Abstract: For the second time, we present CryptoCompare’s in-depth report into the cryptocurrency exchange ecosystem. The review focuses on spot exchange volumes, crypto derivatives trading data, market segmentation by exchange fee models and crypto to crypto vs fiat to crypto volumes. There is also an analysis of bitcoin trading into various fiats and stablecoins, an additional overview of top crypto exchange rankings by spot trading volume, as well as a focus on how volumes have developed historically for the top trans-fee mining and decentralized exchanges.

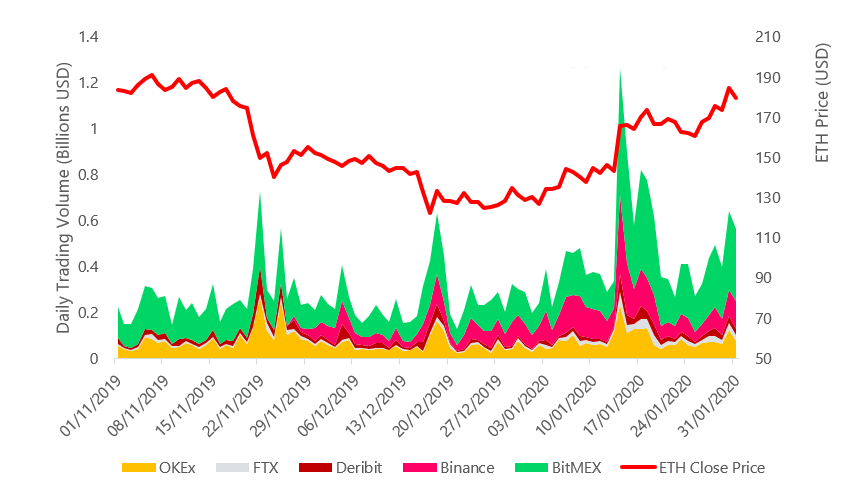

ETH Daily Perpetual Futures Product Volumes

Executive Summary

Macro Analysis and Market Segmentation

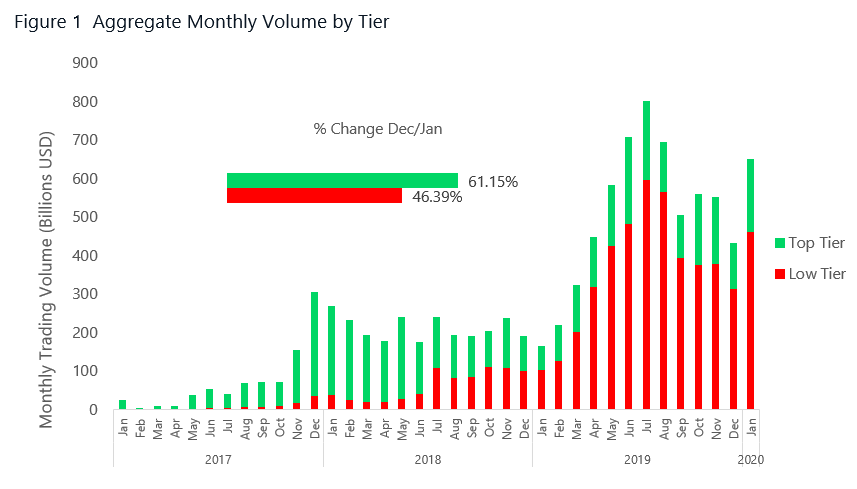

- Exchange benchmark analysis – On aggregate, volume from Top-tier exchanges (AA-B) increased 61.2% while volume from Low-tier exchanges (C-F) increased 46.4%. Aggregate Top-tier exchange volume represents 29.3% of the total market.

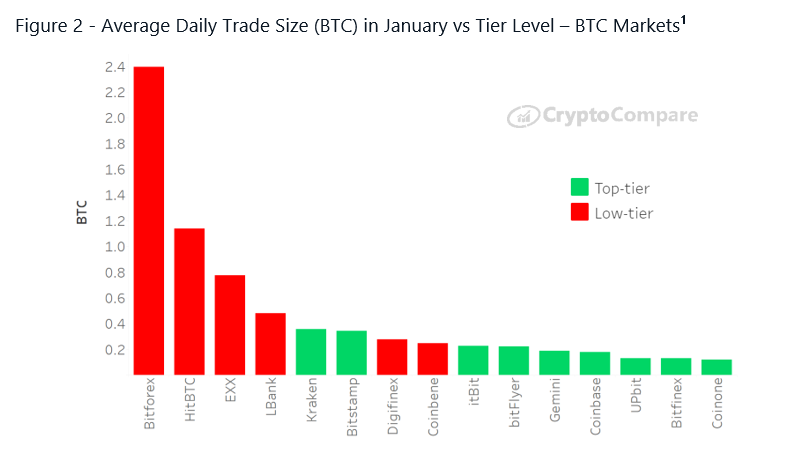

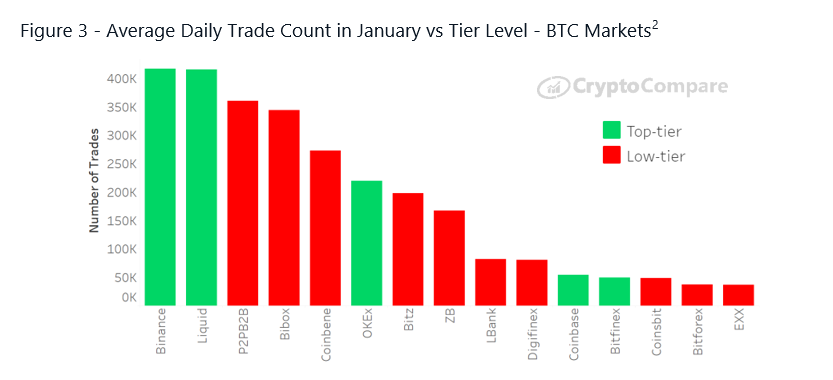

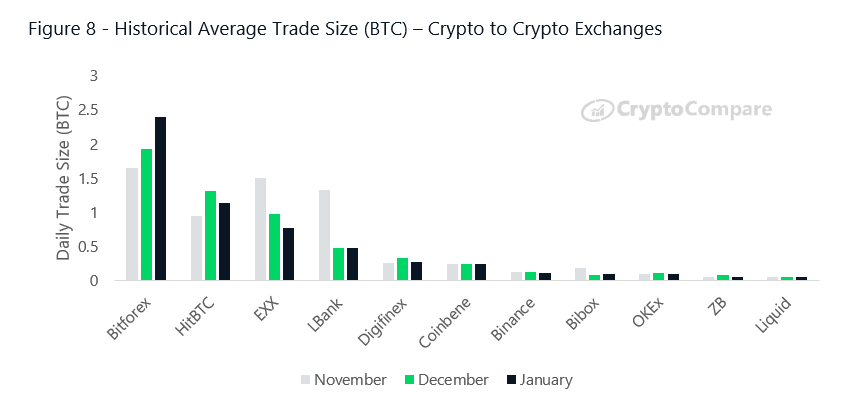

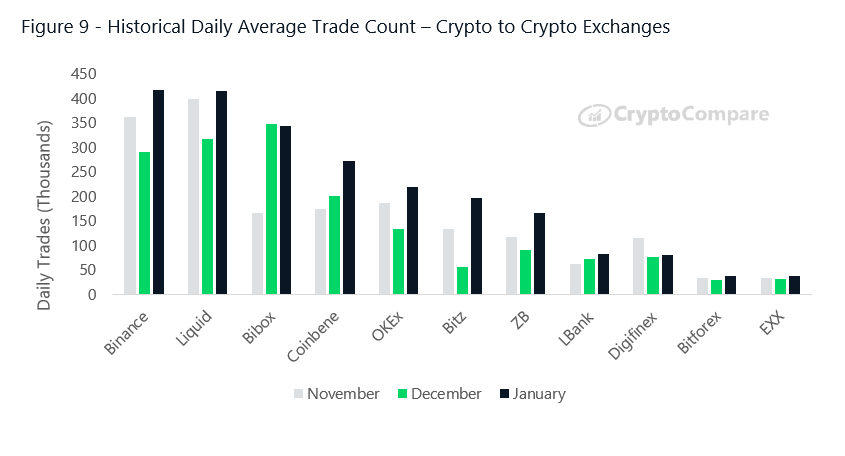

- Trade Data Analysis – Coinsbit, Bitforex and Hitbtc had the largest trade sizes relative to other top exchanges at an average of 2.4 and 1.2 BTC respectively. Binance and Liquid (both top-tier) saw the highest average trade count per day in January at 417k and 415k trades per day respectively (for BTC/USDT and BTC/JPY markets).

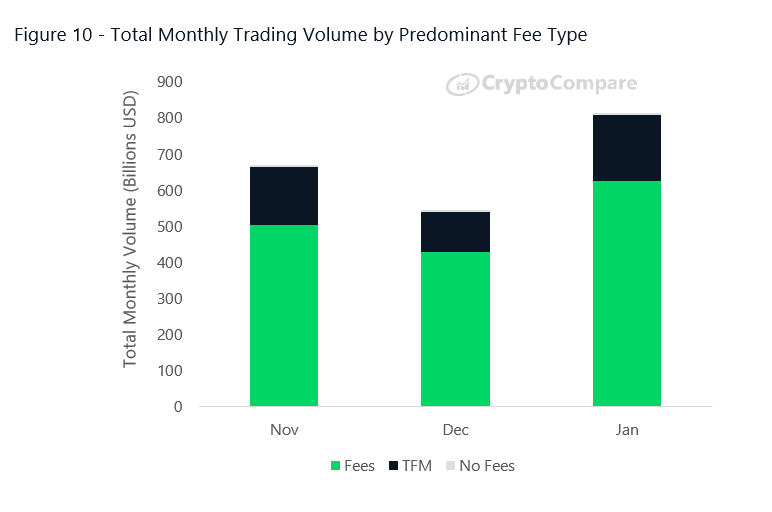

- Predominant Fee Type – Exchanges that charge taker fees represented 76% of total exchange volume in January, while those that implement trans-fee mining (TFM) represented 22%.

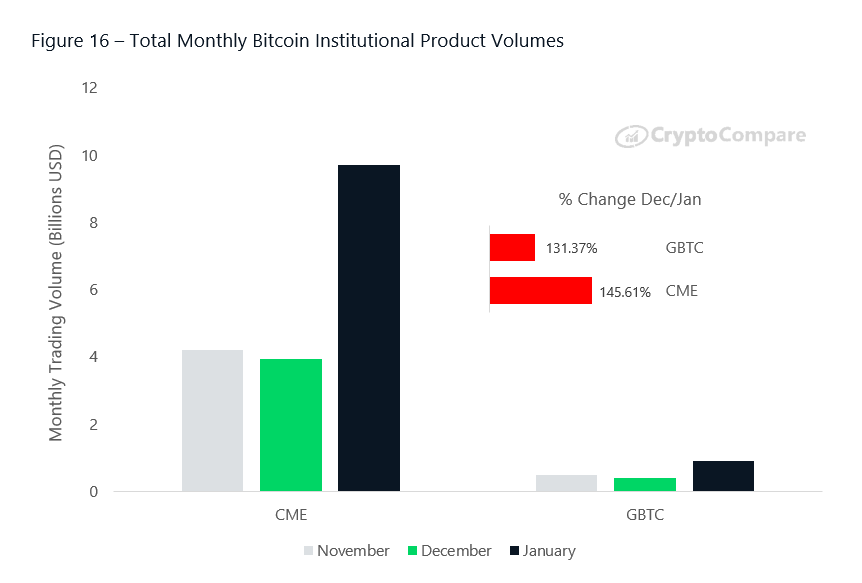

- Derivatives (Institutional Products) – Regulated bitcoin derivatives product volumes are still dominated by CME, whose total trading volumes are up 145.6% since December at 9.72 billion USD. CME’s bitcoin futures product volumes increased from a total of 3.96 billion USD traded in December to a total of 9.72 billion USD traded in January. Meanwhile, Grayscale’s bitcoin trust product (GBTC), increased in terms of total trading volume with 913.25 million USD traded in January (up 131.4% since December).

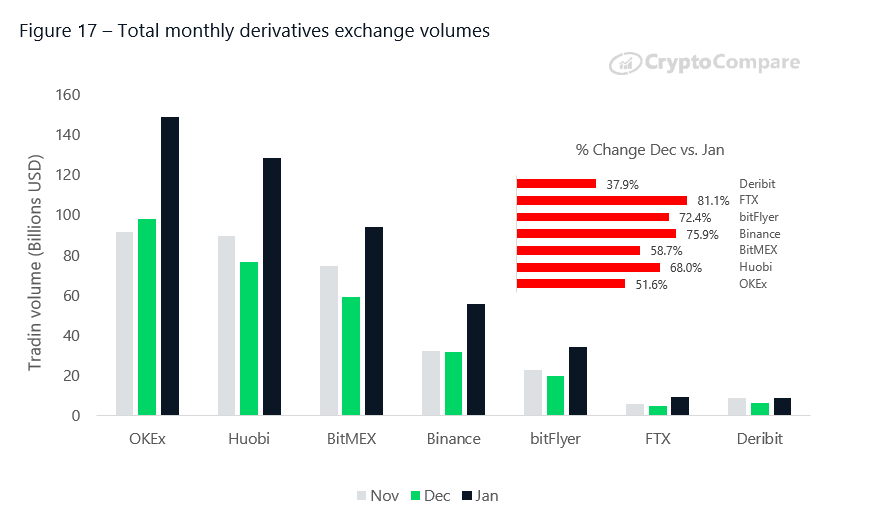

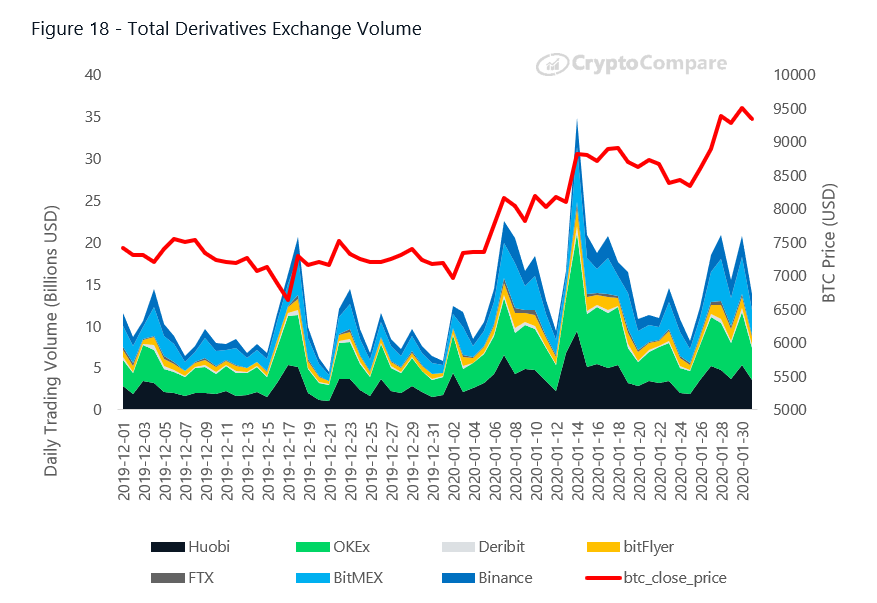

- Derivatives Trading (Crypto Exchanges) – During the month of January, OKEx represented the majority of daily derivatives volumes – trading at 4.96 billion USD per day (31.1% market share) followed by Huobi (4.29 billion USD, 26.9%), BitMEX (3.13 billion USD, 19.6%) and Binance (1.86 billion USD, 11.6%). Smaller exchanges bitFlyer and FTX represented (1.14 billion USD, 7.2%) and (301.39 million USD, 1.9%) of the market respectively.

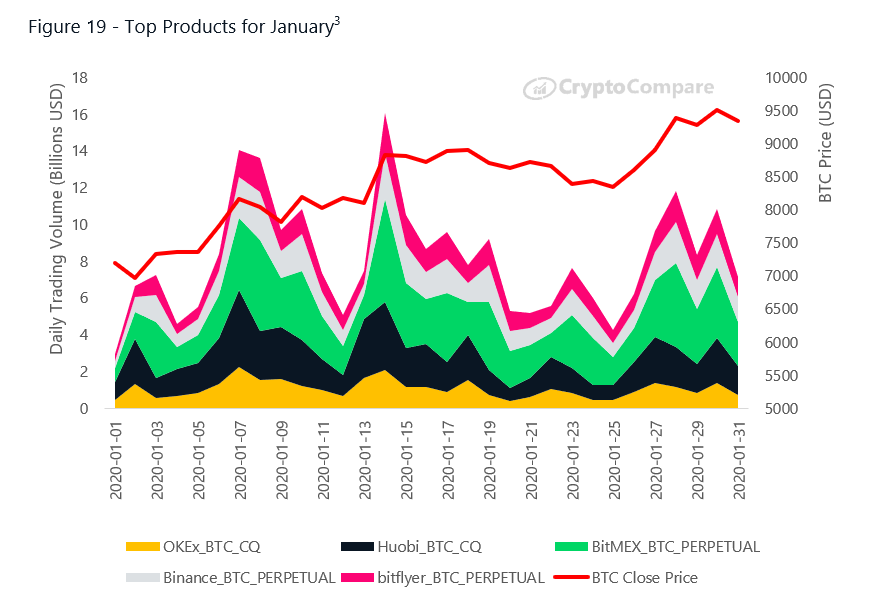

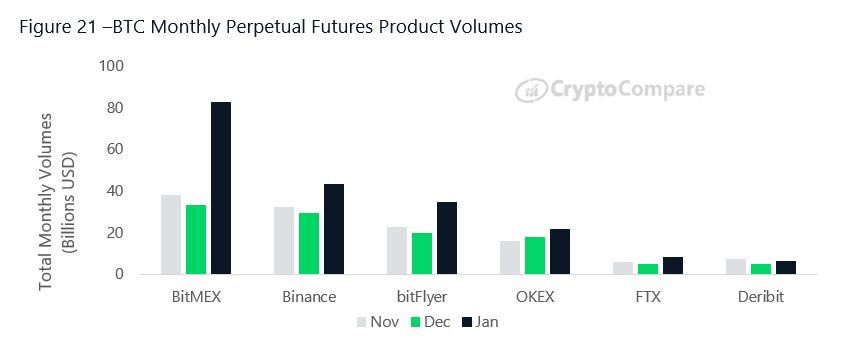

Top Products – In January, the most traded products by total monthly volume were BitMEX’s Bitcoin Perpetual contract (82.53 billion USD) and Huobi’s BTC_CQ contract (60.37 billion USD), followed by Binance’s Bitcoin Perpetual contract at 43.36 billion USD. On average, these three products traded 2.75 billion, 2.01 billion and 1.45 billion USD per day in January.

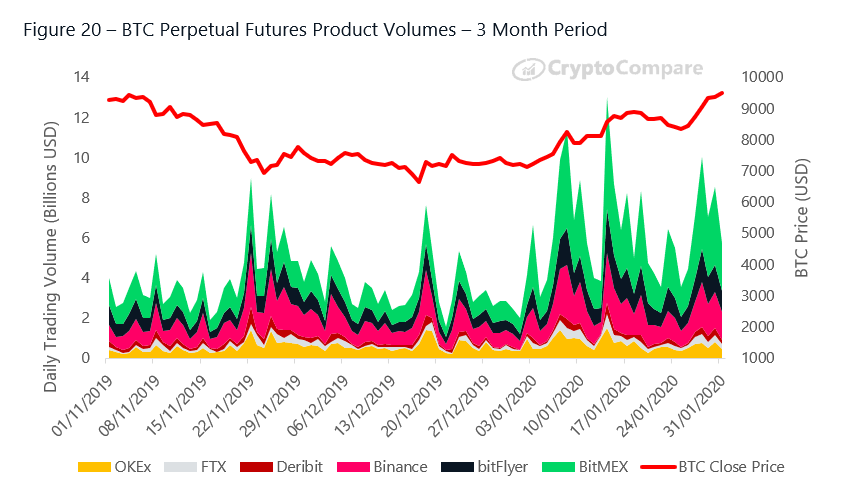

BTC Perpetuals – BitMEX, Binance and bitFlyer represent most of the BTC perpetual futures market volume at 2.66 billion (42%), 1.45 billion (22.1%) and 1.11 billion (17.5%) per day respectively on average. In terms of total monthly volume, BitMEX traded 82.5 billion USD (up 148% since December), Binance traded 43.36 billion USD (up 47.6%), and bitFlyer traded a total of 34.35 billion USD (up 72.4%).

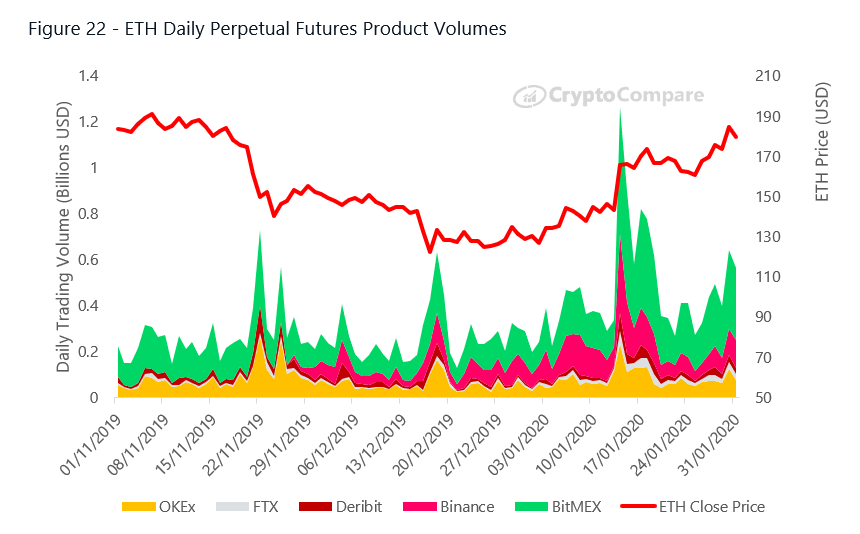

ETH Perpetuals – BitMEX and Binance represent the majority of the ETH perpetual futures market volume at 238.47 million (49.6%) and 115.3 million (30.1%) per day respectively on average.

In terms of total monthly volume in January, BitMEX represented 49.6% (7.15 billion USD in monthly volume), and saw an increase in trading activity of 96% since December. This is followed by Binance (+81%) and OKEx (+44%) at 3.46 billion and 2.45 billion USD respectively. - Fiat Capabilities – Trading volume from exchanges that offer only crypto pairs represented 75.4% (614.18 billion USD) of total trading volume in January, while fiat to crypto exchanges represented 25.0% (200.38 billion USD). This is similar in proportion to the previous two months.

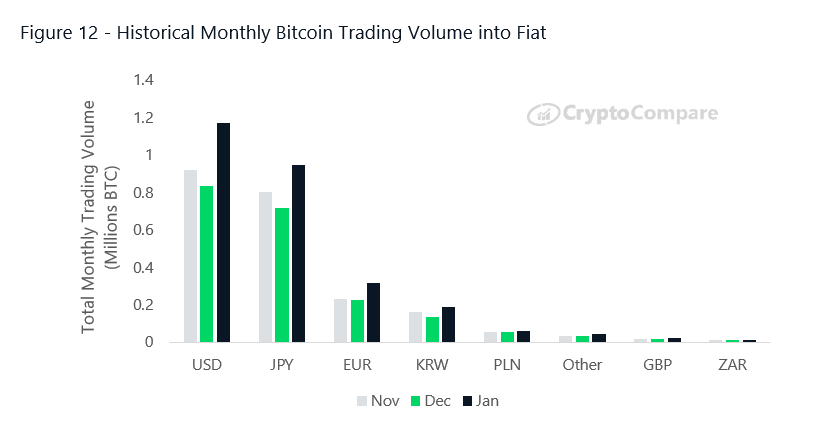

- Bitcoin to Fiat Volumes – In January, 73.0% of all Bitcoin trading into fiat was made up of the US Dollar. BTC to USD volumes increased, from 834.76k BTC in December to 1.17 million BTC in January (up 40.0%). Meanwhile, BTC trading into JPY represented 946.49k BTC in January (up 32.0% since December), while BTC trading into EUR represented 316.15k BTC (up 42.0% since December).

- Bitcoin to Stablecoin Volumes – BTC trading into USDT totalled 7.58 million BTC (down 2.34% since December). USDT represents 94.08% of the total Bitcoin trading into these four coins.

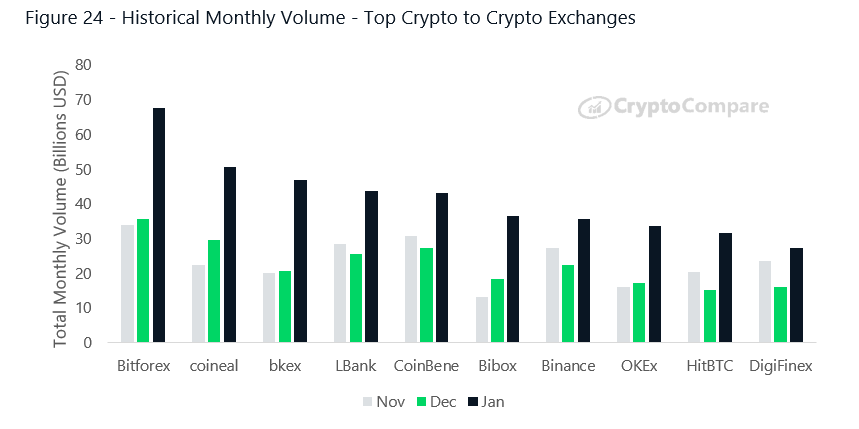

Exchange Volumes

- Top Crypto to Crypto Exchange Volumes – Bitforex was the top crypto to crypto exchange by total volume in January at 67.51 billion USD (up 89.45% since December). This was followed by coineal and bkex at 50.61 billion USD (up 70.72%) and 46.88 billion USD (up 125.28%) respectively.

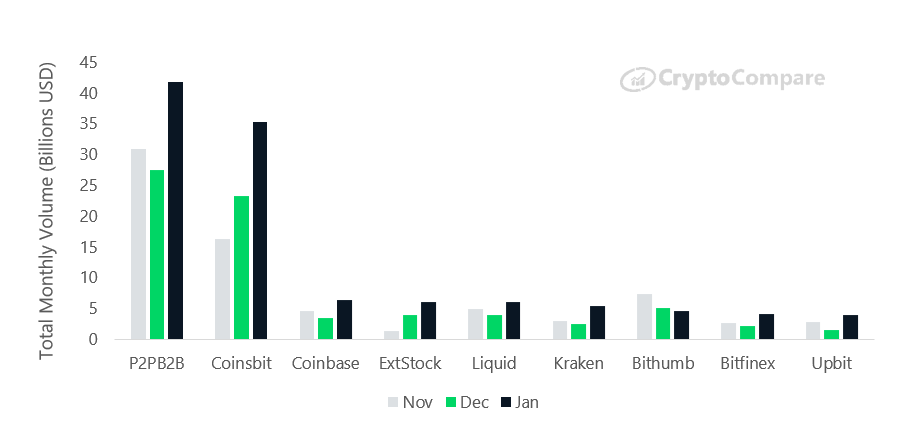

- Top Fiat to Crypto Exchange Volumes – biki was the top fiat exchange by total volume in January at 54.08 billion USD (up 120.14% since December). This was followed by P2PB2B and Coinsbit at 41.87 billion USD (up 52.01%) and 35.4 billion USD (up 52.23%) respectively.

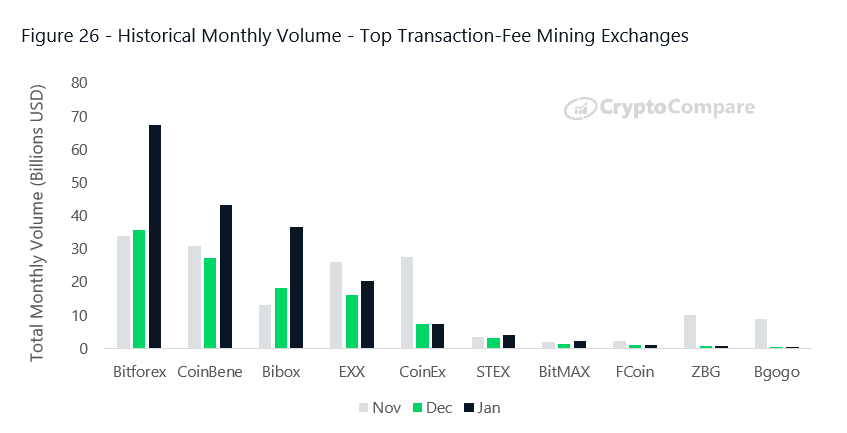

- Trans-Fee Mining Exchanges – Bitforex was the top TFM exchange by total volume in January at 67.51 billion USD (up 89.45%), followed by CoinBene at 43.14 billion USD (up 58.04%) and Bibox at 36.51 billion USD (up 99.91%).

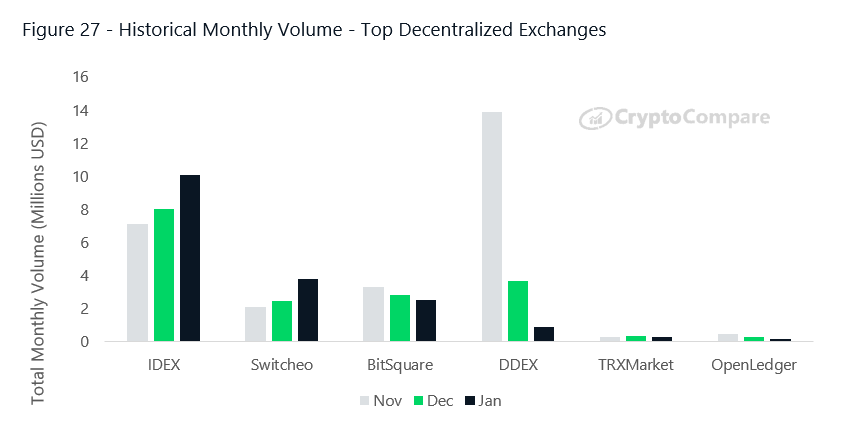

- Decentralized Exchanges – IDEX was the largest DEX in January trading a total of 10.05 million USD (up 25.4%), followed by Switcheo and BitSquare trading 3.77 million USD (up 54.7%) and 2.56 million USD (down 9.4%) respectively.

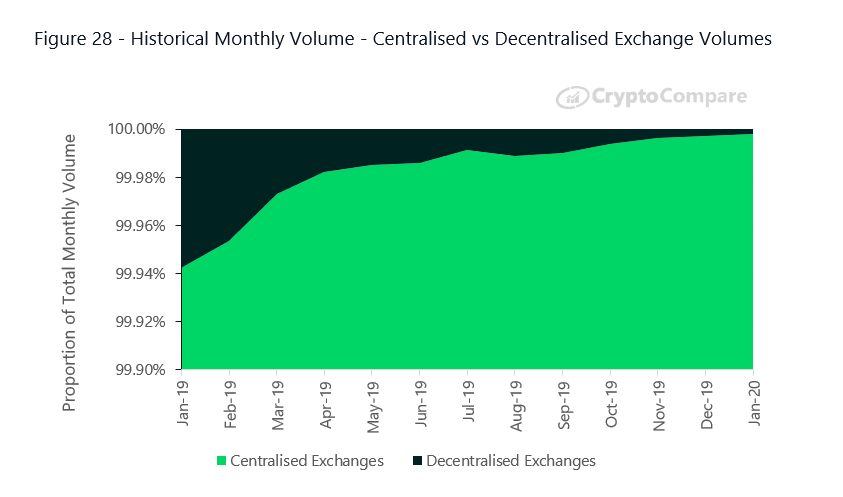

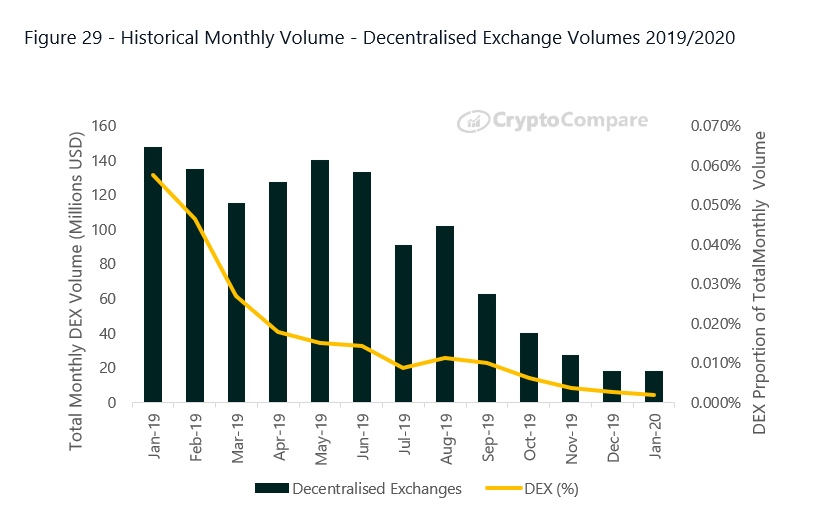

DEX volumes have diminished 88% since early 2019. They now represent only a small fraction of global spot exchange volume (0.003%), trading a monthly total of 17.8 million USD in January 2020. In January 2019, their volumes totalled ~148 million USD.

January Exchange News

|

COMPANY |

STORY |

DATE |

|

Bitfinex |

Jan 6 | |

|

Binance |

Jan 9 | |

|

CME |

Jan 13 | |

|

Kraken |

Kraken Acquires Australia’s Longest-Running Crypto Service Provider Bit Trade |

Jan 14 |

|

Gemini |

Jan 16 | |

|

Binance |

Jan 20 | |

|

BitMEX |

Announcing the new XRPUSD Swap and Delisting BitMEX UP and BitMEX DOWN Contracts |

Jan 23 |

|

Coinbase |

Jan 30 |

January Exchange News

2020 promises to be a pivotal year in the crypto industry’s relatively short history, spurred on by already-visible signs of increased investor interest and speculation around major events such as the Bitcoin halving due in May. In anticipation of growing demand and a volatile trading environment, exchanges are stepping up to offer the range of products and services the market requires. January offered a sign of what is to come, with important news across the major exchange venues. Let’s explore some of the month’s major themes.

New trading products

BitMEX is well established as the leading venue for trading crypto derivatives. Much of its appeal lies in its most famous – and, indeed, highest volume product: the bitcoin inverse perpetual swap. Offering a contract without expiry and maintaining a soft peg to spot price through an ingenious funding mechanism, the instrument continues to attract more than $4 billion in daily trading volume. The introduction of an ETH perpetual in August 2018 precipitated a major fall in ETH’s price, leading to a cycle low by the end of the year. Speculators will be keen to observe the market impact of BitMEX’s newly launched XRP quanto swap, which allows traders to gain exposure to changes in XRP/USD price without holding either of the assets in the pair.

Elsewhere, the institutional-focused CME announced the opening of Options trading to complement its Bitcoin Futures contract, while Deribit announced the launch of BTC daily options, which expire at 8am UTC each day.

Regulatory landscape

Compliance is a long-running topic of concern in crypto. Institutions offering financial products across multiple regions and jurisdictions are almost fated to run into issues with regulators. The latest company to pre-empt a run in with authorities is Dutch-founded derivatives platform Deribit. The company announced a move to crypto-friendly Panama in order to escape ‘very strict’ EU regulations, which it claimed could place ‘high barriers’ for traders using the platform. The company also announced new requirements for mandatory KYC to comply with global regulations.

Stablecoins

Stablecoins, perhaps surprisingly, have emerged as one of the most popular use cases in crypto, underlined by the recent revelation that the volume of Tether transactions on the Ethereum blockchain is now outpacing its native ETH asset. Exchanges continue to open opportunities for investors to utilise stable assets in a volatile environment. Kraken announced the listing of USDC, issued through the CENTRE consortium which includes Circle and Coinbase, on its platform. Binance announced an investment in Korean -based BxB to offer Korean investors access to a KRW-pegged asset.

Fiat onramps

Onramping funds continues to be a major source of frustration for crypto investors in many regions, in large part due to the difficulties exchanges face in interfacing with domestic banks and financial institutions. Binance has continued to make great strides in this regard. Recent announcements of support for a vast range of global currencies was strengthened in January with news of added support for GBP, EUR and AUD, following a partnership with on-ramping business Banxa. BitFinex also announced the introduction of credit and debit card payments for its users to acquire assets including BTC, ETH and USDt directly from the platform.

Custody

Growing demand for crypto asset custody solutions remains unabated as more institutions seek skin in the crypto game. Coinbase announced it was extending the reach of its custody solution – strengthened last year with the acquisition of Xapo’s custody business – beyond the US, with support for European-based investors through its Dublin-based operations. Gemini also increased the appeal of its custody services with the launch of a new insurance product offering coverage for funds up to $200 million in size.

M&A activity

As any emerging market matures, consolidation becomes increasingly likely as the dominant companies seek to strengthen their position. Kraken made the surprising announcement that it has acquired BitTrade, Australian’s longest running crypto service. Whether the move is intended to increase its reach in the APAC region or as an acquihire for the company’s talent, who are all being retained as part of the deal, will likely become clearer in time.

Exchange Benchmark Analysis

CryptoCompare’s Exchange Benchmark aims to serve investors, regulators and crypto enthusiasts by scoring exchanges in terms of transparency, operational quality, regulatory standing, data provision, management team, and their ability to monitor trades and illicit activity effectively. Rather than drawing attention specifically to bad actors, we instead highlight those that behave in a manner that is conducive to maintaining an efficient and fair market, ensuring greater safety of investors. We have hence introduced the notion of “Top-tier” vs “Lower-tier” volumes.

Aggregate Monthly Exchange Volumes

On aggregate, volume from Top-tier exchanges (AA-B) increased 61.2% while volume from Low-tier exchanges (C-F) increased 46.4%.

Aggregate Top-tier exchange volume represents 29.3% of the total market.

Trade Data Analysis by Tier Level

Bitforex and HitBTC had the largest trade sizes relative to other top (by volume) exchanges at an average of 2.4 and 1.2 BTC respectively.

Binance and Liquid (both top-tier) saw the highest average trade count per day in January at 417k and 415k trades per day respectively.

Trade Data Analysis – Top Exchanges

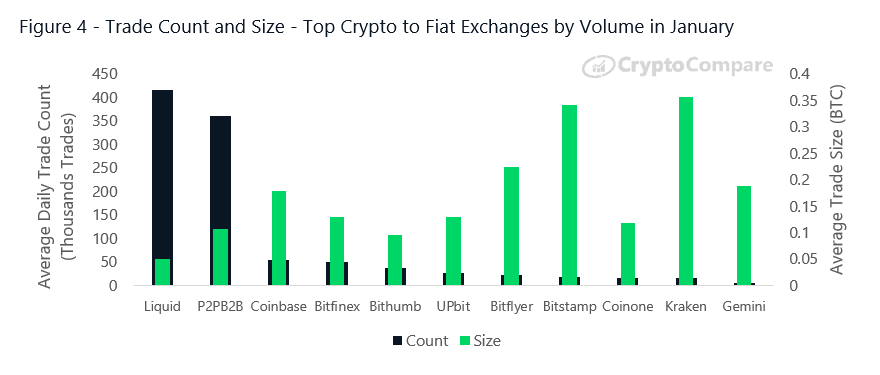

Trade Count and Size

*Note, the above chart analyses data from bitcoin trading into the most relevant fiat currency for each exchange. For example, Liquid’s numbers refer to its BTC-JPY market while those of Coinbase refer to its BTC-USD market etc.

Among the top fiat exchanges, Liquid had the largest average daily trade count (415.61k trades) combined with an average trade size of 0.05 BTC.

P2PB2B, Coinbase and Bitfinex followed with fewer trades per day (360.66k , 54.33k and 49.28k respectively) combined with higher trade sizes (0.11, 0.18, 0.13 BTC respectively).

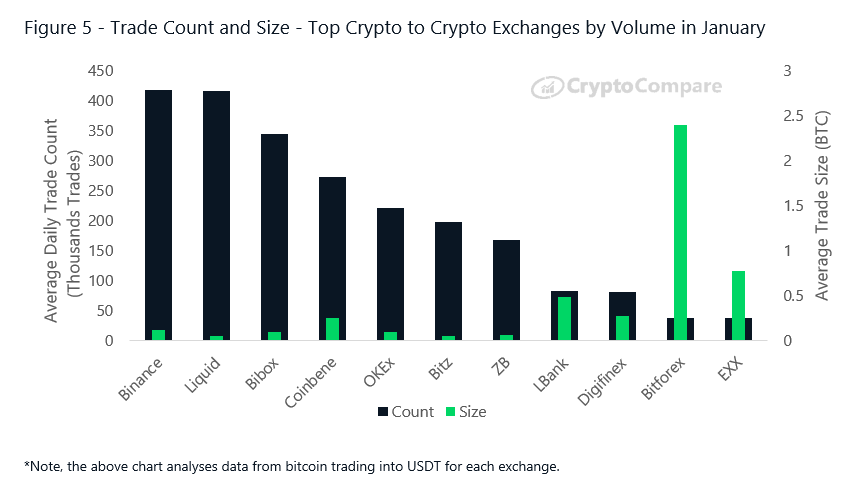

*Note, the above chart analyses data from bitcoin trading into USDT for each exchange.

Among the top crypto exchanges, Binance had the largest average daily trade count (417.19k trades) combined with a low average trade size (0.12 BTC).

This was followed by Liquid (415.61k trades and 0.05BTC) and Bibox (343.92k trades and 0.1BTC).

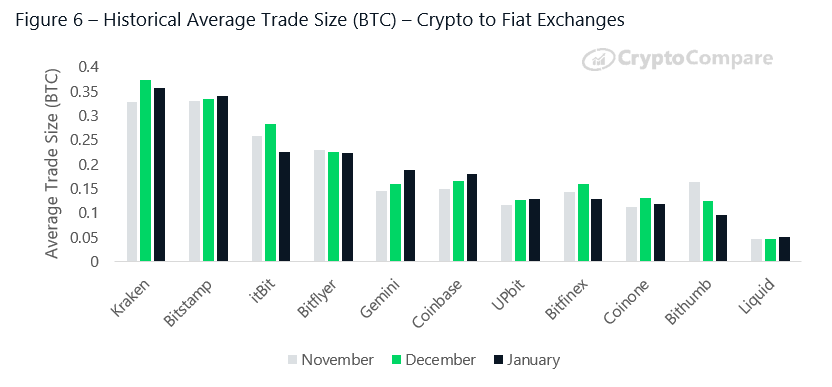

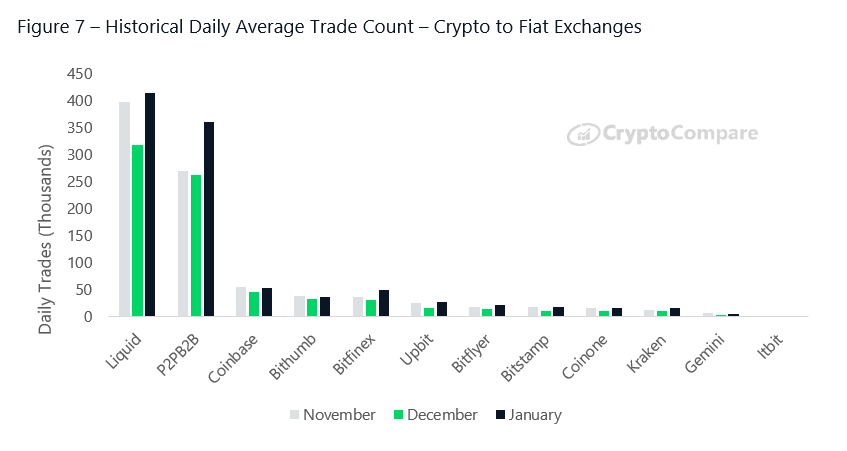

Historical Trade Count and Size

Kraken and Bitstamp had the highest average trade sizes in January among the top fiat exchanges by volume. Meanwhile, Liquid and Bithumb had the lowest trade sizes.

Liquid, P2PB2B and Coinbase had the highest average daily number of trades in January among the top fiat exchanges by volume. Meanwhile, itBit and Gemini had the lowest number of trades.

Exchanges Bitforex, HitBTC and EXX had the highest average trade sizes in January among the largest crypto exchanges by volume. Meanwhile, Liquid and ZB have consistently maintained low trade sizes.

*Data in above chart represents BTC-USDT markets

Binance, Liquid and Bibox had the highest trade count over the last month.

Macro Analysis and Market Segmentation

Segmentation by Fee-Type

Exchanges that charge taker fees represented 76% of total exchange volume in January, while those that implement trans-fee mining (TFM) represented 22%.

Fee-charging exchanges traded a total of 624.87 billion USD in January (up 46.1% since December), while those that implement TFM traded 183.31 billion USD (up 63.5% since December). The remaining volume represented trading by exchanges that charge predominantly no trading fees, at 6.39 billion USD.

Segmentation by Fiat Pair Trading Capability

Trading volume from exchanges that offer only crypto pairs represented 75.4% (614.18 billion USD) of total trading volume in January, while fiat to crypto exchanges represented 25.0% (200.38 billion USD). This is similar in proportion to the previous two months.

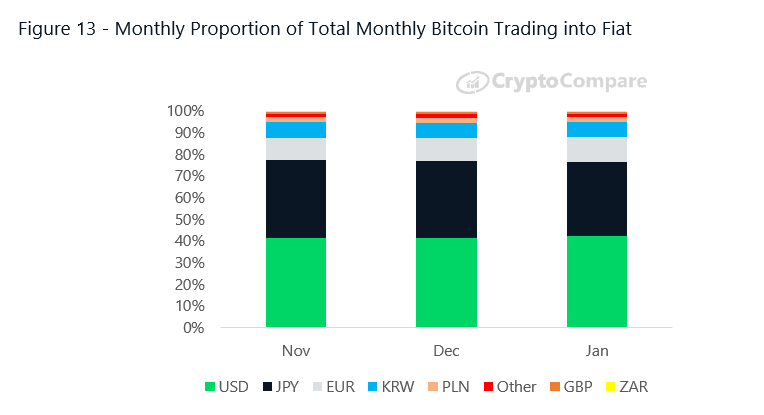

Bitcoin to Fiat Volumes

In January, 73.0% of all Bitcoin trading into fiat was made up of the US Dollar. BTC to USD volumes increased, from 834.76k BTC in December to 1.17 million BTC in January (up 40.0%).

Meanwhile, BTC trading into JPY represented 946.49k BTC in January (up 32.0% since December), while BTC trading into EUR represented 316.15k BTC (up 42.0% since December).

In January, USD, JPY, EUR, KRW and PLN made up 95.01% of total trading from Bitcoin into fiat.

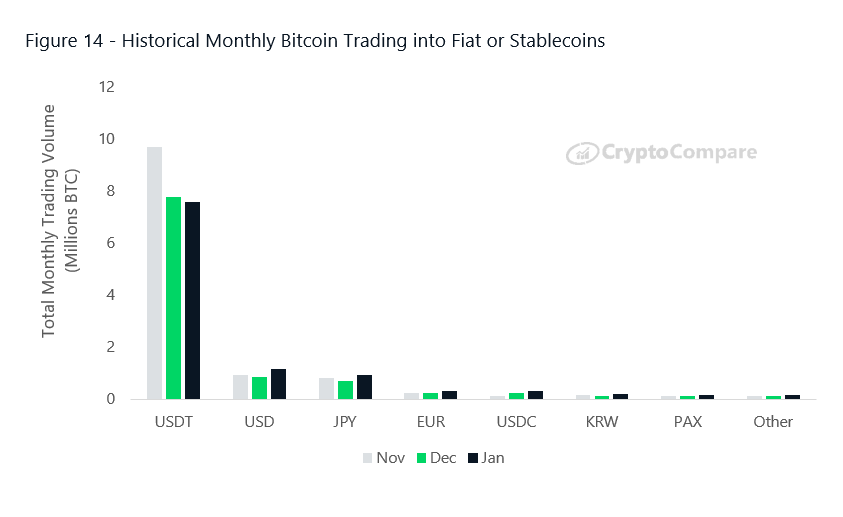

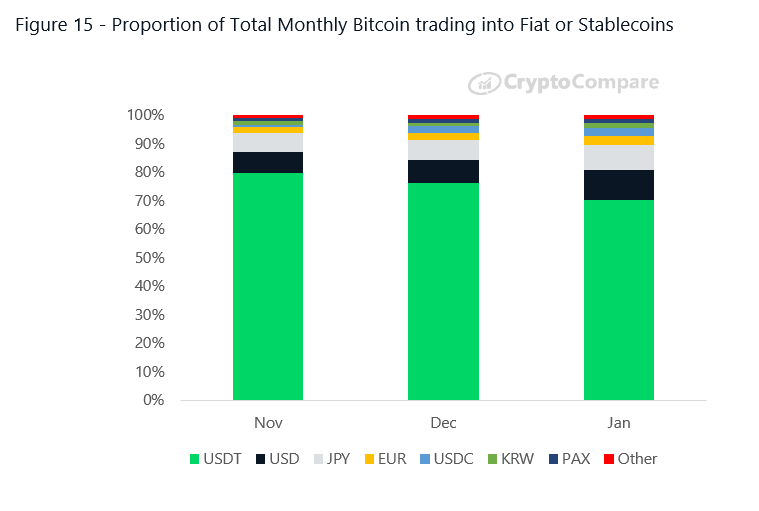

Bitcoin to Stablecoin Volumes

BTC trading into USDT totalled 7.58 million BTC (down 2.34% since December).

USDT continues to be the most popular stablecoin for trading with Bitcoin, followed by USDC, PAX and TUSD

USDT represents 94.08% of the total Bitcoin trading into these four coins.

January Overview – Derivatives Products

Bitcoin Derivatives Monthly Volume: Institutional Products

Regulated bitcoin derivatives product volumes are still dominated by CME, whose total trading volumes are up 145.6% since December at 9.72 billion USD.

CME’s bitcoin futures product volumes increased from a total of 3.96 billion USD traded in December to a total of 9.72 billion USD traded in January. Meanwhile, Grayscale’s bitcoin trust product (GBTC), increased in terms of total trading volume with 913.25 million USD traded in January (up 131.4% since December).

Bitcoin Derivatives Monthly Volume: Crypto Exchanges

OKEx was the top derivatives exchange in January, trading at total of 148.86 billion (up 51.6% since December). This was followed by Huobi and BitMEX with trading at 128.67 billion (up 68.0% since last month) and 93.82 billion (up 58.7%) respectively.

Derivatives Exchange Volumes in January – Overview

During the month of January, OKEx represented the majority of daily derivatives volumes – trading at 4.96 billion USD per day (31.1% market share) followed by Huobi (4.29 billion USD, 26.9%), BitMEX (3.13 billion USD, 19.6%) and Binance (1.86 billion USD, 11.6).

Smaller exchanges bitFlyer and FTX represented (1.14 billion USD, 7.2%) and (301.39 million USD, 1.9%) of the market respectively.

In January, the most traded products by total monthly volume were BitMEX’s Bitcoin Perpetual contract (82.53 billion USD) and Huobi’s BTC_CQ contract (60.37 billion USD), followed by Binance’s Bitcoin Perpetual contract at 43.36 billion USD.

On average, these three products traded 2.75 billion, 2.01 billion and 1.45 billion USD per day in January.

Derivatives Exchange Volumes in January – Perpetual Futures Products

BitMEX, Binance and bitFlyer represent most of the BTC perpetual futures market volume at 2.66 billion (42%), 1.45 billion (22.1%) and 1.11 billion (17.5%) per day respectively on average.

In terms of total monthly volume, BitMEX traded 8.25 billion USD (up 148% since December), Binance traded 43.36 billion USD (up 47.6%), and bitFlyer traded a total of 34.35 billion USD (up 72.4%).

BitMEX and Binance represent the majority of the ETH perpetual futures market volume at 238.47 million (49.6%) and 115.3 million (30.1%) per day respectively on average.

BitMEX represents the majority of ETH perpetual futures volumes at 49.6% of the total market (7.15 billion USD in monthly volume), and saw an increase in trading activity of 96% since December. This is followed by Binance (+81%) and OKEx (+44%) at 3.46 billion and 2.45 billion USD respectively.

Exchange Volume Rankings

Table 1 – Top 10 Crypto to Crypto Exchanges by Average Daily Volume in January

|

AVG DAILY VOLUME (USD) |

TOTAL MONTHLY VOLUME (USD) |

PAIRS |

COINS |

GRADE* | |

|

Bitforex |

2,177,872,194 |

67,514,038,021 |

268 |

149 |

C |

|

Coineal |

1,632,581,412 |

50,610,023,762 |

22 |

15 |

Not Graded |

|

Bkex |

1,512,282,065 |

46,880,744,024 |

99 |

56 |

Not Graded |

|

LBank |

1,413,385,978 |

43,814,965,333 |

170 |

121 |

C |

|

CoinBene |

1,391,628,466 |

43,140,482,450 |

259 |

206 |

D |

|

Bibox |

1,177,612,112 |

36,505,975,457 |

300 |

126 |

C |

|

Binance |

1,151,542,949 |

35,697,831,416 |

688 |

207 |

A |

|

HitBTC |

1,016,248,775 |

31,503,712,035 |

1139 |

516 |

B |

|

DigiFinex |

876,617,909 |

27,175,155,175 |

265 |

135 |

C |

|

RightBTC |

848,482,892 |

26,302,969,639 |

133 |

50 |

D |

Table 2 – Top 10 Crypto to Fiat Exchanges by Average Daily Volume in January

|

AVG DAILY VOLUME (USD) |

TOTAL MONTHLY VOLUME (USD) |

PAIRS |

COINS |

DOMINANT FIAT CURRENCY |

GRADE* | |

|

P2PB2B |

1,350,647,215 |

41,870,063,670 |

388 |

135 | USD |

C |

|

Coinsbit |

1,142,045,446 |

35,403,408,814 |

115 |

33 | USD |

C |

|

Coinbase |

205,755,769 |

6,378,428,847 |

61 |

26 | USD |

AA |

|

ExtStock |

197,958,335 |

6,136,708,371 |

11 |

4 | USD |

D |

|

Liquid |

195,088,603 |

6,047,746,681 |

345 |

112 | JPY |

A |

|

Kraken |

175,426,912 |

5,438,234,263 |

161 |

38 | USD |

A |

|

Bithumb |

150,429,938 |

4,663,328,064 |

99 |

99 | KRW |

C |

|

Bitfinex |

134,119,232 |

4,157,696,203 |

406 |

147 | USD |

A |

|

Upbit |

127,214,888 |

3,943,661,515 |

415 |

237 | KRW |

B |

*Please see the Exchange Benchmark Report for more information on grading

Top Exchanges by Total Monthly Volume

Bitforex (grade C) was the top crypto to crypto exchange by total volume in January at 67.51 billion USD (up 89.45% since December). This was followed by Coineal and Bkex at 50.61 billion USD (up 70.72%) and 46.88 billion USD (up 125.28%) respectively.

Top Fiat to Crypto Exchanges by Total Monthly Volume

Figure 25 – Historical Monthly Volume – Top Fiat to Crypto Exchanges

Biki (ungraded) was the top fiat exchange by total volume in January at 54.08 billion USD (up 120.14% since December). This was followed by P2PB2B (grade C) and Coinsbit (grade C) at 41.87 billion USD (up 52.01%) and 35.4 billion USD (up 52.23%) respectively.

Transaction Fee Mining Exchange Volume

Bitforex was the top TFM exchange by total volume in January at 67.51 billion USD (up 89.45%), followed by CoinBene at 43.14 billion USD (up 58.04%) and Bibox at 36.51 billion USD (up 99.91%).

Decentralized Exchange Volume

IDEX was the largest DEX in January trading a total of 10.05 million USD (up 25.4%), followed by Switcheo and BitSquare trading 3.77 million USD (up 54.7%) and 2.56 million USD (down 9.4%) respectively.

DEX volumes have diminished 88% since early 2019.

They now represent only a small fraction of global spot exchange volume (0.003%), trading a monthly total of 17.8 million USD in January 2020. In January 2019, their volumes totalled ~148 million USD.

Notes:

- Average daily trade size was calculated based on the daily average trade size for market, and then averaged over the course of the month of January. Markets vary for each exchange and include: BTC/USD, BTC/USDT, BTC/KRW, and BTC/JPY.

- Average daily trade count was calculated based on the trade count per day, average over the month. Same markets as above.

- Letters CQ, CW, NW refer to futures expiring in the current quarter, the current week, and the next week respectively.