Copy trading on BitMEX offers an incredible opportunity to leverage the expertise of top-performing traders and potentially boost your crypto derivatives portfolio. However, the success of your copy trading journey hinges significantly on one crucial decision: choosing the right Copy Leader.

With a marketplace of diverse traders, how do you pick the one that aligns with your goals and risk tolerance? This guide will break down the essential criteria to consider when selecting a Copy Leader on BitMEX.

Why Your Choice of Copy Leader Matters

Think of a Copy Leader as the driver of your investment. Their decisions, strategies, and risk management directly impact your capital. A well-chosen leader can lead to consistent profits, while a poor choice can lead to significant losses. Therefore, approaching this selection process diligently is paramount.

Key Criteria for Selecting a Copy Leader on BitMEX

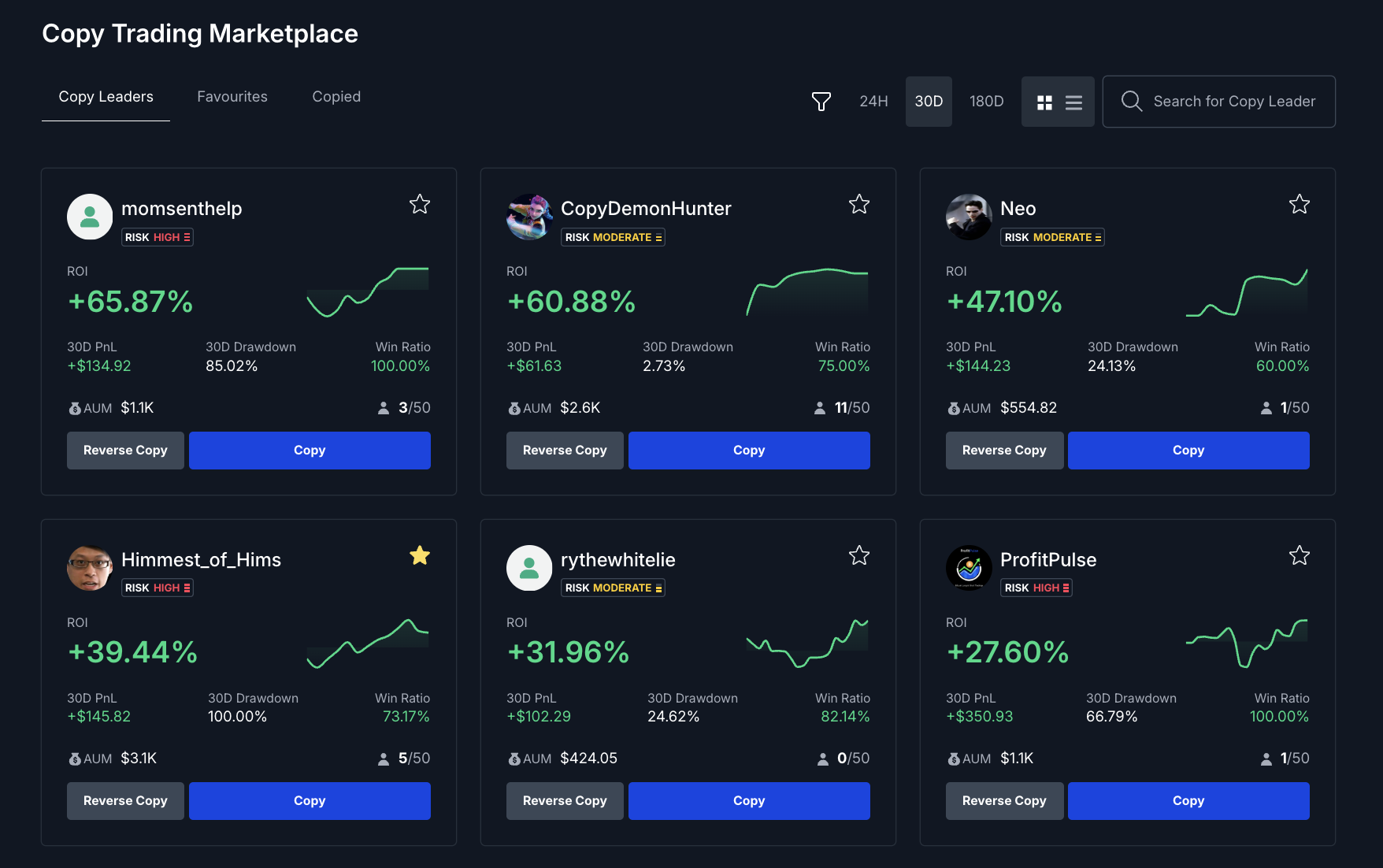

BitMEX provides a transparent marketplace with various metrics to help you make an informed decision. Focus on these key areas:

1. Performance Consistency, Not Just High Returns

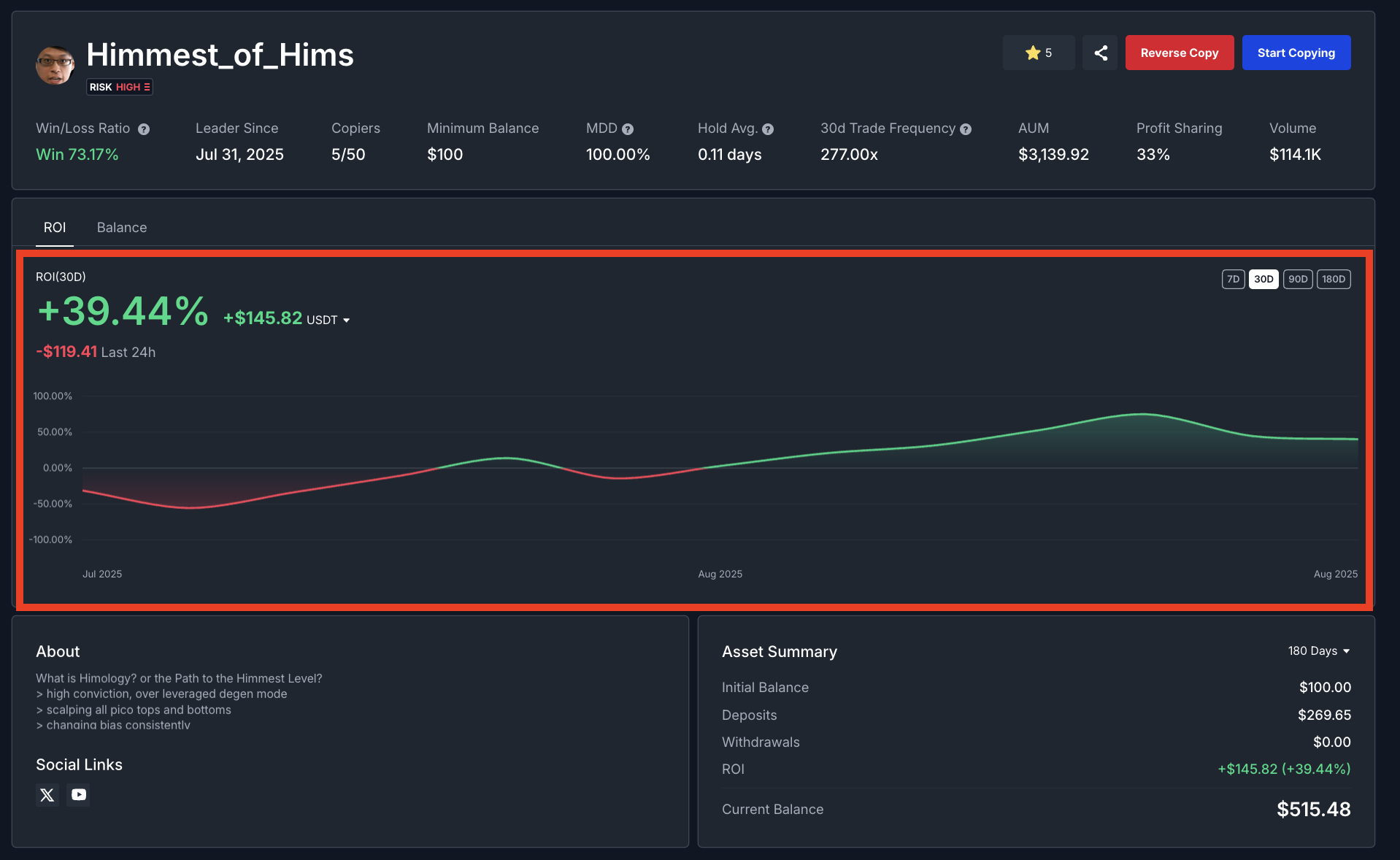

It’s easy to be dazzled by Copy Leaders with exceptionally high Return on Investment (ROI) figures. However, a single massive win could skew their overall performance. Look for consistency and stability over time.

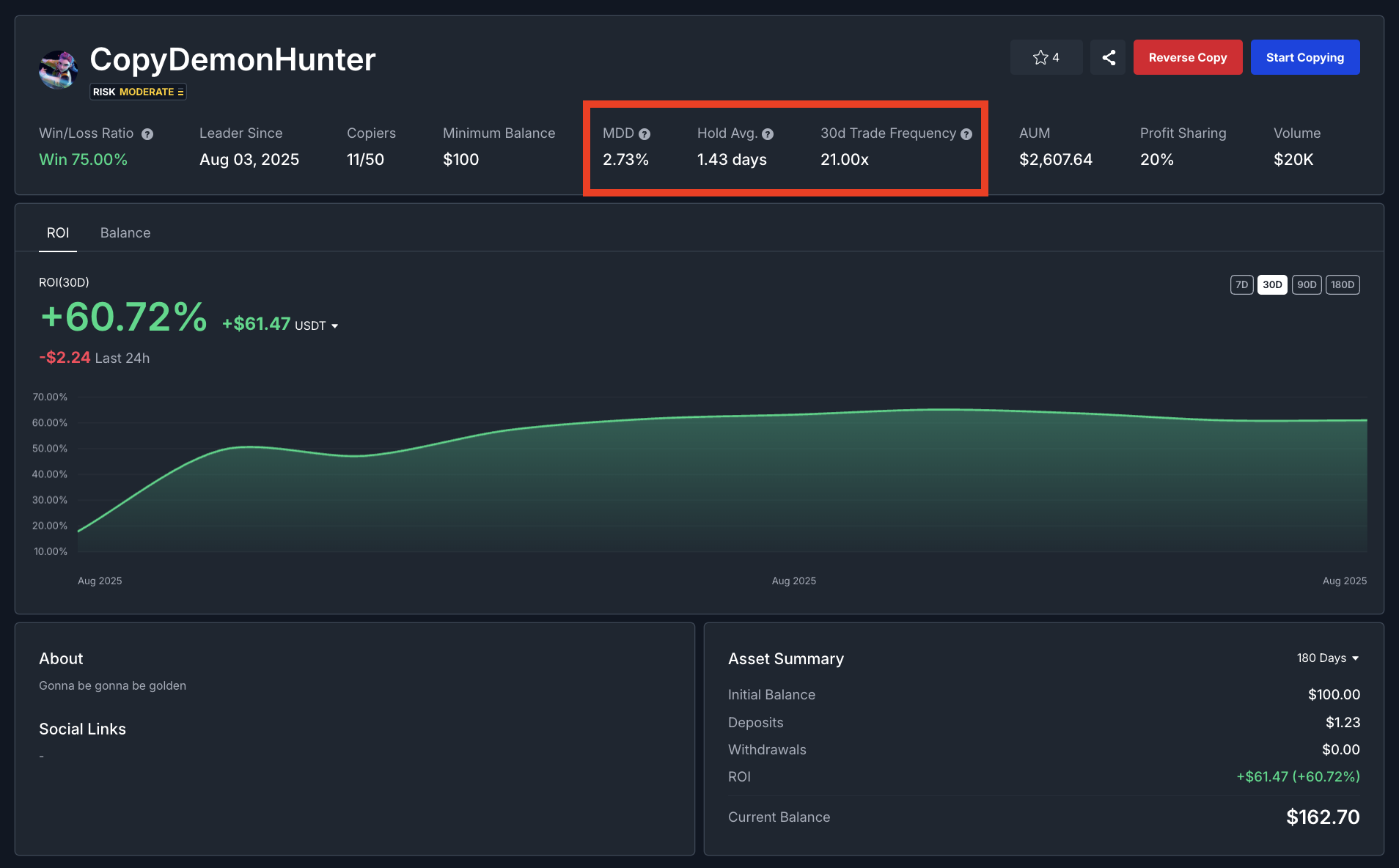

- Review Multiple Timeframes: Don’t just look at 7-day or 30-day ROI. Analyse their performance over longer periods like 90 days, 180 days, or even their entire trading history. A Copy Leader who consistently delivers moderate, steady returns across different market conditions (bullish, bearish, sideways) is often a safer and more reliable choice than someone with erratic, high-risk spikes.

- Overall Portfolio Growth: Examine the overall growth curve. Did their portfolio grow gradually and steadily, or did it see rapid increases followed by sharp declines? Consistency indicates a disciplined strategy.

2. Understand Their Risk Profile

High returns often come with high risk. It’s crucial to ensure a Copy Leader’s risk appetite matches your own risk tolerance.

- Maximum Drawdown (MDD): This metric shows the largest percentage drop from a peak in the Copy Leader’s account value. A lower drawdown percentage indicates better risk control and disciplined trading. If you’re risk-averse, prioritise leaders with historically low drawdowns.

- Position Sizing: Does the Copy Leader take excessively large positions relative to their capital? This can indicate higher risk. While BitMEX supports up to 250x leverage on some products, responsible Copy Leaders typically manage their leverage thoughtfully.

- Trading Style (Trade Frequency and Average Holding Time):

- High-frequency traders (scalpers): Execute many quick trades daily. This can lead to faster turnover but might involve more risk and higher cumulative trading fees.

- Low-frequency traders: Focus on fewer, more deliberate trades with longer holding times. This might mean slower but potentially steadier growth. Choose a style that aligns with your investment objectives.

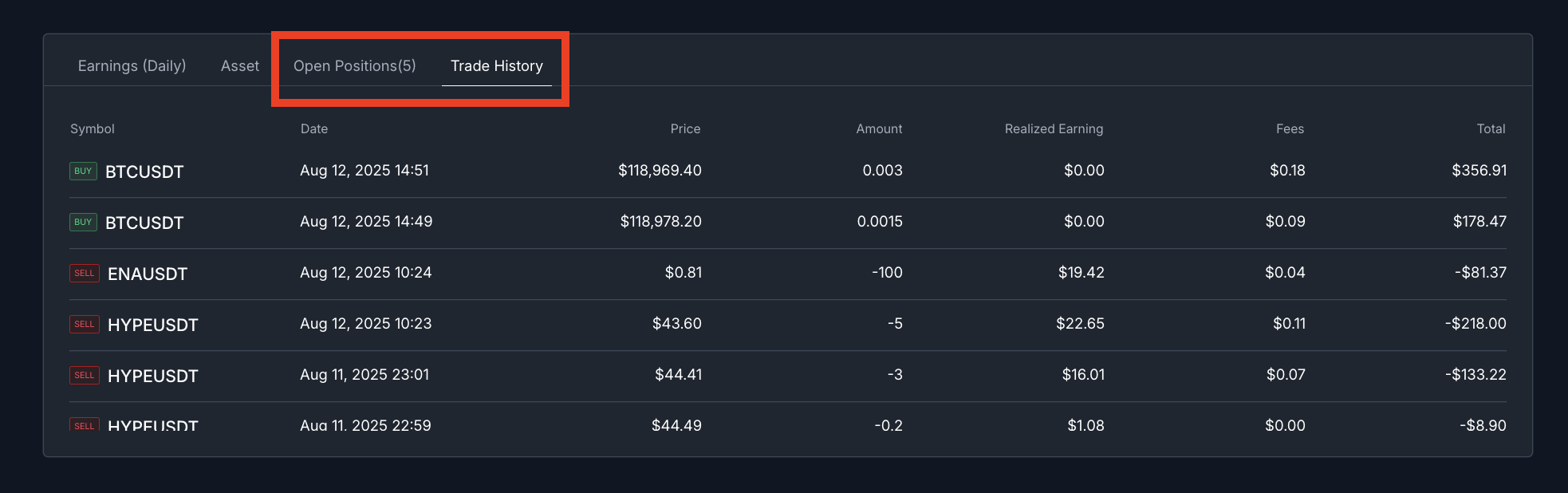

3. Analyse Their Trading Assets and Diversity

- Asset Focus: What trading pairs does the Copy Leader primarily trade?

- BTC/ETH Focus: Traders concentrating on Bitcoin (BTC) or Ethereum (ETH) typically face lower volatility compared to smaller altcoins. These strategies might be more stable and suitable for risk-averse investors.

- Diversification of Assets: If a Copy Leader’s overall strategy involves diversifying across multiple major assets, this can be a positive sign (P.S. BitMEX vets for liquidity).

- Number of Open Positions: Does the leader frequently have many open positions, or do they focus on a few at a time? This can give insight into their concentration risk.

4. Evaluate Community Confidence and Transparency

While performance metrics are objective, community sentiment can offer additional insights.

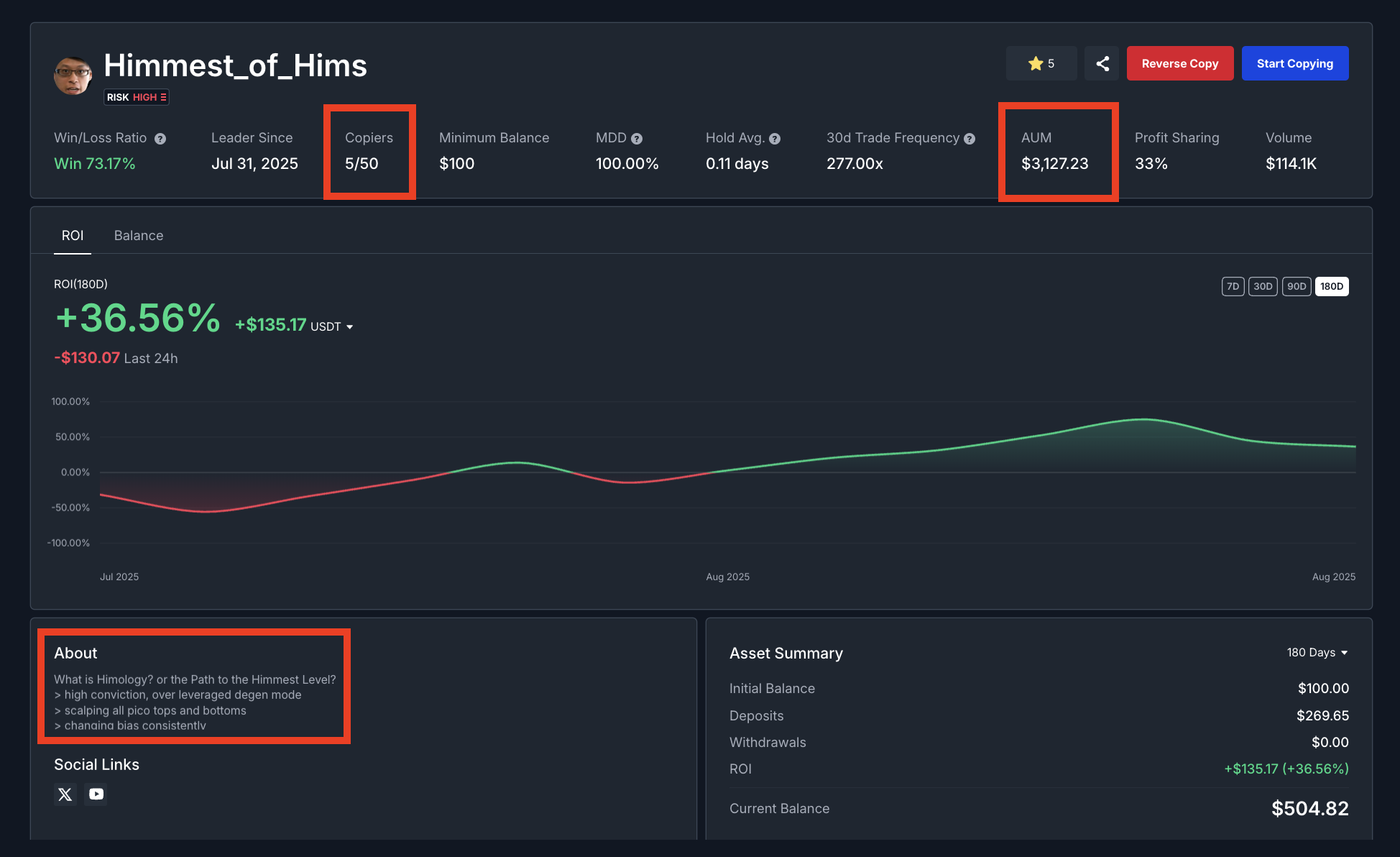

- Number of Copiers: A high number of followers suggests a level of trust from the community. However, don’t let popularity be your sole criterion – always verify profitability and risk management independently.

- Assets Under Management: This metric reflects the total capital a Copy Leader manages, including their own funds and the combined funds from all their copiers. A larger AUM indicates higher confidence from copiers, as many have entrusted their funds to the leader.

- Copy Leader Introduction/Description: Many Copy Leaders provide an introduction about their strategy and approach. Look for transparency and a clear explanation of their trading philosophy. Avoid leaders who make unrealistic promises.

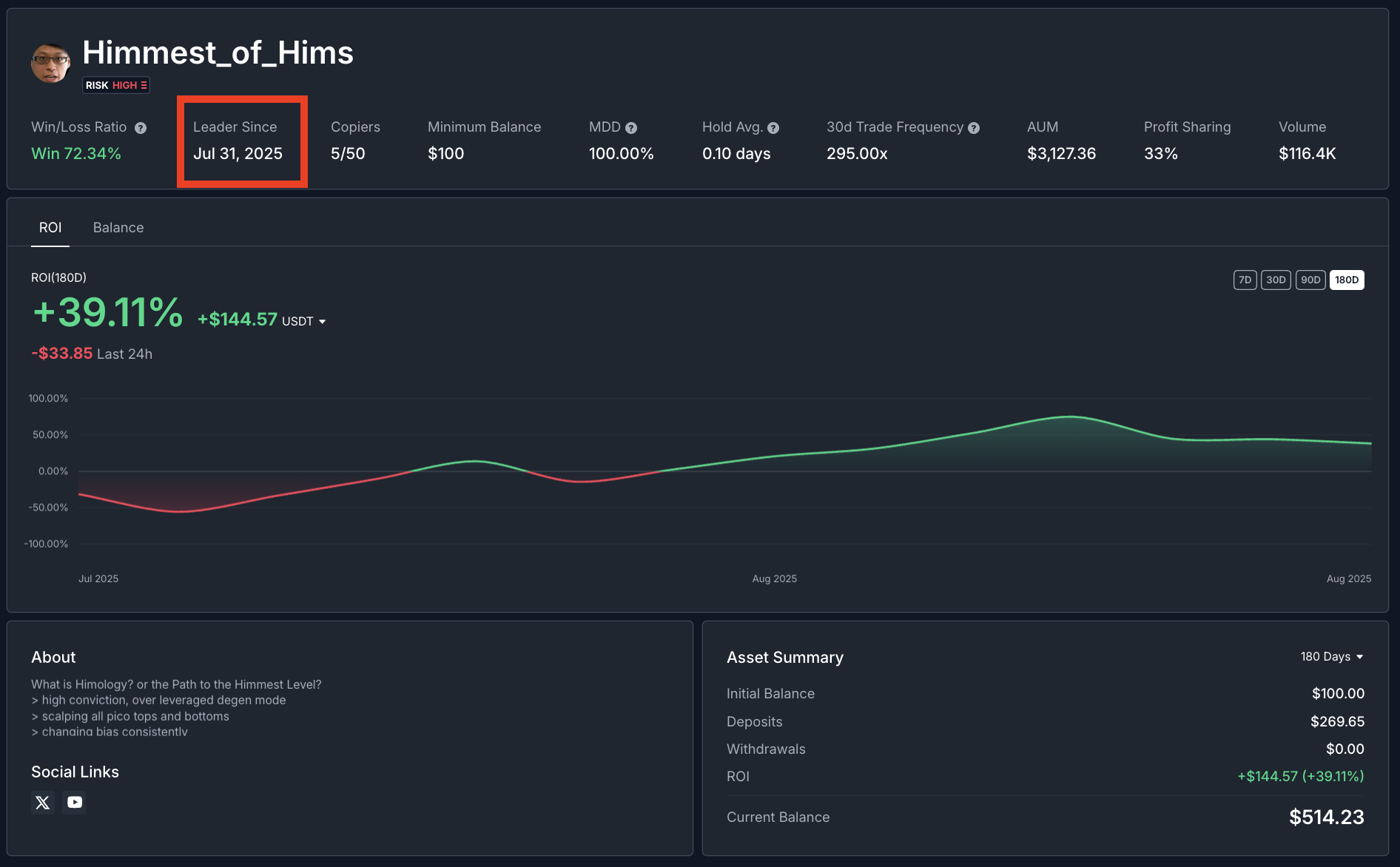

5. Consider Their “Time in the Market”

Experience matters, especially in volatile crypto markets.

- Longer Trading History: Prioritise Copy Leaders with a considerable trading history, ideally at least a year or more. This allows you to assess their performance across various market cycles (bullish, bearish, sideways) and see how they adapt.

- Proven Track Record: A trader who has consistently performed well over a long period demonstrates a robust strategy that can withstand different market conditions.

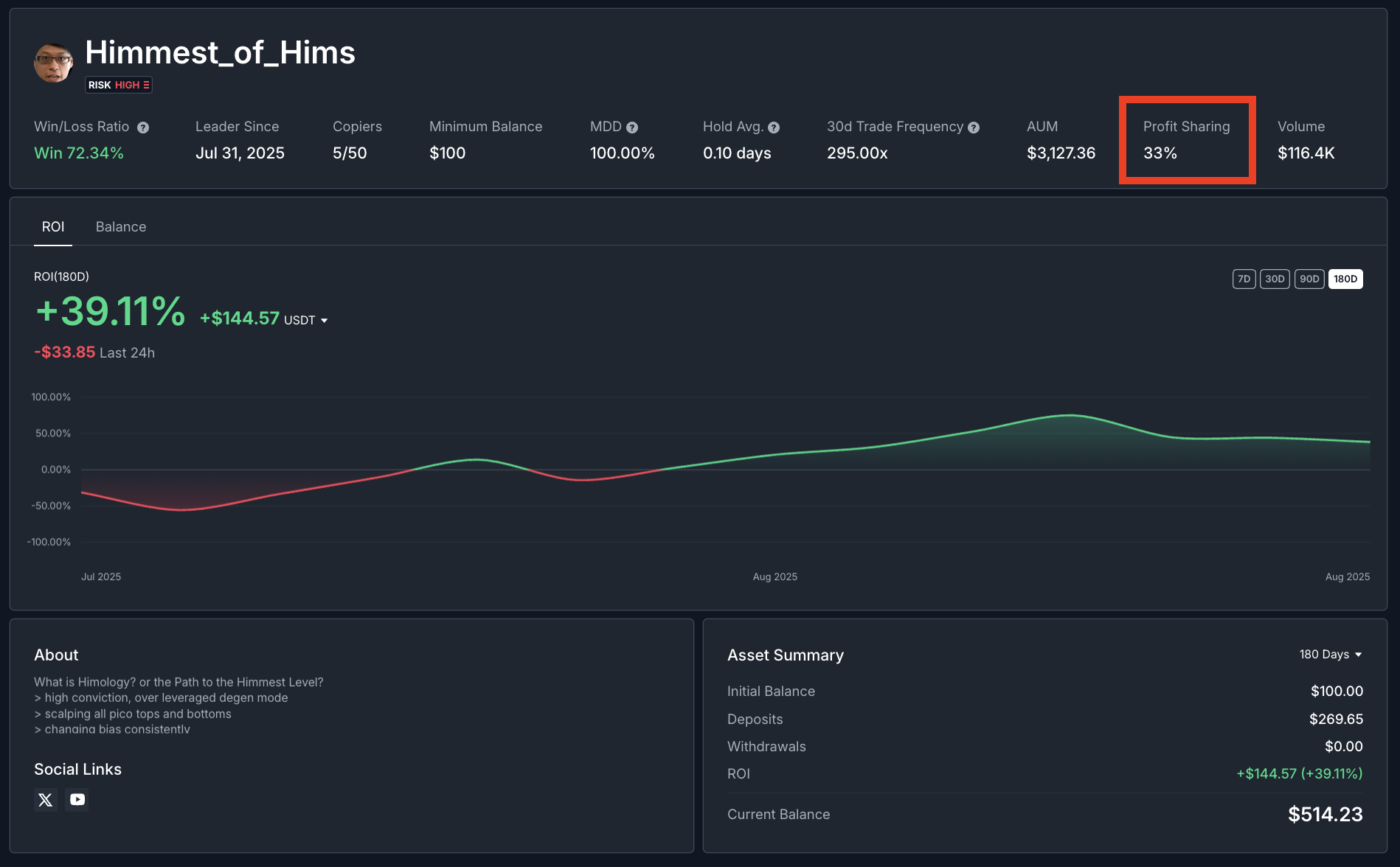

6. Profit Share Rate

Copy Leaders on BitMEX can set their profit share rates from 1% to 50%.

- Factor into Your Expected Returns: Understand that this percentage will be deducted from the profits you make. While a lower profit share might seem more attractive, don’t let it overshadow the leader’s actual performance and risk profile. A leader with a slightly higher profit share but consistently better and safer returns might be more profitable in the long run.

How to Access This Information on BitMEX

BitMEX’s is designed to provide you with all the necessary data:

- Copy Trading Marketplace: Browse and filter Copy Leaders based on various performance metrics.

- Leader Profile Pages: Click on any Copy Leader to view a detailed breakdown of their trading statistics, historical performance graphs (ROI and Balance), asset status, open positions, and trade history.

- “Favourites” Tab: Use the star icon to bookmark leaders you’re considering for easier comparison.

Final Tip: Start Small and Diversify

Even after rigorous selection, remember that copy trading carries risk. As a beginner:

- Start with a small amount you’re comfortable with losing.

- Diversify your capital across multiple chosen Copy Leaders to spread your risk. You can copy up to 5 Copy Leaders on BitMEX.

- Always set your own Stop Loss and Take Profit levels to maintain control over your risk exposure.

By carefully evaluating these criteria and implementing sound risk management, you can significantly increase your chances of a successful and profitable copy trading experience on BitMEX.

Looking for more information? We’ve got a range of educational resources to guide users through topics such as Copy Trading and more. You can find them under the Copy Trading section of this page.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

In the meantime, if you have any questions please contact Support who are available 24/7.