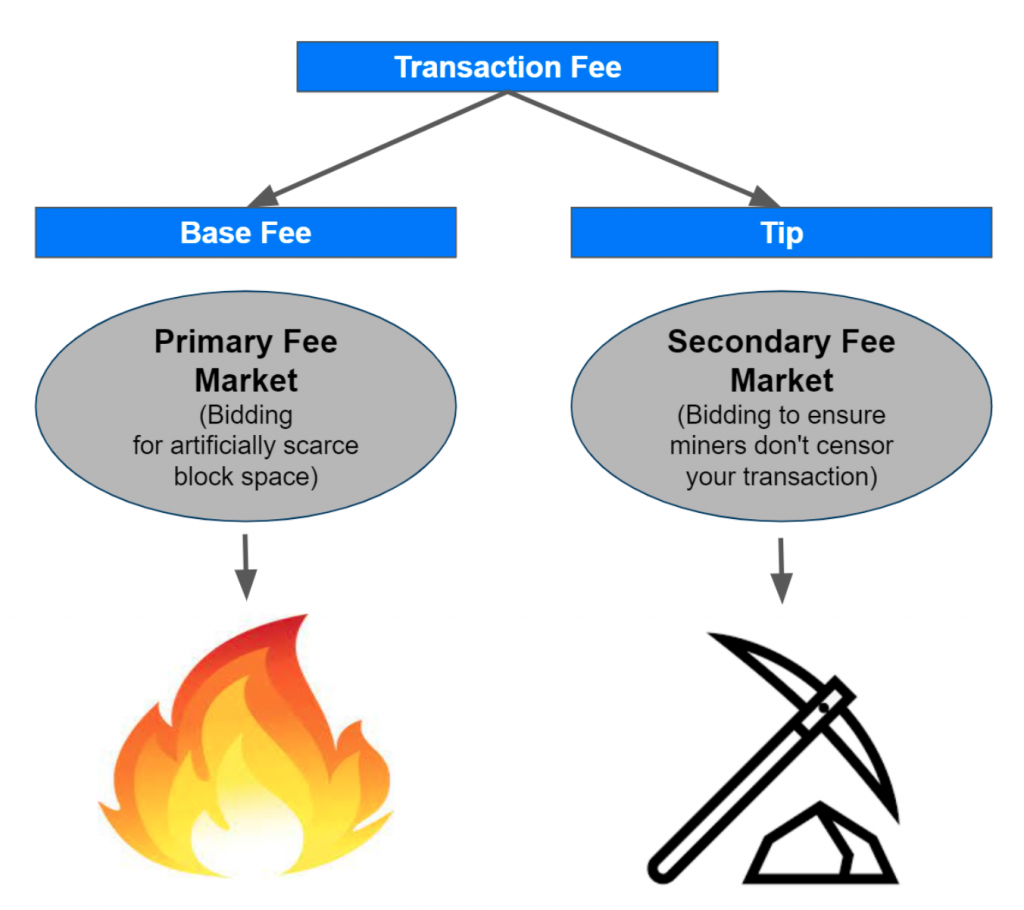

Abstract: We evaluate the theory behind the new Ethereum transaction fee mechanism, EIP-1559. Under the new model there are two elements to the transaction fee, a base fee which is burned, and a tip, which is allocated to block producers. The base fee is determined by the allocation of scarce block space to users, while the tip can be determined by other fee market considerations, such as preventing transactions from being censored. EIP-1559 therefore removes the link between transactional demand and the incentivisation of the consensus agents, to some extent, which could improve the stability of the network. The new mechanism should improve the user experience, ensuring users know with more precision what transaction fee they need to pay in advance. We conclude by arguing that as long as scarce blockspace remains the most significant driver of fees, EIP-1559 should improve the user experience as designed. On the other hand, if other factors begin to drive the fee market, some of the benefits of EIP-1559 could be lost and the upgrade could result in higher transaction fees.

Transaction Fee Overview

When evaluating new transaction fee proposals such as EIP-1559, it is important to consider the purpose of transaction fees on a blockchain network such as Bitcoin or Ethereum. There are various different potential reasons for transaction fees. In the table below (Figure 1) we have provided what we believe to be a full list of potential reasons a transaction fee may be necessary. It is using this framework that we will evaluate EIP-1559. It should be noted that EIP-1559 is not currently active on Ethereum and activation is expected to occur during the next hardfork upgrade.

Figure 1 – Rationale for blockchain transaction fees

| # | Component | Explanation |

| 1 | Allocation of limited blockspace | Most blockchains have an arbitrary limit on block space available, imposed by the protocol. This ensures that validation costs remain low enough such that ordinary users can afford to fully validate the chain and enforce the protocol rules. The idea is that blockspace is a scarce resource allocated by a transaction fee market, which ensures users who obtain the highest utility from the blockchain are the ones who use it, since they bid the highest price per unit block space. |

| 2 | Incentivising consensus agents (Miners or stakers) | Distributed blockchains require consensus agents to produce blocks and then to build on top of them. This is necessarily an expensive process, to ensure the network is resilient against third party attackers attempting to re-org the chain. These consensus agents (miners or stakers) require incentivisation, to ensure they allocate considerable resources to this process and cover any costs. Transaction fees are often used to fund this. This component is somewhat unique, as the benefits here are shared across the network, rather than being wholly attributable to the entities involved in the transaction. This can create potential problems. In some ways, EIP-1559 can be said to solve, or perhaps exploit, this problem. |

| 3 | Censorship resistance | Miners or consensus agents could exclude certain transactions if they are under pressure from regulatory authorities or they wish to exclude transactions for any other reason. A transaction fee can provide an opportunity cost, which must be borne if the transaction is excluded. |

| 4 | The cost to the block producer of including the transaction | Miners or block producers have a marginal cost to bear from including each transaction, the additional orphan/uncle risk of a slightly larger block being broadcast. This cost is believed to be reasonably low, however transaction fees are needed to compensate block producers for this cost. |

| 5 | To outbid any conflicting/competing transactions | Transactions could be competing with each other to be the first to get into a block. For example in Bitcoin this could be a 0 confirmation double spend attempt or in Ethereum’s Defi, it could be an attempt to get ahead of a competing order on a distributed exchange. These competing or conflicting transactions could include a high fee, in an attempt to outbid each other. In Ethereum there is an effort to mitigate this problem called Flashbots. |

Throughout most of the history of Bitcoin and Ethereum, by far the most dominant driver of transaction fees, is component 1 in the above table, allocating scarce block space to the highest bidder. More recently component 5 has become somewhat relevant in Ethereum, as Defi users often try to outbid competing transactions, however this is still dwarfed in significance compared to the impact of Ethereum’s overall gas limit. For simplicity, for the rest of this report we lump components 3, 4, and 5 together, and call it “Censorship resistance”. The dynamics of these three components are reasonably similar to each other when considering the incentives in EIP-1559. In this report we will evaluate EIP-1559 using a theoretical framework, without considering actual data on the Ethereum mainnet.

An interesting aspect to note is that a transaction fee can pay for multiple of these components at the same time, for example a Bitcoin transaction with a US$10 fee, could be enough to outbid other users in the battle for blockspace and at the same time help incentivise miners.

EIP-1559 Overview

The core characteristic or objective of EIP-1559 is to improve the user experience when setting transaction fees. The basic problem is that fee market conditions can be volatile and therefore it can be challenging for users or wallets to know an appropriate transaction fee. At the same time, once a transaction fee is chosen there are no guarantees, for example a user could set what they believe to be a sufficient fee, then market conditions could change and they may need to wait a significant amount of time for a confirmation.

EIP-1559 addresses this problem by defining an element of the fee, the base fee, using historic blockchain data, which makes it predictable. Therefore everyone knows with a high degree of certainty what the base fee should be and users should have a reasonable degree of assurance that the transaction will be quickly confirmed if this base fee is paid. Under EIP-1559, transactions must include a certain minimum amount per unit gas (the base fee), otherwise the transaction is invalid.

In order to achieve this, the block space limit (gas limit) is allowed to vary. EIP-1559 contains parameters such as a target gas limit and a gas limit upper bound (2x the target). If blocks use up more gas than the target, the base fee increases, until demand for use of Ethereum usage declines and the average gas usage per block reaches the target. If usage of Ethereum is below the target gas limit, then the base fee declines and usage of Ethereum should increase. Therefore, rather than the amount of Gwei a user needs to pay being unclear and varying dramatically per block, for the base element of the fee, everyone can set the same value.

In addition to the base fee, there is another element of the fee called the tip. There is no protocol set minimum for the tip.

Fee Burn

If the base fee went to the miners, the above proposal would be very weak for two reasons:

- Fee rebates – Users could evade the base fee by having an out of bound side agreement with the block producers. For example if the base fee was 100 Gwei, the block producers could return 50% of this (50 Gwei) to the user, thereby evading the base fee and undermining the scheme.

- Manipulating the base fee upwards – Block producers could also manipulate the base fee up, increasing their earnings, by filling blocks they produce with transactions. Some in the Ethereum community seem to disregard this theoretical weakness, arguing that miners could always form a cartel and drive up transaction fees anyway. However, we believe this would have been a major weakness in the protocol, as it could help solve the coordination problem associated with a cartel and ensure that non mining nodes enforce the minimum price rules.

Due to the above two factors, the base fee is not allocated to the block producers. Instead the base fee is burned and therefore the critical weaknesses of EIP-1559 mentioned above are not significant issues. The proposal is therefore reasonably strong.

Recently people have been arguing that this fee burn mechanism is positive for Ethereum token holders, because it can result in a lower token supply and thereby boost the price. This does seem to be a key strength of the proposal. Demand for Ethereum transactions is currently growing exceptionally fast and users are spending vast sums of money on transaction fees (Perhaps around 3x Bitcoin in 2021 YTD). This provides an opportunity to burn some tokens and reduce the token supply, while potentially still having plenty of capacity remaining to finance network security. However, these token economic advantages do not seem to be a design goal and the token burn seems necessary to ensure the mechanism works. If lowering token supply was an objective, a more simple measure of just removing the block subsidy could have been considered.

The economic dynamics of the burn model are interesting. For example, if demand for Ethereum transactions increases (the velocity of money increases), the amount of tokens that get burned increases, which could cause monetary deflation. On the other hand if demand for Ethereum transactions declines, the amount of tokens that get burned also declines, which could result in monetary inflation and a potentially needed economic boost to the system. However this monetray framework may be the wrong way of looking at it. Ethereum can also be viewed as an equity and the burn as a buyback. If demand for Ethereum transactions is strong, the company conducts a buyback and the token price could increase. If demand for Ethereum usage is low, the company could conduct an offering and the price of the token should decline. Using this framework, the burn can be thought of as procyclical rather than countercyclical.

Analysing Incentives

Before analysing the fee incentive model under EIP-1559, it is worth evaluating the status quo block producer incentivisation model. While the EIP-1559 model appears risky and complicated, it is worth noting the substantial challenges, controversies and uncertainties with the existing incentivisation model.

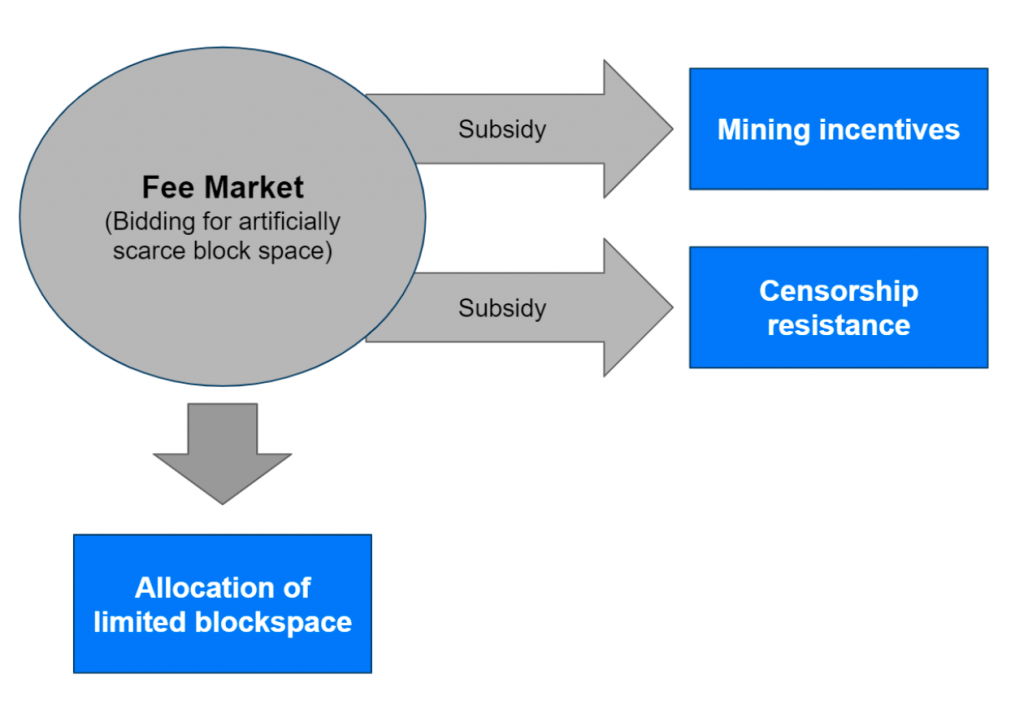

Currently, in Bitcoin and Ethereum the price users pay for transactions is primarily determined by the market for block space. This is considered a good way to allocate block space, since the users who benefit the most from using the blockchain would pay the highest fee. The allocation is therefore effective and considered utilitarian. However, since these fees are allocated to block producers, there are also “side benefits” of these transaction fees. Figure 2 below illustrates this.

Figure 2 – Potential Bitcoin transaction fee market incentivisation model (When the block subsidy becomes insignificant)

Figure 3 below contains example transaction data. A transaction pays a fee of US$10, driven by the market for block space. The user would also need to pay a fee of $2, to ensure block producers have high enough opportunity cost when considering excluding the transaction. In this scenario the user pays a $10 fee, $8 higher than necessary to prevent censorship. In theory, the fee paid is the higher of the amount required by each of these two components.

Of course many people ignore these other components of fees, such as a censorship resistance payment, because it is currently relatively small or near zero. However, it could become more relevant over time, or perhaps even replace the allocation of scarce block space as the most expensive component. For example, Marathon Digital Holdings has recently launched a new Bitcoin mining pool that produces what it calls “OFAC compliant” blocks.

Figure 3 – Transaction fee model prior to EIP-1559 (Illustrative figures)

The fee which results from the bidding for block space has a secondary side benefit, in addition to censorship resistance. It also helps with miner incentivisation. In this area there is a potential problem, if the necessary fee required to incentivise network security is greater than both of the two other components, users may not pay this amount. This is because there may be a tragedy of the commons type situation, with people hoping others pay for the fee necessary to secure the network. This could be a major problem Bitcoin potentially faces in the long run, as the block subsidy declines and security may therefore be insufficient. EIP-1559 attempts to mitigate this problem by having a perpetual block subsidy contribute to financing security.

On the other hand, one can argue that this isn’t actually a problem. If there is not enough demand from users to use the network, then security should decline. Afterall, Bitcoin and Ethereum do not exist for the sake of it, the point of security is to secure transactions. If there are no transactions then no security is required. In the case of proof of work networks, an arbitrarily high perpetual block subsidy could be said to cause an arbitrarily high level of environmental damage, rather than the more egalitarian model of security being funded through organic user demand. Therefore, although there is little doubt ensuring the funding of security is a major challenge for Bitcoin, one can argue that directly trying to address the problem is the wrong path. Instead one should just focus on making Bitcoin more popular and successful in general, which will therefore result in enough transactional demand to secure the network.

It should be noted that this “side benefit” fee model idea is controversial within Bitcoin and not universally accepted as the best way forward nor is it universally accepted that this is how the network actually operates. For example during the blocksize war, many large blockers argued against a blocksize limit, arguing that the artificial scarcity of block space to ensure users could validate the blockchain was not necessary. Large blockers typically considered the idea that block space should be constrained even further, to cross-subsidise mining incentives, as an even less palatable idea.

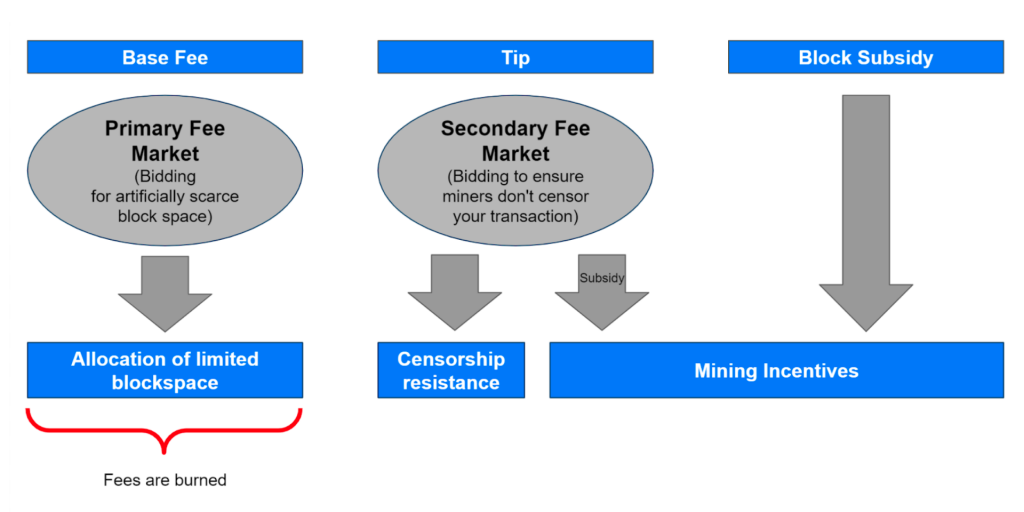

EIP-1559 is a fundamental change in the incentivisation model. There are no longer any side benefits from the market for block space and the components of the fee market are split out more cleanly, as Figure 4 below illustrates. Therefore, in our view, the most significant economic characteristic of EIP-1559 is the decoupling of the various components of the transaction fee into separate markets.

Figure 4 – EIP-1559 transaction fee market incentivisation model

EIP-1559 is not as clean as the above model suggests. It can take time for the base fee to adjust and reflect changing market conditions. During this adjustment process, the fee model under EIP-1559 essentially reverts back to the old model and the tip becomes significant. Most of the benefits (usability) of EIP-1559 are then lost. This may be the case under scenarios when demand for gas is highly volatile, which does currently appear to be the case quite often. However, much of this volatility could be driven by second order effects, reactions to changing gas prices. EIP-1559 may dappen these effects making gas prices more stable. In reality EIP-1559 could result in a middle ground, with the tip partly driven by some block space constraints. Therefore EIP-1559 may be more moderate than many may think.

Anyway, in the long run, it might be reasonable to expect the volatility of the Ethereum fee market to decline and become more stable. When and if this occurs, the market for block space may become decoupled from the other components of the fee market, for example financing security or ensuring censorship resistance. One can argue that this is a positive development, since breaking this components down into separate parts has several benefits:

- In some respects the fee model economics under EIP-1559 are less complex, as it is no longer reliant on a controversial and somewhat unproven “side benefits” concept.

- It may be easier to ensure that each component has sufficient funding.

The main weakness of the EIP-1559 model appears to be a potential loss in efficiency. Before EIP-1559 users had an opportunity to use the same transaction fee to achieve multiple objectives, potentially killing two (or even three) birds with one stone. The ability to do this under EIP-1559 is now greatly diminished and therefore transaction fees could increase. As an example please see Figure 5 below. The total transaction fee has now increased to US$12, compared to the US$10 paid in Figure 3. Under EIP-1559 the transaction fee could be the sum of various components, rather than the highest of the components.

Figure 5 – Transaction fee model under EIP-1559 (Illustrative figures)

Of course this efficiency loss may be somewhat theoretical. Currently high fees on Ethereum are partly driven by the bad user experience and fee rate volatility. EIP-1559 should improve this. Therefore EIP-1559 may actually lower fees in the short run. However, in theory, in the long run, EIP-1559 may result in higher fees. Another argument is that EIP-1559 does not result in an efficiency loss at all. Users should be required to pay for all the benefits of their transaction individually and not get “side benefits” or multiple benefits, while only paying for the most expensive feature.

Another potential weakness of EIP-1559 is that the block subsidy may now become a more significant driver of block producer (miner or staker) incentivisation. The block subsidy is an arbitrary level set by the protocol and no longer dynamically adjusts based on transactional demand. Incentives for the consensus agents could therefore be too low or even too high. Of course, even under the old model, incentives could still be set at an inappropriate level, however now the chances of reaching the “correct” level may be even more remote.

Relative Size of Fee Market Components

When assessing the strengths and weaknesses of EIP-1559, it largely depends on how one sees the relative significance of the various reasons for transaction fees and how these will evolve over time. These components are outlined in the table in Figure 1 in this piece. If one thinks reason 1 is likely to remain dominant, EIP-1559 is probably a strong proposal. However, if one thinks components 3, 4 and 5 will become more significant, EIP-1559 may have limited benefits. The table below attempts to illustrate this.

| Base Fee 100x the Tip | Base Fee ≈ Tip | |

User experience | The fee is mostly predictable and users know how much they need to bid. This results in a stronger user experience. | The user experience benefits of EIP-1559 appear to me mostly lost. However, the user experience is no worse than it was before EIP-1559. |

Price increase | EIP-1559 is unlikely to result in significantly higher prices. In theory the price increase should be less than 1%. | In theory, EIP-1559 should result in large increases in transaction fees. This could reduce demand for Ethereum transactions, resulting in a new equilibrium with less usage. |

Miners Manipulating The Base Fee To Zero

Another potential weakness of EIP-1559, often discussed, is the idea of miners forming a cartel and manipulating the base fee down to zero. This way the miners could keep all the fees to themselves. Alternatively miners could try to engineer volatile base fee market conditions, ensuring the tip becomes a more significant component of the fees. This potential problem has already been widely analysed and therefore we will not go into too much detail here. There is some risk here, however many of these potential cartel like scenarios existed before EIP-1559, therefore it is not clear if EIP-1559 is adding new risks.

Conclusion

With EIP-1559 Ethereum’s token economics and consensus agent incentivisation model may fundamentally change and Ethereum may pivot further away from the economic models used by Bitcoin. EIP-1559 decouples transactional demand from consensus agent incentivisation to a significant extent. A potential strength here is that incentives could become more stable, however the lack of the ability to dynamically adjust the security budget to match demand could also be seen as a weakness. One can argue that the purpose of the consensus system is to secure transactions and potentially diminishing the link between transactions and the incentives in the consensus system can reduce the efficiency of the network.

To a large extent, EIP-1559 breaks the transaction fee market down into its component parts, providing users with greater clarity over what they are paying for. The most significant outcome is that the user experience will be significantly improved, with users knowing with greater certainty what fee level they should set. However, one potential long term downside of the upgrade is higher fees.