BitMEX Alpha: Dovish Powell, Watch ETH @$4,800

TL;DR

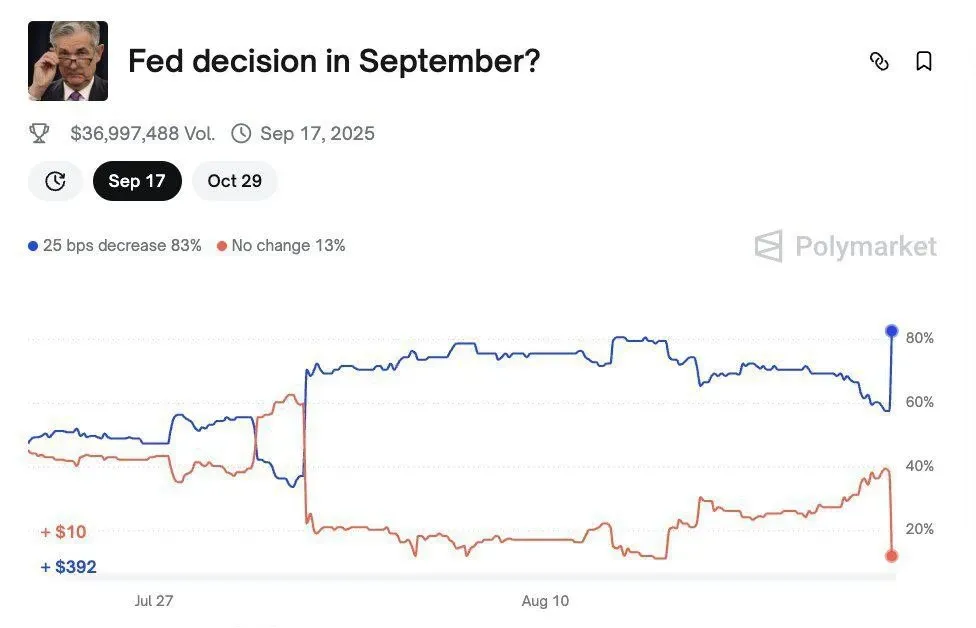

- Macro: Powell’s Jackson Hole remarks tilted dovish, with markets now pricing roughly an ~80% chance of a September cut.

- Next checkpoints: PCE (this week) and payrolls (next week) to confirm the path.

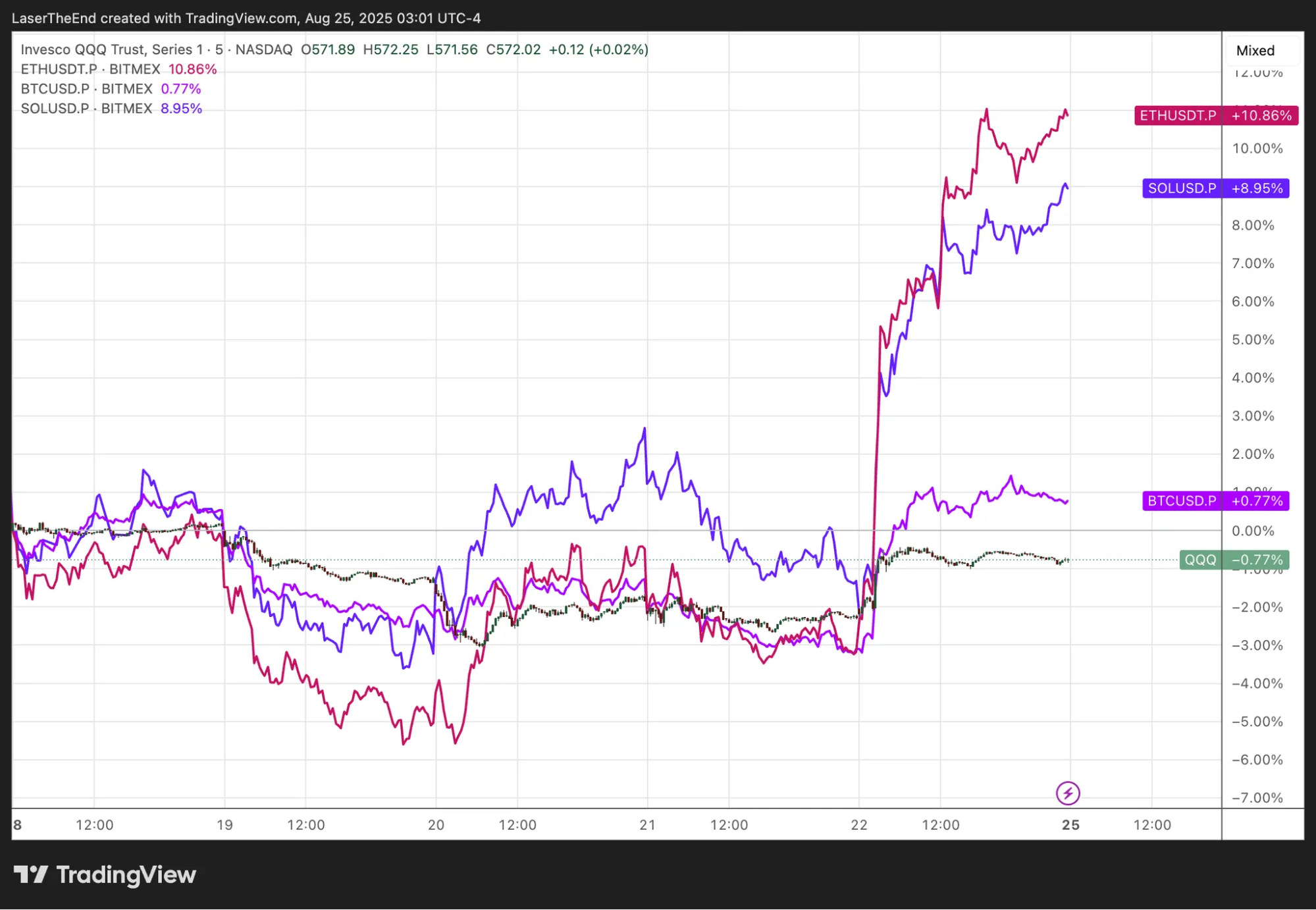

- Leaders/Laggards: ETH tagged ~$4,950 intraday and is re-testing the $4,800 supply zone; SOL extended above $200 with the cleanest trend; BTC lags around $112–115k as flows concentrate in ETH/SOL.

- Flows: U.S. BTC spot ETFs saw heavy mid-week outflows last week (e.g., −$523M Tue), while ETH spot ETFs had large outflows early (e.g., −$429.6M Tue) but strong late-week inflows (e.g., +$287.6M Thu, +$337.7M Fri), underscoring tug-of-war positioning.

Macro Setup — Dovish Powell

Powell emphasised rising downside risks to employment and policy flexibility—markets read this as a green light for a September 25 bp cut. Fed-sensitive assets rallied while the dollar retreated; traders now lean ~80% for a cut, with eyes on core PCE and August payrolls to seal the deal.

Crypto Structure & Levels

- ETH: Printing higher highs; $4,800–4,950 is the near-term supply band. A daily close above $4,800 with follow-through opens $5,000+. First supports: $4,500 / $4,350.

- SOL: Trend leader; after reclaiming $200, momentum targets $220/240 if pullbacks hold $195–200.

- BTC: Stuck in $112–116k; persistent relative weakness vs. ETH/SOL might be a “bull-tail” behavior—late-cycle exuberance in alts while Bitcoins lags.

Pair-Trade Ideas

Long SOL / Short ETH

- Why: Capital rotation into high-beta L1s; trend & breadth favour SOL over ETH.

- Risk control: Cut if SOL loses $195 or if ETH reclaims relative strength for 2–3 sessions.

What to Watch This Week

- Polymarket & Fed funds odds: Does the September-cut stay near ~80% or fade on data?

- ETH at $4,800: Break-and-hold vs. rejection back into the prior range.

- ETF daily prints: Signs of sustained ETH inflows and stabilising BTC outflows would support a “risk-on” continuation.

- CME positioning & ETH staking queue: Any covering in ETH futures short positions or ETH increase staking queue will help ETH push through its all-time-high.