Provides information-systems solution services for financial and telecommunication industries. Issues a cryptocurrency “Caica”. | No |

| 3696 JP | Ceres | 216 | 34.8% | Provides Internet marketing services. Operates CoinTip service. | No |

| 3853 JP | Infoteria | 177 | 47.6% | Provides software development based on XML. Issues a cryptocurrency “Zen”. | No |

| 8732 JP | Money Partners | 133 | (18.0%) | Provides foreign-exchange transactions. Alliance with the Kraken exchange. | No |

| 3807 JP | Fisco | 125 | 22.4% | Provides financial information. Exchange and deal with MonaCoin. | No |

| 8704 JP | Traders Holdings | 120 | (8.7%) | Provides financial services through Internet and call centers. Quoinex exchange business. | No |

| 3121 JP | MBK | 102 | 36.7% | Provides loans and investments services for firms and real estates in Japan and China. Invested in BTCBOX exchange | No |

| 3808 JP | OKWave | 43 | 36.6% | Q&A community website OKWave. Potentially preparing for its own cryptocurrency exchange. | No |

| Taiwan | |||||

| 2377 TT | Micro-Star | 2,058 | 5.6% | Also known as MSi. Manufactures and markets motherboards, graphics cards, and other computer peripherals. | No |

| 2376 TT | Gigabyte Tech | 1,102 | 28.8% | Manufactures and markets computer motherboards | No |

| 3515 TT | AsRock | 296 | 100.6% | Develops, designs, and retails motherboards | No |

| 2399 TT | BioStar Micro | 84 | 70.5% | Manufactures and markets computer motherboards and interface cards | No |

| 6150 TT | TUL Corp | 68 | 312.3% | Develops, manufactures, and markets graphics cards, multimedia products, and interface cards | No |

| United States | |||||

| NVDA US | Nvidia | 116,085 | 80.2% | Designs, develops, and markets graphics processors and related software. | No |

| AMD US | AMD | 9,928 | (9.3%) | Manufactures semiconductor products. | No |

| GBTC US | Bitcoin Investment Trust | 5,139 | 2,383.0% | Trust invested exclusively in Bitcoin. | Yes |

| RIOT US | Riot Blockchain | 275 | 732.7% | Buys cryptocurrency and blockchain businesses, and supports blockchain-technology companies. | Yes |

| SSC US | Seven Starts Cloud Group | 262 | 241.5% | Provides artificial-intelligence, blockchain and fintech-powered digital-finance solutions | No |

| MGTI US | MGT Capital | 204 | 475.3% | Operates a portfolio of cybersecurity technologies. | Yes |

| DPW US | Digital Power | 103 | 686.4% | Designs, develops, manufactures, and markets switching power supplies for sale to manufacturers of computers and other electronic equipment. | No |

| Canada | |||||

| HIVE CN | Hive Blockchain | 636 | n/a | Operates as a cryptocurrency-mining firm. | Yes |

| BTL CN | BTL Group | 197 | 991.7% | Develops blockchain technologies. | Yes |

| CODE CN | 360 Blockchain | 33 | 600.0% | Invests in blockchain-based technology. | Yes |

| Australia | |||||

| DCC AU | Digitalx | 106 | 495.7% | ICO advisory and blockchain consulting services | Yes |

(Source: Bloomberg, BitMEX Research)

Disclaimer

This piece does not constitute investment advice. You should do your own research before deciding to make any investments.