Abstract: We look at the recent elevated level of hashrate volatility on the Bitcoin Cash network. We note that the apparent cyclical nature of the oscillations may indicate a form of manipulation, although we found no direct evidence of such behavior. We conclude that there are no easy solutions to Bitcoin Cash’s hashrate volatility issue, on the other hand the negative impact on the usability of the coin has been marginal so far. The best course of action in the short term may be to be patient and research possible solutions, unless a particular cause becomes more apparent.

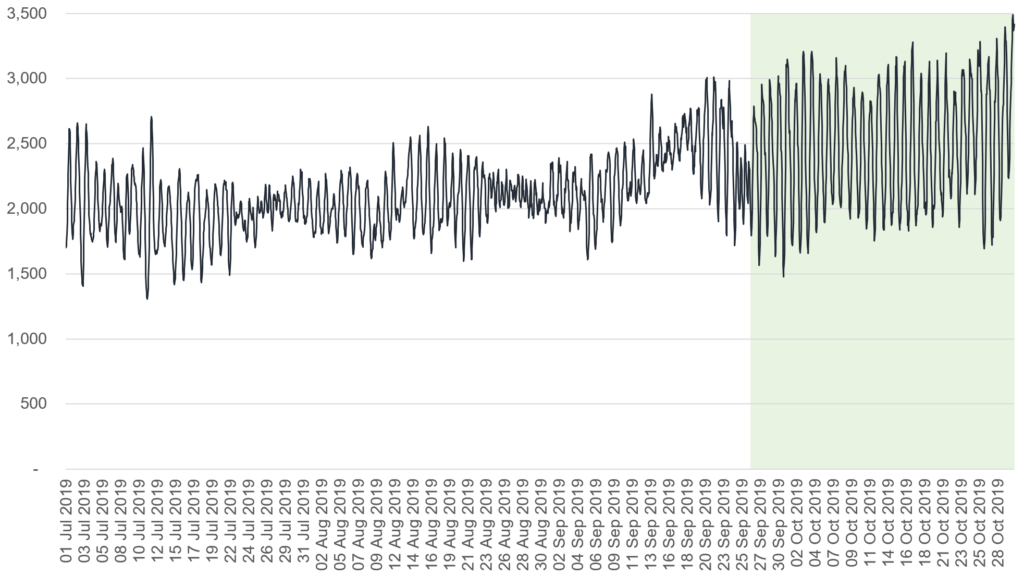

Bitcoin Cash Hashrate Estimate- (8 hour rolling average) – PH/s

(Source: BitMEX Research)

(Notes: Eight hour periods were chosen to maximise the visual impact of the apparent hashrate oscillations. Hashrate data calculated by using the difficulty and block timestamps)

Bitcoin Cash Hashrate Volatility Concerns

Recently some have expressed concerns about the apparent unusually high level of volatility in the Bitcoin Cash hashrate, causing larger than expected variances in block times. As the above chart indicates, the volatility in hashrate appears to have picked up at around the start of October 2019. It is important to consider that we calculated the hashrate based on block times, which is a random and volatile process anyway, therefore determining if short term changes in the hashrate are random or caused by actual changes can be challenging. However, in our view the data is reasonably compelling. This volatility may have made the network marginally less reliable for payments in some periods, although its not a major issue, in our view.

For the month of October 2019 we conducted a basic analysis of Bitcoin Cash’s difficulty, block timestamps and the times in which our node received the Bitcoin Cash blocks.

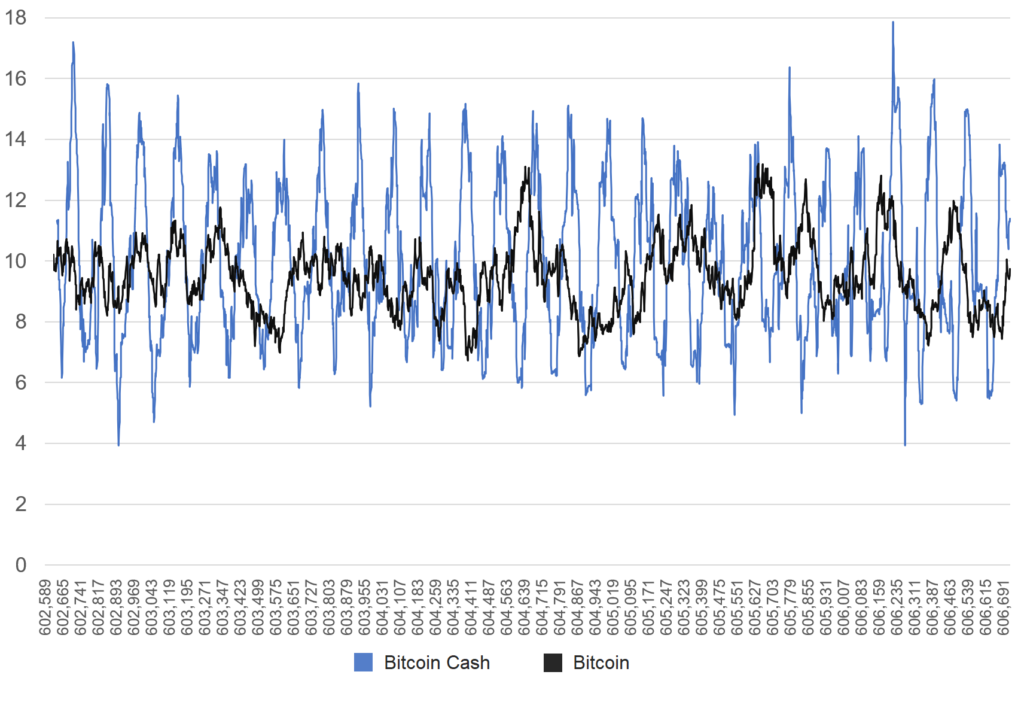

As the below chart illustrates, Bitcoin Cash does indeed appear to have more volatile time gaps between blocks when compared to Bitcoin.

Time interval between blocks – 50 block rolling average (Minutes) – October 2019

(Source: BitMEX Research)

(Notes: The x-axis is block heights for Bitcoin Cash, while Bitcoin is added for the same 29 days ending 29th October 2019)

Not only does the Bitcoin Cash time gap between blocks appear more volatile than Bitcoin, with higher peaks and lower troughs, but it also appears to be slightly less random, with more regular peaks and troughs. There may be some form of cyclicality in the data, which might imply manipulation, although we found no direct evidence of this. On the other hand, the random nature of the data means that the chart may look cyclical, but it could be an illusion. Please note, the Bitcoin Cash difficulty is adjusted on a per block basis and therefore the adjustment algorithm should not cause such cyclicality. Please also note that a 50 block rolling period was chosen to maximize the size of the peaks and troughs, therefore the chart may exaggerate the issue slightly.

The Inconclusive Hunt For Evidence Of Causation

In the table below, we analysed the average difficulty of each block for each mining pool, by calculating the difficulty at each block height. We were trying to determine if one mining pool had been successful in some strategy aimed at achieving a lower average difficulty than its peers. The analysis was inconclusive and the unknown miner(s) achieved an average difficulty reasonably close to the total average. However, it is possible a more detailed analysis of the data could find something more interesting.

Bitcoin Cash – October 2019 Mining Pool Statistics

|

|

|

|

|

|

|

|

|

346,505,954,955 |

0.48 |

|

|

|

| 338,181,028,080 | 0.37 |

|

|

|

|

| 0.35 |

|

|

|

|

| 0.68 |

|

|

|

| 354,652,554,749 |

0.40 |

|

|

|

|

| 0.38 |

|

|

|

|

|

|

|

|

|

|

360,262,982,821 |

|

|

|

|

|

|

|

(Source: BitMEX Research)

We also analysed the time gaps between the block timestamps and the time our local system clock says it received the block, again looking for discrepancies between pools for evidence of manipulation. Perhaps exploiting the potential 8.3% vulnerability we mentioned in yesterday’s piece. Again, no such direct evidence was found, with the unknown pool bang on the average, with the timestamp 0.48 minutes before our system clock.

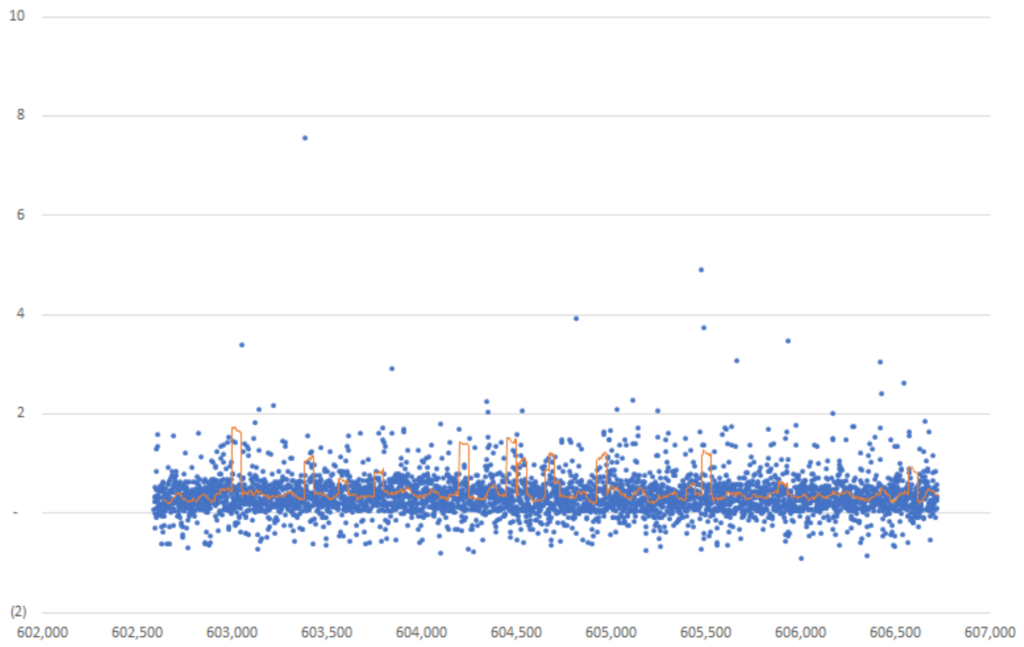

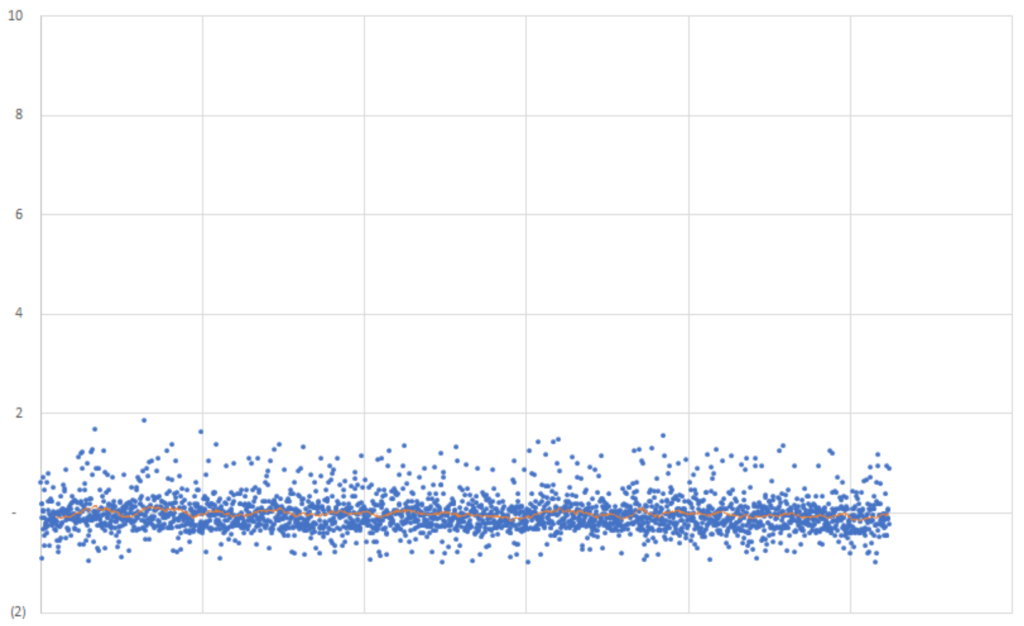

The following charts continue to look at the timestamp gap to our local clock, and compare Bitcoin and Bitcoin Cash, in an attempt to visually identify any irregularities. What they appear to indicate is that Bitcoin timestamps are on average more consistent with our local clock and the time gaps are less volatile. This may merely suggest that Bitcoin has a stronger peer-to-peer network than Bitcoin Cash, with faster block propagation, rather than any nefarious manipulation of the timestamps.

Bitcoin Cash – Average Time Gap Between Timestamp & Our Local Node Clock (Minutes) – October 2019 – (Y-axis cut to compare with Bitcoin)

(Source: BitMEX Research)

(Notes: Orange line is 50 block moving average)

Bitcoin – Average Time Gap Between Timestamp & Our Local Node Clock (Minutes) – October 2019

(Source: BitMEX Research)

(Notes: Orange line is 50 block moving average. The x-axis is the month of October 2019)

We were unable to find any evidence of timestamp manipulation or other nefarious mining strategies. Bitcoin Cash is a minority hashrate coin and therefore this is likely to make the hashrate more volatile to some extent. Perhaps the apparent cyclicality is caused by lags in automated systems designed to mine the most profitable coins or some other more benign factor.

Conclusion

Fixing the potential problems with Bitcoin Cash’s hashrate volatility may require a hardfork and the coin is already scheduled to have a hardfork upgrade in a few days time, which does not include a fix for the above issue. Any fix is likely to require considerable development work and analysis/discussion before it is rolled out. Therefore a fix is unlikely in the short term. However, the issue may not be urgent.

As for how Bitcoin Cash may consider fixing the problem, we suggest consideration of the following proposals:

- Merged Mining – Enabling merge mining with Bitcoin, as we explained back in November 2017, could add stability to Bitcoin Cash mining, however some in the Bitcoin Cash the community may still be unwilling to adopt this due to the somewhat unfriendly attitude towards Bitcoin. In our view, this anger will dissipate over time.

- Adopt Bitcoin’s Two Week Adjustment Period – Bitcoin Cash could return to Bitcoin’s fixed two week window difficulty adjustment system. This is perhaps one of the more simple solutions, although it will not completely solve the problem.

- Reduce block times – Bitcoin Cash could re-enable the 1MB blocksize limit and reduce the block time to around 1 minute instead, although this may not fix hashrate volatility, due to the lower block time gaps, blocks would appear reasonably regularly anyway. This strategy more directly aligns with the Bitcoin Cash community’s objective of higher onchain throughput and improved usability without waiting so long for confirmations, than blocksize limit increases would, in our view.

As of now, the elevated hashrate volatility issue does not appear urgent and has only persisted for one month. The apparent sudden increase in volatility in October 2019 remains a mystery, at least to us. However, if this continues or a particular cause becomes apparent, in our view, a fix may be necessary.