Executive Summary

13 March Market Crash Saw Highest Daily Volumes Ever

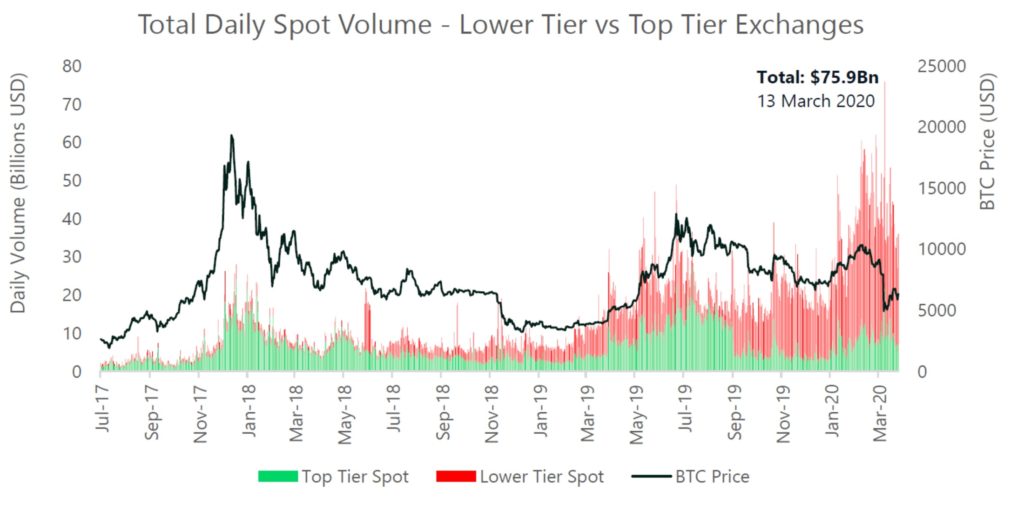

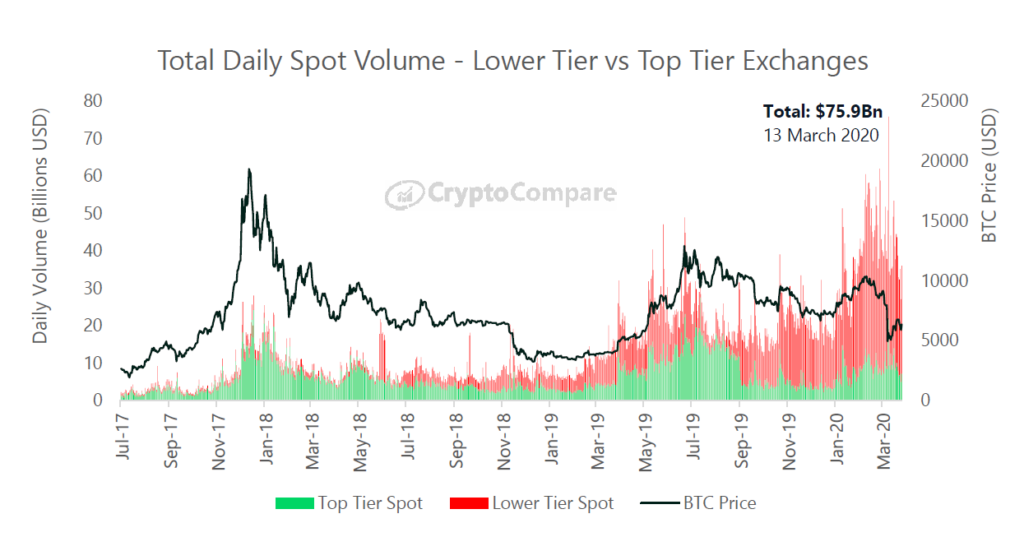

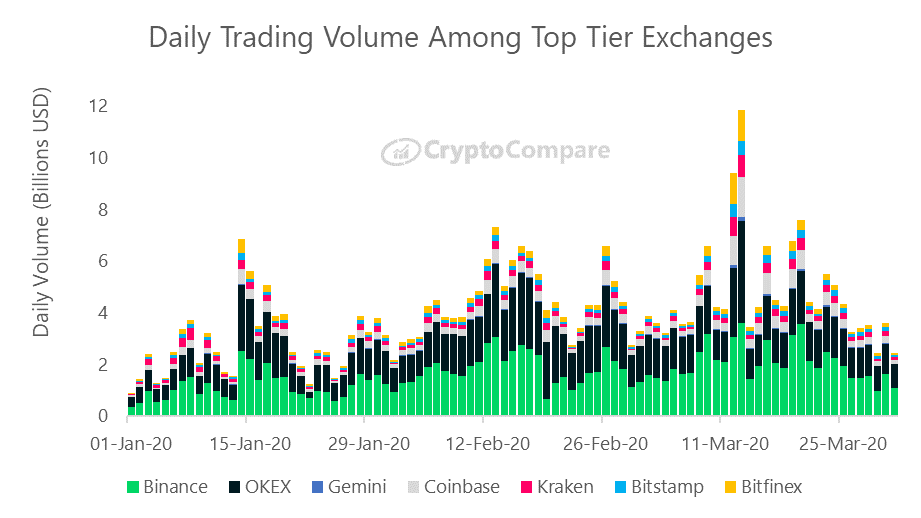

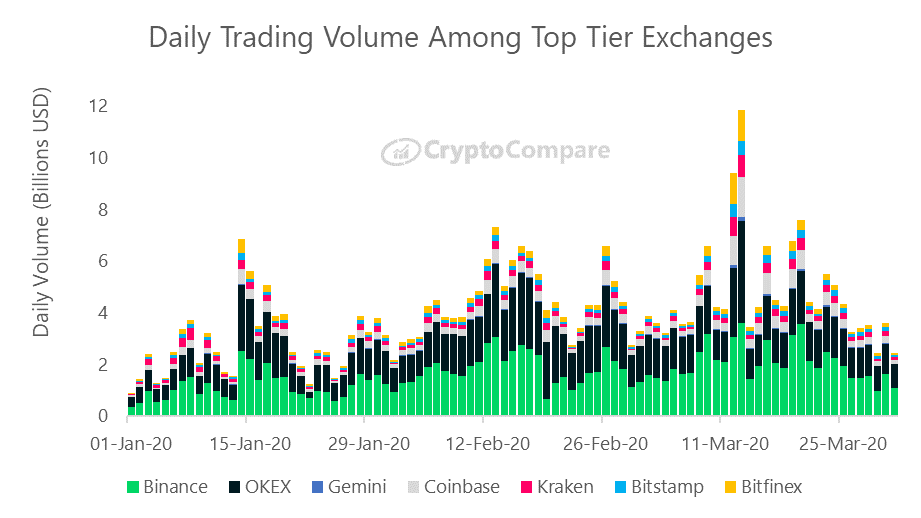

- The massive market crash on March 12-13 saw daily volumes hit $75.9bn in a single day (13 March) – the single greatest daily volume recorded in cryptoasset history.

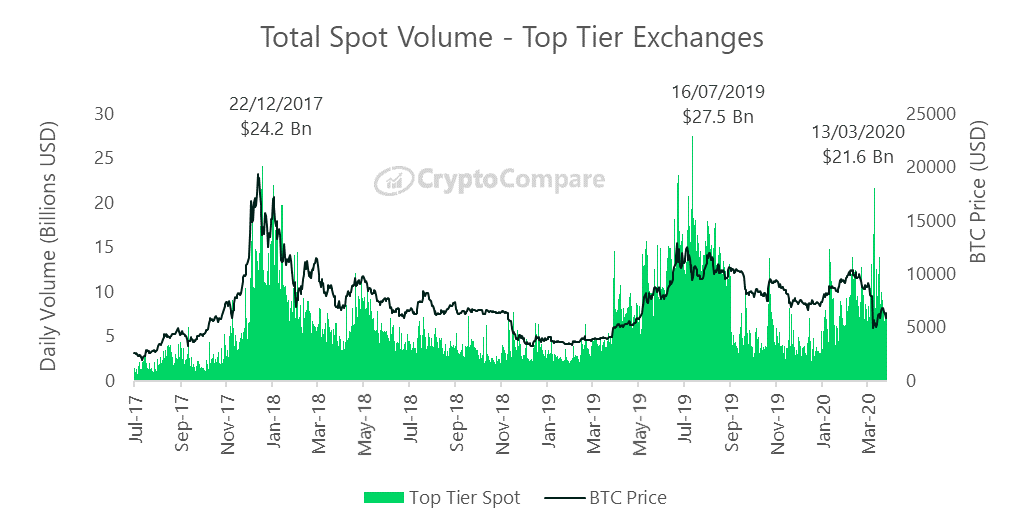

- Most of this figure came from lower-tier exchanges ($54.3bn), with volume from Top Tier exchanges totalling $21.6bn (28.5%) – one of the highest Top-Tier volumes recorded.

Spot Volumes Have Surged in Q1 2020

- Since December 2019, volumes from Top-Tier exchanges have continued to increase month on month. In March, volume from many of the largest Top Tier exchanges increased 35% on average (vs February).

Derivatives Volumes Hit All-Time-High in March 2020

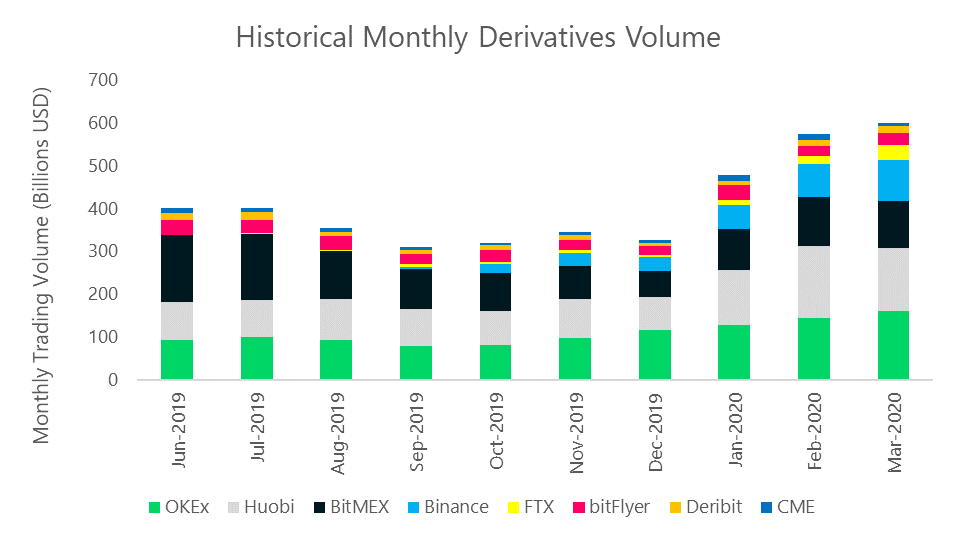

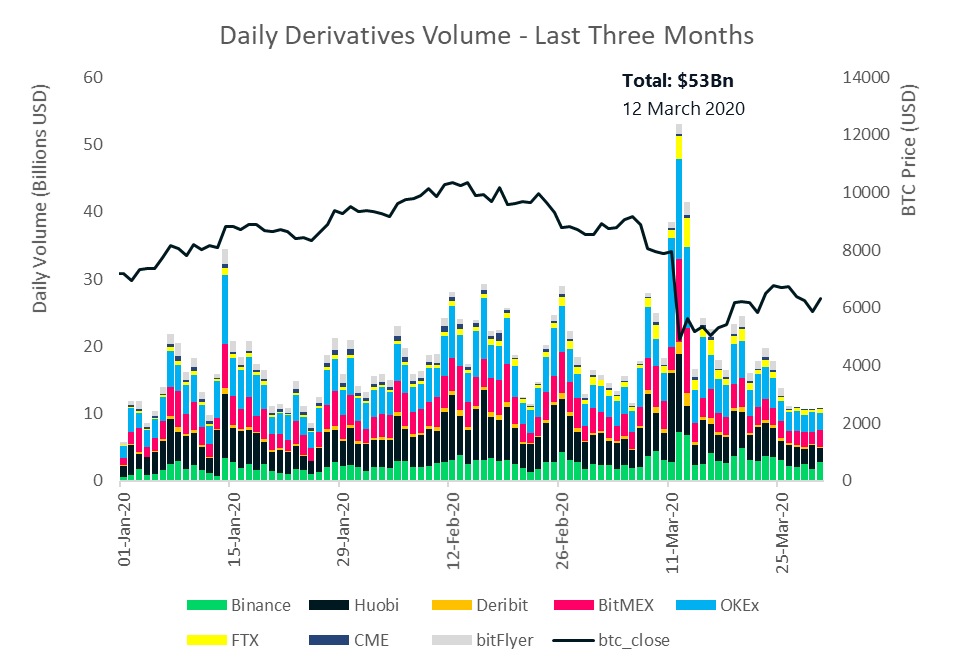

- Derivatives volumes totalled $600bn in March, up 5% since February. The largest derivatives players include OKEx, BitMEX, Huobi and Binance, with these four representing a combined $514bn (86% of the derivatives market for March).

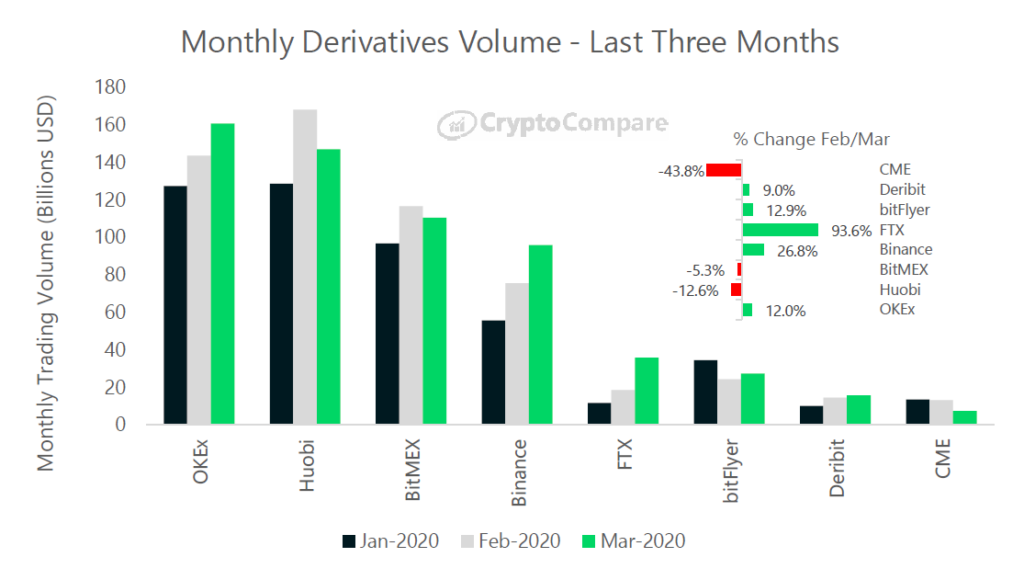

Newer Derivatives Exchanges Binance and FTX Saw Volumes Soar

- Binance and FTX saw monthly volumes surge 27% (to $95.8bn) and 94% (to $35.8bn) respectively in March. Binance and FTX initially together represented 14% market share in January, but now represent approximately 22% in March.

Institutional Derivatives Volumes Plummeted

- Institutional appetite for derivatives products appeared to decline rapidly following the BTC crash, with CME losing 44% of volume compared to February. Trading volumes totalled $7.36bn in March compared to $13.1bn in February.

Exchange Benchmark Analysis

CryptoCompare’s Exchange Benchmark aims to serve investors, regulators and crypto enthusiasts by scoring exchanges in terms of transparency, operational quality, regulatory standing, data provision, management team, and their ability to monitor trades and illicit activity effectively. Rather than drawing attention specifically to bad actors, we instead highlight those that behave in a manner that is conducive to maintaining an efficient and fair market, ensuring greater safety of investors. We have hence introduced the notion of “Top-Tier” vs “Lower-tier” volumes.

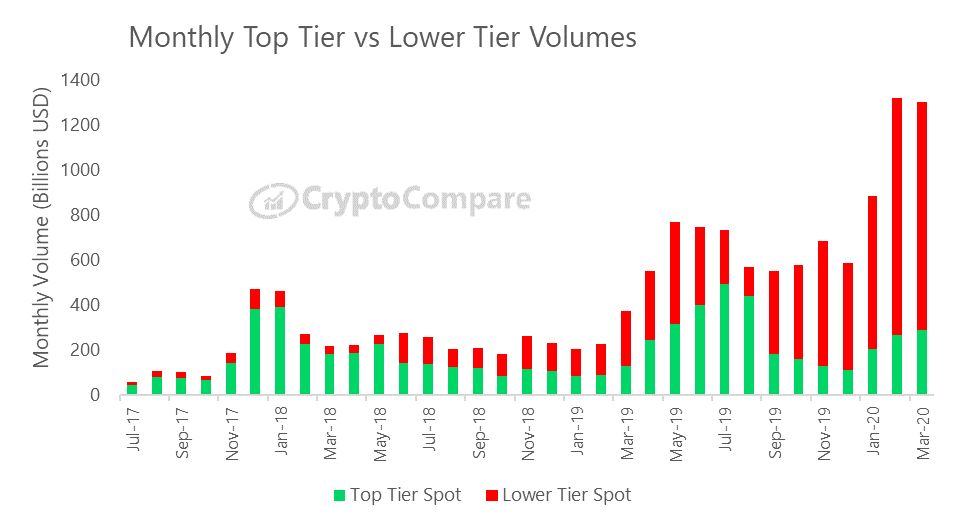

In March, Top Tier volumes increased 8.0% to $288bn, while Lower Tier volumes decreased 7.9% to $1.02tn.

In March, spot markets saw a historic daily volume totalling $75.9bn in a single day (13 March). However, the majority of this figure came from Lower Tier exchanges ($54.3bn), with volume from Top Tier exchanges totalling $21.6bn (28.5%).

Categorising exchanges by tier level based on our rigorous Exchange Benchmark methodology helps use to capture a more representative picture of where the market has moved.

Top Tier spot volume totalled $21.6bn on the 13 March. While not a new high, it compares closely to volumes seen in July 2019 and those at the end of the bull run in December 2017.

Macro Analysis and Market Segmentation

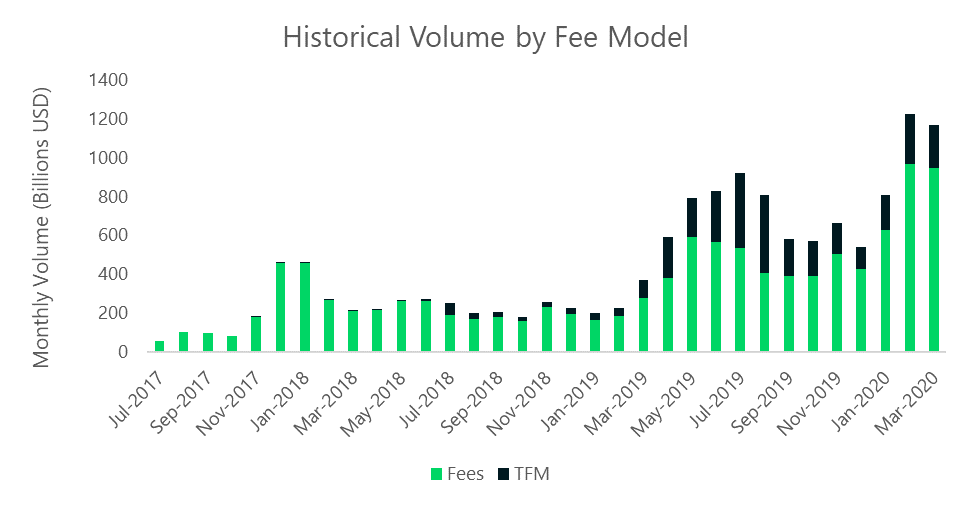

Exchanges that charge traditional taker fees represented 80.4% of total exchange volume in March, while those that implement trans-fee mining (TFM) represented less than 20%. Last month, fee charging exchanges represented 78% of total spot volume.

Fee-charging exchanges traded a total of $924bn in March (down 2% since February), while those that implement TFM models traded $222bn (down 14% since February).

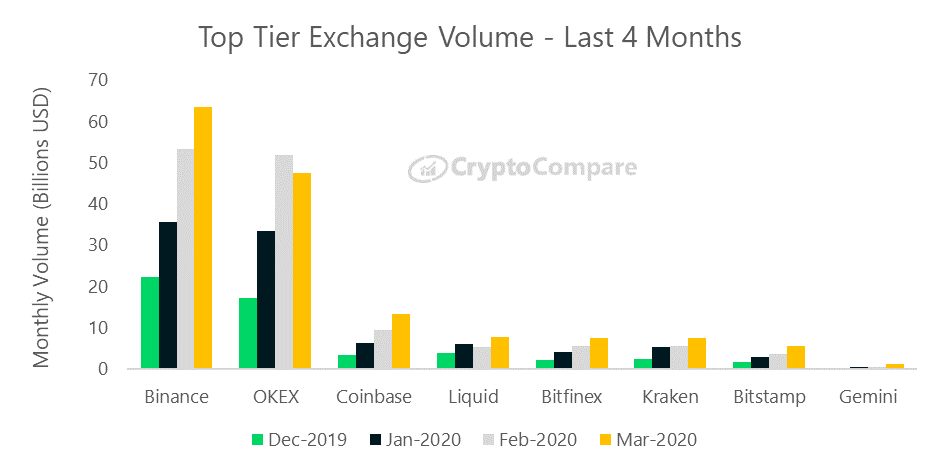

Since December 2019, volumes from Top-Tier exchanges have continued to increase month on month. In March, volume from many of the largest Top Tier exchanges increased 35% on average (vs February).

Despite the March price crash, volume levels for these exchanges still haven’t reached those seen in the Dec-2017 bull run. Overall, volumes across all Top-Tier exchanges increased 8.0% to $288bn in March.

Binance was the largest Top Tier exchange by volume in March, trading $63.6bn (up 19.2%). This was followed by OKEx trading $47.7bn (down 8.2%), and Coinbase trading $13.3bn (up 41.9%).

Binance and OKEx have dominated in Q1 2020 relative to other Top Tier exchanges, capitalising on the recent BTC volatility seen on the 12th and 13th. On the 13th, Binance and OKEx traded $3.6bn and $3.9bn respectively while the next largest exchange (Coinbase) traded $1.54bn.

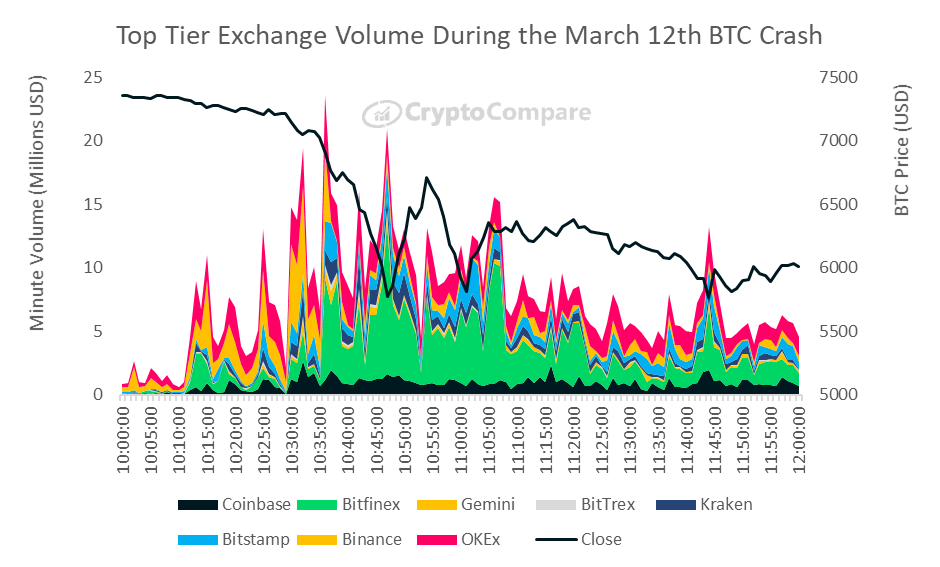

Top Tier Volumes During the March Bitcoin Crash

Despite Binance and OKEx trading the most volume across all markets in broad terms, during the exact moment of the BTC crash (approx. 10:30 am GMT) which began on the 12th, it was Bitfinex that represented the majority of Top-Tier exchange trading volume (across BTC/USD and BTC/USDT markets). This was followed by Coinbase, OKEx and Bitstamp who also maintained high volumes during this time.

Among other Top-Tier exchanges, Bitfinex generated the most volume within the first hour of the crash. Between 10.40am and 11am, it represented 40% of volume on average among these exchanges, matching up to $11.8m worth of trades in a single minute.

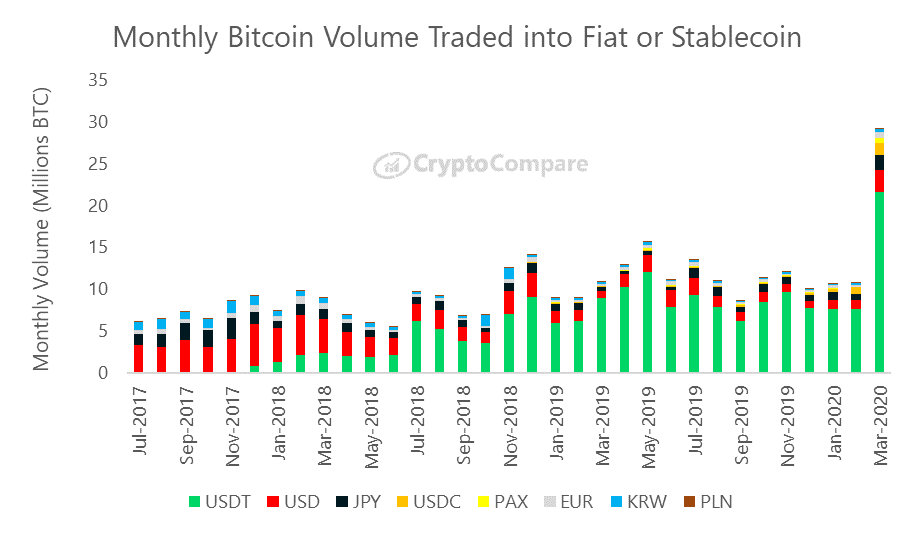

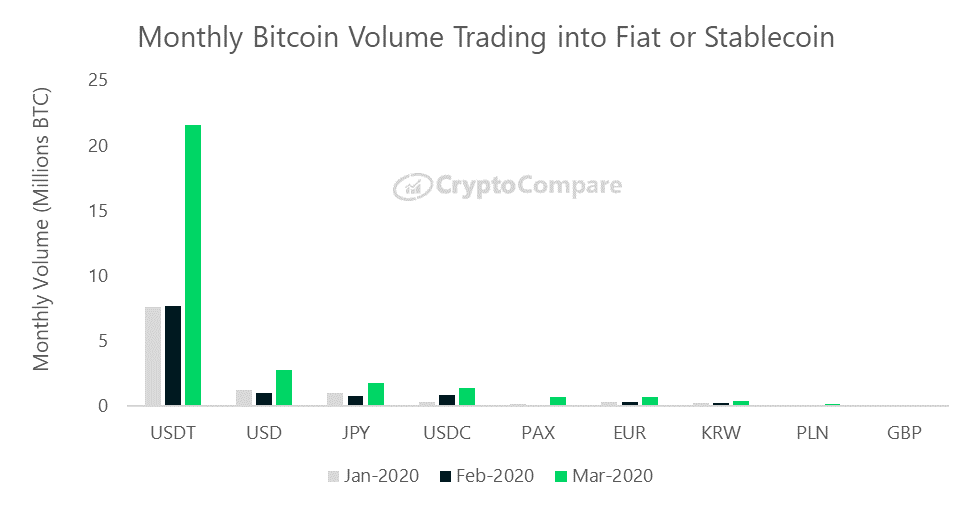

Bitcoin to Fiat Volumes

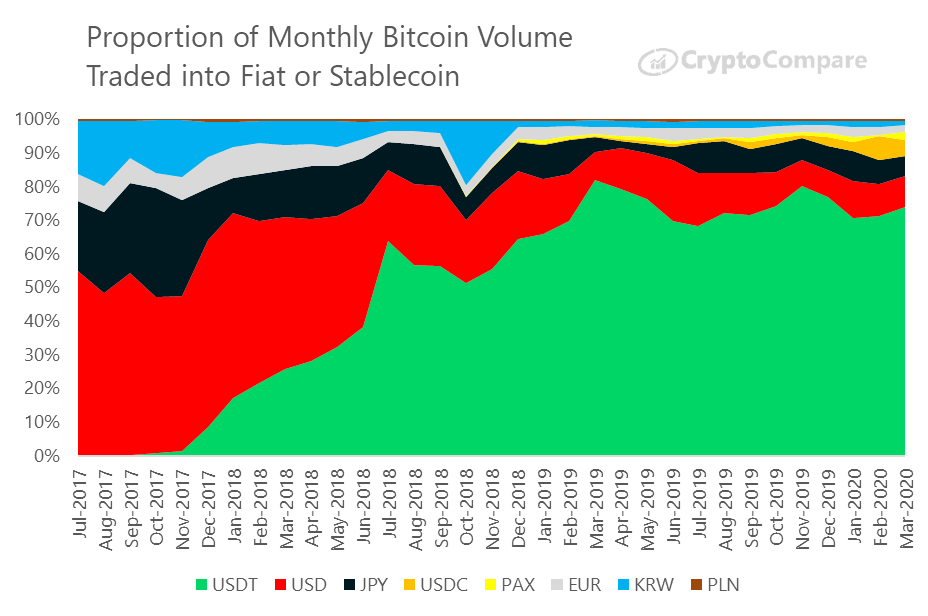

BTC trading into USDT nearly tripled in March to 21.6m BTC vs 7.7m BTC in February (up 182% ). Trading into USD and JPY also surged to 2.7mBTC (up 170%) and 1.8m BTC (up 132%) respectively. The BTC/USDT market now represents 73% of total BTC traded into fiat or stablecoin.

Stablecoins USDC and PAX overtook the BTC/EUR and BTC/KRW markets in terms of total volume traded into BTC. BTC/USDC and BTC/PAX markets traded 1.35m BTC (up 71%) and 0.67m BTC (up 1553%) respectively in March.

Since late 2017, the BTC/USDT market has consistently gained market share relative to other fiat BTC trading markets. It has represented approximately 70% of trading volume since 2019, 50% in late 2018 and 25% in early 2018.

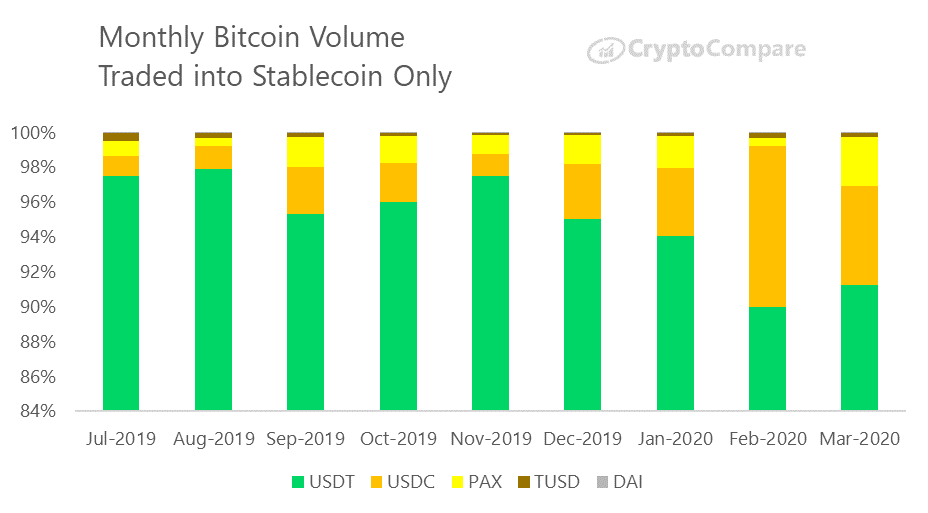

USDC and PAX have become popular in recent months, with USDC representing approximately ~5% of BTC volume into stablecoins and PAX at ~2.5%. Despite their growth, the BTC/USDT pair still represents the majority of BTC traded into stablecoins at ~92%.

Derivatives

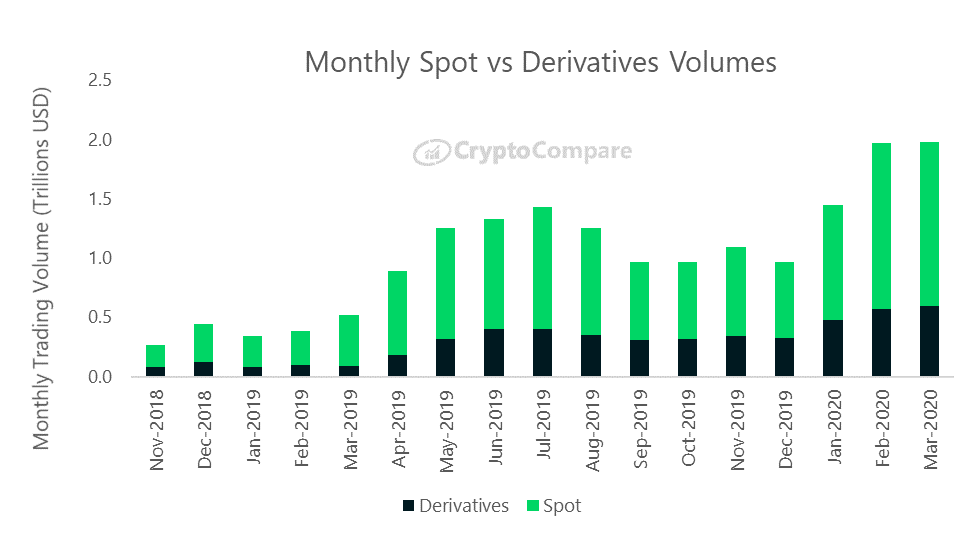

Volumes from derivatives exchanges have generally increased in tandem with those of spot exchanges and now represent approximately ~30% of the market.

In light of increased volatility during the March BTC price crash, derivatives volume peaked to an all-time high in March 2020, totalling $600bn (up 5% since February).

The largest derivatives players include OKEx, BitMEX, Huobi and Binance, with these four players representing a combined $514bn (86% of the derivatives market for March).

OKEx was the largest derivatives exchange in March, with volumes increasing month on month to $161bn (up 12% since February). Huobi and BitMEX followed in terms of monthy volumes with $147bn (down 12.6%) and $110bn (down 5.3%) traded respectively.

Binance and FTX saw volumes surge 27% (to $95.8bn) and 94% (to $35.8bn) respectively.

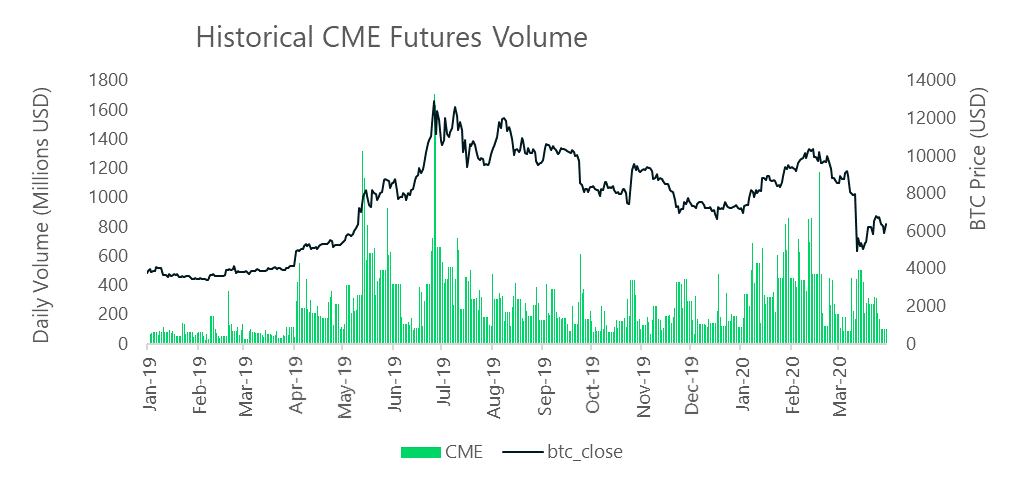

Meanwhile, institutional appetite for derivatives products appeared to decline rapidly following the BTC crash, with CME losing 44% of volume compared to February. Trading volumes totalled $7.36bn in March compared to $13.1bn the previous month.

Competition between the top exchanges has more or less remained stable, with Binance and FTX showing the highest growth in volumes in the first quarter. They initially represented 14% market share in Jan, and now represent approximately 22% in March.

On the 12th of March, the day of the BTC price crash, daily trading volume totalled $53bn. On this day, OKEx traded the highest amount at $14.9bn followed by BitMEX with $12.3bn and Huobi with $11.5bn.

Options

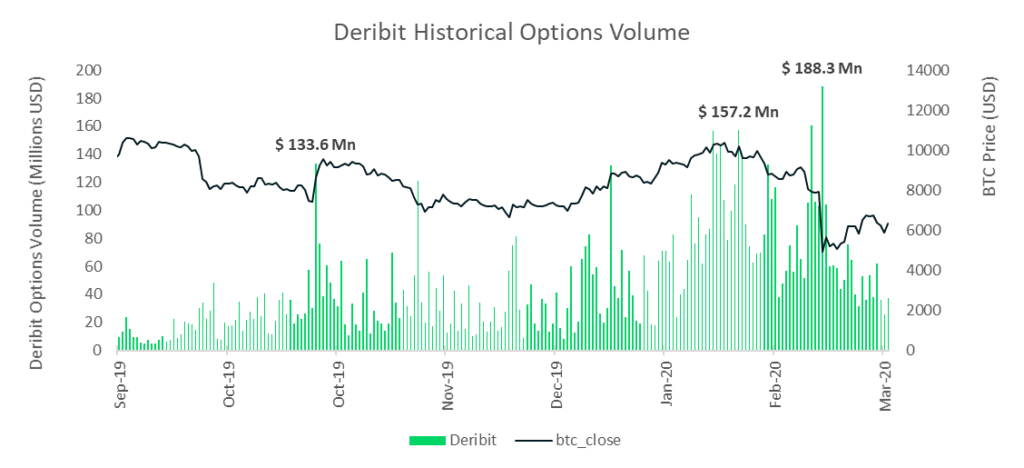

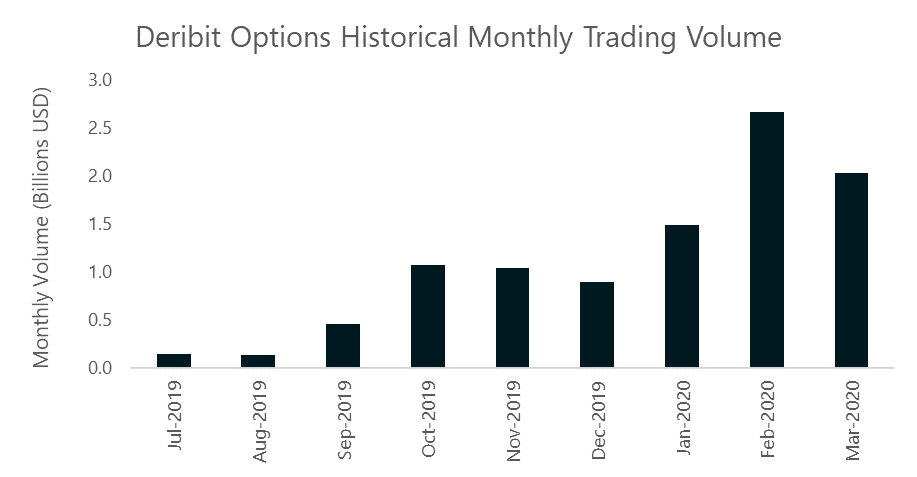

On the 12th of March, derivatives exchange Deribit traded a record amount of options volume at $188m. The next highest volumes were registered on the 18th Feb 2020 at $157m. Despite the spike in volume around the bitcoin crash period, Deribit traded 24% less volume on aggregate in March compared to February ($20.4bn vs $26.7bn in Feb)

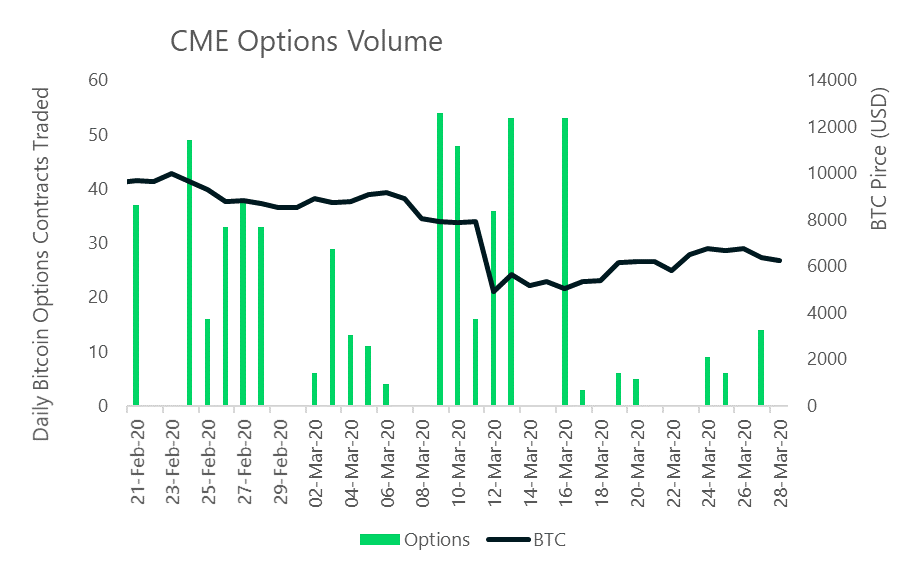

CME Institutional Volume

CME futures volumes have plummeted 44% since February following the BTC price crash.

While only launched in January this year, CME options have not seen significant improvements in volumes, and are quite a far from generating the activity seen on crypto exchange Deribit.